The South African (SA) sugar industry is one of the world’s most cost-competitive producers of high-quality sugar. It makes an important contribution, not only to agricultural employment and sustainable development in rural areas, but to the agricultural economy as a whole. It is a diverse industry combining the agricultural activities of sugarcane cultivation with the manufacture of raw and refined sugar, syrups, specialised sugars, and a range of by-products. Based on revenue generated through sugar sales in the Southern African Customs Union ([SACU] comprising of Botswana, Eswatini, Lesotho, Namibia, and SA) region and world market exports, the local sugar industry generates an annual estimated average direct income of over R14bn, consistently ranking in the top-15 out of approximately 120 sugar-producing countries worldwide.

Stretching across two SA provinces (Mpumalanga and KwaZulu-Natal), the industry provides employment in job-starved regions, often in remote rural areas where there is little other economic activity or employment opportunities. The local sugar industry creates approximately 85,000 direct jobs, representing over 11% of the total SA agricultural workforce. In addition, there are registered cane growers supplying cane for processing to sugar mills. Indirect employment is estimated at 350,000 jobs. Approximately 1mn people or 2% of SA’s population depend on the local sugar industry for a living.

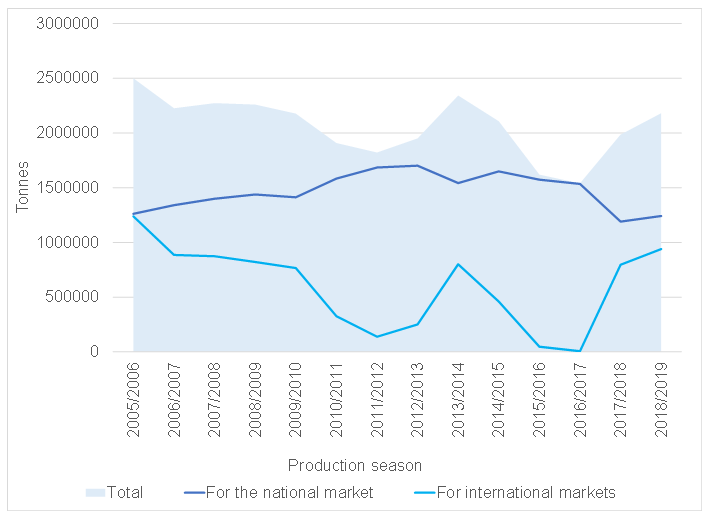

The cane growing sector comprises 21,926 registered sugarcane growers farming in KwaZulu-Natal and Mpumalanga. Sugar is manufactured by six milling companies with 14 sugar mills operating in these cane growing regions. In total, the industry produces an estimated average of 2.2mn tonnes of sugar per season. In SA, sugarcane in irrigated areas constitutes a 12-month crop, which reaches maturity for harvesting anytime between late February/early March until December. In rain-fed areas, the crop cycle is ideally around 15 months, and is harvested between March and December each year. About 60% of this sugar is marketed in the SACU, while the remainder is exported to markets in Africa, Asia, and the Middle East.

Figure 1: SA saleable sugar produced

Source: SASA, Anchor

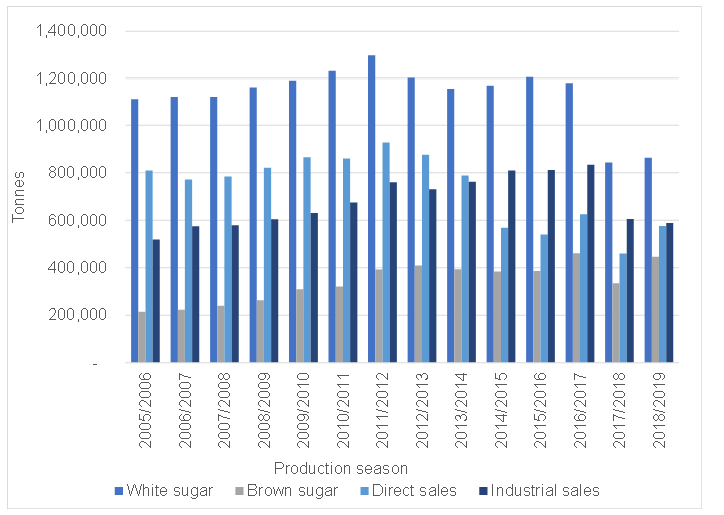

Figure 2: SA sugar sales

Source: SASA, Anchor

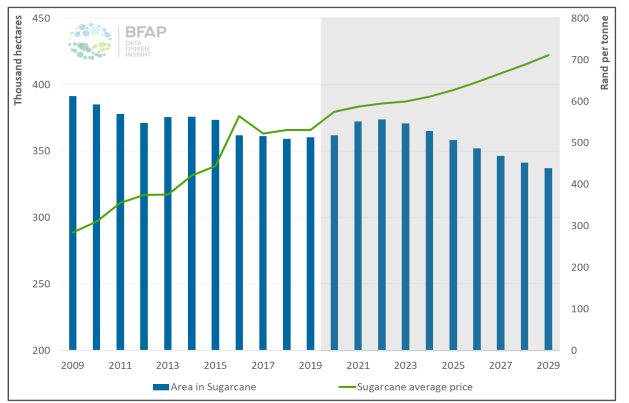

However, despite the sugar industry’s inherent value to SA’s overall agriculture sector (and further growth potential) the industry has lost a total of 20.6% of its cane area since 2000. While area under cane has been relatively stable at around 360,000 hectares since 2016, there is consensus among industry roleplayers that the current situation may not be sustainable, and there could be further contraction over the next 10 years. Importantly, the alternative crops replacing cane are not as labour intensive, thus displacing the many rural jobs that cane provides.

The Bureau for Food and Agriculture Policy (BFAP) estimates that, whilst over the next three years the notional sugarcane price will increase in line with the inflation rate, it will likely not be enough to prevent further contraction. The BFAP expects that, over the baseline period and based on current economic conditions and industry structure, the local sugar industry could lose a further 10% or 36,000 hectares of cane area from 2022 to 2029.

Figure 3: BFAP forecasts on SA area in sugarcane and average sugarcane price

Source: BFAP

The BFAP further believes that the industry’s contraction is driven by four main issues:

- Long-term challenges with productivity due to changing weather patterns and limited investment in soil and cane health given the land ownership uncertainties in SA.

- A distorted world sugar price, below production cost in most cane-producing countries, due to production surpluses from subsidised production in large cane-producing countries.

- Eswatini’s loss of preferential export quotas to the EU in 2017 has resulted in increased SACU tariff-free exports into the SA market.

- The implementation of the SA government’s Health Promotion Levy in 2018 has resulted in beverage producers formulating away from cane sugar towards more low-calorie and alternative sweeteners. This has consequently led to a drop in local sugar demand of as much 250,000 tonnes (c. 15%-20% of the local market). The issues highlighted above have been developing over several years, subsequently leading to the development of the SA Sugar Masterplan. The Masterplan partners (retailers and wholesalers, industrial sugar users, sugar industry, government, and labour) have committed to implementing a phased approach, with Phase 1 focused on setting the foundations for Vision 2030. Over the next three-year period, Phase 1 will see actions being put in place to develop and ensure: i) the restoration of the local sugar market and offtake agreements; ii) producer price restraint and certainty; iii) strategic trade protection; iv) job retention and mitigation; v) small-scale grower retention and support; and vi) ownership transformation.

Whether the Masterplan and the various actions outlined by it will be sufficient to prevent the shedding of more hectares is yet to be determined. Overall, we believe that the plan’s overriding objective of a managed consolidation for increased efficiency and a more optimised industry is a step in the right direction. However, amid the rising trend of lower domestic demand levels for sugar (with the continued drive for reduced human consumption), the restructuring or transformation of SA’s sugar industry will by no means be an easy task.