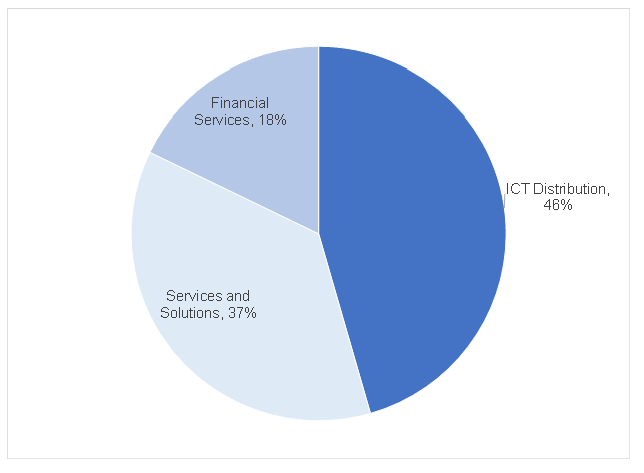

Alviva (formerly Pinnacle Holdings) is best-known as a distributor of information and communication technology (ICT) products. However, the Group has expanded into services and in Figure 1 below, we highlight its 1H20 product mix (at an EBITDA level).

Figure 1: Alviva EBITDA by segment, 1H20

Source: Alviva, Anchor

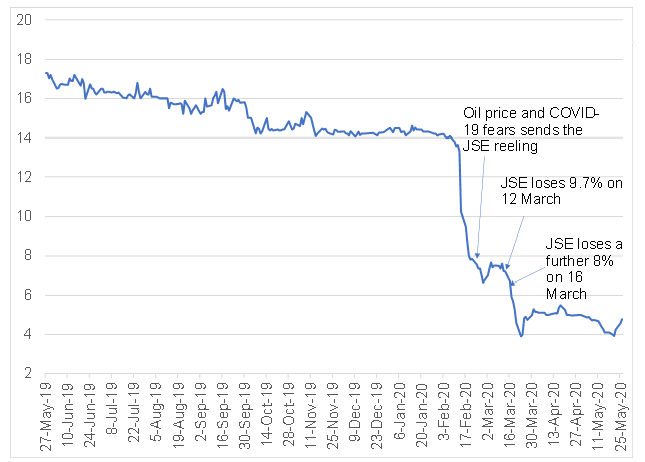

The Alviva share price has plunged c. 65% YTD (to 26 May) and it is now trading at seemingly absurd levels. To put this into context, at a share price of ZAc460, Alviva has a market cap of R571mn. In the year to June 2019 (FY19), the business recorded EBITDA of R859mn, an operating profit of R670mn and HEPS of ZAc353. This places the company at an historic PE of 1.3x. The Group has a tangible net asset value (TNAV) of over R2bn, or R9.12/share, which is primarily inventory (and net debtors/creditors) and is reflected at current value. Interestingly, the company has spent R616mn on new acquisitions in the past two and a half years, which it indicated generated an annualised profit of R89mn.

Figure 2: Alviva share price performance, May 2019 to date, ZAc

Source: IRESS, Anchor

The share price action would seem to imply that the business is in big trouble, but Alviva’s recent SENS statement and our discussions with management gave us confidence that the company will survive the current difficult period. While Alviva cannot give forward earnings projections, we expect an EBITDA of over R100mn for the six-month period ending June (2H20). Many parts of the business could still trade in April (when the country was in full lockdown) and most at Level 4 (from the start of May), since large chunks of the business are considered essential services.

The balance sheet is sound, and the company seems to be managing liquidity risks well. Gearing, excluding its finance lease business (Centrafin), is 16% and Alviva has over R1bn in largely unutilised credit facilities. Centrafin has c. R600mn of securitised/ring-fenced debt and thus far the business is managing well through the COVID-19 disaster. Centrafin generates a ROE of over 20% and is in a good position, with solid growth prospects under normal operating conditions.

Alviva is a small-cap share, but still big in its operating space in South Africa (SA), with R16bn in turnover. In our view, the current six-month period (2H20) will be tough, but the second six months of calendar 2020 (Alviva’s 1H21) should see a resumption of more normalised conditions. The company will then be subject to a poor SA economy and less influenced by COVID-19 restrictions. Prior to COVID-19, we believed that Alviva could earn ZAc250/share in FY20. However, at this stage, it looks to us like core HEPS could be in the region of ZAc150 to ZAc200 (the firm reported earnings of ZAc128 in 1H20). Thus, we would pencil in EPS of ZAc200c for FY21 (under very tough economic conditions), which places the company on a forward PE of around 2.2x. Bear in mind that this company made ZAc352 in FY19 and management would clearly aim to exceed earnings projections of around the R2 level.

Alviva also looks like it is managing its way relatively well through the current crisis, and thereafter it has to contend with a weakened economy. So, the risks are fairly high, but this is now a well-diversified business with exposure to many growth sectors of the IT world.

Currently, this segment of the market is completely out of favour but, if investors are looking for extreme value, we believe that Alviva is a good bet. We note though that small-cap shares are also likely to lag any market rebound. Nevertheless, once investors have confidence that SA is in recovery from the current crisis, the share has the potential to rerate to something near normality.

The counter’s average PE over time has been around 8x but, even if we use a 5x PE on depressed earnings of around ZAc200, that gives you a share price of around R10 – a more than 100% share price increase from current levels. We could paint an even more bullish (share price) scenario, but 100% is enough for now. It is also comforting to see that the CEO, CFO, and other directors have bought shares in recent days. We remember back in the 2009 crash when the company’s share price got down to below R2 and it was a 10-bagger to over R20 over the next few years. This might not be a 10-bagger now, but it is nevertheless a pretty good risk/return bet, in our view.