Executive summary:

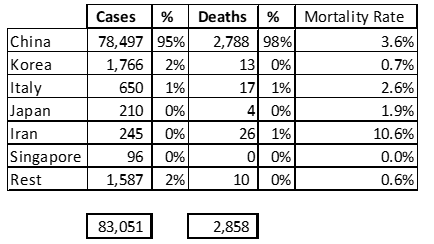

- As of 27 February, there have been c. 83,000 cases (95% in China) of the new coronavirus (Wuhan flu or 2019-nCoV) and 2,858 deaths (96% in China) globally.

- Outside of Asia, the recent spike in cases in Italy (650 cases and 17 deaths) has increased concerns about the impact of the virus spreading globally.

- The Chinese government has imposed a quarantine on the city of Wuhan (population 11mn), where the new coronavirus originated, and more than a dozen other cities with approximately 50mn people being restricted mainly to their homes.

- The IMF currently forecasts only a negative 0.1% impact from the virus on global economic growth. We believe it could be more severe.

- Data from China’s Ministry of Transport suggest that since the outbreak, passenger travel by road, rail and air have been operating at levels 75%– 85% lower than usual.

- China is responsible for c. 15% of global oil demand and this demand has dropped by at least one-third since the outbreak started, resulting in a 21% fall in the price of Brent crude oil.

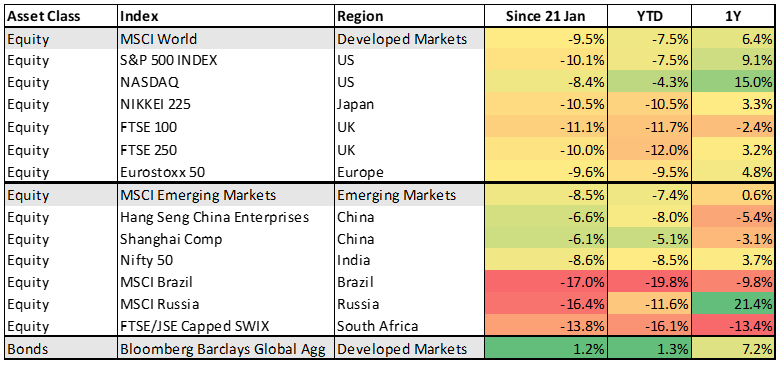

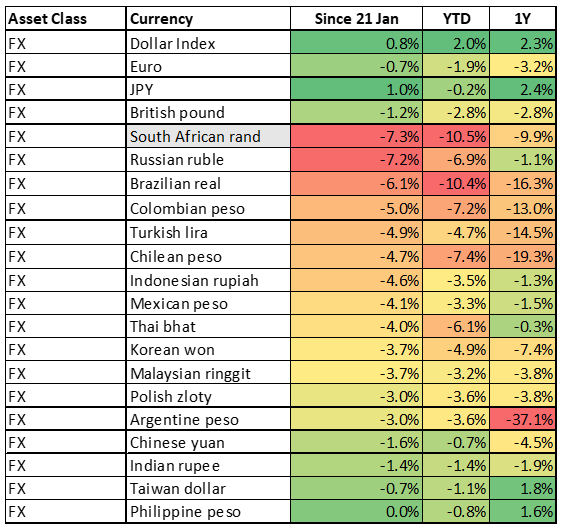

- Developed market (DM) and emerging market (EM) equities are down by 9.5% and 8.5%, respectively, since the start of the outbreak. Most EM currencies are 4%– 7% weaker against the US dollar over the same period.

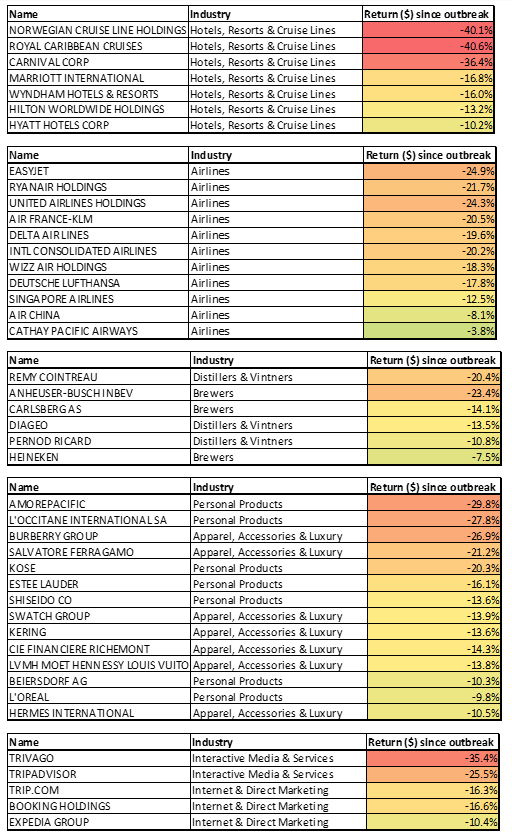

- The companies most impacted by the virus tend to be in the travel and oil-related sectors, with the share prices of cruise line operators down around 40% and the share prices of integrated oil and gas companies falling by around 20%, since the outbreak began.

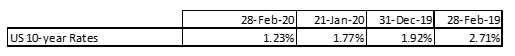

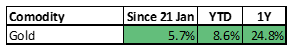

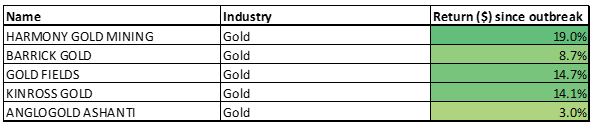

- US 10-year government bond rates have reached an all-time low of 1.23%, with markets having moved to price-in at least two rates cuts by the US Federal Reserve (Fed) in the next few months. The price of gold is around 5% higher and gold mining stocks are up around 20% since the outbreak started.

Conclusion

It’s clear that economic activity is down meaningfully in China, with some industries completely shut or operating at a fraction of capacity. This is very likely to have a significant impact on the near-term earnings of those companies directly and indirectly impacted. It’s less clear how long it will take for activity to return to normal or how significant the spread of the virus will be beyond China and that uncertainty is spooking investors. However, there are encouraging signs that shipping activity in and out of China is returning to normal levels and that data tend to be a bellwether of international trade activity. Taking a step back, equity investors are usually paying for multiple years’ worth of future earnings and it’s hard to imagine the current slowdown having a meaningful impact beyond a few quarters. So, in theory, significant price reactions to transitory events are usually overdone. Expectations on central banks have also increased dramatically and their ability to meet those expectations are becoming incrementally harder, though central bankers have all indicated a willingness to do what’s required.

So what do we do with our shares?

Issues like this pass with time. For long term investors our default position would be to sit through these events, as in the past markets have snapped back once the worst is over. However, for investors with sensitivity to short-term moves we would consider taking some risk off the table. We would rather do this by selling highly valued shares, rather than buying gold.

There are some specific companies who will be more materially impacted and we are disinvesting from these, where the impact is not factored into valuations.

Global markets are down around 12% from elevated valuation levels and are basically back to where they were three months ago. So, in aggregate, this market dip is not presenting an attractive valuation opportunity – valuations are now broadly in line with 10-year averages, with some short-term earnings risk. We believe it is too early to “buy the dip”, but we are watching certain equities carefully as buying opportunities at another notch down.

The local market is somewhat different – the “SA-inc” portion of the JSE was already trading at extremely low valuations – with many big companies at 5-year lows or worse. The SA market will follow the rest of the world down, but some once-in-a-decade opportunities are surfacing. Our analysts are hard at work firming up the buy-list … but we are not in a hurry!

The story so far

It’s been about 6 weeks since news started breaking of the impact of the current strain of the Wuhan coronavirus (2019-nCoV), which saw its firstly fatality on 9 January. The virus causes a lung illness dubbed Covid-19. Since news started gathering momentum around 21 January, we’ve had reports of c. 82,000 confirmed cases around the world and 2,801 deaths globally.

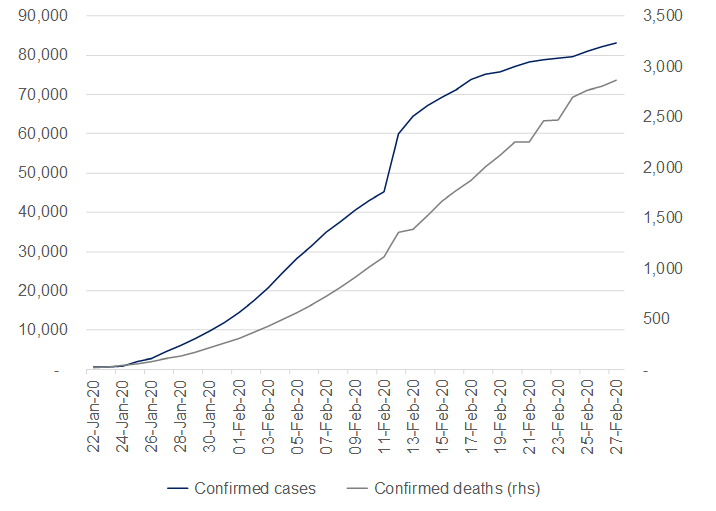

Figure 1: Wuhan coronavirus confirmed worldwide cases and deaths

Source: Anchor, Bloomberg

Approximately 96% of confirmed cases have been reported in China and 98% of deaths have also been reported in China. The method for tallying the number of confirmed cases has been amended multiple times, but it does appear that the number of new cases being reported daily in China is slowing. The focus now seems to be on the number of cases outside of China, with the latest scare being the number of cases reported in Italy (650 confirmed cases and 17 deaths, making it the most significant source of cases and deaths outside of Asia).

Figure 2: Coronavirus cases and deaths as of 27 Feb 2020

Source: Anchor, Bloomberg

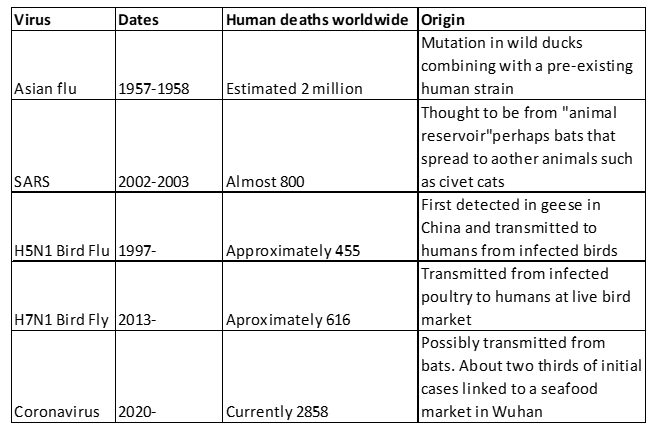

As it currently stands, the virus is the deadliest of its kind in Asia for at least the past 70 years.

Figure 3: Comparison to previous Asian viruses and their impact

Source: Anchor, Bloomberg

Many experts have attempted to forecast the ultimate spread of the virus and, while the World Health Organisation (WHO) has declared the outbreak a global health emergency (this helps mobilise international responses), it is not yet calling it a pandemic.

The Chinese government has imposed a quarantine on the city of Wuhan (with its 11mn inhabitants) and more than a dozen other cities in China, with approximately 50mn people being restricted mainly to their homes. Countries including the US, Australia and India have denied or restricted entry for non-citizens arriving from China and many countries are now also restricting travel to and from Italy.

The purpose of this note is to explore the potential impact on global economic activity as a result of the restrictions on movement of people and how asset prices have responded since news of the virus first dominated headlines.

In an analysis that predates the current outbreak, the World Bank reckons a destructive pandemic could result in millions of deaths, and points to how even conservative estimates suggest such an experience might destroy as much as 1% of global GDP. A disastrous health crisis akin to the 1918 Spanish flu, which may have killed as many as 50mn people, could cost 5% of global GDP, the Washington-based lender said in a 2015 report. The IMF currently forecasts only a negative 0.1% impact on global economic growth.

Asset prices

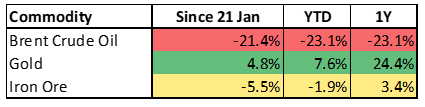

Data from China’s Ministry of Transport suggest that passenger travel by road, rail and air has been operating at levels 75%–85% lower than usual since the start of the outbreak. China is responsible for c. 15% of global oil demand and this demand has dropped by at least one-third since the outbreak started, causing a 21% drop in the price of Brent crude oil.

Figure 4: New coronavirus impact on various commodities

Source: Anchor, Bloomberg

DM and EM equities are down 9.5% and 8.5%, respectively, since the start of the outbreak.

Figure 5: New coronavirus impact on major equity and bond benchmarks

Source: Anchor, Bloomberg

Most EM currencies are 4%–7% weaker against the US dollar since the start of the outbreak.

Figure 6: New coronavirus impact on currencies

Source: Anchor, Bloomberg

The companies most impacted by the new coronavirus tend to be travel, travel-related and luxury goods companies, where purchases are often associated with travel.

Figure 7: New coronavirus impact on various industries

Source: Anchor, Bloomberg

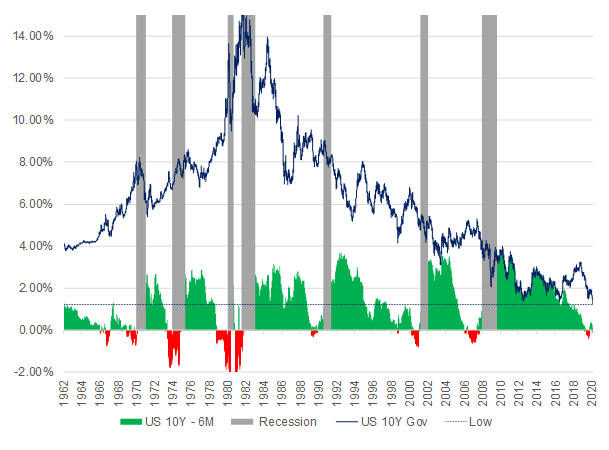

US 10-year government bond yields have also reached an all-time low of 1.23%,

Figure 8: New coronavirus: Impact on US 10-year government bond yields

Source: Anchor, Bloomberg

Figure 9: New coronavirus: Impact on US rates and the shape of the US yield curve

Source: Anchor, Bloomberg

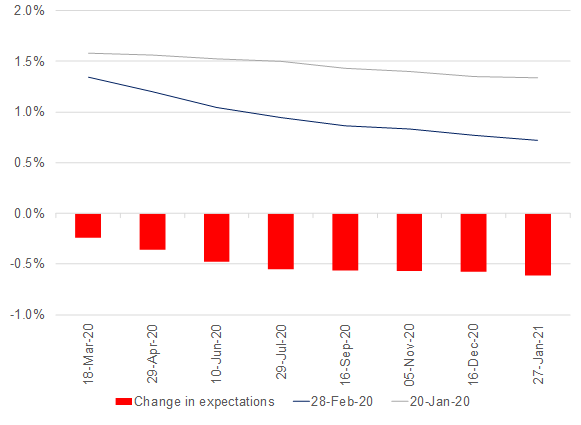

Meanwhile, markets have moved to pricing in at least two rates cuts by the US Fed in the next few months.

Figure 10: Market implied path of US Fed rates

Source: Anchor, Bloomberg

Figure 11: Gold has rallied as investors flock to safe-haven assets

Source: Anchor, Bloomberg

Figure 12: Gold miners have benefited from a rally in the gold price

Source: Anchor, Bloomberg

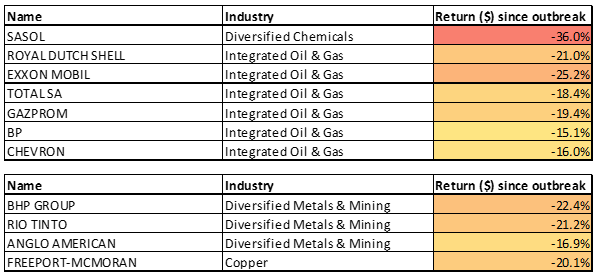

Figure 13: Oil and diversified mining companies are amongst the most negatively impacted

Source: Anchor, Bloomberg