April was a brutal and volatile month for world equity markets (MSCI World -8.3% MoM, -12.9% YTD), with most major global markets ending in the red on the back of Russia’s war in Ukraine, ongoing inflationary pressures (US inflation is at its highest in c. 40 years), and as strict movement restrictions in parts of China to curb COVID-19 infections raised supply chain worries and rattled investors.

US indices’ losses accelerated towards month-end, with the blue-chip S&P 500 gauge falling by 8.8% MoM in April (down 13.3% YTD) – its worst monthly performance since March 2020 – and the Dow ending the month 4.9% lower (-9.2% YTD). The tech-heavy Nasdaq recorded its worst monthly performance since October 2008 during the global financial crisis, falling 13.3% MoM (-21.2% YTD) in April’s tech-led sell-off. Apple results disappointed, with the company continuing to see supply-chain challenges and again declining to provide guidance, while Amazon shares plummeted as it became the latest victim of the sell-off on 29 April after reporting its first net loss since 2015 and its e-commerce business posting its slowest sales growth in c. 20 years.

On the US economic data front, March inflation continued to accelerate, coming in at 8.5% YoY (its highest level since January 1981 and vs February’s 7.9% YoY print). Excluding the volatile food and energy prices components, March’s core CPI rose 6.5% YoY (as expected) vs February’s 6.4% YoY print. MoM, US inflation was up 1.2% – its biggest increase since September 2005. Meanwhile, US 1Q22 real GDP shrank at an annual rate of 1.4% vs an increase of 6.9% YoY in 4Q21. We note that in 1Q22 there was a resurgence of COVID-19 cases due to the Omicron variant, while the US government’s pandemic assistance programme decreased and there was also a reduction in retailers’ inventory purchases. This slowdown is also the first since the COVID-19 induced recession in April 2020.

In Germany, Europe’s largest economy, the DAX closed last month 2.2% lower (-11.2% YTD), while the eurozone’s second-biggest economy, France’s CAC Index ended April 1.9% in the red (-8.7% YTD). French President Emmanuel Macron won a second term in office (the first French president in nearly two decades to do so), with 59% of the vote, while his far-right challenger, Marine le Pen received 41% of the vote. April eurozone inflation data reached 7.5% YoY vs March’s 7.4% print, as energy prices rocketed (+38% YoY) following Russia’s invasion of Ukraine. France’s April inflation rate (+4.8% YoY) also continued to rise, while Germany’s inflation rate (+7.4% YoY) advanced at its fastest rate since before reunification.

The UK’s blue-chip FTSE-100 surprised on the upside, closing April 0.4% higher (+2.2% YTD), while in economic data, UK March inflation jumped to a fresh three-decade high of 7% YoY (vs February’s 6.2% print), increasing pressure on the Bank of England to raise interest rates again.

In China, fears about the impact of that country’s zero-COVID strategy on its economy weighed on markets for most of the month as the outbreak worsened with rising COVID cases in Beijing sparking jitters about an unprecedented lockdown of the capital (similar to what happened in China’s financial centre, Shanghai). Concern that China’s strict adherence to a Zero-COVID policy will further damage its economy and disrupt global supply chains dragged down shares and sparked panic buying as Beijing residents stocked up on supplies after the government announced mass testing plans and put some areas under lockdown. However, there was a late-month rally in Chinese stocks after the government pledged support for economic growth and the People’s Bank of China cut reserve requirements for banks and vowed to increase support for the economy. MoM, Hong Kong’s Hang Seng Index was down 4.1% (-9.9% YTD), while the Shanghai Composite Index fell by 6.3% MoM (-16.3%YTD). In economic data, China’s official manufacturing purchasing managers index (PMI) disappointed, contracting to 47.4 in April (vs 49.5 in March) – its second consecutive month of contraction. Meanwhile, the official non-manufacturing PMI, which measures business sentiment in the services and construction sectors, also declined to 41.9 in April vs 48.4 in March (the 50-point mark separates expansion from contraction). Elsewhere, for the month, Japan’s benchmark Nikkei fell by 3.5% (down 6.8% YTD).

Commodities also had a tough April. Brent crude oil pushed higher last month (+1.3% MoM/+40.6% YTD) albeit at a slower pace than in previous months due to concerns that a spreading COVID-19 outbreak in China will weigh on demand (China is the world’s largest crude oil importer). Iron ore slumped (-8.5% MoM/+14.3% YTD), taking a hit in the final week of April on a deteriorating demand outlook spurred by fears around the lockdowns in China and supply-chain disruptions. The steel-making ingredient is seen as a barometer for China’s economic outlook. The gold price was down 2.1% MoM (+3.7% YTD) as aggressive policy tightening by the US Federal Reserve (Fed) weighed on the yellow metal. Platinum fell 4.8% MoM (-3.0% YTD), but despite a bumpy final week of April, palladium rose 2.6% MoM (+22.2% YTD).

It was red across the board on the JSE, as South Africa’s (SA’s) FTSE JSE All Share Index followed global markets lower, closing April down 4.1% (-1.7% YTD). The FTSE JSE Capped SWIX (-3.9% MoM) was also down but YTD that index is up 2.5%. The Fini-15 plummeted 7.8% MoM (+10.2% YTD), as banks and insurance companies were amongst April’s worst-performing stocks, while the Resi-10 lost 5.4% MoM (+8.8% YTD). Miners have been a key driver of the strong local market performance but were generally weaker last month as production reports disappointed. The SA Listed Property Index declined 2.6% MoM (-4.5% YTD) and the Indi-25 retreated by 2.0% MoM (-16.0% YTD). Highlighting April’s best-performing shares by market capitalisation, Anheuser-Busch InBev (AB-InBev), the second-largest company on the JSE, gained 4.1% MoM, while Glencore rose by 4.7%, British American Tobacco jumped 7.7% MoM, and Sasol soared 10.6% MoM. After a strong performance in March, where the rand gained 5.2% vs the US dollar, the local unit gave back these gains and more as it fell 8.1% against a strong greenback (+0.9% YTD), weighed down by Eskom announcing stage-4 loadshedding and government declaring a national state of disaster due to flood damage in KwaZulu-Natal (KZN) and the Eastern Cape.

On the local economic data front, March’s annual headline inflation, as measured by the consumer price index (CPI), rose moderately to 5.9% YoY vs February’s 5.7% YoY print. Stats SA said the key driver was the transport component of the CPI basket, which was raised by the elevated oil price stemming from Russia’s war on Ukraine. The government’s reduction of the fuel price levy until the end of May will minimise upside pressure from the fuel component in the near term, however, elevated food prices are expected to remain a feature, especially as the conflict in Eastern Europe persists, exacerbating global supply chain challenges. Retail sales data showed the first negative print in five months as February retail trade sales fell 0.9% YoY, after soaring 7.7% YoY (to R76.9bn) in January. In KZN c. 40,000 people were left homeless, and infrastructure was destroyed after the province was hit by one of the country’s worst natural disasters. The economic damage stemming from the flooding could not come at a worse time, given that the local economy is just starting to gain traction from the social unrest that occurred in July 2021.

On the pandemic front, as at 30 April, Department of Health data show that 34.9mn vaccine doses have been administered to date (vs 33.6mn as at 31 March), while the total number of confirmed COVID-19 cases in SA since the start of the pandemic stood at 3.79mn vs 3.72mn on 31 March.

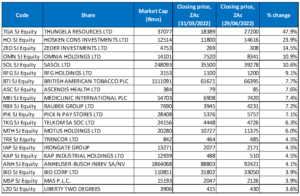

Figure 1: April 2022’s 20 best-performing shares, % change

Source: Bloomberg, Anchor

Thungela Resources (+47.9% MoM) was the best-performing share for the third month running. The company’s share price has been on a tear since Russia’s invasion of Ukraine supercharged the coal market, leaving power producers clambering for supply and pushing coal prices to record levels. In March, Thungela also delivered stellar maiden results, with FY21 headline EPS coming in at R66.57 vs a loss of R5.31 a year before, while the company also posted a profit of R6.9bn vs a loss of R362mn in FY20. At its results, Thungela announced R4bn in new projects over four years (all replacement tonnes) had been submitted for board approval.

Investment holding company, Hosken Consolidated Investments (HCI) was April’s second best-performing share with a MoM gain of 23.9%. The HCI share price soared last week on the back of a report in Norwegian oil, gas, and energy publication, Upstream, that an offshore field in Namibia, in which HCI has a 10% stake, could be the world’s largest deep-sea oilfield. HCI has a 49% stake in Impact Oil, which explores large deep-sea oil and natural gas opportunities off the African coast, and Impact, in turn, owns 20% of the Venus-1X field, which could have as many as 13bn barrels of oil and over 10trn cubic feet of natural gas.

HCI was followed by Zeder Investments (+14.5% MoM), which reported FY22 results last month that showed its investment income had advanced by 30.3% YoY to R86.0mn, while diluted EPS stood at ZAc45.3 compared with ZAc146.8 recorded in FY21. The company’s share price rallied after it hiked its special dividend by 362.5% YoY – from ZAc20/share in FY21 to ZAc92.5/share in FY22. CEO Johann Le Roux said that favourable agri conditions had been positive for the Group’s portfolio, which had shown growth over the past few years. He added that the Kaap Agri unbundling, the disposal of The Logistics Group, and prior-year corporate transactions had a positive impact on wealth creation for Zeder’s shareholders.

Omnia Holdings, Sasol, and Rhodes Food Group Holdings (RFG) followed, recording MoM gains of 10.9%, 10.6%, and 9.1%, respectively. Omnia supplies fertiliser to the agricultural industry and is well-positioned to benefit from the current commodities rally and Russia’s invasion of Ukraine, which has seen fertiliser prices soar globally as both Russia and Ukraine are big producers of fertilisers. Sasol was also a beneficiary of higher energy prices and in its production and sales metrics for the nine months ended 31 March 2022, the Group said that it is continuing to manage the consequences of the heavy rainfall and floods experienced in KZN. Sasol said the situation has resulted in a force majeure declaration on the export of certain chemical products, adding that its 4Q22 volume outlook could be impacted subject to the extent of infrastructure damage and the timing of the restoration of key infrastructure and utilities. Meanwhile, RFG clawed back most of its March losses (the share fell 13.0% MoM) in April.

Rounding out April’s ten best-performing shares were British American Tobacco (+7.7% MoM), Ascendis Health (+7.6% MoM), Mediclinic International (+7.4% MoM), and Raubex (+7.2% MoM). As a JSE-listed company with foreign earnings (like AB-Inbev), British American Tobacco benefitted from the weaker local currency. Mediclinic said in its FY22 trading statement, that its revenue advanced by c. 7.8% YoY to GBP3.23bn and that the Group’s EBITDA margin improved to c. 16.0%, from 14.2% in FY21. The healthcare Group also noted a recovery in profitability and strong cash conversion leading to a significant reduction in its leverage ratio, adding that it was optimistic about the rest of this year.

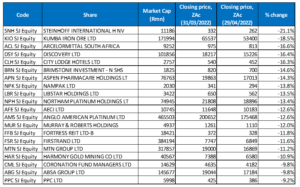

Figure 2: April 2022’s worst-performing shares, % change

Source: Bloomberg, Anchor

With a MoM decline of 21.1%, Steinhoff International was April’s worst-performing share. Steinhoff was followed by Kumba Iron Ore (-18.5% MoM) in second spot, and ArcelorMittal (-16.6% MoM) in the third position as weak iron ore prices (-8.5%) provided a headwind for these counters. Last month, Kumba reported operational challenges for 1Q22 and reduced its FY22 volume guidance by 1mn tonnes or 2.5%. The company also warned of weaker 2022 production and sales due to heavy rain and geopolitical disruptions. It was also a disappointing quarter operationally for Kumba with production down 21% YoY and sales 8% lower YoY. Meanwhile, ArcelorMittal said in April that it was conducting feasibility studies on two potential renewable energy projects to reduce its dependence on electricity supply from the national grid.

Discovery, City Lodge Hotels, Brimstone Investments, and Aspen Pharmacare were down 16.4%, 16.3%, 14.6%, and 14.3% MoM, respectively. In November 2021, Aspen negotiated a licensing deal to package and sell Johnson & Johnson’s COVID-19 vaccine and distribute it across Africa, but last month Aspen said that its COVID-19 vaccination plant risked being closed after it had not received a single order for the product. The company said that it was now in talks with African leaders about how to raise demand for the vaccine.

Rounding out the ten worst-performing shares was Nampak (-13.8% MoM), Libstar Holdings (-13.5% MoM), and Northam Platinum (Northam; -13.45 MoM). Food producer, Libstar last month postponed the payment of its final dividend to preserve cash due to the impact of the pandemic. It had been due to pay R170.5mn in dividends to shareholders on 14 April but this has been delayed until the release of its 1H22 results in September 2022. At the end of March, Northam released 1H22 results, which were a big miss vs market expectations before the trading statement was released. Operational issues (higher COVID-19 absences, community unrest) and strong unit cost inflation (+15% YoY) led to production volumes coming in below Northam’s previous guidance. Poor volumes led to lower earnings growth vs previous expectations. Still, the Group did announce a 66%-plus jump in profit as it benefitted from buoyant metal prices, while revenue rose to R13.88bn from R11.88bn posted in 1H21, and diluted EPS jumped 81.7% YoY to ZAc965. No interim dividend was paid with the company citing the need to consider its growth prospects as the reason.

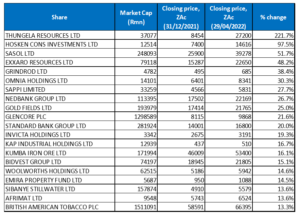

Figure 3: Top-20 April 2022, YTD

Source: Anchor, Bloomberg

Thirteen out of April’s top-20 YTD best-performing shares also featured among the top-20 performers for the year to end-March, with Omnia Holdings (+30.3% YTD), Glencore Plc (+21.6% YTD), KAP Industrial (+16.7% YTD), Bidvest (+15.1% YTD), Woolworths (+14.6% YTD), Emira Property Fund (+14.5% YTD), and British American Tobacco (+13.3% YTD), replacing FirstRand, Discovery, Brimstone, ABSA, ARM, Sanlam and Blue Label Telecoms.

Thungela Resources (+221.7% YTD, discussed earlier) once again took the top spot for the third month in a row, while HCI (+97.5% YTD, discussed earlier) was in second place followed by Sasol (+51.7% YTD). Sasol bumped Exxaro Resources (+48.2% YTD) from the third position in the year to end-March to the fourth position last month. In April, Exxaro told Reuters that it has received “numerous” requests from European countries wanting to sign supply contracts after the EU proposed sanctions on Russian coal following Russia’s invasion of Ukraine. This has put European countries under immense pressure to diversify their coal supply. While Exxaro had the right quality of coal for that market, the company said that its current production has already been allocated and the struggling local Transnet rail network meant that miners were unable to meet the increased demand and export more coal.

Exxaro was followed by Grindrod (+38.4% YTD), Omnia Holdings (+30.3% YTD), Sappi (+27.7% YTD), and Nedbank (+26.7% YTD). In its FY21 results, Nedbank reported a 115% YoY jump in headline EPS, while the bank’s profit almost tripled due to lower impairment costs, a recovery in its non-interest revenue growth, and a strong focus on lowering costs.

Rounding out the YTD 10 best-performing shares were Gold Fields and Glencore with YTD gains of 25.0% and 21.6%, respectively. While Gold Fields lost 4.6% MoM in April, its stellar performance this year assured it a spot among the YTD best-performing shares. Glencore said last week that it expected its full-year earnings to comfortably exceed the top-end of its long-term adjusted earnings before interest and taxes guidance range of US$2.2bn (R33bn) – US$3.2bn p.a.

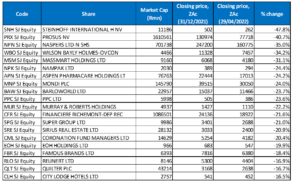

Figure 4: Bottom-20 April 2022, YTD

Source: Anchor, Bloomberg

Among the YTD worst-performing shares, 18 of the 20 worst-performers for the year to end-April also featured among the 20 worst performers for the year to end-March. Aspen Pharmacare (-24.2% YTD), and City Lodge Hotels (-16.5% YTD) were the newcomers, replacing Telkom and Zeder Investments.

Steinhoff (-47.8% YTD and discussed earlier) replaced Prosus to take the worst-performer spot for the year to end-April. It was followed by Prosus (-40.7% YTD) in second place and Naspers (-35.0% YTD) in the third spot. While Naspers and Prosus benefitted from the weaker local currency and an 11% rally on the last day of the month from their largest underlying investment, Tencent, it was not enough to salvage their YTD performances. Tencent’s late-April rally was on the back of reports that the Chinese government would support the healthy growth of platform companies, an apparent U-turn from the past few years of increasing regulatory headwinds in China.

Naspers was followed by Wilson Bayly Holmes Ovcon (WBHO; -34.2%), Massmart (-31.1%), and Nampak (-24.4%). WBHO released disappointing 1H22 results in March, with Group revenue declining 22% YoY due to reduced activity in Australia and the UK.

Aspen (-24.2%), Mondi Plc (-24.0%), Barloworld (-23.7%) and PPC Ltd (-23.6%) rounded out the ten worst-performing shares YTD.