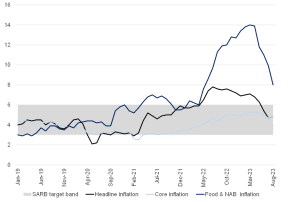

Matching expectations, South Africa’s (SA) August headline CPI print rose for the first time in 5 months to 4.8% YoY, from 4.7% YoY in July. The recent deceleration in headline inflation over the last few months has primarily been driven by strong base effects on fuel inflation, which, as expected, have now begun to dissipate from the August data. This, in addition to some of the fuel price increases we saw back in August, was largely responsible for this renewed increase in inflation data. Indeed, Brent crude oil prices have risen by over 25% since late June amid cuts in supply from major producers. Unfortunately, these factors offset further easing in food and non-alcoholic beverages inflation, softening from 9.9% YoY in July to 8.0% YoY in August. Except for fruit, all food and non-alcoholic beverages (NAB) categories recorded lower annual rates in August, which still assisted in taking some of the heat off the headline rate. This was not enough, however, to counteract the rise in fuel prices and increases in municipal tariffs.

Figure 1: SA inflation, YoY % change

Source: StatsSA, Anchor

Looking ahead, we forecast another spike in the September inflation data, supported by sizeable increases in fuel prices. It should then drift sideways in the top part of the inflation-target band until around mid-2024, when it is likely to get closer to the mid-point of the target range on a more sustained basis.

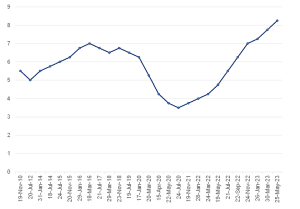

Against this backdrop, as expected, the SA Reserve Bank (SARB) looked through the first-round inflation impact of these supply-side shocks and kept the repo rate on hold at 8.25%, with the prime rate remaining at 11.75%. As expected, the material retreat in inflation expectations in the Bureau of Economic Research’s (BER) 3Q23 survey (released last week) largely negated the renewed inflation risks from the latest currency slippage and increased global fuel and food prices. Nonetheless, it is important to note that the latest jump in global oil prices remain a notable risk to the short- to medium-term inflation trajectory (as is the recent rand weakness), with the SARB still cautioning that it might tighten policy further if supported by data developments.

Since the Monetary Policy Committee’s (MPC) last meeting, near-term prospects for the global economy have been broadly unchanged. Whilst global inflation has broadly eased over the year, any further slowdown is beginning to look less certain. In addition, in SA specifically, loadshedding continues to hamper the economy, and prices for commodity exports continue to weaken. In the near term, stronger El Niño conditions threaten the agricultural outlook, while global climatic events present additional risks. Energy and logistical constraints remain binding on the growth outlook, limiting economic activity and increasing costs. As such, the renewed upside risks from rand weakness and higher global fuel and food prices will likely keep the possibility of modest further tightening alive in the last MPC meeting for the year, which will be held in November.

Figure 2: The history of the SARB MPC’s repo rate changes, %

Source: SARB, Anchor