Bidcorp released a 1Q21 (the first quarter of the Group’s FY21) capital markets trading update on Tuesday (17 November), in which it highlighted that COVID-19 continues to impact some of its operations. Bidcorp said that in those regions and countries where lockdown restrictions were eased it has seen demand recover with the exception of businesses associated with large crowds (sporting events, business travel, conferences, aviation, the cruise line industry etc.), which for the most part remain closed.

According to the company, FY21 started out well as most of its geographies came out of the worst periods of the pandemic but, unfortunately, conditions started to deteriorate in August as a second wave of COVID-19 infections in the UK and Europe resulted in the implementation of lockdown restrictions within those geographies. Although these restrictions have subsequently affected sales progression in these regions, management said they were confident that these geographies will be able to withstand the second wave of the pandemic. Positively, the second wave lockdown restrictions have been less severe relative to lockdown restrictions earlier in the year.

Key takeaways

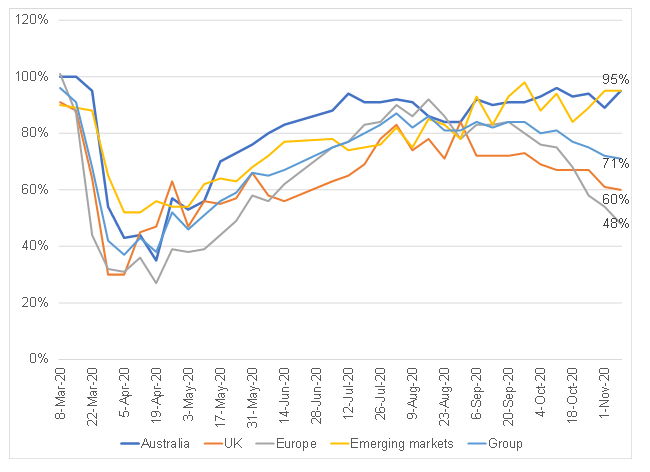

- Group sales (in constant currency terms) for the financial YTD peaked in the week ended 2 August 2020 at 87%, vs the corresponding week in Bidcorp’s FY20, but sales progression eased to 71% of the corresponding weekly sales for the week ended 8 November 2020, due to new lockdown restrictions being implemented in Europe and the UK.

- The Group’s gross profit margin for 1Q21 was flat and was driven by a mix of smaller independent customers.

- Earnings before interest, taxes, depreciation, and amortisation (EBITDA) for 1Q21 was equal to 5.2% of monthly net revenue vs 5.9% in the prior comparable period.

- Due to a predominantly fixed-cost base, there will not be a linear reduction in operational expenses as revenue declined during the period.

- Management appeared confident that they were gaining market share against competitors in Bidcorp’s existing markets.

- Overall, Bidcorp has remained highly cash generative during the period under review and it has continued to be profitable despite sales declines in some of its geographies

Bidcorp sales progression for 34-week period starting March 2020’

- Bidcorp’s sales progression has deteriorated for those geographies that are experiencing a second wave of COVID-19 infections.

- Australia and New Zealand have been resilient and Bidcorp sales are tracking at between 90% and 100% higher YoY in these countries.

Figure 1: Bidcorp sales progression for the 34-week period during COVID-19

Source: Anchor, company reports

We have previously indicated that forecast risk for FY21E was extremely high, given the uncertainty around how the pandemic would pan out. Despite near-term forecast risk, we remain confident that Bidcorp’s operations will not be permanently impaired but will likely normalise within the next 18 months. We think that market share gains, organic growth, and possible acquisitive growth will drive Bidcorp’s continued growth trajectory as its operating environment changes for the better. We recommend holding the share.