Major global markets declined in October (MSCI World -2.9% MoM; +8.4% YTD) as worries about the global economic outlook and the higher-for-longer interest rates narrative weighed on sentiment. In addition, the bond market is seeing a rapid rise in US Treasury yields, with the benchmark US 10-year Treasury yield breaching 5% for the first time since 2007. The possibility of a US government shutdown was also a concern for investors – Congress has until 17 November to reach an agreement on the federal budget. Additionally, inflation worries have been exacerbated by renewed geopolitical tensions in the Middle East. The killing of Israeli civilians by Hamas in early October and Israel’s ensuing war on Gaza could spread regionally, drawing oil-rich countries into the conflict, straining global oil markets and negatively impacting inflation and interest rates.

In US economic data, September headline inflation, as measured by the Consumer Price Index (CPI), was unchanged at 3.7% YoY, although the print came in higher than expected. September core CPI, excluding the erratic food and energy components, edged lower to 4.1% YoY vs 4.3% YoY in August. MoM headline inflation decelerated to 0.4% vs August’s 0.6% increase. September US retail sales advanced 0.7% MoM – slightly faster than August’s 0.6% increase and better than market expectations. It also marked the sixth straight MoM gain in US retail sales. YoY, retail sales increased by 3.8%. September core personal consumption expenditure (PCE), excluding food and energy, the Fed’s preferred inflation gauge, slowed to 3.7% YoY (the lowest reading since May 2021) and compared to a downwardly revised 3.8% YoY in August. MoM, September core PCE rose to a four-month high of 0.3% vs 0.1% MoM in August. US 3Q23 gross domestic product (GDP) grew at a 4.9% annualised pace, ahead of the 4.7% consensus estimate and higher than 2Q23’s 2.1% growth.

US markets posted losses for a third month running, with the tech-heavy Nasdaq Composite and the blue-chip S&P 500 indices falling into correction territory last week and gaining some ground at the end of a tough month for markets. The Nasdaq recorded a 2.8% MoM decline (+22.8% YTD), the S&P 500 fell by 1.4% MoM (+9.2% YTD), and the Dow Jones was down by 1.4% MoM (-0.3% YTD).

In Europe, Germany’s DAX was down 3.7% MoM (+6.4% YTD), while France’s CAC Index closed the month 3.5% in the red (+6.4% YTD). In economic data, September euro area inflation was lower at 4.3% vs 5.2% YoY in August, while core inflation (excluding food and fuel) eased to 5.5% vs 6.2% YoY in August. Germany’s October inflation eased to its lowest level since August 2021, at 3.0% YoY vs September’s 6.1%. The core inflation rate, excluding volatile items such as food and energy, declined to 4.3% YoY vs 4.6% in September. France’s September inflation was unchanged from August at 4.9% YoY. Meanwhile, the eurozone’s 3Q23 GDP shrank, coming in worse than expected at a 0.1% QoQ decline. YoY, GDP grew by 0.1% vs 2Q23’s 0.5% YoY growth. QoQ, Germany, the eurozone’s largest economy, shrank by 0.1%, while France’s economy grew by just 0.1% QoQ. The European Central Bank (ECB) left rates unchanged at its October meeting, snapping a streak of ten consecutive rate hikes (it has lifted rates by a combined 4.5% since July 2022).

The UK’s blue-chip FTSE-100 lost 3.8% in October and is down by 1.7% YTD. September UK inflation remained at 6.7% YoY (unchanged from the August print). Core inflation, excluding the volatile food and energy items, came in at 6.1% in September – marginally lower than August’s 6.2%.

October saw ongoing jitters over China’s economic recovery and the country’s property sector weighing on its equity markets. MoM, Chinese equity markets recorded losses, with Hong Kong’s Hang Seng Index down 3.9% in October (-13.5% YTD), while the Shanghai Composite Index retreated by 2.9% (-2.3% YTD). China’s official October Manufacturing Purchasing Managers Index (PMI) unexpectedly fell back into contraction territory, coming in at 49.5 vs September’s 50.2 print. The official non-manufacturing PMI, measuring business sentiment in the services and construction sectors, stood at 50.6 in October vs 51.7 in September. The 50-point mark separates expansion from contraction.

Japan’s benchmark Nikkei declined 3.1% MoM (+18.3% YTD). Core CPI (excluding the volatile fresh food category but including energy costs) slowed to 2.8% YoY in September vs 3.1% YoY in August. This was the first time in over 12 months that inflation came in below 3%, although it remains above the Bank of Japan’s 2% target.

Among commodities, after four consecutive MoM gains, Brent crude was down 8.3% MoM (+1.3% YTD), likely on concerns about the global economy’s health and what it means for oil demand and weak Chinese economic data. Iron ore prices rose 0.5% MoM and are up 5.2% YTD. The spot gold price rose above the psychological US$2,000 level on 27 October before falling back and ending the month 7.3% higher (+8.8% YTD) at US$1983.88/oz. The price of the yellow metal shot up despite rising US bond yields and a strong US dollar, buoyed by the Israel/Palestine conflict after Israel launched airstrikes against Gaza on 7 October and ahead of the Fed’s policy meeting this week. As a safe-haven asset, gold is a good hedge against geopolitical risks. The platinum price rose by 3.2% MoM (-12.8% YTD), while palladium plummeted by 10.0% MoM (-37.3% YTD). Natural gas prices rose by 22.1% MoM (-20.1% YTD), while thermal coal fell by 4.3% MoM (-32.8% YTD).

South Africa’s (SA’s) FTSE JSE All Share Index declined by 3.8% in October (-4.6% YTD), while the FTSE JSE Capped SWIX was down 2.9% MoM (-3.2% YTD). Except for the gold counters, it was red across the board on the JSE, which was weighed down by industrial metals, industrial and resources counters. The Indi-25 was down 4.7% MoM (+3.8% YTD), while the SA Listed Property Index lost 4.4% MoM (-12.9% YTD), and the Resi-10 ended the month 4.3% lower (-22.2% YTD). The Fini-15 lost 3.1% MoM (+0.7% YTD). Highlighting the monthly performances of the biggest shares by market cap on the JSE, the largest company on the exchange, BHP Group, fell by 2.0% MoM, while the second-biggest share, Anheuser-Busch InBev, rose 1.2% MoM. Prosus, the third-biggest listed company, dropped by 5.9%, Richemont was down 4.4%, and Naspers lost 3.8%. After jumping by 7.6% MoM in September, Glencore gave that back and more with a 8.9% MoM drop, while Anglo American Plc fell by 9.3% MoM. The rand strengthened by 1.5% against the greenback in October but is down 8.6% YTD.

In economic data, SA’s September headline CPI rose 5.4% YoY vs 4.8% YoY in August. Besides a significant hike in fuel prices, the costs of meat, fish, fruit, and non-alcoholic beverages all registered higher annual rates in September. Core inflation (excluding the volatile food and energy categories) came in at 4.5% YoY in September vs 4.8% YoY in August. Seasonally adjusted August retail sales (released in October) fell by 0.5% YoY following a downwardly revised 1% YoY drop in July, as local consumers remained under pressure.

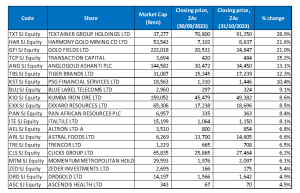

Figure 1: October 2023 20 best-performing shares, MoM % change

Source: Bloomberg, Anchor

Textainer Group, which focuses on purchasing, leasing, and reselling marine cargo containers, was October’s best-performing share, jumping by 28.9% MoM. The Group’s share price surged on 23 October after announcing that it would delist from the JSE as alternative investment firm Stonepeak is set to buy the company for US$7.4bn (c. R141bn). Stonepeak specialises in infrastructure and tangible assets, and the proposed buyout will see Textainer shareholders receiving a cash payout of US$50/share – a c. 46% premium over Textainer’s closing price on 20 October. The deal is subject to regulatory approval and includes a 30-day period for Textainer to shop around for better proposals until 22 November. If the deal goes ahead, Olivier Ghesquiere will remain the president and CEO of the Group, which is based in Bermuda.

The much stronger gold price (+7.3% MoM) buoyed the gold mining counters on the JSE, with Harmony and Gold Fields taking the second and third spots with MoM gains of 21.6% and 21.0%, respectively. Global geopolitical tensions, led by a flare-up in the conflict in the Middle East region, have supported the gold price gains. Meanwhile, Transaction Capital saw its share price stage a recovery in October, albeit from a very low base, to end the month 15.2% higher. It was followed by another gold miner, AngloGold Ashanti, which rose by 13.1% MoM.

Food producer and consumer goods Group Tiger Brands recorded a 12.3% MoM share price rise. Tiger Brands shares surged c. 19% on 20 October (its biggest one-day gain in 25 years) after the company released earnings guidance and announced that its CEO Noel Doyle was stepping down and would be replaced by Tjaart Kruger. The Tiger Brands board said new leadership is needed to “respond to the challenges now facing the company”. In a voluntary trading update for the year to end September (FY23), Tiger Brands said that its headline EPS was expected to be only slightly lower or up to 2% higher YoY. Local food producers and retailers have faced many challenges over the past 18 months, including increased loadshedding, which has led to high diesel costs impacting company profits, while food inflation has hit its highest level in c. 14 years.

Investment and insurance holding company PSG Financial Services (formerly known as PSG Konsult) rose by 10.4% MoM. In its 1H23 results, released in October, the company said that its insurance revenue rose to R1.02bn from R0.82bn posted in the corresponding period of the previous year, while its diluted EPS increased by 21.4% YoY to ZAc37.40.

Rounding out October’s top-10 performers were Blue Label Telecoms, Kumba Iron Ore (Kumba), and Exxaro Resources, with MoM gains of 9.1%, 8.6% and 8.5%. In a 3Q23 production and sales update, Kumba said its total production had declined by 2.0% to 9.74mn tonnes. Moreover, iron ore sales decreased by 12.0% to 8.87mn tonnes due to Transnet equipment failure and adverse weather conditions at the Saldanha Bay Port. However, its production increased by 4% QoQ due to some improvement in Transnet’s rail performance, reflecting measures taken to reduce cable theft in 3Q23. Kumba’s CEO, Mpumi Zikalala, said the Group had maintained its full-year 2023 guidance subject to logistics constraints.

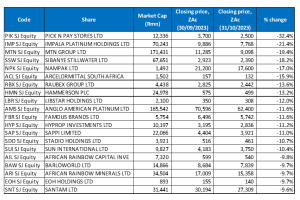

Figure 2: October 2023 20 worst-performing shares, MoM % change

Source: Bloomberg, Anchor

Pick n Pay Stores (-32.4% MoM) was October’s worst-performing share. The retailer’s share price dropped by c. 15% on 15 October after it released a “disappointing” interim loss (its first), which resulted in it not declaring a dividend. The company reported a 1H24 headline loss per share of ZAc129.20, down from HEPS of ZAc88.76 in 1H23. Group turnover grew 5.4% YoY to R54.1bn vs R51.3bn in the last comparable period. According to the company, turnover growth was boosted by a strong performance from its Boxer stores, which recorded 16.1% YoY growth. Pick n Pay recently reappointed Sean Summers as its CEO, replacing Pieter Boone. Summers, also its CEO between 1996 and 2006, officially took office at the end of September. According to the company, Summers’s priority will be returning core Pick n Pay stores to growth and profitability.

Pick n Pay was followed by Impala Platinum (Implats) and MTN Group, which recorded MoM declines of 21.4% and 19.4%, respectively. Last month, MTN’s SA unit signed a deal with local fintech company Payabill as part of its enterprise supplier development (ESD) programme that plans to increase its mobile procurement spend by R4.0bn over two years with 51.0% black-owned small, medium and micro enterprises (SMMEs).

Sibanye Stillwater’s share price (-18.2% MoM) slumped after Morgan Stanley downgraded the counter, catching the market off guard. Sibanye and its peers have been under significant pressure due to the precipitous drop in platinum group metal (PGM) prices from their record highs around two years ago and the potential impact on cash flows at a time when mining costs are high. The Sibanye-Stillwater CEO Neal Froneman said earlier last month that Sibanye (SA’s biggest mining employer) may be forced to close unprofitable shafts, adding that job cuts in the platinum mining sector have become inevitable as PGM prices continue to drop.

Nampak, steelmaker ArcelorMittal, construction and engineering group Raubex Group and Hammerson Plc were down 17.0%, 15.9%, 13.6% and 13.2% MoM, respectively. SA’s ongoing electricity crisis (disrupting its business), high inflation, weak growth, and lower demand from key steel-consuming sectors continue to weigh on ArcelorMittal. Raubex’s share price rose on 16 October after the company said earnings for the half-year to end-August were expected to increase by as much as one-fifth. The company said that its headline EPS is expected to rise by 15%-20% YoY for the interim period to between ZAc182.9 and ZAc190.8. Group CEO Felicia Msiza said that Raubex “… continues to maintain a strong balance sheet and a healthy cash balance,” adding that this did not include contributions from the completed Beitbridge Border Post project. Unfortunately, by the end of the month, Raubex had given back those gains and more.

Libstar Holdings (-12.0% MoM) and Anglo American Platinum (Amplats; -11.6% MoM) rounded out the ten worst-performing shares for October. Amplats’ share price came under pressure after it reported that its total PGM production declined by 2% YoY to c. 1mn oz for 3Q23. Of this, platinum output was down 1% YoY at 475,900 oz, while palladium production was 3% lower at 314,800 oz, with own managed assets down by a similar rate. Along with lower metal prices, Amplats also recorded a 9% YoY decline in refined PGM production from its production due to “an unplanned multi-municipal water stoppage”, impacting its operations for five days in July. This year’s average 3Q23 basket price of US$1,539 per PGM oz was also 39% lower than in 3Q22.

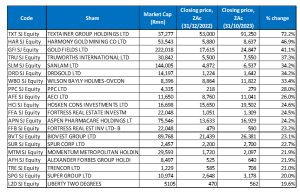

Figure 3: Top-20 best-performing shares, YTD

Source: Anchor, Bloomberg

Fifteen out of September’s top-20 YTD best-performing shares again featured among the top-20 best performers for the year to the end of October. Following good performances in October, Gold Fields (+21.0% MoM), Momentum Metropolitan Holdings (+6.1% MoM), Alexander Forbes (+2.4% MoM), Trencor (+6.5% MoM), and Liberty Two Degrees (+0.9% MoM) were the new entrants, bumping Bidcorp, Sirius Real Estate, Reinet, Sun International and Life Healthcare from the list.

Last month’s knockout performance from Textainer (+72.2% YTD; discussed earlier) saw it bump Wilson Bayly Holmes Ovcon (WBHO; +33.4% YTD) from the number-one spot to number seven. Meanwhile, good gains from the gold counters in October (discussed earlier) saw Harmony jump to the second spot (+46.9% YTD) and resulted in Gold Fields re-entering the top 20 performers with a YTD gain of 41.1%. Gold Fields was followed by retailer Truworths (+37.3% YTD), despite its share price losing some ground in October (-1.3% MoM).

Sanlam (+34.2% YTD) moved to fifth place, followed by the gold tailings retreatment Group, DRDGold, which is now up 34.2% YTD after gaining 4.9% in October. Last week, in an operating update, DRDGold said that for the quarter that ended 30 September, it achieved a 5% QoQ increase in gold production. It said that gold production and gold sold increased from 2Q23 to 1,284kg and 1,267kg, respectively, primarily due to a 13% increase in tonnage throughput because of the commissioning of a major reclamation site at Ergo Mining in July 2023.

WBHO, PPC Ltd, diversified chemicals Group AECI, and Hosken Consolidated investments rounded out the top-10 YTD performers with YTD gains of 33.4%, 28.0%, 26.0% and 24.6%.

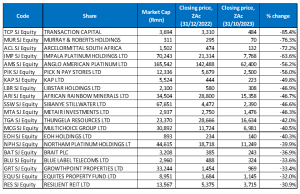

Figure 4: Bottom-20 worst-performing shares, YTD

Source: Anchor, Bloomberg

Among the YTD worst-performing shares, nineteen of the twenty shares for the year to the end of September remained among the twenty worst-performers for the year to the end of October. Following its 12.3% MoM share price gain in October, Tiger Brands dropped out of the bottom 20, with Equites Property Fund filling its spot.

Investment holding company Transaction Capital remained the worst-performing share YTD, with a 85.4% drop even after the share price saw a brief respite in October when it gained 15.2% MoM (discussed earlier). Once again, Transaction Capital was followed by Murray & Roberts (M&R; -76.3% YTD) in second place (M&R recorded a 4.1% loss in October), while ArcelorMittal (-72.2% YTD) remained in the third spot.

Implats, Amplats, and retailer Pick n Pay (discussed earlier) followed with YTD declines of 63.6%, 56.2% and 56.0%. Platinum counters continue to be in a rout this year as PGM prices have plummeted (YTD, platinum, palladium, and rhodium prices are down 12.8%, 37.3% and 64.5%, respectively), and China’s economic growth has remained sluggish, resulting in lower demand from the world’s second-largest economy.

KAP (-49.8%), Libstar Holdings (-46.9%), diversified miner African Rainbow Minerals (ARM; -46.7%), and Sibanye Stillwater (-46.6%; discussed earlier) rounded out the ten worst-performers YTD.