AVI released its 1H21 results on 8 March, showing a resilient first-half performance in the midst of negative COVID-19 effects and raw material price headwinds. In light of these challenges, AVI’s first-half performance greatly benefitted from a quality and agile management team, which has proven itself to be successful even when navigating a tough operating environment. AVI managed to improve and mitigate significant margin declines by increasing selling prices, instituting cost containment measures and successfully managing volumes and value for its customers. Overall, the 1H21 result was characterised by a recovery in AVI’s retail brands and a return to normalised demand levels in the snack and beverage segments.

Following AVI’s FY20 results, we previously expressed the view that I&J could stand to benefit from oil price hedges and increased export sales into Europe in FY21, but we also cautioned that abalone’s performance could detract from a good operational performance by I&J. During the period under review, abalone continued to face poor export demand and low selling prices, resulting in losses that drove an operating profit decline in I&J. The benefit from oil price hedges and increased export sales into the second half remains to be seen, as global supply-chain disruptions have increased global freight rates significantly. In addition, I&J’s abalone segment continues to experience market access issues in Hong Kong.

Key takeaways

- Group revenue declined by only 0.1% YoY, driven by growth in AVI’s food and beverage categories. However, this was partially offset by the continued impact of COVID-19 on sales volumes in its fashion businesses and the Ciro out-of-home coffee solutions business.

- Gross profit fell 4.8% YoY due to cost pressures from the weaker rand vs US dollar exchange rate and the performance of I&J’s abalone business.

- However, we note that this decline was somewhat mitigated by currency and raw material hedge positions, selling price increases, as well as effective management of selling and administrative costs, which decreased by 6.9% YoY.

- Operating profit was down 2.6% YoY.

- HEPS increased 1.2% YoY – from ZAc293.8 to ZAc297.3.

- Overall, we note that cash generation remains strong and debt levels have dropped below AVI’s targeted gearing range.

- An interim normal dividend of ZAc160/share as well as a special dividend of ZAc280/share was declared (a 9.2% 1H21 dividend yield).

Divisional performance

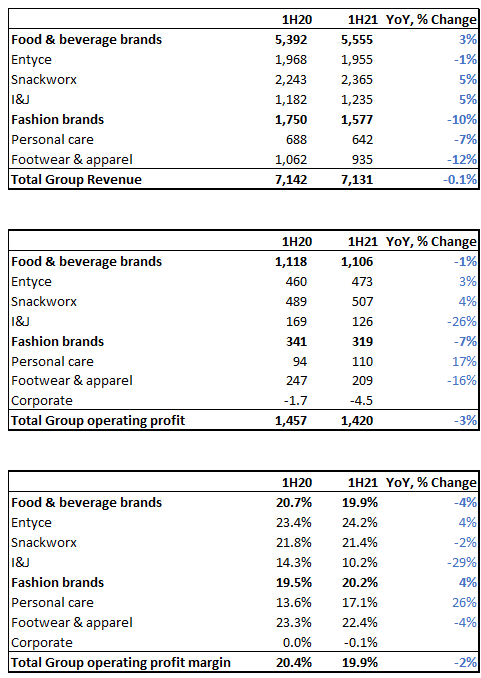

Figure 1: AVI segmental revenue, operating profit and operating profit margin performances, 1H21 vs 1H20, Rmn

Source: Company data, Anchor

Entyce beverages

- Revenue decreased by 0.7% YoY in this segment, to R1.95bn, while operating profit increased by 2.9% YoY to R473mn.

- Tea revenue grew 2.4% YoY due to rooibos and black tea volume increases, as well as selling price increases on black tea.

- Rooibos’ selling prices declined due to lower raw-material costs.

- Coffee revenue fell 13.8% YoY, driven by lower sales in the Group’s Ciro out-of-home coffee business, which was severely impacted by lower demand from hospitality, leisure, and corporate customers due to the pandemic.

- The decline in Ciro out-of-home was partially offset by the growth in mixed instant and premium coffee sales volumes, as well as selling price increases to offset pressure from the weaker rand and higher production costs.

- Creamer revenue grew 12.5% YoY due to a 4.2% increase in sales volumes and selling price increases to offset higher raw-material costs and foreign exchange pressure.

- Tea revenue grew 2.4% YoY due to rooibos and black tea volume increases, as well as selling price increases on black tea.

- Entyce’s operating profit margin rose to 24.2% from 23.4% , driven by an improvement in the gross profit margin and declining selling and administration costs.

Snackworks

- Revenue increased 5.4% YoY, while operating profit rose by 3.6% YoY.

- Biscuits’ revenue grew 5.1% YoY, driven by higher selling prices and limited discounting, sales volumes were also slightly lower than in 1H20.

- Raw material cost pressure and a change in the sales mix resulted in a gross margin decline within the Biscuits category, while a decline in selling and administrative costs supported operating profit, resulting in a slightly lower operating profit margin.

- Snacks’ revenue jumped 6.6% YoY due to increased sales volumes of 5.4%, as well as higher selling prices that were implemented in April 2020.

- While the gross profit margin was lower than last year, operating profit was slightly better due to lower selling prices and administrative costs.

- The operating profit margin declined slightly, from 21.8% in 1H20 to 21.4% for the period under review.

- Biscuits’ revenue grew 5.1% YoY, driven by higher selling prices and limited discounting, sales volumes were also slightly lower than in 1H20.

I&J

- At I&J, revenue advanced 4.5% YoY but operating profit declined 25.5% YoY – from R169mn to R125.9mn. The decline in operating profit was attributable to losses in its abalone operation, as well as lower royalties from Simplot, following its disposal in November 2019.

- The overall result from fishing was in-line with last year, as there was minimal disruption to this segment from COVID-19. Higher catch rates offset lost sea days for repairs and maintenance, while the adverse impact of lower export prices in some markets, and cost inflation, was largely offset by a weaker rand and lower fuel prices.

- Danger Point abalone farm experienced poor export demand and lower selling prices because of lockdown restrictions in its key markets, compounded by increased airfreight costs due to flight restrictions. A restructure at the farm has been completed and further cost cuts are expected to come through in 2H21.

- The operating profit margin decreased from 14.3% in 1H20 to 10.2%.

Personal care

- Revenue in this segment fell 6.6% YoY to R642.1mn, driven by declining sales volumes (colour cosmetics and fragrances) due to the impact of the pandemic.

- Operating profit improved 17% YoY, driven by selling and administrative costs, which declined by 15% YoY because of lower new product launches and other cost savings.

Footwear & Apparel

- Revenue decreased 12% YoY to R934.6mn, driven by a 13.7% YoY decline in footwear sales volumes.

- The operating environment continues to experience strain, but a partial recovery is underway, according to the company.

Outlook

Looking ahead, management expect the constrained environment to continue, and they anticipate weak demand levels to persist, with no meaningful improvement in current operating conditions. We note that management are uncertain about how soft commodity pricing pressures will impact AVI’s operations in FY22 as its hedging programme rolls off in FY21. Overall, however, the team said AVI will continue to focus on cost containment measures in a weak environment and to review its business model considering the unexpected challenges brought about by the pandemic. We expect subdued volume sales and continued elevated soft commodity prices to be an operational headwind within the Food producer space in the short term.