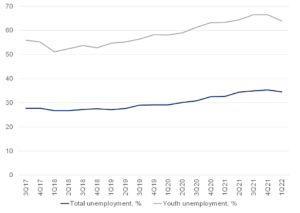

The latest Quarterly Labour Force Survey (QLFS), released by Stats SA on 31 May, shows that South Africa’s (SA’s) unemployment rate declined slightly to 34.5% in 1Q22 from 35.3% in 4Q21. There were 7.9mn unemployed people in the country in 1Q22, meaning that 370,000 jobs were gained QoQ. Still, the unemployment rate fell for the first time in seven quarters as the manufacturing and mining industries added jobs to meet the demand for commodities. This has been stoked by Russia’s war on Ukraine and the SA government employing more people through its public works programme. Positively, as per the expanded definition of unemployment (i.e., including those discouraged from seeking work, and thus more reflective of the true number of unemployed persons in SA) 45.5% of the labour force was without work in 1Q22 – down from 46.2% in the prior quarter (4Q21).

Figure 1: SA quarterly unemployment rate

Source: Stats SA, Anchor

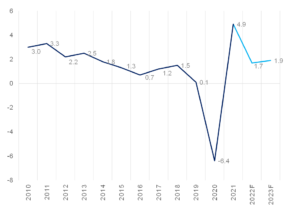

Nevertheless, despite these positive decreases, at the end of the day, SA’s official unemployment rate remains the highest on a list of 82 countries monitored by Bloomberg. Strict labour laws, stagnant productivity, bureaucratic hurdles, and a skills shortage have essentially stymied the ability of local companies to hire additional workers. Furthermore, despite SA’s economy rebounding faster than expected from the COVID-19 pandemic last year, 2022 GDP growth is expected to slow to a meagre 1.7% YoY.

Figure 2: SA GDP, YoY % change

Source: Stats SA, Anchor

Typically, in the local economy, material job creation has only occurred when GDP growth approaches 3% p.a. Thus, the economy is simply not growing at an adequate pace to sustainably boost further long-term employment prospects for South Africans. Consequently, the recovery in the unemployment rate may be short-lived as the record number of electricity outages forecast for this year, the ongoing devastating flooding in KwaZulu-Natal, a slowdown in global output, rising interest rates, and surging fuel and food prices caused by extreme weather and the war in Ukraine are likely to weigh on economic growth and job creation going forward.

If you have any questions or would like to discuss the subjects raised in this article with someone at Anchor please email us at info@anchorcapital.co.za.