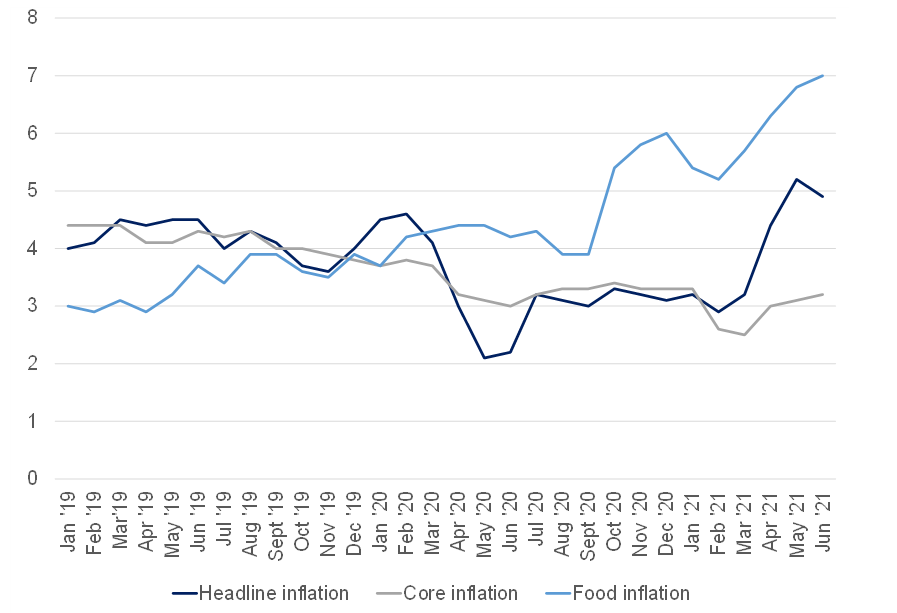

South Africa’s (SA’s) annual consumer price index (CPI) inflation eased to 4.9% YoY in June after reaching a 30-month high of 5.2% YoY in May. The fall in headline inflation was mainly driven by fuel inflation, where adverse base effects from last year’s sharp decline in Brent crude oil prices eased. However, food and non-alcoholic beverages inflation was unchanged. While recent data indicate that SA’s consumer food price inflation remains elevated, underlying trends show that it will begin to moderate as we move into 2H21.

Figure 1: SA consumer price index (CPI) inflation, %

Source: Anchor, StatsSA

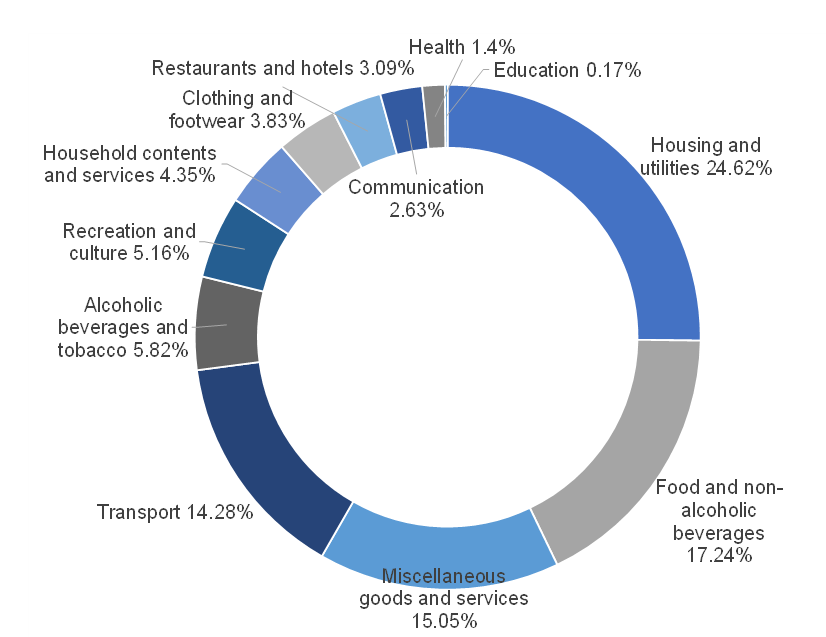

Figure 2: SA CPI basket weightings

Source: Anchor, StatsSA

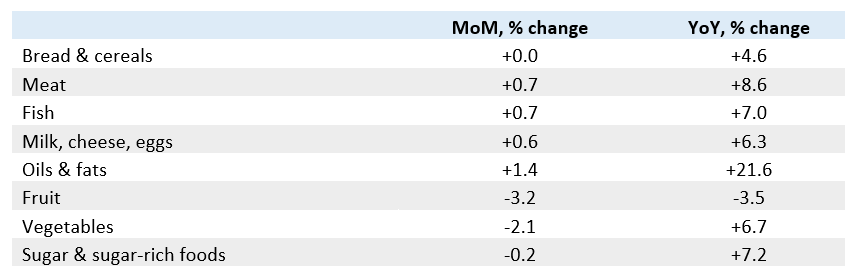

In June 2021, SA’s consumer food price inflation accelerated to 7.0% YoY from 6.8% YoY in May. This was the fastest pace of food price inflation since June 2020. The underpinning drivers of the monthly increase were primarily the oils and fats; meat; and milk, eggs, and cheese categories. Bread and cereals, which are amongst the products with higher weightings and were one of the drivers of the inflation uptick over the past few months, was broadly unchanged from May 2021.

Figure 3: SA food inflation in June 2021

Source: StatsSA

The general increase in consumer food price inflation over the past few months has not been a unique occurrence to SA but rather a global phenomenon. Moreover, the price increase of various products such as grains, as well as oils and fats in SA were driven by global developments. The global market price increases were, in turn, supported by a range of factors such as growing demand in China, lower production of palm oil in Asia, lower global grains stocks, drought in South America and unfavourable weather conditions in parts of Europe and North America at the start of the 2021/2022 production season. However, there has since been a substantial change in these factors and global prices are starting to reflect this. For example, production conditions have improved notably in Europe and North America. As such, both the International Grains Council (ICG) and the US Department of Agriculture (USDA) forecast an improvement in the 2021/2022 global grains and oilseeds production.

Both institutions forecast 2021/2022 maize production at 1.2bn tonnes – 7% higher than the last season. This optimism is on the back of an expected large crop in the US, Brazil, Argentina, Ukraine, China, EU, and Russia. 2021/2022 global wheat production is estimated at 792mn tonnes – 2% higher than the 2020/2021 season. This is off the back of an expected large crop in the EU, US, Ukraine, Argentina, China, India, and the UK. Meanwhile, global rice production is forecast at 506mn tonnes – up 0.2% from the 2020/21 season, due to the expansion of area plantings in Asia. The soybeans 2021/2022 global harvest estimate is at 385mn tonnes – 6% higher than the previous season. This is supported by an expected large harvest in the US, Brazil, Argentina, India, Paraguay, Russia, Ukraine, and Uruguay.

The improvement in global grains and oilseed production prospects is evident in the FAO Global Food Price Index (FFPI), which fell by 3% MoM in June 2021 to 125 points -its first drop following 12 consecutive MoM increases. This drop in the index value was driven by a reduction in cereal and vegetable oil prices, although meat and sugar prices still showed an upward trajectory. Notably, the price decreases above were not yet reflected in local inflation data released in June, with YoY inflation dynamics similar to those recorded for May. All sub-categories, except for fruit, once again showed significant inflation in June.

However, MoM slowdowns in categories such as meat, oils and fats does suggest that the rate of growth is losing momentum. Overall, these production forecasts indicate that from 2H21 global agricultural commodity prices could continue softening slightly, from the recent months’ levels. If this transpires, local grain prices could follow a similar path. Thus, expectations that food inflation in July will slow compared to 2Q21 are well justified. Furthermore, the higher base effects that were apparent during 3Q20 will assist in driving down overall inflation data.

Nevertheless, it is worth noting that the unrest, looting, and infrastructure destruction incidents which took place during July have resulted in numerous manufacturing and distribution bottlenecks, which could ultimately impact short-term availability and cost of inputs. This could then have knock-on effects on consumer prices and, as a result, July food inflation data could remain firm for longer than we had initially expected.

Added to the above are surges in input cost already apparent before the unrests. Elevated crude oil prices are also expected to add to inflationary pressures in manufacturing and distribution costs, with Brent crude almost 60% higher vs the corresponding time last year. Ultimately, a large share of SA food products are transported by road. Furthermore, animal disease issues remain a concern. The recent outbreak of foot-and-mouth disease in KZN and avian influenza outbreaks at selected layer and broiler farms, pose further inflationary risks if not contained. Nonetheless, the underlying trends discussed above continue to indicate that, ultimately, SA food inflation will start to moderate as we move into 2H21.