Bidcorp released its 10-month capital markets trading update on Wednesday (9 June). The message from the capital markets trading call was broadly similar to what was said at the time of Bidcorp’s 1H21 results release on 24 February, which is that its Australasian operations continued to be resilient, while its UK and European operations were negatively affected by a second wave of COVID-19 restrictions. However, the company also highlighted that its operations in the UK and Europe have rebounded strongly, following the recent easing of restrictions. Despite this strong rebound in operations, a degree of uncertainty does still lie ahead given the variability in operational performance when lockdown restrictions are put in place.

Key takeaways from the capital markets trading update were:

- The EBITDA margin for the 10-month period to end April 2021 has remained stable at 4.8% when compared to a comparable period that was mostly unaffected by the COVID-19 pandemic.

- Free cash flow (FCF) generation for the year to end April amounted to R2.2bn, c. R1.9bn better than the same time last year. This was driven by improved cash generation from operations, proceeds received on the sale and leaseback of properties, and reduced capex spend.

- Bidcorp remains well within its debt covenant ranges.

Sales progression

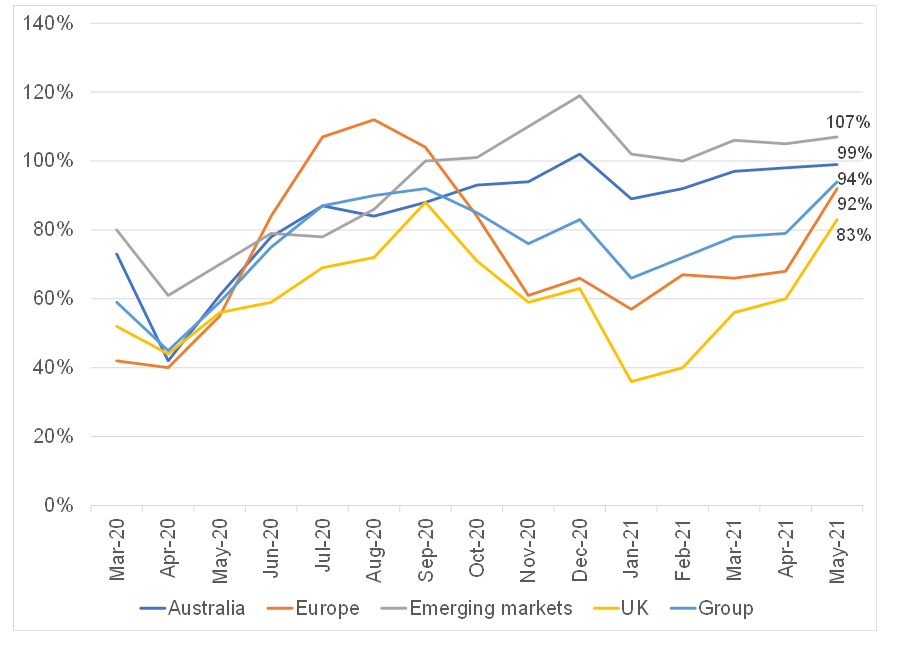

The rebound in sales has been very strong on the back of an easing of lockdown restrictions across the various regions in which the company operates. For the past two weeks, Group sales have returned to 100% of Bidcorp’s pre-pandemic levels. In this regard it is important to note that COVID-19 restrictions have impacted the company’s sales progression in the recent past, and we expect sales progression to decline if there are more pandemic-induced restrictions ahead. However, we also anticipate reduced lockdown restrictions as developed market (DM) populations become fully vaccinated.

In Australasia sales have oscillated between 89% and 99% of ‘normal’ demand during 3Q21, reaching 99% in May 2021. However, demand has been negatively impacted by localised lockdowns at varying times both in New Zealand and Australia.

In the UK, the Group’s Wholesale and Fresh segment’s sales were severely impacted by the strict lockdown restrictions through its 3Q21 but have subsequently improved as restrictions were eased from mid-March onwards.

Sales in Europe were severely impacted from November 2020 through to end-April 2021, reaching a low of 57% in January 2021. However, May 2021 sales have recovered to an average of 92% for the month.

Sales in emerging markets (EMs) have been resilient and are improving, with notable upswings seen in the Middle East, Turkey, and in South Africa (SA).

Figure 1: Bidcorp monthly sales progression in constant currency terms (rebased to the period just prior to the global pandemic)

Source: Company reports, Anchor

Conclusion

We maintain our view that Bidcorp will continue to benefit from out-of-home eating habits as the world returns to normal. This is evidenced by the strong rebound in its operations following the easing of lockdown restrictions in the various regions in which the company operates. We believe that the Australasian region is a good proxy on how Bidcorp’s food services market will unfold as the world returns to normal and lockdown restrictions are eased across the Group’s major DMs. Overall, we remain bullish that market share gains, potential acquisitions, and organic growth factors will hold Bidcorp in good stead in the near future. Our investment thesis on the counter remains intact and we continue to recommend holding the share.