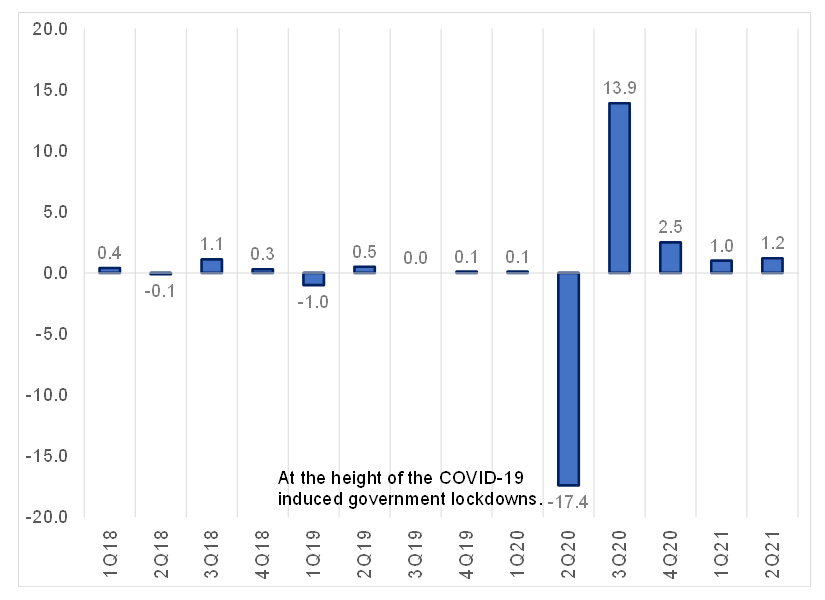

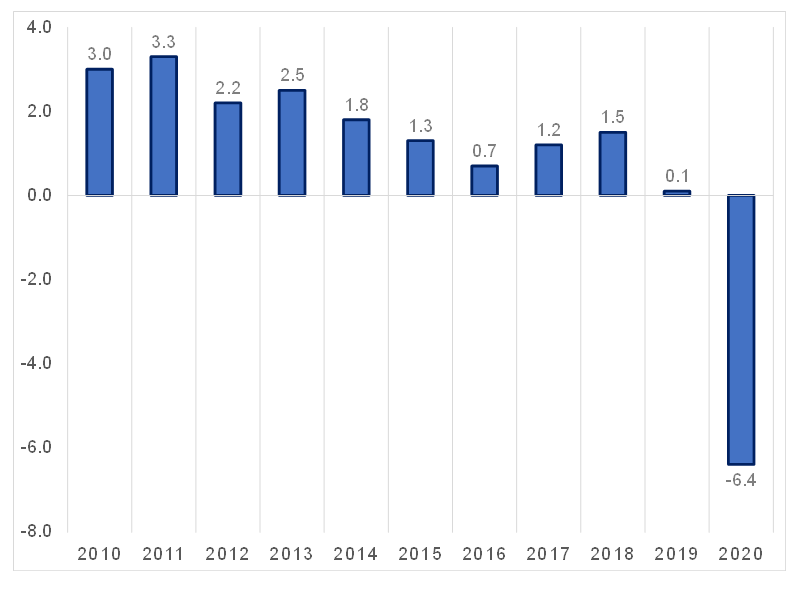

South Africa’s (SA’s) 2Q21 GDP printed at 1.2% QoQ seasonally adjusted (see Figure 1), amid a wide range of forecasts. Despite recording four consecutive quarters of growth, Stats SA said that the SA economy was still 1.4% smaller than it was prior to the COVID-19 pandemic. On a YoY basis, GDP came in at 19.3%. However, we note that it is important to remember that this is off last year’s very low base (during the height of the government’s COVID-19-induced lockdown restrictions). Aside from the headline print, the underlying data are also worth noting, particularly fixed investment where recovery remains rather sluggish since the hard lockdowns last year.

Figure 1: SA GDP growth, QoQ % change

Source: Anchor, StatsSA

The 1.2% QoQ increase follows a revised 1% rise in 1Q21, with six industries recording positive QoQ growth. The largest contributors among these industries were transport & communication (+6.9% QoQ), agriculture (+6.2% QoQ), personal services (+2.5% QoQ), and trade (+2.2% QoQ). Construction recorded the largest decline – down 1.4% QoQ. According to Stats SA, nominal GDP was estimated at R1.53trn in 2Q21 – up R76bn vs 1Q21.

Figure 2: SA GDP growth, YoY % change

Source: Anchor, StatsSA

Looking ahead further than the current quarterly prints, overall, from a growth perspective the SA economy is at a critical juncture. For 2021 in total, GDP growth is forecast to reach c. 4%, thereafter moderating to c. 2% for 2022 and 2023. Typically, in the case of the local economy, in the past material job creation has only occurred when GDP growth approaches 3% p.a. With 2Q21 unemployment now at 34.4% (and the youth unemployment rate of 64.4%), government needs to urgently address structural issues that were already preventing robust and sustainable growth prior to the pandemic. These include inefficiencies at the country’s major ports, energy constraints and poor service delivery by municipalities.