In this note, the Anchor investment team highlights a selection of JSE-listed companies we believe are worth watching in the year ahead. These picks, presented alphabetically, illustrate our stock-picking philosophy. Please note that these individual stock ideas may not necessarily be reflected in all client portfolios, given the differing mandates and risk-return profiles.

At the time of writing, with a return from the FTSE/JSE Capped SWIX Index of 33% (6 December 2024 [our 2025 stock picks closing prices date] to 1 December 2025), it looks like 2025 will go down in history as an exceptional year for South African (SA) equities. Looking back at what we anticipated lay ahead when we published our stock picks for 2025, we noted that the post-Government of National Unity (GNU) rally in domestically focused companies had pushed the so-called “SA-Inc” component of the market’s valuation much closer to its long-term average. This, as investors bid up shares in anticipation of these companies benefitting from a series of much-needed tailwinds in the months ahead, including the end of loadshedding, greater confidence post the GNU formation, two-pot retirement fund withdrawals, and declining interest rates. By that point, we noted that evidence of this improving backdrop was proving decidedly patchy in translating into results.

In hindsight, investors were way too overoptimistic about the SA Inc. renaissance. Online gaming has been widely blamed for sucking the oxygen out of the SA consumer recovery theme. At the same time, there was little evidence of any GNU-inspired reforms feeding through into improved business confidence in other parts of the market dependent on the domestic economy. Instead, 2025’s performance has been almost entirely driven by:

- Gold and platinum group metals (PGM) miners, which have enjoyed an eyewatering rally on the back of rising metal prices;

- Telcos, thanks for the most part to their operations in the rest of Africa, which are finally managing to translate strong demand into reported earnings growth; and

- Naspers/Prosus riding the renewed investor interest in Chinese technology stocks via key investment, Tencent.

The index performance has papered over what was, in fact, a minefield of highly divergent outcomes for SA investors.

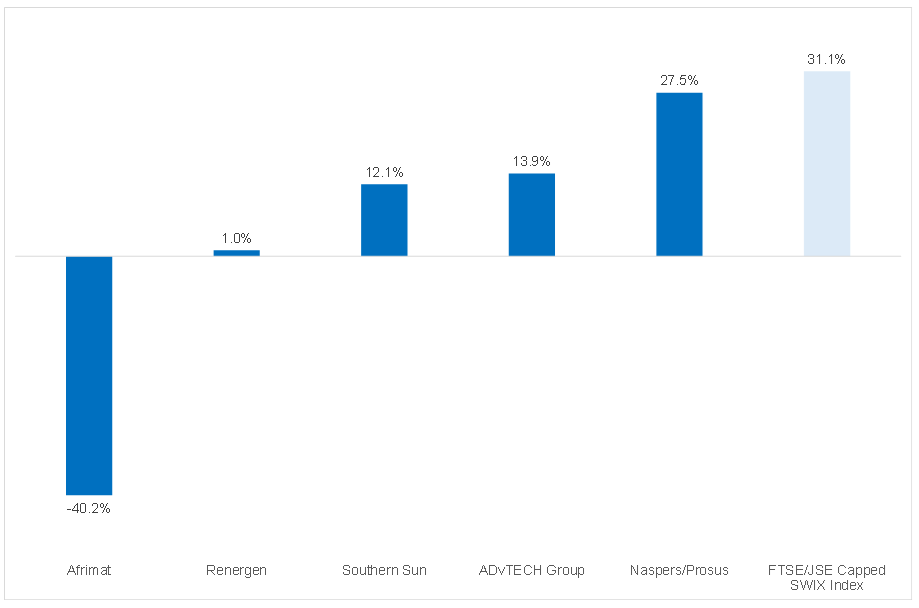

Regarding our 2025 stock picks, for which the outcome is shown in Figure 1, an equal weighting in each of them would have yielded a rather underwhelming total return of 2.9%. We were undone by Afrimat, which reminded us yet again that operational turnarounds typically take longer than your spreadsheet suggests. Our consumer recovery plays – Southern Sun and ADvTECH did ok, considering the consumer did not actually recover. Naspers/Prosus was, pleasingly, a case where the thesis did unfold as expected. Our wild card, Renergen, played out nothing as we expected, but did provide brave and nimble investors several opportunities to profit handsomely during the year, only to return to where we started!

Figure 1: Anchor’s 2025 domestic stock picks – total return (rand)

Source: Anchor, Bloomberg

Note: Capped Swix performance is from 6 December 2024 to 1 December 2025.

Turning to the year ahead, while many of the supports for domestically focused companies remain in place – declining interest rates (albeit slower and more tentatively than many would like), a stronger rand and a modest rebound in economic growth in prospect – current valuations across this cohort of companies suggest the 2025 experience means investors are waiting for evidence of this in results this time. This presents some compelling company-specific opportunities. On the flipside, it is questionable whether the runaway winners of this year can repeat that feat in 2026.

After five surprisingly good years for domestic investors, in which total US dollar returns have fallen only marginally short of the S&P 500, we approach 2026 fairly constructive but clear-eyed about the structural constraints that remain. Our c. 10% market return expectation anticipates a broadening of performance, likely more oriented towards domestic names that were overlooked in the past year.

Our five stock picks selected for 2026 reflect this view. They are:

- Premier and KAL Group – two domestically focused consumer names that we believe are led by strong management teams with clear growth strategies.

- Optasia – a new listing, where we expect growing investor support as its strong non-SA growth potential becomes more visible.

- Valterra – our preferred way to access a clearer demand/supply outlook in PGMs,

- Blu Label Unlimited – our 2026 wild card, where we believe investor reaction to the slightly underwhelming reception to Cell C’s listing has created a compelling set-up for the year ahead.

Blu Label Unlimited Group: Time to ignore the doom-mongers

By Mike Gresty, CA(SA), CFA, Fund Management

The value unlock from the restructuring of the Blu Label Unlimited Group (BLU; formerly Blue Label Telecoms), culminating in the Cell C IPO, dominated much of the 2025 investment narrative and has been a widely anticipated event, pushing the BLU share price to a level above R17 in August. However, the Cell C IPO proved a lot more challenging to get across the line than expected and was ultimately priced below the initial guidance range, valuing Cell C at R9bn. This is around half of what bullish’ value unlock’ advocates had projected earlier in the year.

The outcome has proved to be a perfect set-up for the doom-mongers: questions as to what lay behind the urgency of the Cell C listing despite the Group’s results still being mired in the complexity of the restructuring that has taken place, longstanding investor unease around the credibility of BLU’s management team, questions over the future contractual terms on which Cell C depends to secure wholesale capacity from MTN and Vodacom (Cell C no longer has a mobile network of its own) might change, provided fertile ground for the naysayers. This loss of investor confidence has shaken out many weak shareholders and driven the share price to levels below R10 in the process.

Granted, BLU might not have achieved the hoped-for Cell C IPO valuation price, but it did deliver the restructuring it promised – a point often lost amid the repetition of concerns. Understanding what that means suggests that this may be an excellent opportunity to adopt a contrarian position here.

Unfortunately, BLU results for the financial year to end May 2026 (FY26) will remain messy due to the scale of the restructuring the Group has undergone this year. With investors typically allergic to complexity, it may require some patience before a clear picture emerges. However, this is what we think could emerge:

- A cleaner BLU with a revealed “rump” business: The combination of the IPO placement (c. 25%), BEE structure (30%) and Cell C management incentive plan (4.5%) will leave BLU with a Cell C stake of c. 45%. That is important because it means Cell C will be accounted for as an associate rather than having to be consolidated as before. This will reveal the BLU ‘rump’ business, which we think has qualities that are underappreciated because its earnings have essentially been poured into keeping a highly indebted Cell C afloat. The BLU rump can be thought of as a low capital intensity “fintech” that essentially acts as a tollgate on a broad range of financial transactions it facilitates. Initially merely a prepaid airtime distributor (now a largely ex-growth part of its business), it has expanded into many other areas, making use of various forms of prepaid vouchers: prepaid electricity, event tickets (Ticketpro), gaming, for example. We think this ‘rump’ should generate close to R1/share of earnings with a very high level of cash conversion. Thanks to healthy growth rates in the non-mobile airtime categories, we expect earnings to grow at a double-digit rate over the next few years.

- A reset Cell C with a viable path forward: We are cautious of management’s assertion that Cell C’s model will prove to be superior to that of mobile operators with their own networks and agree investors should be clear-eyed about how future contract renegotiations with Vodacom and MTN, on which it is dependent, might change the economics. That said, the Cell C that now exists as a listed entity has a clean capital structure (thanks to a significant conversion of debt to equity before listing), should generate healthy free cash flow (FCF), will benefit from a sizeable, assessed tax loss for years to come, has valuable spectrum and has assembled a high-calibre management team that is keen to prove the sceptics wrong. On our estimates, we think the initial IPO price equates to a forward P/E multiple of about 4.5x. Assuming Cell C delivers on its promises, there is scope for it to rerate upwards.

- Balance sheet strength at BLU: While the proceeds from the IPO were less than hoped for, BLU should emerge unindebted and with a decent cash pile with which to pay a special dividend or buy back shares. Furthermore, although not central to our investment thesis, we wonder if the urgency to get the IPO done might relate to possible corporate action opportunities that become available to both companies once they are independent of one another.

In conclusion, with a market capitalisation at the time of writing of just R8.8bn, investors appear to be ascribing no value to the BLU rump at all. Even that value implies a very depressed rating for Cell C. We see a tremendous value underpin here with a multitude of options to drive upside in the year ahead. With recent announcements that the joint CEOs, Brett and Mark Levy, have acquired R190mn worth of BLU shares, it would appear they agree!

KAL Group: Shifting the narrative from farm gates to forecourts

By Sean Culverwell, Investment Analyst

KAL Group (formerly Kaap Agri), long regarded as a niche agricultural supplier, is steadily transforming into a scaled convenience and fuel retailer. While the company’s Agrimark chain still anchors earnings, the rapid expansion of its PEG fuel-station business is reshaping the Group’s fundamental profile.

Agrimark – a farmer’s best friend

Agrimark contributes roughly two-thirds of the Group’s profit and spans agricultural inputs, general retail and fuel. The agri inputs business supplies almost everything farmers need to maintain, upgrade and expand operations.

KAL is selective on farmer exposure, focusing on producers with access to naturally occurring water systems. Within its catchment, KAL services the top 200 commercial farmers in SA and is actively growing its share among the next 200. Large commercial farmers are consolidating their vendor bases to secure better terms and reliability of supply. This has made KAL a clear beneficiary, recording consistent market-share gains.

Scale and assortment are key advantages: with c. 50,000 stock-keeping units (SKUs), KAL is often the default partner of choice for farmers seeking a one-stop solution.

A strong 2025 horticulture season, particularly in citrus, lifted farmer incomes and boosted Agrimark’s second-half profits by 35%. With healthy farm balance sheets and favourable early-season weather, we expect another strong year ahead for Agrimark.

PEG – consolidating convenience retail

The shift in KAL’s investment profile comes from PEG, the fuel and convenience retail business acquired in 2023 and merged with The Fuel Company. The deal doubled KAL’s footprint to 89 service stations, making it the country’s largest independent operator. PEG now contributes around one-third of Group profits and, in our view, will be the primary growth engine.

Fuel dominates PEG’s revenue line, but profitability is driven by convenience retail and quick-service restaurants. PEG sells c. 300mn litres of fixed-margin fuel p.a. but generates roughly R4/litre in retail and quick service restaurant (QSR) revenue.

While some regions are oversupplied with low-margin fuel sites, PEG is looking to expand its footprint in high-traffic, peri-urban locations with above-average retail spend per litre. Recent acquisitions include sites generating up to R7 retail spend per litre at c. 25% EBIT margins.

Going forward, we believe PEG’s bolt-on strategy offers meaningful optionality:

- As one of the largest Famous Brands franchisees, KAL can acquire underperforming sites in good locations and bolt on multiple QSR chains to uplift spend per litre.

- PEG is acquiring sites at low single-digit earnings multiples, making deals immediately earnings accretive.

- Retail and QSR inventory turns at fuel stations are high, keeping capital requirements low relative to returns.

- KAL is viewed as a “partner of choice” by the oil majors thanks to its scale and operational track record, supporting favourable terms vs smaller competitors.

With three sites added in late FY25 and five more planned in the year ahead, coupled with a low fuel price environment supporting domestic travel and expected consumer relief into 2026, we expect PEG to deliver a strong performance in FY26.

Moving forward from a position of strength

Strong cash generation, coupled with recent disposals of lower-return businesses, has left KAL with its strongest balance sheet in more than a decade. This gives the Group the capacity to continue to acquire value-accretive sites at attractive multiples.

We expect earnings to compound at double-digit levels over the medium term, while the recent drop in the Group’s dividend cover will provide an uplift to shareholder returns.

Despite strong FY25 results and an increasingly attractive strategic mix, the share still trades on a forward P/E multiple of just 6x, which we believe is compelling in the context of a clear growth runway and improving fundamentals.

Optasia: A unique JSE fintech with a long runway

By Keagan Higgins, CGMA, ACMA, Investment Analyst

Optasia (OPA) provides a rare form of JSE exposure: a scaled, profitable fintech platform embedded directly within telecom and mobile-money ecosystems across emerging markets (EMs). Founded in 2012, Optasia has more than a decade of operating history at scale. It provides the AI decisioning, underwriting, and platform layer, while partner banks fund the loans.

The Group estimates a potential reach of c. 860mn underserved mobile network members through its telecom rails and data network partners. Only around 120mn are currently active users. That difference signals a significant runway for growth as Optasia deepens penetration within its existing footprint.

In these segments, traditional banks often struggle to price and distribute small-ticket credit efficiently. Optasia fills this gap by using telecom data and real-time decisioning inside daily mobile channels. Years of high-volume operations have also built a deep consumer dataset that continuously enhances its credit models – a competitive moat that is difficult for new entrants to replicate.

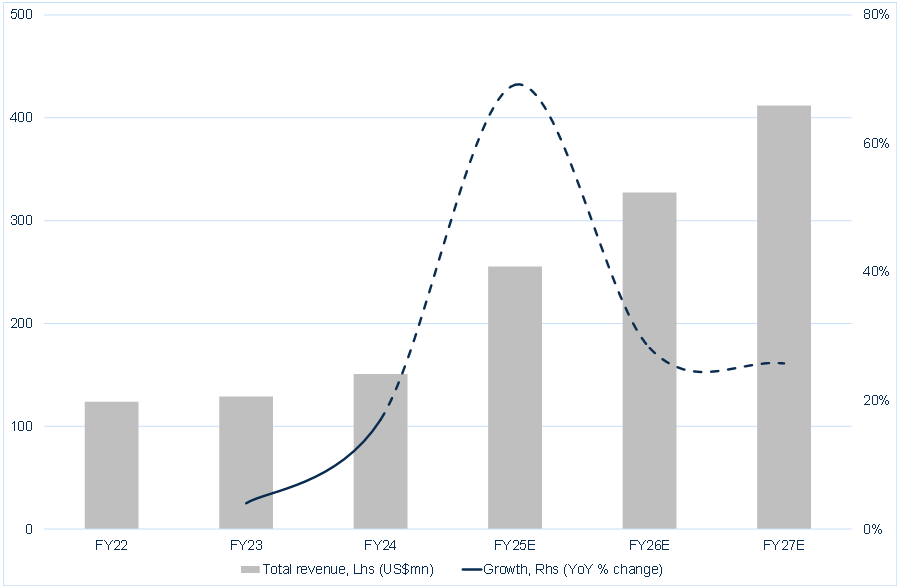

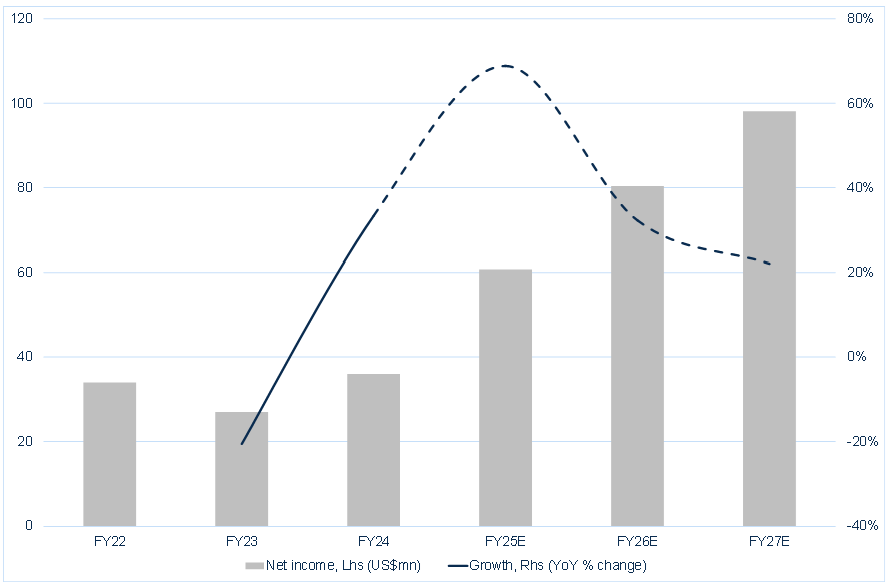

Momentum into 2026 is strong. Management has guided to above 50% revenue growth in FY25E and over 25% in FY26E, driven by deeper penetration of micro-financing products inside existing partner networks, alongside measured geographic expansion. FY25E marks a step-change because FY24 reflects a lower comparison base before the platform’s recent scale-up, while 1H25 has already shown accelerating volumes and an improving product mix.

Figure 2: Optasia revenue growth expectations

Source: Company reports, Anchor Capital estimates

Figure 3: Optasia net income growth expectations

Source: Company reports, Anchor Capital estimates

The next growth leg should come from deepening penetration across Optasia’s existing footprint, especially in Africa, with Asia remaining an attractive additional runway. South and South-East Asia offer large underbanked populations, extremely high mobile and wallet penetration, and telecoms partners with deep daily engagement. This is where Optasia’s playbook works best – leveraging established digital rails rather than building them from scratch.

Risks remain those typical of EM-fintech platforms: regulatory shifts, key telecom and banking partners’ importance to distribution (partner dependency), and disciplined underwriting as volumes scale. Optasia’s embedded distribution model and continuously learning credit engine help mitigate these risks by improving accuracy and pricing as the platform expands.

The standout feature is the valuation disconnect. At current prices, the stock trades at a c. 17x FY26 forward P/E, which appears undemanding relative to management’s medium-term growth guidance, where revenue is forecast to rise in excess of 25% in both FY26E and FY27E. The strategic stake acquired by FirstRand adds a further layer of long-term optionality, both as a validation of the model and a potential future corporate tailwind.

Premier: A cut above the rest

By Sean Culverwell, Investment Analyst

Premier Group is one of the leading food producers in Southern Africa. Under Brait’s stewardship, Premier has invested c. R3.5bn in acquisitions since 2012 and over R7.5bn in capital expenditure to upgrade its manufacturing facilities and distribution network. Headlined by its flagship Blue Ribbon brand, Premier has effectively become the “Shoprite” of milling and baking.

The company’s growth strategy hinges on three core drivers: single-digit revenue growth, operating margin expansion, and declining finance costs. Premier’s consistent execution against these levers has delivered industry-leading growth since its listing, a trend we anticipate will continue through the coming year.

Aeroton – the bakery that will deliver more than just bread

The opening of the long-delayed Aeroton mega-bakery in November marks a major milestone and should be a significant margin driver.

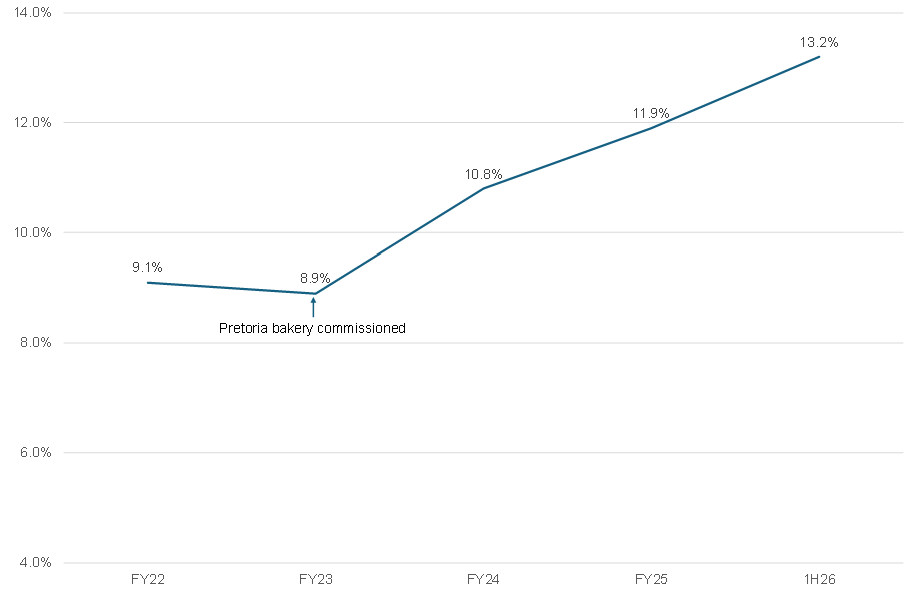

Figure 4: Millbake EBIT margin

Source: Anchor, Company data

With the Aeroton facility open, the Group can consolidate its regional manufacturing footprint by mothballing its three older bakeries (Vereeniging, Old Pretoria and Potchefstroom). Lowering the requirement to transport bread from other facilities to service the area should result in cost savings.

Furthermore, the new site is expected to drive improvements in bread quality and service levels, particularly in the informal channels, which is a hotly contested area of the market. Importantly, this is not Premier’s first mega-bakery. The Group commissioned its Pretoria mega-bakery in 2023, and the benefits have been evident since (see Figure 4).

RFG acquisition creates a formidable opponent

While the acquisition of RFG Holdings is still subject to approval, management is confident the deal will be closed by the end of March 2026. We believe the deal makes both strategic and financial sense.

Two longstanding concerns in the Premier investment case have been limited liquidity in its shares and concentration risk to Millbake. Consolidating RFG addresses both, while also providing immediate earnings accretion.

The industrial and route-to-market synergies between the two companies are obvious on paper, but such benefits are often difficult to deliver in practice. However, CEO Kobus Gertenbach and his team have given us little reason to question their execution, so we look forward to seeing what Premier can achieve with the consolidated entity.

Improving capital allocation flexibility

With the commissioning of Aeroton in November, Premier effectively concludes its Millbake capex cycle. The RFG deal is a share swap, so rising cash on the balance sheet presents an opportunity for management to raise the dividend payout ratio or execute on the authorised share buyback programme. Both of which would be the cherry on top of what is an already enticing investment case.

Valterra Platinum: Positioned to win as the PGM cycle evolves

By Anchor Investment Team

Since its demerger from Anglo American in 2025, Valterra has emerged as a frontrunner, poised to capitalise on the evolving PGM cycle.

A market in transition

The PGM basket has rebased higher in 2025, but this upswing has been fuelled more by speculative positioning, shifting policy expectations, and perceived scarcity than by a broad-based demand recovery. With margins normalising from the lows of 2023, it is tempting to assume the rally has run its course—yet the market remains in flux.

Speculative flows continue to exert an outsized influence on prices, with US-led exchange-traded fund (ETF) inflows and futures activity amplifying both liquidity and tightness. Palladium’s rebound has coincided with a c. 40% surge in ETF holdings, while platinum has seen more volatile flows despite substantial US inflows of 335koz. The introduction of Guangzhou Futures Exchange (GFEX) futures may further accelerate price discovery and volatility.

Beneath this speculative layer, auto demand (from internal combustion engine [ICE] and hybrid vehicles) has proven more resilient than expected, with key markets still up around 2% YTD. As the US and EU reassess emissions and fuel-economy regulations, the relevance of PGMs in powertrains could persist for longer than many anticipate. Overall, while speculative positioning has dominated recent price action, the combination of resilient auto demand and a more balanced regulatory risk/reward suggests the market may have firmer fundamental support than initially assumed.

Why Valterra stands out

Against this backdrop of shifting fundamentals and heightened volatility, Valterra stands out as a clear sector outlier. Its fully integrated model—spanning mining, processing, refining, and global marketing—delivers industry-leading cost control and margin resilience. Mogalakwena, the world’s largest open-pit PGM operation, provides significant structural cost advantages, while technologies such as the Jameson Cleaner Circuit enhance all-in sustaining cost efficiency. Even after operational interruptions, including 1Q25 flooding at Amandelbult, management restored output ahead of schedule, demonstrating strong agility and discipline.

Valterra’s low net debt, ample liquidity, and consistent dividend policy provide both stability and optionality. As efficiency, mechanisation, and disciplined capital allocation increasingly define sector leadership, Valterra is well positioned to convert a stabilising PGM backdrop into sustained margin uplift and stronger FCF generation.

Efficiency, discipline, and the risk/reward

Valterra’s commitment to investment and productivity improvements contrasts with peers who have deferred capex in response to weaker prices. As industry spending normalises, higher capex is likely to pressure competitors’ FCF and dilute returns, creating downside risk to 2026–2027E FCF yields (c. 12%).

Valterra, by contrast, screens attractively at a c. 10% FCF yields over the same period and trades at c. 0.7x spot P/NPV, below the sector average despite superior fundamentals. Although speculative flows have dominated recent PGM price dynamics, the next phase of the cycle will require confirmation of a genuine demand-led recovery, most likely anchored in the automotive sector. Potential US and EU regulatory adjustments could further reinforce platinum and palladium demand. Volatility and geopolitical risks remain, but Valterra’s operational excellence and financial strength position it as a relative winner as sentiment gives way to fundamentals.

Outlook

As the PGM sector enters this transition phase, Valterra stands out for its ability to deliver consistent returns through the cycle. Its integrated model, cost leadership, and disciplined growth strategy create a robust platform for compounding FCF, while its strong balance sheet and shareholder-focused capital policy enhance upside capture.

In our view, Valterra’s quality-over-leverage approach and strategic positioning make it the standout choice for investors seeking exposure to the next chapter of the PGM story.