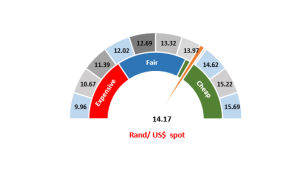

Figure 1: Rand vs US dollar gauge

Source: Anchor

The rand started this morning (4 April 2019) at R14.17/ $1. The market breathed a collective sigh of relief that ratings agency Moody’s didn’t put South Africa on negative watch on Friday (29 March) but instead delayed its decision. However, the euphoria has worn off slightly as Moody’s also made it clear that a continued stagnant economy will result in a negative watch and an eventual downgrade (it is scheduled to make a decision in November). Moody’s also indicated that it believes South Africa’s debt levels could get to 65% of GDP. This is meaningfully higher than the 60% that is being suggested by National Treasury. At the same time, Eskom held a press conference on Wednesday (3 April), which was perhaps less dire than it could have been, although some questions remain and, we continue to believe that fixing the power utility will take a long time.

Globally, Brexit is grabbing all the headlines as the UK government continues to wrestle with different permutations of leaving the European Union (EU), none of which is ideal. Financial markets also continue to focus on slower growth, with negative yields returning in many developed countries and interest rates coming down. Arguably the global search for yield is starting again with foreigners buying close to R6bn of South African bonds over the past few weeks. This will keep the rand well supported, for now.

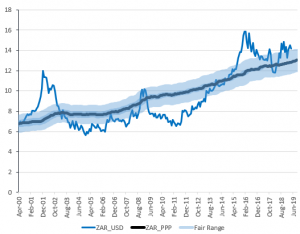

We note that the rand is slightly outside of our fair range at present (see Figure 2). However, we think that it will return in time and we consider the local currency to be slightly oversold. Nevertheless, the cheapness of the rand is quite slight, and we are not making significant changes to our portfolios at current levels.

Figure 2: Actual ZAR/$ vs rand PPP model

Source: Bloomberg, Anchor