With Tencent (through its holding of WeChat) caught up in the escalating Sino/US trade tensions, we share some thoughts on the possible impact on Naspers and Prosus.

- What happened? On 6 August, US President Donald Trump issued a pair of executive orders against Chinese tech companies, imposing a ban on US transactions with TikTok, and WeChat, on the grounds that “they threaten national security, foreign policy and the economy”. The ban comes into effect on 20 September.

- How material is this move for Tencent? Tencent’s share price has fallen by c. 8% (to its 11 August close) since the ban was announced last week. Although the tech sector has been on the back foot recently, Tencent has been a notable underperformer, no doubt on this news. As far as direct revenue and profit exposure to the US is concerned, it is estimated at about 2%, with this, in fact, largely comprising of gaming. Thus, the direct impact via the WeChat ban would seem to be miniscule. The other impact potentially comes via Tencent’s investments in US companies (although, we highlight that we are not seeing anything to suggest there are plans to expand the scope of this ban to cover those as well). Tencent’s investments include stakes in the likes of Tesla, Epic Games, Activision Blizzard and Warner Music, with a total value of c. $26bn (HK$21/share). The sell-off seems, on the face of it, to be an overreaction. However, it is worth keeping in mind that prior to this development, Tencent’s valuation was looking relatively full, so it was certainly not that tolerant of any bad news when the executive order was announced. It is also likely that the market is discounting the possibility of this situation escalating and impacting Tencent more materially in the future.

- How material is Tencent for Naspers? At the moment, Tencent accounts for 87% of our Naspers net asset value (NAV).

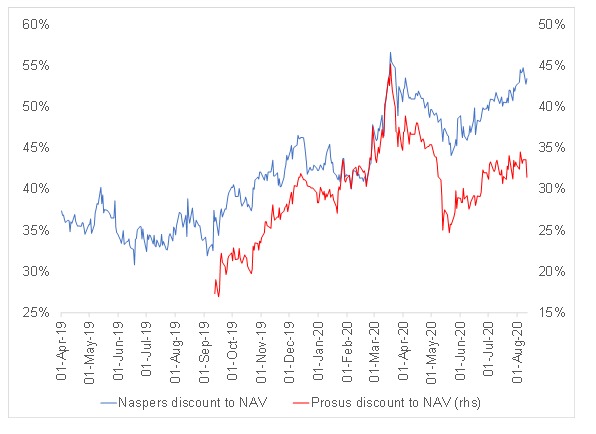

- What happened to the Naspers discount recently? Currently, we calculate the discount to NAV for Naspers is 53.5% and for Prosus 32.5%. Recently, Prosus has been outperforming Naspers, as can be seen from the gap between the two discounts widening (see Figure 2). At present, it looks to us like it is at the widest point it has been since Prosus listed on 11 September 2019. The Naspers discount is also close to the widest it has been (it did get a little bit wider in the severe market dislocation of March 2020). The only reason we can think of that explains why Prosus is currently outperforming is that investors may be positioning for the potential inclusion of Prosus in the Eurostoxx 50 Index in September. However, JP Morgan has been raising the risk that Prosus may not be included because of the complicated two-step calculation that needs to be done. On an absolute market capitalisation basis alone, Prosus should easily qualify, but rules to limit a sector becoming excessively dominant may count against it – SAP and ASML are already major index constituents in its sector.

Figure 1: Naspers and Prosus discounts to NAV

Source: Bloomberg, Anchor

Figure 2: The gap between the Naspers and Prosus discounts to NAV

Source: Bloomberg, Anchor

- What should investors do at this point? We think that this is yet another example of the unforecastable “left-field” event risk that one is exposed to with Tencent. So far, it has bounced back from these events, leaving investors that panicked and sold out living to regret the move. Based purely on Tencent’s current direct exposure to the US, the market move already looks like an overreaction, implying it is too late to sell now unless you think there is worse to come. Tencent also reported strong 2Q20 results on Wednesday (12 August), which came in above consensus analyst expectations – its fastest revenue-growing quarter in two years. This was driven by online gaming revenue, which jumped by 40% YoY. This confirms that Tencent is currently in a very favourable space in terms of the pipeline for its all-important gaming division. Given these points, together with the very wide discount on Naspers at present, we think the most sensible course of action is to do nothing. However, it is yet another “shot across the bows” to remind us that it is unwise to have an irresponsibly large level of single-stock exposure to Naspers.