Over the past decade, African economies have been undergoing a period of significant transition, with growing foreign investment interest and extensive focus on the continent’s potential for mobilising local resources. However, as we begin 2021, after what has been a very difficult 2020, African countries are facing immense challenges from the global COVID-19 pandemic. As this health crisis persists, the resilience of financial systems in every economy is being tested. Financial markets have been disrupted, but expansion and innovation in recent years are expected to benefit the eventual rebound and the recovery process.

The initial impact of the pandemic was hardest felt by those countries with high levels of external debt as global investors pulled back on investments. The withdrawal of international capital impacted the region’s stock markets as liquidity dropped in 1H20. The sudden fall in foreign activity showed the value of having deep and liquid local markets that could withstand external shocks. Notably, central banks and financial policymakers across the continent responded by supporting local debt markets with a variety of tools, which have assisted greatly in mitigating the disruptive impact of the pandemic.

While the longer-term outlook largely relies on the extent to which economic activity can resume in the local and global economy, recent progress in financial market development will only serve to improve Africa’s chances of having a rapid and sustainable recovery. Despite the difficulties posed in the past year, there are some significant market developments and policy changes that have assisted in boosting growth and the sustainability of financial markets across the African continent. These developments are highlighted in Figure 1 below.

Figure 1: Developments and policy changes that have assisted in boosting growth and the sustainability of African financial markets

Source: Anchor, ABSA, RMB

Whilst initiatives such as the examples set out in Figure 1 above have assisted countries in making significant strides in growing the depth and sustainability of their financial markets (in addition to boosting international activity), further progress was stunted due to the pandemic. With regards to money markets in particular, central banks across the continent have provided emergency liquidity throughout 2020 to quell the market panic that struck in March and April, and markets have mostly calmed since. Overall, sell-offs can increase liquidity, however with many African markets which depend on foreign participation for a large proportion of their liquidity, less international participation has hindered market liquidity levels. Therefore, to promote the functioning of domestic financial markets, some African central banks made use of the more unconventional monetary policy tools developed over the past decade. The South African Reserve Bank (SARB), for example, implemented a programme of purchasing government securities on the secondary market. The central banks of Botswana, Egypt, and Ghana also conducted asset purchases. The Bank of Central African States (BEAC), which serves Cameroon, undertook purchases in a restricted way to ensure consistency with rules against direct monetary financing. Other, more common, policies included reducing repo rates, widening the collateral accepted for central bank lending facilities, and reducing liquidity and capital requirements for banks.

Notably, much progress has been made in linking exchanges within African financial markets over the past year or so. The Africa Exchange Linkages Project (AELP), for example, offers an important new opportunity to link African exchanges and boost cross-border activity. In April, the project began procurement for an order-routing technology platform to enable a broker on one exchange, to channel a client’s buy- or sell-order to a broker on a second exchange, where a target security is listed.

The AELP is a joint initiative by the African Securities Exchanges Association (ASEA) and the African Development Bank (AfDB) to encourage pan-African investment flows. It is funded by the Korea-Africa Economic Cooperation Trust Fund (KOAFEC), through the AfDB. Pilot exchanges that are participating in the AELP include the Bourse Régionale des Valeurs Mobilières (BRVM), the Casablanca Stock Exchange, the Egyptian Exchange, the Johannesburg Stock Exchange, the Nairobi Securities Exchange, the Nigerian Stock Exchange, and the Stock Exchange of Mauritius (SEM). In addition, Cameroon’s Douala Stock Exchange (DSX) merged with the regional Bourse des Valeurs Mobilières de l’Afrique Centrale (BVMAC) towards the end of 2019, raising its equity market capitalisation to 1.1% of Cameroon’s GDP.

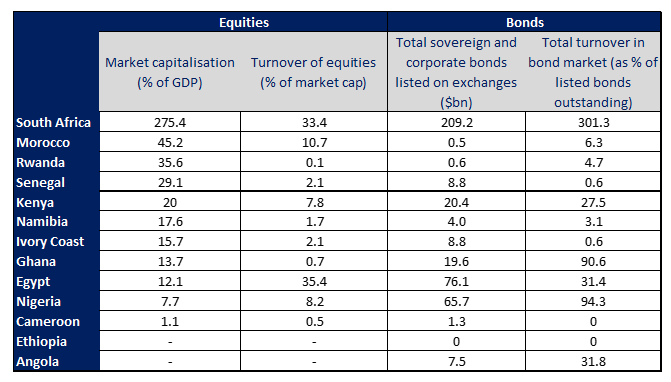

Figure 2: Various African financial market sizes and liquidity levels, as at September 2020

Source: ABSA, Anchor

All in all, whilst Africa may be heading for its first recession in more than 25 years, there remains many reasons to be optimistic about the continent’s growth prospects. Fiscal and monetary stimulus programmes are supporting local debt markets, helping prevent bankruptcies, and spurring global demand and trade. The countercyclical liquidity support of multilateral development banks are helping countries adjust to COVID-19 induced macroeconomic pressures and liquidity strains. Overall, a recovery will largely rely on Africa’s commitment to macroeconomic stability.

Decreasing inflationary pressures and expectations have enabled central banks to extend monetary stimulus and other policy responses to support small- and medium-sized enterprises – helping these businesses to avoid payment defaults. This shift, from a largely single-monetary policy objective across the continent (inflation-targeting), towards the dual objectives of price stability and growth, represents a significant change in the continent’s policy-making environment. This hopefully also signifies the beginning of a deepening integration of Africa into the world economy.

Another key driver of Africa’s improved financial market resilience is the newly implemented African Continental Free Trade Area (AfCFTA) agreement – the trade area was founded in 2018 and trade commenced from 1 January 2021. Whilst it will take a while for intra-Africa trade to flow smoothly, and at sustainable volumes (given the structural challenges still faced by various countries), once trade does commence effectively, the benefit for economies across the continent will be significant. This is particularly poignant, given the current low levels of intra-trade (hovering below 20% of total trade).

Nevertheless, we highlight that, by expanding growth opportunities and returns on investment, African economies can better sustain investment flows and shift their economic composition away from natural resources and towards the more labour-intensive manufacturing industries. This structural transformation will increase domestic resource mobilisation and deepen capital markets – thus helping set Africa on a path to better fiscal and debt sustainability.