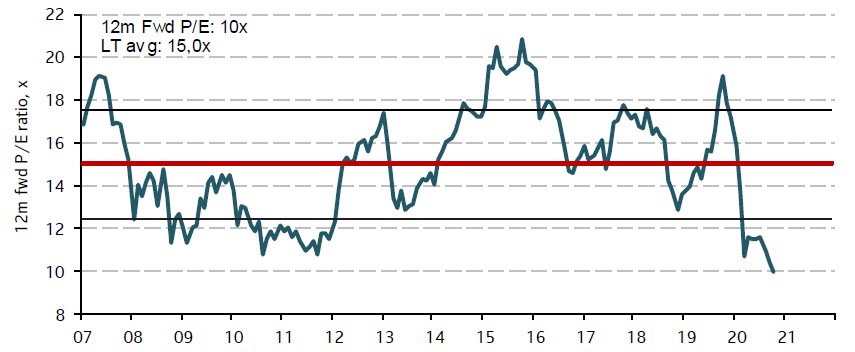

Despite a late flourish in November, the total return achieved by the FTSE/JSE Capped Swix Index this year currently stands at a miserable -1%. Taking a slightly longer-term perspective, over the past 4 years, the compound total return from SA equities has been just 1% p.a. When compared with the 16% annual return from US equities (in US dollar terms) over the same period, South Africa (SA) has felt like the investment equivalent of trying to push water up a hill. Unsurprisingly, institutional and retail investors have been voting with their feet – shifting investments offshore to the extent that they can or opting for the more secure returns on offer from local fixed income. Removing the distorting impact of Naspers, which has a large and growing weighting in the index that tends to crowd out the rest, Figure 2 below shows how this investor exodus from local equities has driven a steady decline in valuation.

Figure 1: SA equities: Price as a multiple of expected earnings in 12-months’ time (ex-Naspers)

Source: Standard Bank

With the number of false dawns there have been for SA equities over the last few years, investor scepticism that this time will be any different is understandable. However, there is no denying that, judged by valuation, the bar of expectation right now is very low indeed. Interestingly, one thread that has been fairly pervasive across the recent updates from JSE-listed companies is that many of them have not let a good crisis go to waste. Through tight cost management and a focus on cash, these companies have fared better than might have been expected.

Below, the Anchor investment team has compiled a selection of local equities that we believe are worth keeping an eye on in the year ahead. In compiling this list, we have tried to avoid selecting those stocks whose prospects we see as closely linked to the SA economy only – we await more evidence of a willingness by government to grasp the nettle on reform before relying on this as a driver. Rather, we have selected those shares that we think fall into more durable themes: (1) consistent growth compounders, which investors should be happy to hold over the next five years; (2) quality stocks that were hit hard by the pandemic but which should bounce back stronger; and (3) special opportunities, where corporate action, delayed by the disruptions to deal-making in 2020, may unlock value in the coming year.

Naspers

Naspers’s 31% stake in Hong Kong-listed Tencent comprises approximately 90% of the Group’s net asset value (NAV), whilst its investments in three other internet verticals –Online Classifieds, Payments, and Food Delivery – account for the bulk of the rest. Naspers has been a standout performer in a broader local equity market which, for investors, has resembled trying to push water uphill over the past 5 years. This performance has been underpinned by Tencent’s consistently strong earnings growth – it has delivered compound growth of 27% over the past 4 years. Given its size, and the fact that its gaming division (the dominant contributor to its bottom line) was a significant beneficiary of COVID-related lockdowns in 2020, investors may well ask whether Tencent’s best days are behind it. In fact, Tencent is projected, based on Bloomberg consensus forecasts, to grow by more than 20% p.a. over the next three years, as its past strategy to diversify starts to deliver results. Streaming of content, financial services, online advertising, and cloud services are likely to grow robustly off low bases.

However, Naspers’ other internet investments had a more mixed experience from the COVID-19 pandemic – Food Delivery saw a significant boost, but Online Classifieds and Payments faced headwinds. Pleasingly though, Naspers’ latest results showed tentative signs of reversing longstanding concerns that have kept investors favouring Tencent over Naspers and thus contributed to Naspers’ widening discount to its NAV – the inferior reported growth in Naspers relative to Tencent and the consistent consumption of cash by Naspers’ other investments. Although Naspers would warrant inclusion by virtue of Tencent’s compound growth potential alone, but we expect 2021 to be of additional importance for two reasons: (1) a confirmation of Naspers’ other investments’ ability to drive superior growth; and (2) the likely next step in corporate action to narrow the discount to NAV.

Tencent is currently trading at a multiple of 38x its expected earnings in 12 months’ time. Like many technology stocks that have been beneficiaries of the COVID pandemic, this appears demanding relative to its history. One mitigating factor to keep in mind is that Tencent has a portfolio of listed investments of its own that do not contribute to earnings and which have grown significantly in value over the years. If these are stripped out, the valuation falls to a more reasonable 32x. Markets have proven notoriously unwilling to account for such value in conglomerates of late and there is little reason to think this will change in 2021. Rather, it is the corporate action we may see in 2021 to address the yawning discount to NAV that could be the driver of investment returns. The discount currently stands at 52% – close to the widest it has been historically. Given the attention this has been receiving, and the commitments made by management to address it, we think it is highly likely that the next major step in this regard will be announced in 2021.

MTN

MTN operates mobile networks in 21 countries across Africa and the Middle East, with a top-2 market share across all markets – important in a winner-takes-most industry. While present in many markets, Nigeria, SA, and Ghana account for c. 75% of its earnings. Having spent several years strategically realigning the Group and addressing underperforming parts of the business, 2020 was supposed to be the year in which MTN’s “self-help” initiatives finally landed. Although operationally MTN has delivered a solid performance this year, it has been overshadowed by the more negative consequences of COVID-19 – a delay in the disposal of non-core assets, a fall in oil prices triggering another foreign exchange shortage in Nigeria, which in turn forced MTN to pass on its interim dividend, and a general aversion by investors to emerging market (EM) investments perceived to be at the riskier end of the spectrum. This has resulted in 2020 being yet another frustrating year for MTN investors. However, MTN’s strategic journey has been delayed by COVID-19 rather than completely upended by it.

As economic activity normalises in 2021, a recovery in oil demand should alleviate Nigeria’s foreign exchange shortages, paving the way for a resumption in dividends. We also expect progress in MTN’s plans to raise R25bn through the sale of various assets, many of which are classified as non-core. Finally, MTN’s recently announced plans to exit the Middle East should simplify and de-risk the business. In this regard, the recent win by Democratic challenger, Joe Biden, in the US Presidential Election could pave the way towards a thawing in relations with Iran, which in turn could improve MTN’s prospects of disposing of, or exiting, what is arguably its most valuable asset in the region. Although mobile networks in markets such as Afghanistan, Syria, Iran, and Yemen are hardly premium assets in the current geopolitical climate, it should be kept in mind that, at MTN’s current valuation, no value is ascribed to these markets.

From a valuation perspective, MTN trades at a multiple of 8.3x its expected earnings in 12-months’ time, while it is forecast to deliver low-teen growth over the next 3 years. The current market capitalisation of MTN Group is only slightly more than the value of the stakes in its listed operations in Nigeria and Ghana, although few investors are likely to rely heavily on these values. MTN’s valuation of its 29% stake in IHS Group, which is expected to list in 1H21 (it contributes nothing to reported earnings on account of it being classified as “available for sale”), is c. R17/MTN share. In short, while MTN’s risk profile means that it is probably not appropriate for all investors, expected progress on its asset realisation and simplification strategy, alongside solid earnings growth, should continue to drive a strong recovery in the share over the next year.

Telkom

Over the past decade, the telecommunications sector globally has been a poor bet for investors. A chronic inability to pass inflation on to consumers of their services (a deeply ingrained belief exists that prices only fall), often destructive competition, and regulatory interference from authorities who seemingly see the services telcos provide as a social right in which commercial principles are secondary, are just some of the reasons why the sector has been incapable of producing reliably high returns on capital to be reinvested to deliver compound growth.

However, from time to time, the stars do align to present a special opportunity that could deliver an attractive investment return. Bear in mind that Telkom’s share price reached almost R100/share as recently as June 2019. The reasons, as to what has changed to explain why it is trading at around one-third of that level currently, are in our opinion twofold: (1) the decline of its legacy fixed services has been more rapid than expected; and (2) due to its relatively high corporate exposure, it has felt the consequences of SA’s weak economy, which was amplified further by the heavy-handed lockdown SA chose to impose in 2020.

Through all of this, however, Telkom has continued to progress in its reorganisation of the Group into several self-sustaining businesses/brands, with the aim to unlock value through a break-up of the conglomerate structure. Operationally, despite pedestrian top-line growth, with the help of further headcount reductions and other cost saving measures, we expect Telkom to deliver a compound annual growth rate (CAGR) in earnings of c. 10% over the next three years. More importantly, however, we expect 2021 to be the year in which Telkom’s value-unlock starts in earnest, beginning with a potential tower asset disposal by the end of this financial year (FY21). This could be followed by the separation of its data centre and wholesale network businesses.

From a valuation perspective, Telkom is currently trading at a price as a multiple of its expected earnings in 12-months’ time of 5.7x, or just 2.2x EV/EBITDA. While Telkom is hardly unique among SA-listed companies, where investors are not paying up for this potential value unlock at present, it should be kept in mind that the reorganisation of Telkom has been several years in the making. We therefore believe it is now very close to being able to begin releasing value.

Bidcorp

Bidcorp is a leading international food services company that operates in developed and developing countries across five continents. The company was unbundled from Bidvest and listed on the JSE on 30 May 2016. Operationally, Bidcorp is a clear market leader in key regions and it has an excellent track record in the food service space, which has been driven by strong organic and acquisitive growth over the years. Bidcorp delivers food-service products to a diversified customer base and fundamentals within its sector have been structurally attractive given the material shift towards eating out of home. COVID-19 disruptions and lockdown restrictions have negatively affected operations and consumer behaviour but, despite these headwinds, Bidcorp experienced a quick rebound in eating away from home after lockdown restrictions were lifted. Although the second round of restrictions, on the back of a second wave of COVID-19 infections, have subsequently affected sales progression in Bidcorp’s various regions, management are confident that these geographies will be able to withstand this next phase of the pandemic. Positively, second wave lockdown restrictions have been less severe relative to lockdown restrictions earlier this year. We remain confident that Bidcorp’s operations are not permanently impaired and will most probably normalise within the next 18 months.

From a valuation perspective, Bidcorp is trading on a 20x forward PE multiple, which is in-line with its historical average. We expect Bidcorp’s earnings to revert to FY19 earnings within the next two years. We also think that the combination of market share gains as well as potential acquisitive and organic growth are compelling factors in Bidcorp’s continued growth trajectory. As a result, we expect Bidcorp’s diluted headline earnings per share to increase by a CAGR of 50% for the next two years as sales start to normalise. In our view, Bidcorp is well placed to recover to pre-COVID levels in the next 18-24 months.

Raubex

Raubex is a construction company with three major divisions. In the traditional sense, the company’s segments are Road and Earthworks and Infrastructure. Within Road and Earthworks, Raubex focuses on broad aspects of road construction and related infrastructure development. On the infrastructure side, the company specialises in disciplines outside of the construction sector, including renewable energy, rail, telecommunications, pipeline construction, housing, and commercial building projects. A distinguishing factor for Raubex from other construction companies is its materials segment. This segment contributes c. 67% towards operating profit and involves the supply of aggregates from quarries. It also provides handling and mobile crushing services to the mining industry.

We think that Raubex is well placed to benefit from the SA government’s infrastructure build programme to drive long-term economic growth. Government is currently evaluating 276 projects that have a total investment value of c. R2.3trn and it will be looking to significantly invest in strategic integrated projects (SIPs) in energy, water and sanitation, transport, digital infrastructure, human settlements as well as agriculture and agro-processing over the next few years. We believe that Raubex will be well equipped to participate in renewable energy, transport, and human settlements. It is also important to note that Raubex has won three significant contract opportunities recently and continues to await adjudication of other contract opportunities that were tendered for within SA’s construction sector. Given that contract revenue contributes c. 70% towards its total revenue, contract wins are especially important for revenue and earnings growth. We think that the South African National Roads Agency (SANRAL) and government infrastructure build programmes offer compelling prospects for Raubex in the short-to medium-term and possibly even in the long term.

Raubex’s earnings growth will be gradual in the near term and will begin to accelerate as the company continues to win significant contracts. In our view, its operating profit margins will expand over the medium term from current depressed levels relative to its history. With many competitors exiting the industry over the last few years and with few having the balance sheet strength to take on larger projects, pricing power for companies like Raubex should improve as limited capacity is absorbed by new contract awards. On valuation, Raubex is currently trading at premium rating of c. 13x. This is above its historic average of ~8.4x expected earnings. Off current depressed levels, however, we think Raubex could be in for several years of improving profitability, which is not yet fully discounted in the share price.

Mr Price

Times of crisis can provide a company with significant risks or attractive opportunities. Most times it is dependent on the position the company was in upon entering the crisis that determines how the crisis will impact that company. In this regard, Mr Price has been able to navigate through the COVID-19 crisis very well and to take advantage of the opportunities it has presented.

Mr Price entered the crisis with an extremely strong balance sheet. At the end of March 2020, just as we entered the level 1 lockdowns, Mr Price had R4.2bn in cash. The company used this strong position to identify new growth vectors and the results were evident in its latest financial results presentation. During probably the toughest trading environment ever experienced by SA retailers, Mr Price was able to improve its operating margin, successfully launch a new affordable cosmetic range, enter the attractive babywear and customer-pulling schoolwear categories and acquire Power Fashion. And, after all these ventures, it was still able to build on its cash pile. Mr Price ended September with a cash balance of R6.2bn, or c. 14% of its total market cap.

Out of all these new growth initiatives we are most excited about the R1.6bn Power Fashion acquisition. Power Fashion is a deep value clothing retailer that offers basic clothing needs at very affordable prices – much like Pep Stores. Currently, Power Fashion operates out of 170 stores, while Pep Stores operates out of more than 200 stores across SA. We believe that there exist exciting opportunities for Mr Price to expand this store base aggressively over the next few years. Additionally, Mr Price management have indicated that Power Fashion will also allow it to better categorise its product offerings across its brands, enabling it to stabilise the gross profit margin going forward.

Mr Price is trading at a premium valuation rating to its SA peers, but we believe that this premium rating is justified due to its higher profit margin, superior return metrics, and its cash generation. As mentioned above, Mr Price is extremely cash flush and has an incredible ability to convert its earnings into cash profits. Management have indicated that they have no intention of hoarding cash and will look to distribute excess cash to shareholders through share buybacks or enhanced dividends.

Overall, the combination of organic growth from a normalisation of economic activity in 2021, acquisitive growth, the entry into new growth categories and cash distribution to shareholders makes Mr Price our preferred SA retailer going into 2021 and one which we will definitely be keeping an eye on.

Curro Holdings

Private education is, theoretically, a very stable and defensive sector, but the 2020 lockdowns and the ensuing economic hardships caused even this sector to take pain. And it could not have happened at a worse time for Curro Holdings.

Over the past five years, Curro has been rolling out new schools in SA. Some would argue, with the benefit of hindsight, knowing what we know now about SA’s economic situation, this rollout was too aggressive. But what made the company even more vulnerable as we entered the lockdown was that it funded this rollout with debt. As the economic consequences of the lockdown started to bite, Curro management had to make tough decisions. It decided to increase its tolerance for bad debt and to take a chance on the resilience of the SA consumer rather than just evicting learners. However, with that decision management realised that it could not carry the risk of a highly indebted balance sheet if the consumer is not able to pay outstanding fees. Curro thus carried out a sizeable capital raise by way of a rights issue that was concluded in early September. The greater number of shares in issue, combined with the tough economic environment, does not bode well for the Group’s 2H20 results.

Nevertheless, we believe that Curro has now taken its medicine and that it may be on an attractive growth path going forward. Management have indicated that Curro will be using cash from the capital raise to reduce the company’s debt levels. The reduction in the interest expense will, on its own, help Curro to grow earnings. Cost growth should also start to subside. Management have in the past highlighted that the salary increases offered by government to public sector teachers is the base from where Curro negotiates with its teachers. The SA government’s commitment to reducing its wage bill will thus bode well for Curro’s future cost growth. Finally, the SA consumer has proven far more resilient than many pundits, including us, had expected. Looking at the performance of the COVID-19 loans offered by the SA banking sector, we believe that the market may be overestimating the bad debt loss that Curro will suffer in 2020.

We believe that private education in SA still has very strong thematic tailwinds as the demand for good quality, affordable education continues to grow. We also think Curro is best positioned to benefit from this trend. It has, as mentioned, built out an extensive network of schools. The expensive capital outlay has been sunk and from here Curro must continue to fill the capacity it has created already, with only maintenance expenditure then being required. The operational leverage of this can be significant, making Curro a very interesting stock to watch in 2021.

Transaction Capital

Transaction Capital is made up of (1) a vertically integrated taxi finance business (SA Taxi); (2) a debt collection business (TCRS), which collects debts on behalf of others (agency basis), as well as buying books for collection (principal basis); and (3) trade in second-hand vehicles following the recent purchase of a 49.9% stake in WeBuyCars. Operationally, 2020 has been a “lost year” in a manner of speaking for Transaction Capital, with increased provisions for credit losses in SA Taxi, the impairment of its purchased collection portfolios, and reduced volumes all conspiring against it. However, it has emerged from the COVID-19 pandemic in a strong position. The resilience of the taxi industry has been proven in the speed with which it has recovered, and transaction volumes have rebounded.

Although Transaction Capital adopted a conservative stance with respect to buying books of bad debts through the pandemic, there will be plenty of opportunity in the months ahead for this activity. Finally, the WeBuyCars deal is set to be earnings accretive off the bat and, so far, the signs are that it has been a well-timed addition to the portfolio, with plenty of runway ahead.

Although the company’s share price fell very sharply in the initial panic, it has recovered to a point where it is no longer a likely beneficiary of the normalisation in 2021. From a valuation perspective, Transaction Capital currently trades on a price as a multiple of its expected earnings in 12-months’ time of 15.5x. On the face of it, this is not particularly cheap relative to the depressed ratings of many other depressed SA Inc. stocks. However, given the track record of this management team in delivering solid high-teen earnings growth, the strong positions that its operating divisions occupy in their respective fields and our belief that Transaction Capital has used the 2020 “reset” to conservatively build reserves for any future rainy day, we see this share as a well-managed compounder that investors should be happy to hold over the next few years.

Sibanye-Stillwater

Sibanye-Stillwater does not fit the mould of what we as an investment team typically look for – high return-on-capital businesses, with the ability to compound earnings for a long period of time. Sibanye is a much more cyclical situation. It initially came to the market years ago just as a gold company. Then a few years ago, Sibanye aggressively acquired assets in the platinum sector. In hindsight, this drive into the platinum sector was extremely well-timed. Platinum group metal (PGM) prices strongly recovered into a bull market soon after and PGMs continue to be strong at present. That has allowed Sibanye to quickly pay down the debt it took on to make those acquisitions. From R27bn in net debt at the end of 2017, we estimate that it is now in a net cash position. Cash flow for 2020 YTD is more than twice that of 2019 and more than three times that of 2018. The danger, of course, is that the cash flow is very dependent on precious metals prices, particularly PGM prices.

Still, at the current valuation, we believe the market has been cautious to recognise the change in its debt situation or the level of precious metals prices. Part of this hesitance may come from concerns about what the company will do with the cash (will it go on another M&A spree, for example?) and the cyclicality of commodity prices. At just over four times estimated 2021 earnings, however, we believe little upside of a cleaner balance sheet and a strong commodity price environment has been priced-in to the current valuation.

Grindrod

Grindrod is a shadow of its former self. After unbundling its once extremely profitable shipping business it is now a collection of assets that do not really fit together. Management are aiming to change this which should help in narrowing the gap between its share price of just less than R5 and its NAV of over R12. The market cap of the business is R3.5bn and there are assets worth c. R3bn which the company intends disposing of. These include Grindrod Bank (with a book value of around R1.6bn), a stake in Senwes (which would realise around R500mn), the working capital in a trading business (c. R600mn), and various private equity interests. The intention is for this cash to be given back to shareholders via share buybacks or dividends. Grindrod has been a disastrous investment for Remgro, and it is pushing hard to realise value.

While the timing of these realisations is uncertain, if you are willing to hold on for six months there should be healthy share price upside. The bank, in particular, is a tough one to sell at book value as it does not earn the ROE required to justify the book value, especially given its lack of critical mass and conservative gearing. Nevertheless, it has value and that is not represented in the share price.

Once these assets are dealt with, what is left is a Southern African logistics business, offering a network of ports, rail, freight forwarding, and shipping. Much of its asset base is in Mozambique and, while some of the areas of operation are complex politically, there are high barriers to entry. These assets should generate cash of over R1bn p.a. at reasonable capacity, underpinning the value equation. Some might consider this a messy business, but when times are good cash flows are strong. The biggest macro driver is resources, which appear to have a good few years still to run.

Alviva

Alviva (R9.25) is a classic small-cap value play which, by any reasonable metric, is worth more than double its current share price. The share already looked cheap at R15 heading into the COVID-19 market crash and it has only partly recovered. Recent corporate actions suggest that there might be some more interesting news in the months ahead.

While Alviva is a small cap, it is a fairly material business with over R15bn in turnover. It is also SA’s biggest IT distributor and has a growing services business. It earns around a 10% margin on the sale of products and it is a working capital business, with working capital days of around 20-25. Last month, the company announced the purchase of Tarsus, its biggest SA competitor and this should add handsomely to its profit over the coming years.

The earnings metrics are as follows: Core HEPS: ZAc351 (June 2019), ZAc226 (June 2020), and, we forecast it to earn ZAc260 (+15% YoY) for the year to June 2021. This places it on a forward PE of 3.5x. It has a NAV/share of ZAc1,763 and it is targeting an ROE of 15%-20%, which would be achieved if FY21 HEPS was ZAc260–ZAc340. We estimate that the business generates a R400mn run-rate free cash flow, on a market cap of R1.15bn. We forecast that Alviva will pay out R35mn as a dividend (10%, or ZAc26/share, which equals a dividend yield of 3.2%), use c. R50mn for share buybacks and have the remainder left to pay down debt or make acquisitions. The share price is currently trading at 40% of free cash flow and the Group’s 2020 EBITDA was over R700mn.

Alviva’s balance sheet is strong. It has a ringfenced and securitised its finance business (Centrafin), but its core debt to equity is less than 10%. Centrafin has performed relatively well under the circumstances. It does not expect material bad debts and provided conservatively at June 2020. The company posted resilient June 2020 results (core EPS were down only 36% YoY), despite facing COVID-19 headwinds as it experienced reduced trading conditions during the last quarter (3Q20). However, significant demand for work-from-home products and services slightly offset the poor performances in its other segments.

Alviva is predominantly driven by the SA economy. Despite headwinds, it continues to demonstrate resilience. It was profitable even during the lockdown months. The biggest risk to the company is the SA economy and this will probably prevent it from achieving a high PE multiple in the medium term.

At a 5x PE, the share price would be R13 and at its average PE for the last few years, the price would be R20.80. It started the year at around R15/share. In tough times shares tend to trade at very low multiples and at R9.25 Alviva is still absurdly cheap, in our view. We would expect a good share price performance over the next 12 months, but the timing thereof is always uncertain in the small-cap sector. The upside is potentially 100%, but this will need some positivity on the SA economy. One added element is the entry of a new shareholder in the form of a BEE entity, which has just acquired a c. 10% stake in Alviva – so perhaps there is more corporate action to follow.

To summarise, above we have provided 11 interesting local stock ideas for investors to mull over during the Festive Season. We think that they fit a range of interesting themes that could play out over the next year or so, without being overly reliant on SA’s economic fortunes. Given the low bar that current valuations imply about investors’ expectations at the moment, not a lot has to go right to deliver decent returns from SA equities in the year ahead. If talk does translate into action on the structural reform front, that would merely add further impetus for many of the shares selected. On that note, we wish you safe travels if you are going away this Festive Season and here’s to a steady road back to normality in 2021.