Executive Summary

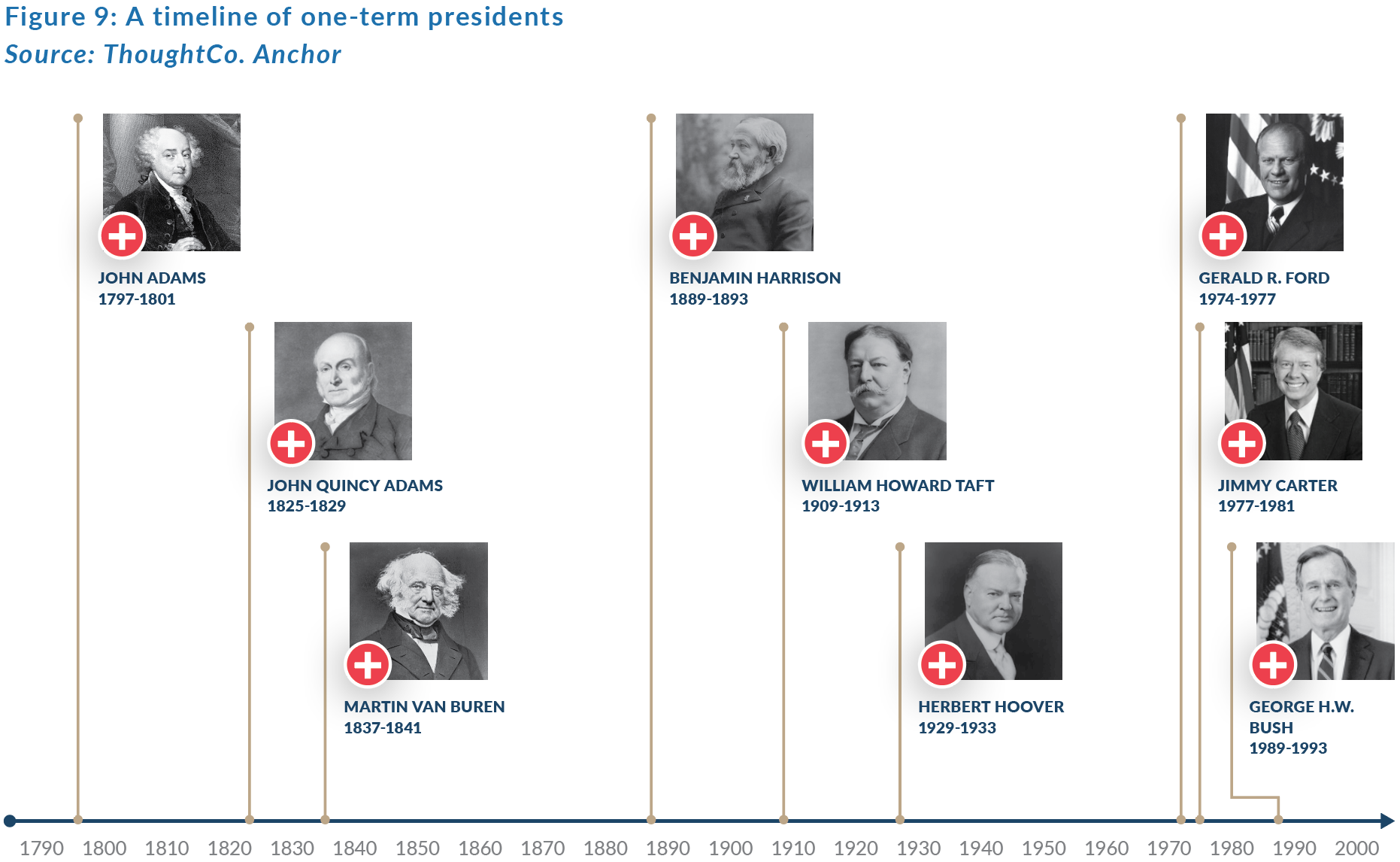

- Incumbent, Donald Trump, will run for a second term, hoping to avoid becoming only the fifth US president in the past 100 years to miss out on a second term.

- Polls currently suggest a victory for Democratic challenger, Joe Biden, though the outcome is likely to hinge on a few key “swing states” which are probably too close to call at this stage.

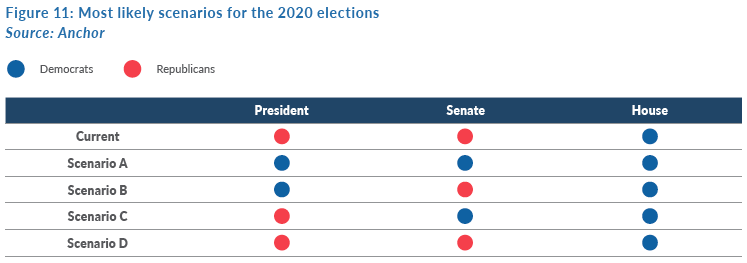

- Democrats are likely to maintain control of the House of Representatives, but the key question is whether they can also wrest control of the Senate and the presidency from Republicans.

- A “blue sweep”, where Democrats take control of the Presidency, the Senate, and the House would see the most significant shift in policy, including an increase in government spending and higher corporate taxes.

- The US economy is likely to benefit from a strong Democratic showing, with the increase in government spending likely to outweigh the drag from higher taxes in the short- to medium-term.

- The COVID-19 pandemic has increased the appeal of mail-in voting, which could result in a higher voter turnout which is most likely to benefit the Democrats. Mail-in voting is regulated at a state level and is currently subject to multiple legal challenges from both sides which is expected to cause a delay in the confirmation of the election result.

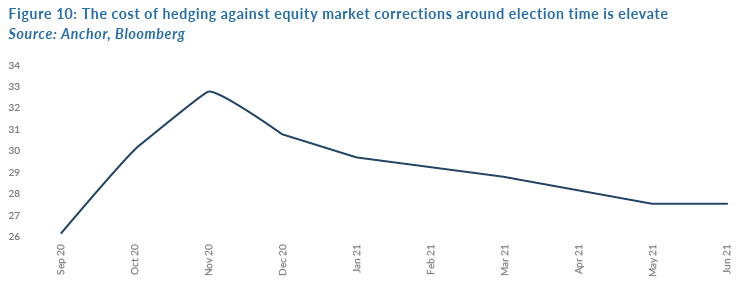

- The last time election results were disputed/delayed in 2000, markets fell around 8% in the weeks of uncertainty between the vote and the final outcome. Markets are already largely anticipating this with costs for hedging against equity market corrections around the election already extremely elevated.

- The other issue most likely to impact markets could come from a partial reversal of Trump’s US corporate tax cuts (which drove a c. 20% re-rating in US equity markets in early 2019).

Important Dates

The second presidential debate:

Thursday, 15 October 2020.

The third presidential debate:

Thursday, 22 October 2020.

Voting day:

Tuesday, 3 November 2020.

Election results could be finalised by around 8am SA time on 4 November 2020 although, with a large contingent of mail-in votes, it is extremely likely that the final result will be delayed by days, or even weeks, if there are legal challenges.

US Politics 101

1. The president

A US president is elected every 4 years and can serve a maximum of 2 consecutive terms, so the incumbent Republican president (Trump) is eligible for another term and will face off against his Democratic challenger Joe Biden.

Each US state gets a set number of electoral votes to allocate to the presidential candidate who gets the most votes in that state. The states allocate their electoral votes on a winner-take-all basis (except Nebraska and Maine, who pro rate them). There are 538 available electoral votes and a candidate needs at least 270 of these votes to be elected president.

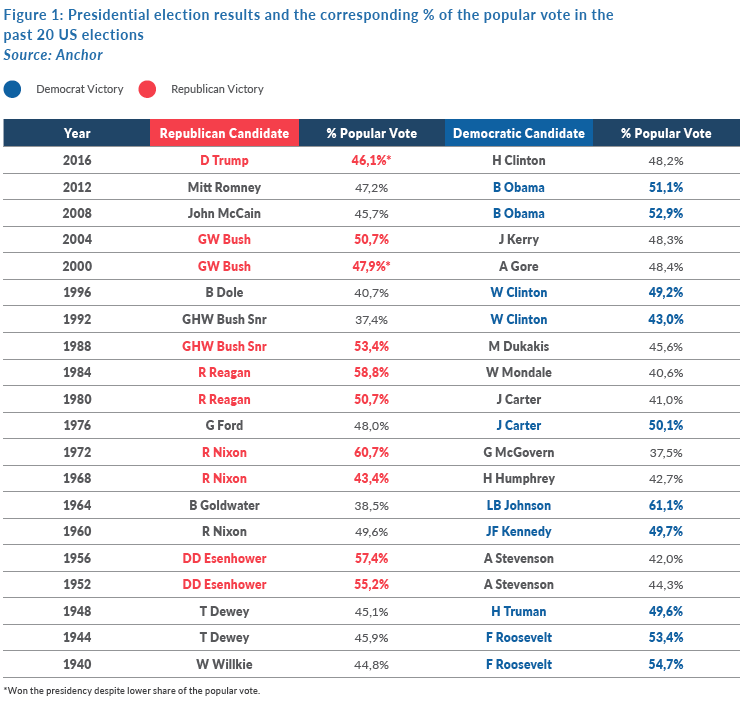

Electoral votes are not proportionate to the population, e.g. Wyoming has a population of c. 0.6mn people and 3 electoral votes compared to California with c. 40mn people and 55 electoral votes – so c. 70x more people but only c. 18x more electoral votes. This makes Wyoming votes theoretically almost four times as valuable as California votes. So, it is possible to become president while winning less votes than the challenger and in fact that has happened twice in the last 20 elections. In 2000, George W. Bush Jnr. won the election with 0.5% less votes than Al Gore and in the 2016 election Trump won with 2.1% less votes than Hilary Clinton.

2. Congress

The US Congress is made up of two chambers – the Senate, and the House. They have power over the budget (taxation and government spending) and creating laws.

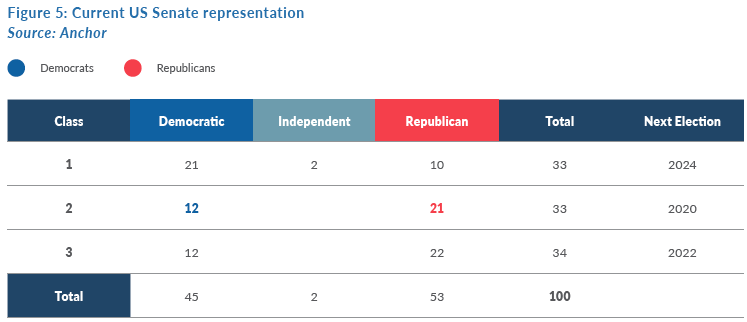

a) Senate: 100 seats – each of the 50 states have two senators who serve a six-year term (votes are staggered so roughly one-third of senators are elected every two years).

b) House of Representatives: 435 seats with each state getting allocated seats roughly in proportion to their population (with a minimum of 1 seat per state). Representatives serve two-year terms.

New laws, as well as spending and taxation proposals, generally pass through the House for approval and then the Senate (where 60% approval is usually required) before being signed into law by the president, who can veto these proposals. Spending and taxation bills can avoid the 60% majority in the Senate with a process called reconciliation.

The current state of play

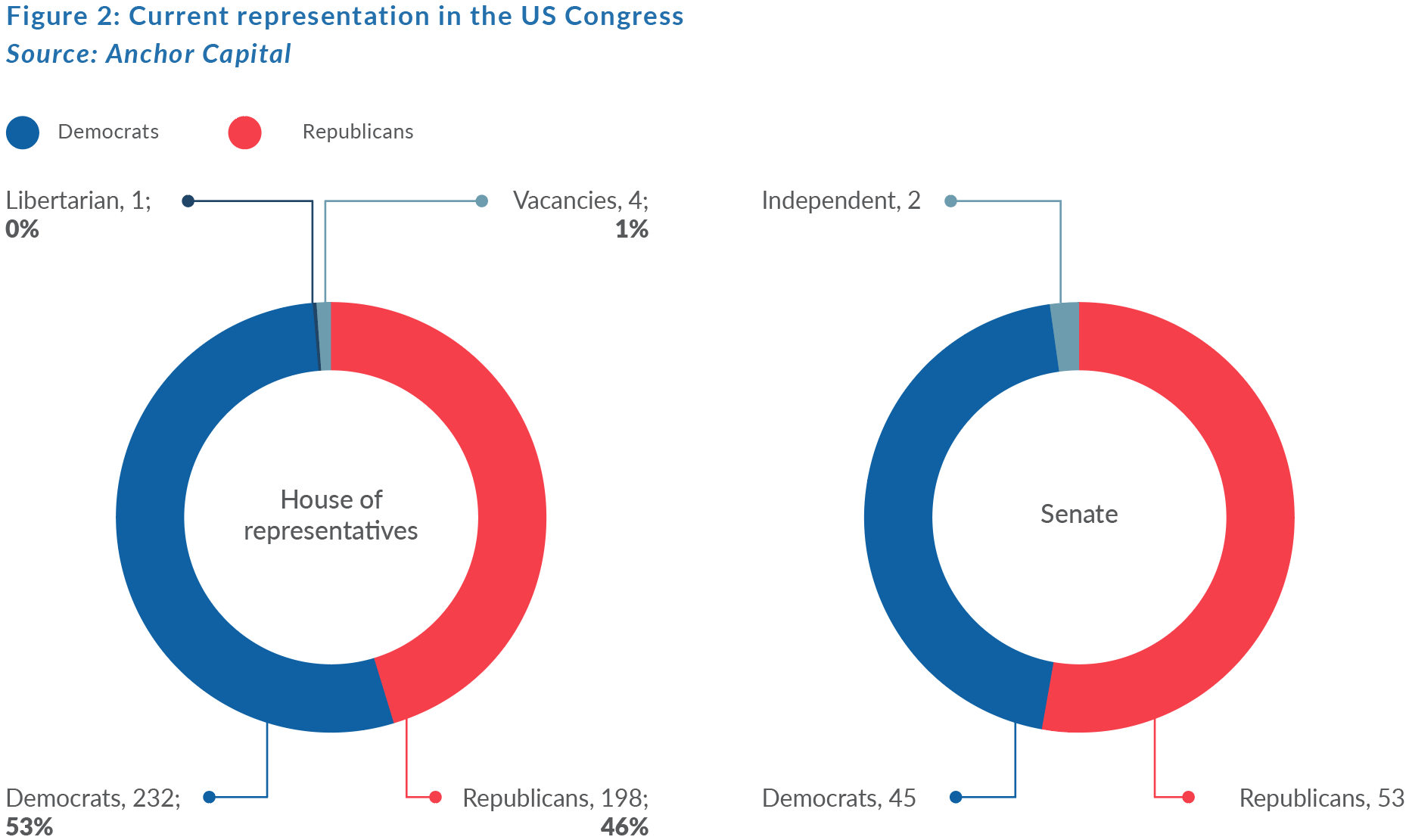

Congress is currently split, with the Democrats controlling the House and the Republicans controlling the Senate. That makes it challenging to get budgets and new legislation approved.

Polls

We analyse the elections in three sections: The Presidential Election, Senate elections, and House of Representatives elections, each of which has slightly different implications for what happens over the next four years.

President

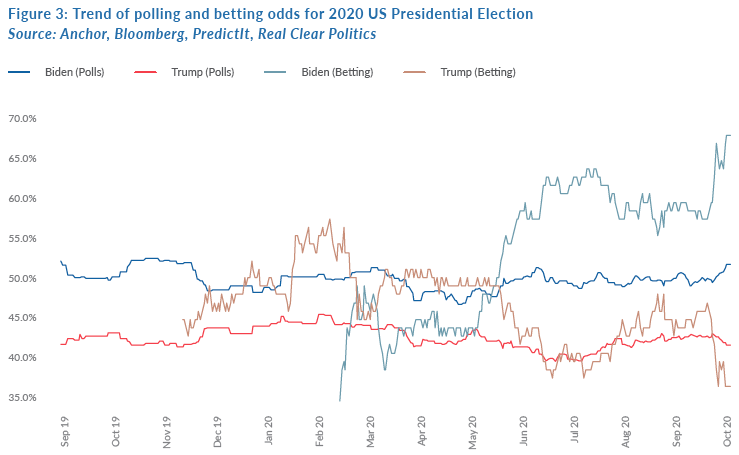

Polling aggregates have Joe Biden slightly ahead at 52% vs. 42%, while the betting markets have a significantly bigger lead for Biden.

However, as described above, based on the electoral vote system, the popular vote is not always a good indicator of the outcome of the Presidential Election and we will discuss that under the “swing states” section later in this note.

Senate

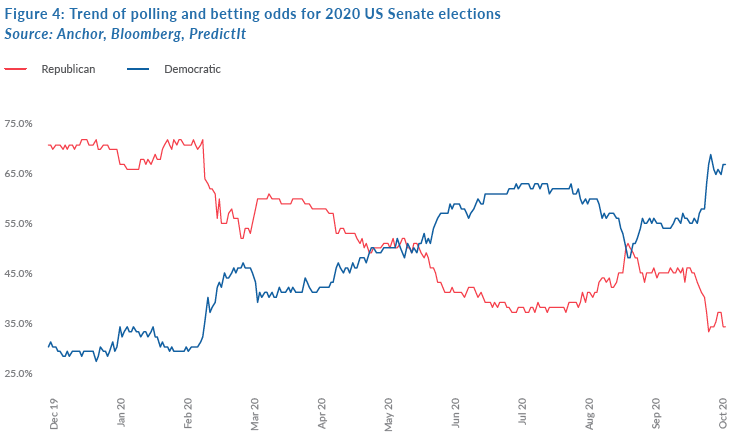

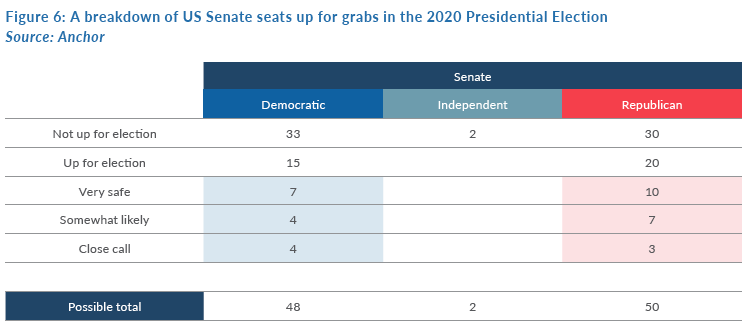

Betting odds currently have a 68% chance of the Democrats ending up with control of the Senate.

The Senate is currently controlled by the Republicans.

Class 2 senators are up for election in November, along with 2 seats which are vacant because of a death and a resignation, so there are 35 Senate seats up for grabs at this election. At least 7 of those are going to be a very close call, leaving the outcome quite tightly balanced. The 2 independent seats in the Senate (which are not up for grabs), typically vote with the Democrats. Should the Senate end up evenly split (50 seats each), the outcome of the Presidential Election becomes even more important as the vice president gets the deciding vote when there is a tie in Senate voting.

The House of Representatives

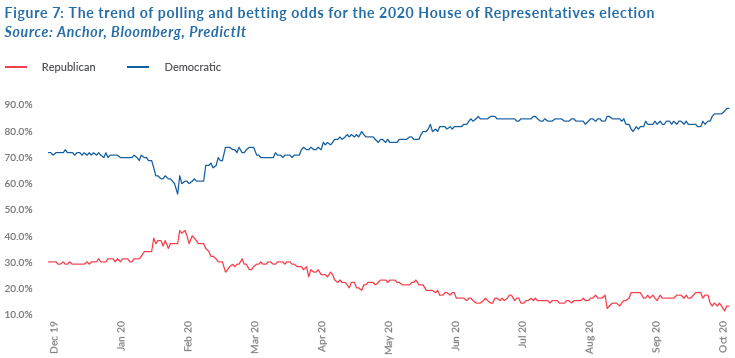

Democrats currently control the House and are expected to comfortably keep that control.

Swing States

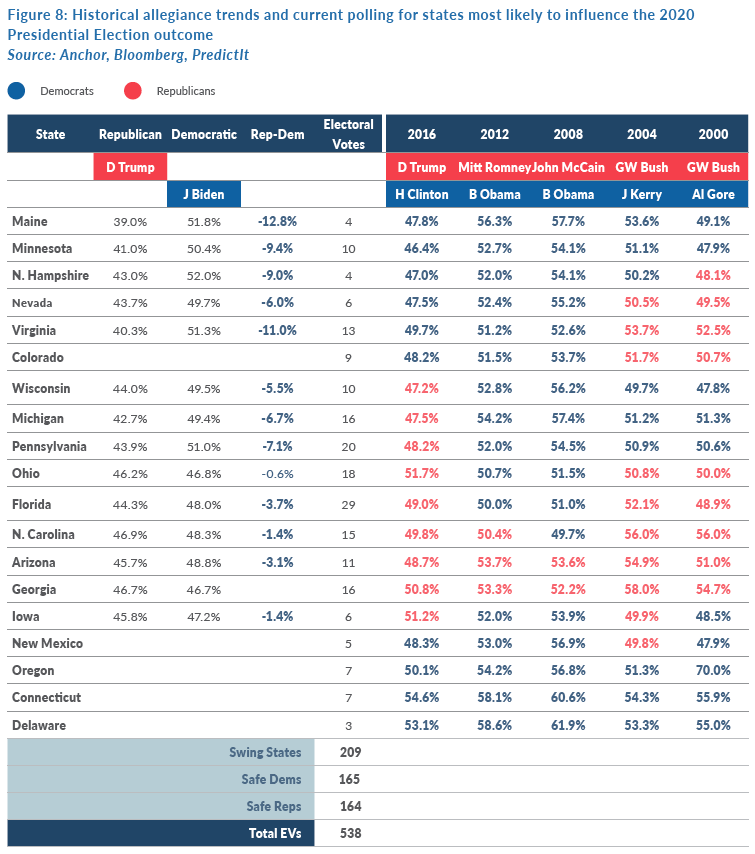

States representing around 60% of the 538 electoral votes on offer at the Presidential Election are usually quite consistent in terms of their allegiances. Those electoral votes usually given to each presidential candidate amount to about 165 “safe” electoral votes to begin with, meaning that a presidential candidate typically needs about 105 electoral votes from so-called swing states (which do not always have a strong allegiance) in order to win the presidency. The US electoral system’s winner-take-all approach to allocating electoral votes means that states like Florida, with 29 electoral votes on offer, can swing the result fairly decisively in favour of either candidate. Figure 8 below shows some of the states where the outcome is in the balance. Where polling is available for these states it currently strongly favours a positive outcome for Joe Biden, but with a tight margin in those states representing at least 20% of electoral votes.

US president who did not win re-election for a second term

Usually, the incumbent is at a distinct advantage when running for a second term. In the past 100 years only four US presidents have failed to win re-election.

Herbert Hoover bore the brunt of the public’s frustration with the economic pain of the Great Depression during his first term, the other three presidents who could not win a second term were all in the past 50 years.

George Bush Snr.

(1989 –1993)

Republican

Bush’s official White House biography describes his re-election loss this way: “Despite unprecedented popularity from this military and diplomatic triumphs, Bush was unable to withstand discontent at home from a faltering economy, rising violence in inner cities, and continued high deficit spending. In 1992, he lost his bid for re-election to Democrat William Clinton.”

Jimmy Carter

(1977–1981)

Democrat

Carter’s White House biography blames several factors for his defeat, not the least of which was the hostage-taking of US Embassy staff in Iran, which dominated the news during the last 14 months of Carter’s administration. “The consequences of Iran’s holding Americans captive, together with continuing inflation at home, contributed to Carter’s defeat in 1980. Even then, he continued the difficult negotiations over the hostages.”

Gerald Ford

(1974–1977)

Republican

Ford was never elected by the public as US president, he was appointed vice president when Spiro Agnew resigned and then became president when Richard Nixon resigned over his involvement in the Watergate scandal. “Ford was confronted with almost insuperable tasks,” his White House biography states. “There were the challenges of mastering inflation, reviving a depressed economy, solving chronic energy shortages, and trying to ensure world peace.” In the end, he could not overcome those challenges.

Campaigns

Controversies

Mail-in votes: The US Postal Service (USPS) finds itself as one of the top issues for this Presidential Election, primarily as a result of the coronavirus which has put the postal service’s balance sheet under pressure and increased the appeal of mail-in voting to avoid the risk of infection at crowded polling stations.

Mail-in voting/absentee voting has been around since the American Civil War for voters who cannot be physically present at their local voting station on voting day. Voters apply to receive a ballot form in advance of voting day, which they complete and mail in.

States tend to have differing legislation around who is eligible for mail-in voting. These range from “universal vote-by-mail” (where ballot forms are automatically sent to all voters), while at the opposite end of the spectrum some states require applicants for vote-by-mail to prove they have an approved reason for mail-in voting (away on voting day, elderly, disabled, or incarcerated). There are also differences in how mail-in voting forms are verified, with some states requiring signatures on ballot envelopes which must be checked against signatures on record, while other states do not check signatures.

In general, Democrats favour looser rules around mail-in voting, since mail-in voting is usually associated with a higher voter turnout, particularly among low-income voters, which tends to favour the Democrats. Trump has pushed back on mail-in voting, suggesting that it is “inaccurate and fraudulent”. Republicans are trying to use the fragile state of the USPS financial situation as a reason why broader access to mail-in voting cannot work, blocking attempts by Democrats to pass funding bills that will help subsidise more mail-in voting.

There are numerous legal challenges in US courts pushing both sides of the mail-in vote agenda, so it is very possible that, if the election is close, the counting of mail-in votes (and the checking of signatures) may delay the final results and that results influenced by mail-in votes may be subject to legal challenges.

Policies

Trump

(Still Make America Great Again, America First, and Promises Made, Promises Kept)

Trump’s biggest challenge for this campaign is convincing Americans that his handling of the pandemic was sufficient and that he has been able to get the economy back on track. His policies are largely more of the same:

- Bring manufacturing jobs home (by protecting local manufacturers from foreign competition, particularly China).

- Bring American troops home (predominantly from Germany and Afghanistan).

- Change immigration to a “merit-based” system and eliminate chain migration (i.e. immigration based on family ties).

- Bring down drug costs.

- Address employment barriers for former prisoners.

Biden

(Restore the Soul of America, Build Back Better, and Unite for a Better America)

Biden will attempt to cast aspersions on Trump’s handling of the pandemic and offer up a change in direction on policies:

- Create new economic opportunities for workers.

- Restore environmental protection (re-join the Paris Climate Agreement and spend $1.7trn over the next 10 years on green tech research).

- Criminal justice reform and grants for minority communities (reduce incarceration and address race, gender, and income disparities).

- Restore healthcare rights (additional government spending of $2trn-plus over the next 10 years).

- Restore international alliances (form alliances to challenge China’s trade and environmental practices).

- Reverse Trump-era tax cuts.

- Reverse Trump’s anti-immigration policies.

- Increase access to free college tuition, introduce universal pre-school, and provide student loan forgiveness.

- Coronavirus relief (small business loans and more cheques mailed out).

- Increase the federal minimum wage (from the current $11.50/hour to $15.00/hour).

The potential impact on markets

Markets generally do not love uncertainty and there is a strong chance that this election result will be delayed due to mail-in voting and legal challenges. The last time the US had a close election where the result was delayed because of legal challenges was in the 2000 Presidential Election, where the result in Florida was ultimately decided by the Supreme Court more than a month after voting day. In the weeks after the vote, the S&P 500 fell c. 8% as investors waited for the outcome to be decided. This time around, the expectation of delays may take the edge off the uncertainty, but it is likely to still result in some market jitters. Markets are already anticipating lots of this uncertainty as the cost of hedging against equity market corrections around the time of the election is around 20% higher than current levels.

Scenario A

(A Democratic sweep or blue wave) is likely to result in the biggest policy changes as Democrats pursue their policies aggressively, reversing course on those policies implemented during the Trump years.

Scenario B and C

(Where the Senate and the Presidency are split) will make it difficult for either party to pursue their agenda robustly and very little incremental policy changes will likely ensue.

Scenario D

(The status quo) is unlikely to see significant changes in policy as the Republicans maintain course on existing policies.

Polling currently suggests that Scenario A is the most likely outcome and, as markets are generally forward looking, it is probably fair to say that this outcome is already reflected to a certain extent in current asset prices.

These are the sectors and asset classes we think are most likely to be impacted by the elections:

Interest rates

- Fiscal policy: Democrats are keen to increase spending (somewhat offset by higher taxation), so in the event of a blue sweep allowing them to pursue those policies, that could put slight upward pressure on US rates to the extent the central bank is not able to absorb all the additional bonds issued to increase the deficit.

- Monetary policy: The Federal Open Market Committee (FOMC) is theoretically independent, but 7 of its members tend to have an outsized influence, including the 3 supervisory positions (chair, vice-chair, and vice-chair for supervision) all of which will be up for election during the next presidential term. As such, the president can choose candidates that are likely sympathetic to their hopes for monetary policy. Trump, in particular, has been outspoken on his hopes for looser monetary policy and thus a Trump presidency could see a chipping away at central bank independence and a stronger likelihood of “lower-for-longer” rates.

The US economy

- A blue sweep should allow Democrats to increase fiscal spending, which generally acts as a bigger short-term boost to economic activity than the resultant tax hikes are able to offset in the short- to medium-term. Longer term, the impact of larger deficits could act as a drag on economic growth.

US equity markets

- Democrats are keen to partially reverse the cuts to US corporate taxes that the Trump administration was able to achieve from the end of 2018 (US corporate taxes went from 35% to 21%). Democrats would like to reverse half of the corporate tax cuts (i.e. raise taxes from 21% to 28%). Trump’s tax cuts were at least partially responsible for a c. 20% re-rating in US equity markets at the beginning of 2019, so in the case of a blue sweep allowing for the partial reversal of those cuts, it is probably fair to assume that up to half of that re-rating could reverse. However, with Democrats ahead in the polls some of that may already be in the price.

Big Tech

The biggest threats to Big Tech are:

- Changes to their ability to recognise earnings in low-tax jurisdictions, which the Democrats are keen to challenge via a 15% minimum tax rate on book profits and a doubling of foreign tangible income taxes from 10.5% to 21%.

- Falling foul of anti-trust regulations, which probably involves a shift in how the judiciary interprets existing anti-trust regulations. Currently, the Supreme Court leans towards the “Chicago School” of competition policy thinking, which only really considers the impact on consumer welfare. For anti-trust to become a bigger threat to Big Tech it would require a shift in thinking of the Supreme Court to a more neo-Brandeisian approach that considers factors such as monopsony power in the labour market and excessive political influence of large corporations. Democrats are likely to lean towards Supreme Court nominees with a more neo-Brandeisian way of thinking should vacancies arise, but a shift towards that way of thinking for the majority on the Supreme Court bench is probably a long way off.

Banks

- With the Fed’s vice-chair of supervisory due for appointment during the next presidential term, a Biden presidency could see the introduction of someone more likely to reverse course on the recent easing in bank regulation around proprietary trading. Democratic campaigning has not focused on vilifying the banks this time around, so it is unlikely that bank regulations will be a big focus in the case of a blue sweep.

Pharma

- Both parties have mentioned an aversion to high drug pricing in their campaigns, though with a slightly different approach to tackling it.

- Current legislation gives government very little power to regulate commercial drug pricing, so a meaningful change in drug pricing requires a change in legislation. Democrats are most likely to pursue that but will probably struggle to achieve it without a 60% control of Senate, which is highly unlikely.

- Major US pharma has about 20% exposure to US government payers, 30% exposure to commercial insurers, and the remainder offshore.

Energy

- Upstream energy (drillers etc.) are likely to suffer in a scenario with major Democratic influence which could introduce a ban on new permits on federal land and public waters.

- Renewable energy is likely to be a significant beneficiary in the event of a blue sweep, with ambitious plans for federal spending on green energy.

China

- Both parties have campaigned on anti-China rhetoric, but with Democrats favouring an approach that involves building global alliances to pressure China. Meanwhile, Republicans will likely continue with a more direct strategy that involves tariffs etc. The Republican strategy is more likely to involve risk for investments in individual Chinese stocks, which run the risk of more targeted attacks.