March was a mixed bag for global markets (MSCI World +2.8% MoM but down 5.0% for 1Q22), with major US indices recording good gains for the month, while European and Chinese equity markets struggled. Although global equity markets had rallied in the last week of March, on signs of progress in peace talks between Russia and Ukraine, the optimism quickly faded after Ukraine President Volodymyr Zelensky said he did not expect a quick resolution to the conflict. The ongoing war in Ukraine, which has further impacted global supply chains, record inflation, and fears of a recession rattled investors. For the quarter (1Q22), major global indices recorded their worst performance in c. two years – when the COVID-19 pandemic sent markets into a tailspin.

Despite the volatility, US markets posted positive MoM gains. The blue-chip S&P 500 gauge rose by 3.6% MoM in March but, following seven straight quarters of gains, is down 4.9% for 1Q22/YTD. The Dow Jones closed the month 2.3% higher (-4.6% 1Q22/YTD) and the tech-heavy Nasdaq advanced by 3.4% MoM (-9.1% 1Q22/YTD).

The US Federal Reserve’s (Fed’s) Federal Open Market Committee (FOMC) concluded its two-day meeting on 16 March and announced that it would lift interest rates by 25 bpts. The FOMC also pencilled in a series of further increases aimed at stopping the US economy from overheating and reducing inflation which is at its highest level in c. 40 years. On the US economic data front, February inflation continued to soar, coming in at 7.9% YoY (vs January’s 7.5% YoY print) – its highest level since January 1982. Excluding the volatile food and energy prices components, core CPI rose 6.4% YoY (its highest since August 1982) vs January’s 6% print. MoM, US inflation was up 0.8%.

In Germany, Europe’s largest economy, the DAX closed last month 0.3% lower (-9.3% 1Q22/YTD), while the eurozone’s second-biggest economy, France’s CAC Index ended March unchanged (-6.9% 1Q22/YTD). March inflation data showed record-high increases across several of Europe’s biggest economies, with most of the surge due to rocketing energy prices and, since both Russia and Ukraine are major grains producers, the conflict is also pushing up the prices of some staple foods. France’s inflation rate (+4.5% YoY) was lower than in neighbouring countries but was still that country’s highest level since the 1980s. Italy recorded 7.0% YoY inflation in March, while Germany’s inflation rate rose to 7.3% (a c. 30-year high) and Spain posted a March inflation gain of 9.8% YoY (a c. 37-year high).

The UK’s blue-chip FTSE-100 ended March 0.8% higher (+1.8% 1Q22/YTD), while in economic data, UK February inflation hit its highest level (of 6.2%) in three decades, fuelled by rapidly rising gas and electricity costs as well as petrol and diesel prices hitting record highs.

In China, Shanghai, the country’s financial centre, grappled with staggered lockdowns to contain a local COVID-19 surge, which saw strict preventative measures being implemented, while investors worried that the prospect of China’s possible support for Russia’s invasion of Ukraine could lead to sanctions. Hong Kong’s Hang Seng Index was down 3.2% MoM (-6.0% 1Q22/YTD), while the Shanghai Composite Index fell by 6.1% MoM (-10.6% 1Q22/YTD). In economic data, China’s official manufacturing purchasing managers index (PMI) disappointed, contracting to 49.5 in March (vs 50.2 in February), while the official non-manufacturing PMI, which measures business sentiment in the services and construction sectors, also declined in March (to 48.4) vs 51.6 in February (the 50-point mark separates expansion from contraction). Both data points contracted for the first time in c. two years as China’s efforts to fight a surge in new COVID-19 cases weighed on economic activity. Elsewhere, for the month, Japan’s benchmark Nikkei gained an impressive 4.9%, although the index is still down 3.4% for 1Q22/YTD.

Among commodities, oil prices continued to soar (+6.9% MoM in March), with Brent crude ending the quarter 38.7% higher at c. US$108/bbl level. Oil prices have rocketed to new highs after Russia (the second-largest crude exporter) invaded Ukraine and strict sanctions were imposed on Moscow. However, with the US releasing record emergency oil reserves, oil prices did drop by c. US$6 on 31 March. After jumping 6.2% MoM in February, the gold price rose 1.5% in March (+5.9% YTD/1Q22) closing at US$1,937.44/oz. Platinum and palladium prices fell by 5.8% and 9.0% MoM (up 1.8% and 19.1% YTD/1Q22), respectively. After declining by 10.4% in February, the iron ore price rose 12% last month and is now c. 25% higher for 1Q22/YTD.

While most major global markets ended 1Q22 in the red, diversified miners and financial stocks drove South Africa’s (SA’s) FTSE JSE All Share Index 2.4% higher for the quarter. March, however, saw the FTSE JSE All Share Index end slightly lower (-0.8% MoM), although the FTSE JSE Capped SWIX rose 1.5% for the month. Thungela, financials and diversified mining stocks were the darlings of the JSE, while Prosus and Naspers were once again the notable losers. The Fini-15 rose 11.6% MoM and is up 19.5% for 1Q22/YTD, while the SA Listed Property Index, which lagged in February, gained 4.3% MoM but is still down 2.0% for 1Q22/YTD. After soaring 14.3% MoM in February, the Resi-10 lost 3.2% in March although it is still up 15.0% for 1Q22/YTD. Industrials disappointed, with the Indi-25 down for a third month running (-5.2% MoM) – the index is now also 14.3% lower for 1Q22/YTD. Highlighting March’s best-performing shares by market capitalisation, BHP Group, the biggest company on the JSE, rose 9.9% MoM, FirstRand jumped 17.2% MoM, Capitec advanced by 12.9% MoM, Standard Bank was up 12.0% MoM, Vodacom gained 8.1% MoM and Glencore ended the month 5.4% higher. Once again, Prosus and Naspers disappointed – down 15.1% and 13.7% MoM, respectively, while JSE-listed companies with predominantly foreign earnings were hindered by the strong rand – Anheuser Busch InBev lost 8.1% MoM and British American Tobacco ended the month 8.4% lower. The rand put in a strong performance – up 5.2% vs the US dollar and 8.3% firmer for 1Q22/YTD.

On the local economic data front, February’s annual headline inflation, as measured by the consumer price index (CPI), came in at 5.7% YoY – unchanged from January’s print. Stats SA said the key drivers were once again food (+6.4% YoY) and transportation (+14.3% YoY) costs. Retail sales data from Stats SA showed that January retail trade sales soared 7.7% YoY (to R76.9bn) compared to an upwardly revised 3.2% YoY gain for December 2021. This was also the fifth consecutive month of retail activity increasing and the fastest pace since June 2021. The delayed Quarterly Labour Force Survey (QLFS) was released by Stats SA last week and showed that total employment partially recovered in 4Q21, with the number of employed persons increasing by 262,000 from 3Q21 as economic activity bounced back following the July riots. However, due to a bigger increase in the labour force (i.e., more people willing to work/return to work), the unemployment rate actually rose from 34.9% in 3Q21 to 35.3% in 4Q21. At the SA Reserve Bank’s (SARB’s) meeting on 24 March, the Monetary Policy Committee (MPC) implemented another 25-bpt rate hike, bringing the repo rate to 4.25%.

On the pandemic front, as at 31 March, Department of Health data show that 33.6mn vaccine doses have been administered to date (vs 31.4mn as at 28 February), while the total number of confirmed COVID-19 cases in SA since the start of the pandemic stood at 3.72mn vs 3.67mn on 28 February. There was a further easing of level-1 restrictions last month, including announcing that wearing masks outside was no longer mandatory, and that venues could accommodate bigger numbers if patrons were vaccinated or could show a negative PCR test. Vaccinated travellers will no longer be required to provide a negative PCR test when entering SA – a boost for the tourism and hospitality sector.

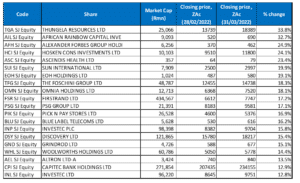

Figure 1: March 2022’s 20 best-performing shares, % change

Source: Bloomberg, Anchor

Local financial and diversified mining counters were the star performers on the JSE in March, with Thungela Resources (+33.8% MoM) emerging as the best-performing share for a second month running. The company delivered stellar maiden results with FY21 headline EPS coming in at R66.57 vs a loss of R5.31 a year before. Net cash stood at an impressive R8.7bn vs net debt of R388mn in the same period of the prior year, while the Group’s maiden dividend was R18/share, or a total of R2.5bn being returned to shareholders. The company has benefited from record-high coal prices, which are being driven by demand from China and Europe as they face supply crunches due to disruptions in Russian exports following its invasion of Ukraine. However, Thungela said that it had lost out on c. R2bn in earnings because its export sales and production were “severely impacted” by state-owned rail operator Transnet’s constraints.

Investment holding firm, African Rainbow Capital (ARC) Investments was last month’s second-best performing share with a MoM gain of 32.7%. ARC released its results in March, which showed that its intrinsic portfolio value increased by 14% YoY to R14bn for the half-year to 31 December, mainly on the back of a net rise of R2bn in asset values. According to CEO Johan van Zyl, ARC’s investments in Rain (a wireless data service provider), Kropz (a phosphate production company), and Tymebank (a digital financial services business) were providing the Group with good short-to medium-term prospects as they scale up and grow.

Alexander Forbes came in third spot, with a MoM gain of 24.9%. the company’s share price surged after it was announced that US investment manager, Prudential Financial, had bought a 15% stake worth c. R1.05bn in the Group and was looking to more than double its stake. The price offered of R5.25/share represented a c. 40% premium to Alexander Forbes’ share price close on 17 March.

Alexander Forbes was followed by Hosken Consolidated Investments (HCI), Ascendis Health (February’s worst-performing share), and casino and gaming Group, Sun International, which recorded MoM gains of 24.1%, 23.4%, and 19.9% MoM, respectively. Sun International said that it had returned to profit in FY21 as the easing of lockdown restrictions benefitted its businesses which were severely impacted by the COVID-19-induced lockdowns. The company said that YoY FY21 revenue rose to R1.18bn, while basic EPS came in at ZAc105 vs a loss per share of ZAc1,045 recorded in FY20. Sun International did not declare a dividend as it looks to further reduce its net debt, which currently stands at c. R7bn.

EOH Holdings’ share price has been under significant pressure over the past few years, but it saw somewhat of a turnaround, albeit from a low base, in March, gaining 19.1% MoM. Last week, EOH gave an optimistic assessment of its turnaround strategy in a trading update, wherein the company said that it expected 1H22 headline EPS to be between ZAc38 and ZAc44 vs a restated ZAc36 headline loss in 1H21. EOH also expects to show an operating profit of between R150mn and R180mn compared to the R76mn generated in 1H21.

Rounding out March’s best-performing shares were The Foschini Group, Omnia Holdings and FirstRand, with MoM gains of 18.3%, 18.1% and 17.2%, respectively. Last month, The Foschini Group said that it planned to acquire Tapestry Home brands, subject to Competition Commission approval, in a deal valued at c. R2.3bn. Tapestry is the owner of Coricraft, Volpes, The Bed Store and Dial-a-Bed, with 175 stores in SA, Namibia, and Botswana. FirstRand, SA’s biggest bank by market cap, reported good 1H22 results which showed a revenue advance of 4.6% YoY to R33.48bn, while diluted EPS stood at ZAc280.6 vs ZAc196.8 recorded in 1H21. The board declared a gross cash dividend of ZAc157/share – c. 43% higher YoY.

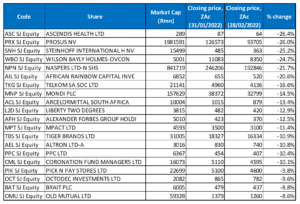

Figure 2: March 2022’s worst-performing shares, % change

Source: Bloomberg, Anchor

After impressive share price performances in February, platinum miners were the biggest disappointment, featuring prominently among March’s worst performers as the price of platinum and palladium fell 5.8% and 9.0% MoM, respectively, on concerns around softness in global vehicle manufacturing, as supply chain disruptions continue to impact the auto industry. In addition, results disappointed with earnings announcements highlighting poor operating performances in the sector. Impala Platinum (Implats) was March’s worst-performing share, declining 23.4% MoM and wiping out nearly all its share price gains from February. Implats reported a disappointing half-year result in early March, with safety stoppages, strike action, power supply interruptions, and maintenance of its Rustenburg furnaces being extended (what was initially expected to be a partial rebuild has morphed into a full rebuild that is set to take 4 months to complete) during the period under review. As a result, production volumes fell short of expectations and Implats revised its FY22 production guidance lower. Headline EPS of R16.90 was down 9% YoY, while 1H22 gross profit fell c. 20% YoY to R17.9bn. Implats has also spent c. R9bn to acquire a 35.3% stake in Royal Bafokeng Platinum (RBPlats), which the RBPlats’ board has recommended shareholders accept. Implats did not provide any major update on the bid in the results.

Implats was followed by RCL Foods, which was down 17.5% MoM. In a lacklustre 1H22 set of results, the consumer goods company indicated that its revenue rose c. 9% YoY to R17.15bn from R15.70bn posted in 1H21, while diluted EPS increased 19.3% YoY to ZAc73.50. In third spot, Anglo American Platinum (Amplats) lost 16.4% MoM, after recording a share price gain of c. 30% in February.

Sibanye Stillwater, and Curro Holdings saw share price losses of 16.2% and 15.2% MoM, respectively. In its FY21 results, Sibanye reported that its revenue rose 35.2% YoY to R172.19bn, while diluted EPS stood at R11.29, compared with R10.55 recorded in the previous year. However, despite posting a second consecutive set of record earnings, FY22 guidance was disappointing with SA gold volumes guided to decline by 21% YoY and SA PGM volumes guided to fall 10% YoY in 2022. In addition, a strike at Sibanye’s 1mn oz p.a. gold operations started in March, led by the National Union of Mineworkers (NUM) and the Association of Mineworkers & Construction Union (AMCU).

The share price performances of Prosus (-15.1% MoM) and Naspers (-13.7% MoM) once again disappointed in March, with the shares coming under pressure as negative sentiment around China’s tech crackdown continued to weigh on these counters. In addition, The Wall Street Journal (WSJ) reported in March that Tencent, in which Prosus has a c. 29% stake, is facing a potential record fine as its WeChat Pay had reportedly violated anti-money-laundering rules. According to the WSJ, the People’s Bank of China found Tencent’s payments platform had allowed the transfer of funds for illicit purposes such as gambling. WeChat Pay was reportedly also judged non-compliant with other rules that required Tencent to identify users and merchants transacting on the platform. Tencent also reported disappointing 4Q21 results, with revenue up 8% YoY at RMB144.2bn, while non-IFRS operating profit was down 13% YoY to RMB33.2bn (a big miss vs consensus analyst expectations), and adjusted net income fell 25% YoY to RMB24.5bn (also a miss vs consensus analyst expectations)

Rounding out March’s worst-performing shares were Massmart, food manufacturer RFG Holdings and Northam Platinum (Northam), which saw their share prices drop by 13.1%, 13.0% and 12.2% MoM, respectively. In its FY21 results, retailer Massmart reported a revenue decline of 0.1% YoY to R77.72bn, while its diluted loss per share stood at R103.00, compared with the R80.23 recorded in FY20. Massmart said that its FY21 performance was severely negatively impacted by COVID-19 lockdowns and the July civil unrest.

Last month, RFG said in a trading update that, for the 22 weeks ended February 2022, its revenue increased 20.0% YoY, with strong volume and turnover growth in both its regional and international segments. However, the food manufacturer said that margins came under further pressure due to significant increases in input costs, while in the current constrained consumer spending environment, it is proving “particularly challenging to recover the higher input costs through price increases, with resistance from both retailers and consumers …”

Northam’s 1H22 results, released last week, were a big miss vs market expectations before the trading statement was released. Operational issues (higher COVID-19 absences, community unrest) and very strong unit cost inflation (+15% YoY) led to production volumes coming in below Northam’s previous guidance. Poor volumes led to lower earnings growth vs previous expectations. Nevertheless, the Group announced a 66%-plus jump in profit as it benefitted from buoyant metal prices. Revenue rose to R13.88bn from R11.88bn posted in 1H21, while diluted EPS jumped by 81.7% YoY to ZAc965. Northam withheld its interim dividend, citing the need to consider its growth prospects.

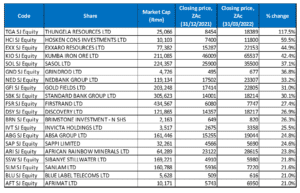

Figure 3: Top-20 March 2022, 1Q22/YTD

Source: Anchor, Bloomberg

Thirteen out of February’s top-20 YTD best-performing shares also featured among the top-20 performers 1Q22/YTD (to end March), with FirstRand (+27.4% 1Q22/YTD), Discovery (+26.9% 1Q22/YTD), Brimstone Investments (+26.3% 1Q22/YTD), ABSA (+24.8% 1Q22/YTD), Sappi (+24.6% 1Q22/YTD), Sanlam (+21.6% 1Q22/YTD), and Blue Label Telecoms (+21.0% 1Q22/YTD), replacing Amplats, Impala, Emira, Anglo American, Northam, Pan African Resources, and RB Plats.

Thungela Resources (+117.5% 1Q22/YTD, discussed earlier) took the top spot for the second month in a row, while HCI (+59.5% 1Q22/YTD) was in second place followed by Exxaro Resources (+44.9% 1Q22/YTD) in third position.

Exxaro’s delivered double-digit FY21 profit growth, with Group revenue increasing by 13% YoY to R32,771mn (FY20: R28,924mn) mainly due to a rise in coal revenue and the inclusion of renewable energy revenue from Cennergi for the full twelve months vs for 9 months in FY20. The miner also reported a 58% YoY jump in headline EPS, despite problems with SA’s rail network, which weighed on production and exports (as was the case with Thungela). It declared a final cash dividend of R11.75, thanks to the buoyant commodity prices and good operational performance for the year.

Exxaro was followed by Kumba Iron Ore (+42.4% 1Q22/YTD), Sasol (+37.1% 1Q22/YTD), Grindrod (+36.8% 1Q22/YTD), Nedbank (+33.2% 1Q22/YTD) and Gold Fields (+31.0% 1Q22/YTD). Last month Sasol’s share price broke through the psychological R400/share level for the first time in c. 3 years, before retreating again and ending the month at R355/share. This as global oil prices soared to multi-year highs due to continued fear around supply constraints after Russia’s invasion of Ukraine and the sanctions again Russia, the world’s second-largest oil supplier. Meanwhile, in its FY21 results, Nedbank reported a 115% YoY jump in headline EPS, while the bank’s profit almost tripled due to lower impairment costs, a recovery in its non-interest revenue growth and a strong focus on lowering costs.

Rounding out the YTD 10 best-performing shares were Standard Bank Group and FirstRand (discussed earlier) with 1Q22/YTD gains of 30.1% and 27.4%, respectively, as both banks reported strong results. Standard Bank posted a 57% YoY increase in FY21 profit to R25bn, while its headline EPS increased to ZAc1,573, compared with ZAc1,002.6 reported in FY20. Revenue grew 5% YoY, with double-digit growth in the second half of the year.

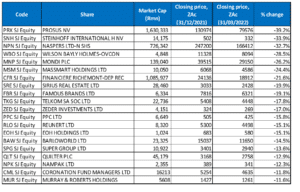

Figure 4: Bottom-20 March 2022, 1Q22/YTD

Source: Anchor, Bloomberg

Among the YTD worst-performing shares, 13 of the 20 worst-performers for 1Q22 also featured among the 20 worst performers for the year to end February. Famous Brands (-19.1% 1Q22/YTD), Zeder Investments (-17.0% 1Q22/YTD), Reunert (-15.1% 1Q22/YTD), Barloworld (-14.5% 1Q22/YTD), Super Group (-13.6% 1Q22/YTD), Nampak (-12.3% 1Q22/YTD), and Murray & Roberts (-11.6% YTD), replaced Ascendis Health, ARC, Altron, Alexander Forbes, Growthpoint, Pick ’n Pay and Sun International.

Prosus (-39.2% 1Q22/YTD and discussed earlier) replaced EOH Holdings to take the worst-performer spot for the year to end March. It was followed by Steinhoff (-33.9%) in second place and Naspers (-32.7%, also discussed earlier) in third spot.

Naspers was followed by Wilson Bayly Holmes Ovcon (WBHO; -28.5%), Mondi Plc (-26.2%), Massmart (-24.4%), and Richemont (-21.6%). WBHO released disappointing 1H22 results in March, with Group revenue declining 22% YoY due to reduced activity in Australia and the UK.

Sirius Real Estate (-19.9%), Famous Brands (-19.1%) and Telkom SA (-17.8%) rounded out the ten worst-performing shares for 1Q22/YTD. Famous Brands revealed in a voluntary performance update for the twelve months ended 28 February 2022, that in SA, its leading brands’ system-wide sales increased by c. 35.8% YoY, while like-for-like (LfL) sales rose c. 33.0% YoY. Its signature brands’ system-wide sales improved by c. 55.1% YoY, while LfL sales increased by c. 59.3% YoY. Telkom said last month that it has postponed the listing of its mast and towers business (Swiftnet), citing the fallout from Russia’s invasion of Ukraine. Swiftnet has operated as a separate tower company for over three years, running more than 6,000 masts and towers.