In this note, the Anchor investment team highlights a selection of five local equities that we believe are worth keeping an eye on in the year ahead. In compiling this list, we have tried to identify local shares that are not necessarily in all our portfolios (as our portfolios have different mandates and risk-return profiles). However, we did try and find stocks that indicate how we pick our shares and that mirror our philosophy in this regard. From a market perspective, it has been an interesting year with the difficult spot being emerging markets (EMs). Nevertheless, by and large, if investors have taken some equity risk, they would have had a relatively good year and, especially, on a two-year view (from the start of 2020) it has been a pleasing outcome.

As we enter 2022, there are factors to be concerned about including the new COVID variant and global markets that have run very hard, and we are looking at these shares with quite some caution. If interest rates go up, then banks can benefit nicely and banks are looking like pretty good value currently, while pharma companies are looking quite cheap.

We are cautious moving into 2022 and that is largely due to valuations. We sit in a complex and concerning environment where US 10-year bond yields are at 1.5% but US inflation is sitting at c. 6%. That really does have to come down during the year.

Our investment approach is very much bottom-up.

Afrimat

Afrimat is a resources and infrastructure business that we have followed for some time. It is a relatively small business, which has been slightly under-the-radar, in the past. However, it is also a business that we like because of its excellent capital allocation track record, which it has built up over a long period of time. Looking back at Afrimat in 2012, it was a pretty boring business – essentially a low-return, low-margin quarrying business that was producing materials for the construction sector, aggregate and cement bricks, etc. In 2012, Afrimat reported R1bn in revenue with a c. 12% RoE. Through a series of regular acquisitions over the next decade, the business has transformed itself and today it is essentially a mid-tier diversified miner, with an excellent capital allocation record. By 2021, Afrimat posted revenue of R5.2bn, with the company consisting of three main segments: Bulk commodities (49% of revenue), Construction Materials (37% of revenue), and Industrial Metals (accounting for 14% of revenue).

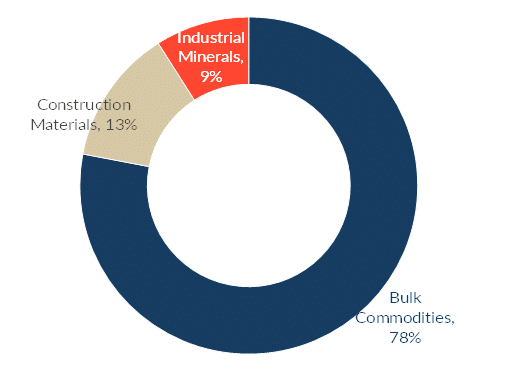

Below, we show the split of operating profit in Afrimat’s latest reported results (1H22). This result was dominated by its Bulk Commodities division, within which the entire contribution was effectively from its iron ore mine – Demaneng. Below, we attempt to give some context to how material the new operations coming on stream at the moment will be (the financial period in which these operations will start contributing to profits is shown in brackets). Note that, because these are operations that have already been acquired, they are “in the bag” to a large extent.

If Demaneng = 100 units

- Nkomati (high-grade anthracite) = 100 units (2H22)

- Jenkins (iron ore) = 200 units (2H22)

- Gravenage (manganese) = 100 units (FY24)

- Construction materials & Industrial minerals = 100 units

Figure 1: Afrimat 1H22 operating profit by segment

Source: Afrimat, Anchor

Afrimat’s sources of growth for the future include:

- The Nkomati mine (in Mpumalanga) generates very high-grade anthracite and when this business came on stream in the first half it was still making losses (it lost about R100mn) and only turned profitable in August 2021. The way to think about this business is that it is now contributing a regular income stream every month and, as that annualises, it effectively equates to another Demaneng mine, which is not in the Group’s historic numbers.

- Jenkins is a new iron ore mine that Afrimat just brought on stream. Again, it contributed almost nothing to the first half of the year but is now fully on stream and producing. And, as you annualise that, it is equivalent of two Demaneng mines coming on stream, and it is happening as we speak.

- Something a little bit further out is the Gravenage manganese deposit that it is busy developing. This is only going to come on stream in 2023, but it could potentially (as it comes on full stream) equate to another Demaneng.

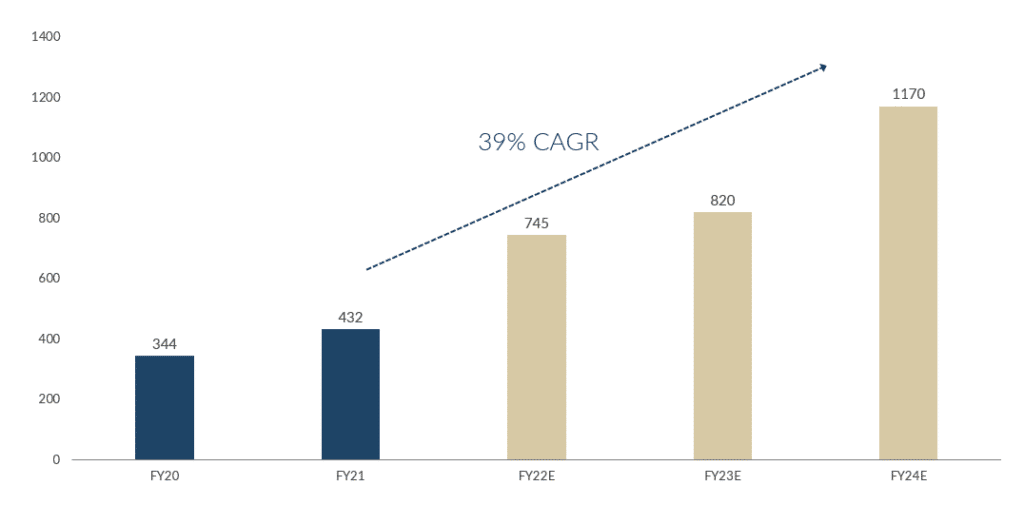

So, while there may be some volatility around commodity prices, relative to BHP or Anglo, which is far more a call on what commodity prices are going to do, you have the appeal in this business of very substantial organic growth because of acquisitions already in the bag. Essentially, just these businesses add another four times Demaneng over the next couple of years. If we now look at earnings growth and rating (see Figure 2), investors can see how, as these new opportunities come on stream you get a very strong ramp-up in earnings. Here we are assuming an iron ore price of US$110/tonne, which is slightly ahead of where it is today (at c. US$100-level) but still well below the US$200 level we have seen over the past few months. An under-the-radar, quite cheap mining play to keep your eyes on.

Figure 2: Afrimat … rapid earnings growth prospects

Source: Afrimat, Anchor

Alviva

Alviva (trading at R15.35 as at 14 December) is a classic small-cap value play that, by any reasonable metric, is worth far more than its current share price (we believe more than R20/share). It is also SA’s biggest IT distributor and has a growing services business.

In the small-cap segment of the market, there has been a lot of value and fund managers have not been prepared to value these shares at the same price levels that the private market has. Hence, we have seen lots of delistings and corporate actions. Alviva, previously known as Pinnacle, is one of these – a reasonable quality business with a lot of critical mass that still sits at a beleaguered valuation level. It is very much a distribution, working capital business that has tended to trade at an 8x to 9x P/E multiple, but is currently trading at a 4x P/E multiple. While it is a small-cap, it is quite a big business, with annualised turnover of c. R20bn at present. We think it can make over R1bn EBITDA over the next year and the market value is R1.8bn so you can see that it is making back in less than two years its market cap and EBITDA or, in cash flows terms, it is making its entire market cap back over the course of three to three-and-a-half years.

To June 2021, that equates to core EPS of ZAc356 or back to 2019 levels, despite the supply constraints that the company has experienced. Alviva falls squarely in that segment of the market where companies have been contending with chip shortages and battling to get laptops and other equipment. Therefore, if the company had been able to access all of its demand, Alviva’s results would have been much better. There is a lot of latent demand for its products.

Alviva has also bought out its biggest competitor, Tarsus which we think is a phenomenal deal. The company pays out only c. 10% of its earnings as a dividend, which we believe has held the share price back. So, what has the company done with its cash? Alviva has paid off almost all its debt and it has been buying back some of its shares because it is so cheap. Over the past year, it has bought back c. 10% of its shares. At a 4x P/E multiple, the company is getting a 25% return on the share – a classic SA small-cap situation, with the market being unwilling to pay a reasonable value.

Investec

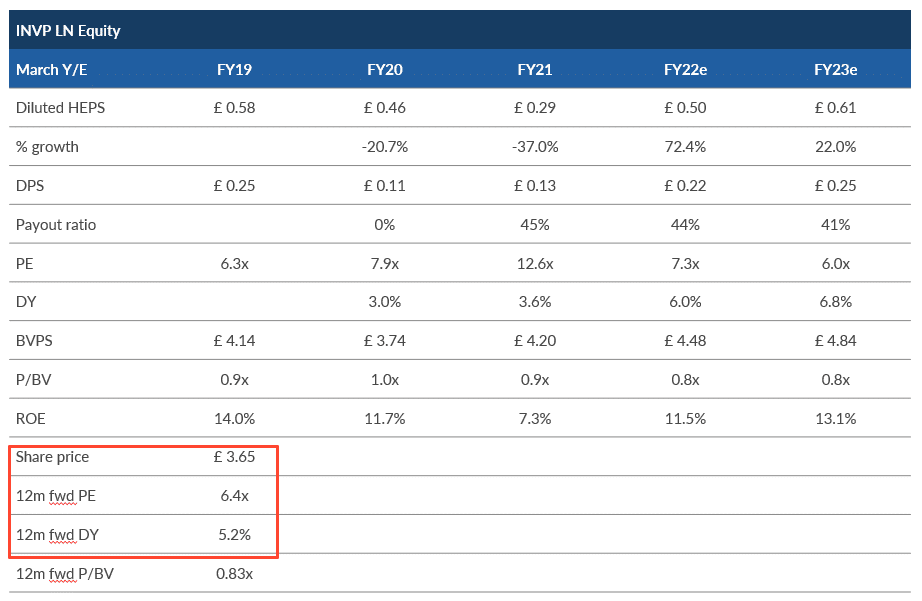

Figure 3: Investec company data summary

Source: Bloomberg, Anchor

Investec is starting to generate good performances and its investment case now hinges on earnings growth and operating profit. Previously, it was centred much more around a deep value investment case, where there was a lot of trapped value in the structure, and management needed to almost reshuffle the deck chairs to create the optics that the business was generating a higher return on capital than it was. However, for the first time in recent memory, Investec’s operating momentum is starting to gather steam and for us as fund managers, who are far more focused on earnings as opposed to trying to identify bottom-up value cases, Investec currently represents a much more attractive investment case than it did a while ago.

On a forward 6.5x earnings, where you have quite a lot of upgrades coming through (Investec has reported to the half-year and to the full-year ending September), we think that there is at least 15% upside to earnings expectations after it reported results and we have started to see consensus analysts’ estimates going up.

We also note that Investec is trading cum of c. R10 in distributions of which R2 is cash and about R8 of that is the bulk of its stake in Ninety-One (which is listed in London and on the JSE), so you know once that distribution happens, we think it is going to be quite accretive to return on equity (RoE) thus justifying a higher multiple to book than the bank is currently trading at. This makes it very pleasing that, for once, our investment case for Investec is one of focusing on earnings and earnings growth.

We think the current management team’s refined focus, new sets of targets, and really cleaning up shop will hopefully deliver positive shareholder total returns for investors, with the obvious caveats being that investors should know with Investec the risk is quite high.

Recently there were headlines around its involvement in some accounting or arbitrage scandals in Europe and we will obviously monitor these developments but we have spoken to management, and it seems like these exposures are quite ring-fenced within one agency with a low financial impact on the business from what they can quantify at this point in time. Thus, we believe that Investec still offers very good value and we will continue to hold the stock.

Multichoice

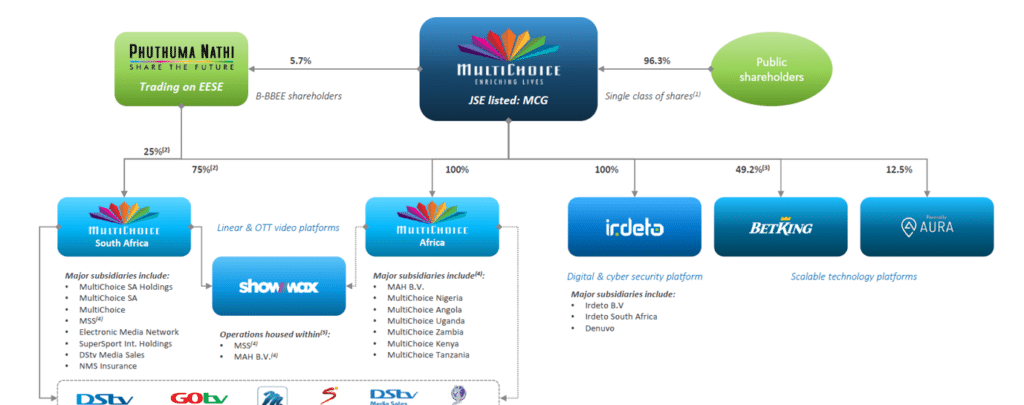

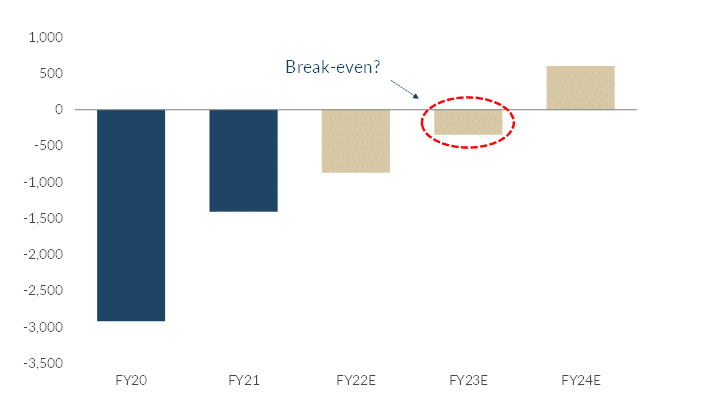

Since Multichoice listed, when it was spun out of Naspers in 2019, it has been anything but a standout performer. Most of the focus, when people think about Multichoice, is the Group’s SA business, which is also the company’s big cash cow. However, what we are going to highlight below is the degree to which this is a business that is much more than just a SA pay-TV operation. We believe that in the next year or so, investors are going to be forced to start ascribing value to the other parts of the business – most importantly the currently loss-making African business. At the time Multichoice was listed separately, management guided that MultiChoice Africa would reach operating profit break-even in this next financial year. As that date rapidly approaches, we believe things will get interesting for Multichoice investors.

Besides the aforementioned segments, investors have recently seen Multichoice start to invest in several new seeds for growth, which the market is not currently recognising at all. Multichoice has interests in Irdeto, a world leader in digital platform security, BetKing, an online betting business, and Aura, a new tech platform in SA in which Multichoice has made early-stage investments (see Figure 4).

Figure 4: Multichoice … more than just SA Pay-TV

Source: Multichoice

MultiChoice SA (the SA business) generates between R14-R15/share of cash each year. Admittedly, its growth prospects appear limited given the high penetration of pay-TV in SA already. With this in mind, a fair value for this business is closer to R150/share. The current share price of c. R120/share is effectively implying a negative value on the rest of the business. However, while that has probably been reasonable historically, given the losses in Africa, the turbulence we have seen through the pandemic, and the currency volatility, Multichoice Africa has been steadily making progress towards breakeven. As mentioned earlier, that is expected to happen in the next financial year (we note that Multichoice has a March year-end so when we say FY23 that is effectively next year) although, as can be seen from Figure 5 below, we are still forecasting a small loss. Management guidance implies the prospect of a positive surprise vs our expectations.

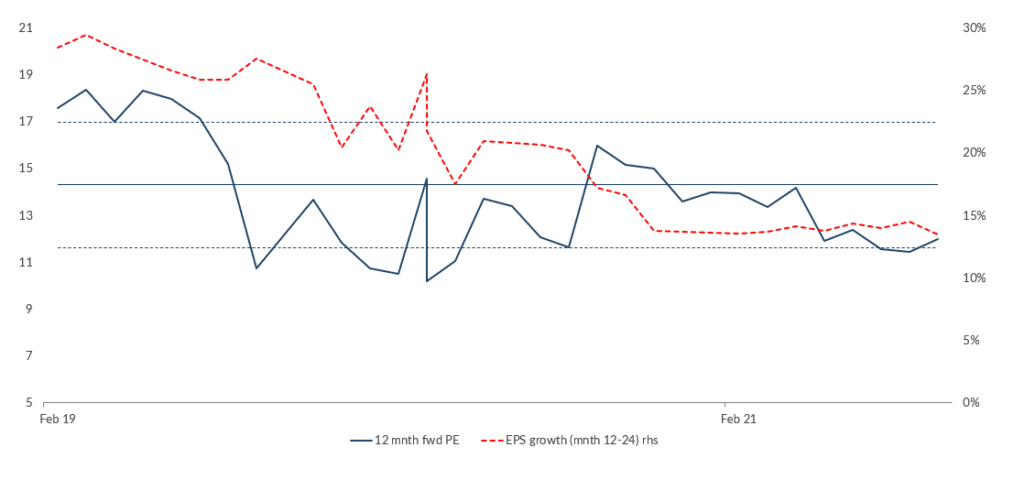

At a group level, MultiChoice is trading on a fwd P/E of c. 12x. While the SA business is likely to grow at a pedestrian pace as we pointed out above, because of the rapidly receding losses in Africa, the Group is set to compound its earnings at around the mid-teens level, with a dividend yield of c. 6%. As the need to fund the African operations recedes, the highly cash-generative nature of the SA operation implies the yield should grow strongly in the future. Thus, the key message here is that it is a share for which the whole ex-SA opportunity is not yet priced in and that is going to become very difficult to justify as the ex-SA business continues to hit its targets and turns profitable.

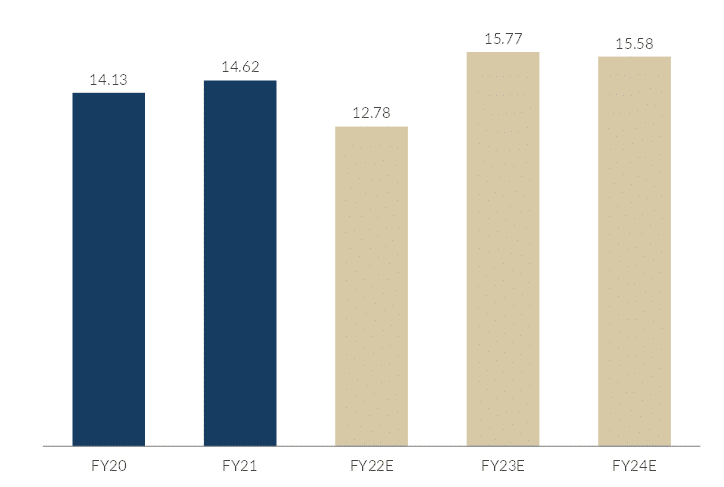

Figure 5: Multichoice SA “cash” EPS attributable to MCG shareholders

Source: Multichoice, Anchor

Figure 6: Multichoice Africa trading profit, Rmn

Source: Multichoice, Anchor

Figure 7: Multichoice valuation, 12-month fwd P/E 12x

Source: Multichoice, Anchor

Transaction Capital

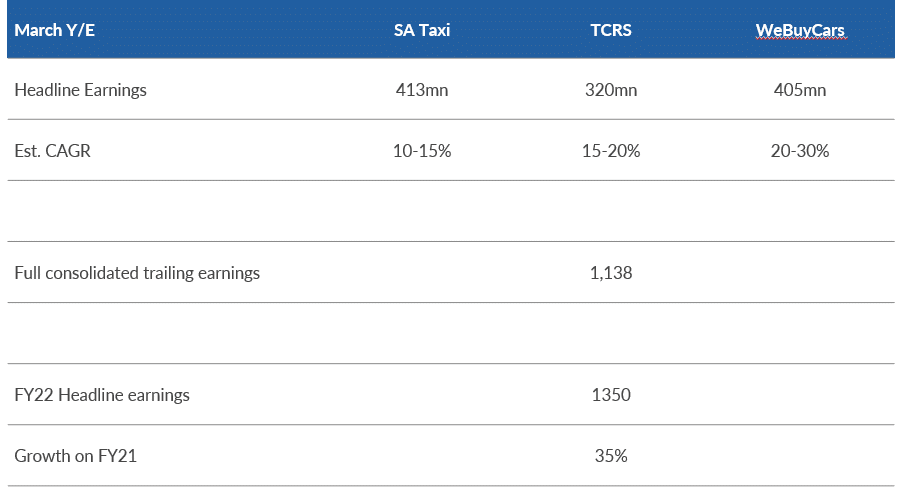

Transaction Capital is a share we first purchased when it was trading on a 5x or 6x P/E. The company has since done some corporate restructuring and it has also added another pillar to its business with the acquisition of WeBuyCars. Transaction Capital is now made up of (1) a vertically integrated taxi finance business (SA Taxi); (2) a debt collection business (TCRS), which collects debts on behalf of others (agency basis), as well as buying books for collection (principal basis); and (3) trade-in, second-hand vehicles following the purchase of a 74.9% stake in WeBuyCars. In Figure 1 below, we highlight what each division contributes to operating profit on a fully-loaded basis.

Figure 8: Transaction Capital – contribution to operating profit by division

Source: Bloomberg, Anchor

Looking at Figure 8, we note that Transaction Capital has taken retained earnings and done some capital raises over time and acquired the WeBuyCars business to add as a third vertical. Transaction Capital paid c. 9.5x fwd earnings on the numbers achieved so far for its c. 75% stake of the WeBuyCars business and, if we included WeBuyCars for the full year in 2021 to create a trailing earnings number for a full period, the profit after tax number would be c. R1.1bn. Transaction Capital reported c. R1bn, because WeBuyCars was not owned for the full period, so the aforementioned is just an illustration of how having WeBuyCars in its portfolio will add to the Group’s earnings mix in the year ahead.

With our expected growth rates in the various businesses, WeBuyCars is quite a high-growth business, and we think that c. R1.35bn in profit after tax next year is possible, which represents a growth rate of 35% on the number that it reported this year of R1bn. Transaction Capital is a great story on the JSE of a company that has executed well and has been able to grow in a market where growth has been hard to come by, particularly for financial services businesses. Also pleasing are the growth rates in its legacy (core) businesses, which have a very stable investment case.

We have seen the fwd 5x earnings going to the region of fwd 20x earnings now and this is of a slight concern from a valuation perspective, but here we highlight that with WeBuyCars, Transaction Capital has brought a much higher multiple business into the mix. So, it is very positive for a company to acquire a business on a lower multiple than what we think it would have fetched if it was separately listed. If you look at examples of similar types of businesses around the world, for example in the UK and the US, these businesses are trading on very lofty multiples. It is difficult to know where the P/E multiple is going to be when it reaches scale because the others are all trading on revenue multiples. It is justified that there was some form of rerating, and we are very happy shareholders, as the company’s management has always executed well and delivered on what they said they were going to do. In addition, management have always been transparent and honest with the market. We think that the deal which the company did by selling a portion of its taxi business to The South African National Taxi Council (Santaco), is one of the best corporate deals we have seen over the past few years on the JSE. In a sense, it is wrapping that business in a bit of cotton wool with regards to the Taxi Association of SA. We believe it shows excellent corporate stewardship from the team at Transaction Capital and we are very happy shareholders of the stock.