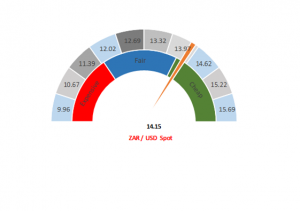

Figure 1: Rand vs US dollar gauge

Source: Anchor

We have reached 2019’s halfway mark and, for the rand, it has been a tumultuous first six months. We started the year at R14.39/$1, then traded as low as $13.25/$1 and as high as $15.15/$1. Whoever said there was no fun in the rand and emerging markets (EMs)? On Tuesday morning (2 July 2019), we were are at c. R14.15/$1, which means that the rand is slightly stronger than when we started the year. We are also seeing a temporary truce in the trade war between the US and China, whilst the UK is taking some time out of Brexit negotiations to elect a new prime minister. This has given investors a little respite from the economic and policy shocks that have been dominating around the globe. The slower global growth has been positive for EMs, with most EM currencies gaining over the past month.

Domestically, May’s trade surplus of R1.74bn, as growth in exports exceeded the rise in imports, was a positive surprise and has helped in the rand recovery. At R14.15/$1, the rand is just on the oversold side of our fair-value range and we are maintaining our current slight underweight positions.

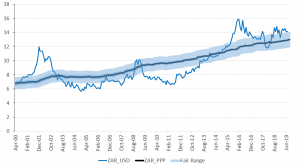

Figure 2: Actual ZAR/$ vs rand PPP model

Source: Bloomberg, Anchor