- There has been a global stock market rout this year and YTD world markets are down by between 15% and 30%, depending on which indices you use and how you measure these. At the same time, the rand vs US dollar exchange rate has weakened by 15% YTD, cushioning some of blow (if you measure your wealth in rand terms).

- These events have been caused by two black swan events – the worsening of the novel coronavirus (COVID-19) and the widely unanticipated Russian assault on the oil price. Both will resolve themselves in time.

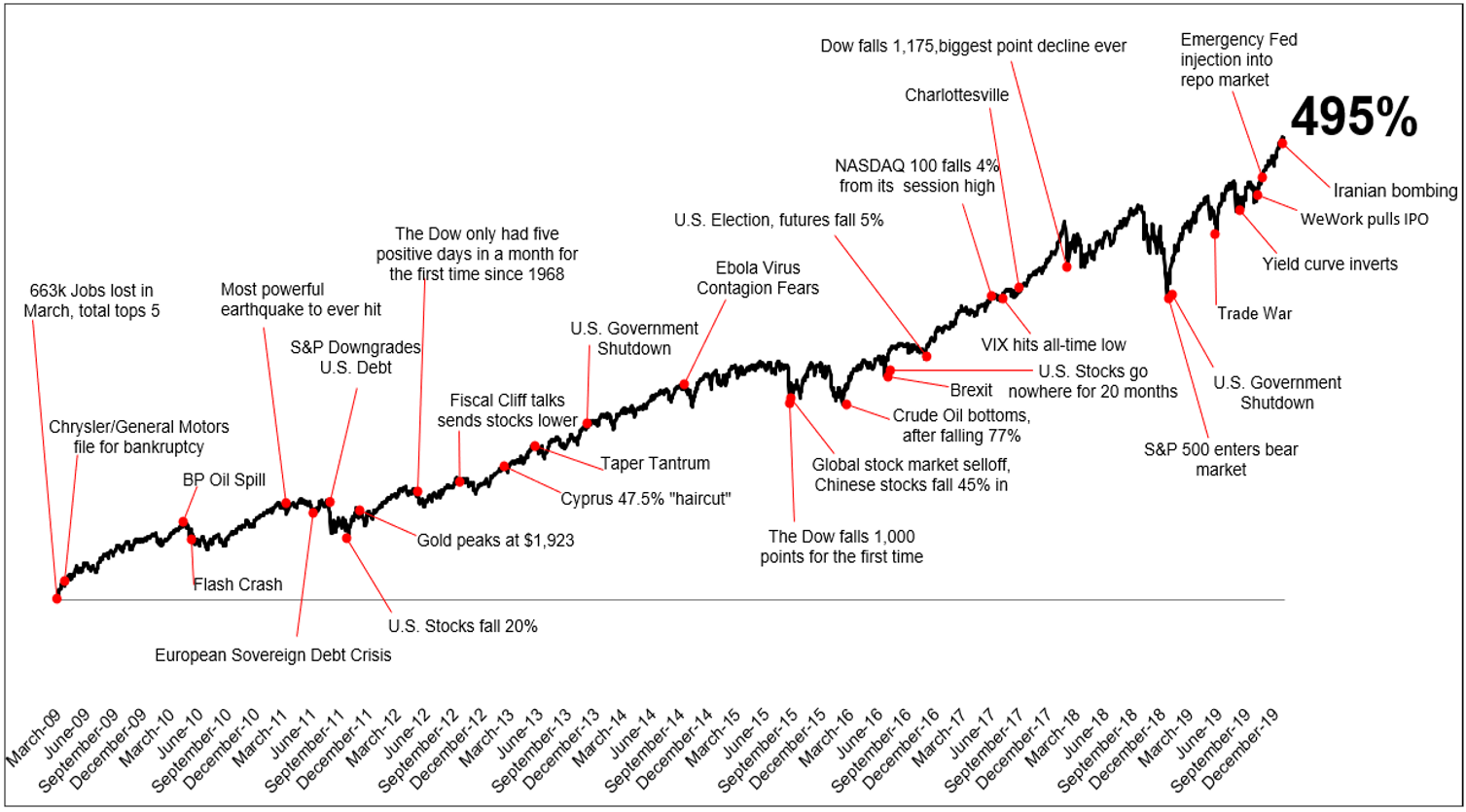

- The big question being debated across the country and the globe is what is priced in, and whether the next big leg will be up or down. The reality is nobody has any idea in the very short term. Our seasoned grey-haired, long-term fund managers are not selling in panic, with a focus on the long term (we have seen this multiple times before!). However, we can be certain that the short term will be massively volatile, and it is not for the fainthearted. Our focus therefore is to emerge from the inevitable recovery positioned optimally.

- There are scant returns to be earned in global markets in those assets without risk – most developed market bond yields are 1% or below. But, investing in equities means volatility and a long-term mindset – this is the price you pay for bigger returns over time.

- The impact of the new coronavirus has been wholly underestimated and is now becoming apparent. The medical impact has many different scenarios and projected outcomes, but what is becoming certain is that the short-term reaction will be material and the earnings of many companies will be under pressure until the world normalises. Travel is grinding to a halt, gatherings of any type are being cancelled, supply chains are being disrupted and folks are greeting each other with “non-touch fist bumps” – all in a matter of days. Half of us, or more, could get this virus in the next year. Many quality global companies will have a short-term decline in their earnings and many will incur losses. The worst-case outcome is a freeze in consumer expenditure, but this will return.

- For certain businesses, the virus’ impact could be devastating, resulting in massive losses and a permanent diminution in value (e.g. airlines, hospitality industries, hotels etc.). We are actively avoiding these companies. However, for the most part, this will be felt through a few poor quarters and a subsequent recovery. Nevertheless, this does not mean that there could not be more short-term pain.

- The 30% drop in the oil price YTD is exactly the opposite of what most forecasters predicted at the beginning of this year. An oil price at around the US$30/bbl level has seldom been seen in the past 15 years. This is below break-even level for many producers and it simply has to correct, but the worst oil price predictors are the experts. For the time being, the lower input prices for companies that have fuel as an input cost is a positive.

- At times like these, gloom is abundant, but it is also when real money is made by the brave. We are not yet advocating “buying the dip”, but investors will never be able to time the bottom and certain shares are approaching very attractive levels. As we have communicated previously, we are not yet seeing broad bargain valuations (in global markets) due to a fairly high valuation starting point at the beginning of the year. Still, in our view we are getting pretty close and our plan is to patiently buy into shares if the market declines further. But this will be subject to conditions not changing dramatically for the worse.

- The SA market has crashed after having already effectively crashed (particularly the SA Inc. component of the JSE). Valuation levels are becoming absurd and bargains abound on the JSE.

- We must always be alert to the fact that markets are not logical and actions by authorities can have a massive impact on them. Expect stimulus packages and loose monetary policies, including possibly from SA. This can result in big market bounces.

- There is no shortage of opinions and fear-mongering at times like this. So, how do we approach the market? Our view is as follows:

- Rid our portfolios of companies where permanent value can be destroyed.

- Rid our portfolios of those shares where balance sheet issues exist (unless the valuation more than factors this in).

- Keep a core portfolio of quality, growth businesses where we are happy to ride out the market cycles.

- Keep enough cash to be able to take advantage of irrationally priced opportunities.

- Keep a cool head.

- For long-term investors who do not wish to draw cash this is becoming a great opportunity, but fortitude is required.

Figure 1: Reasons to sell

Source: B Ritholtz, StockCharts.com, S&P 500 total return 18/01/2020