SUMMARY

Mining shares and commodity prices have been incredibly strong since the lows of the COVID-19 induced selloff in March 2020. In this article, we examine the investment case for basic materials businesses following their strong performance over the past year. We find that mining shares are generally trading at low multiples of near-term earnings and dividends. These low multiples reflect market caution over the sustainability of current commodity prices. The longer-term outlook for commodities is not homogenous. Some, like iron ore, appear to have weaker, longer-term outlooks than others such as copper or nickel. We expect companies in the sector to prioritise cash returns to shareholders in the short term. In certain cases, cash returns justify investment in the sector, but caution is warranted especially given the volatility of equity markets and underlying prices and we note that the outlook may change quickly. A buy-and-hold approach is therefore not advised.

A COMMODITIES BULL MARKET

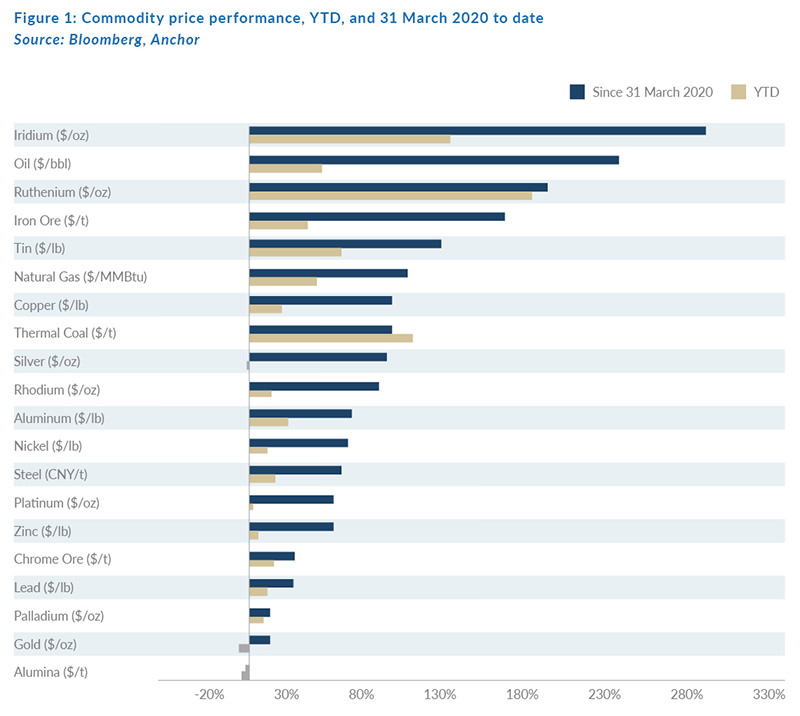

Commodity prices have performed exceptionally well since March 2020, with perhaps the most striking feature of this commodities bull market being its breadth. Energy, metals, and agricultural commodities have all rallied strongly. Iron ore, palladium, rhodium, copper, and lumber have reached all-time highs. Other commodities such as corn and soybeans have also reached their highest levels in years. Unsurprisingly, equities have followed suit. On the JSE, the FTSE JSE Resource 20 Index has returned c. 81% from 31 March 2020 to end June 2021, compared to a 55% return for the Capped Swix over the same period.

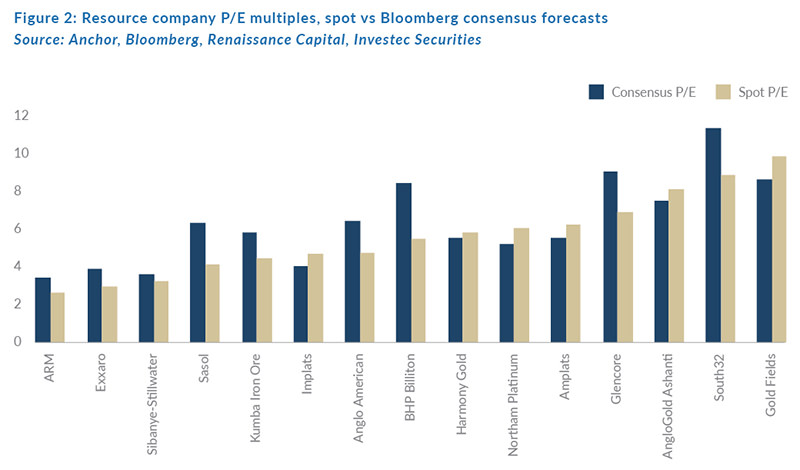

Mining shares are generally trading at low multiples of near-term earnings and dividends. These low multiples can be interpreted as market caution over the sustainability of current commodity prices. Furthermore, profitability across the sector is at cyclical highs. So, we can infer that the market is discounting a normalisation of commodity prices, a subsequent decline in margins, and a reduction in earnings for the sector. We would generally share the market’s caution over the sustainability of current prices. Commodity prices have been spurred by supply disruptions since the onset of the pandemic. A combination of low inventory levels coming into the COVID-19 pandemic, supply disruptions, and swift recoveries in demand have led to surprisingly strong prices. We believe these factors have been the main drivers of recent commodity price strength.

However, the sector is not homogenous and the argument for some commodities may be more compelling than for others. We are cautious over iron ore, for example. We estimate that at current prices, with a couple of exceptions, iron ore contributes at least fifty percent of earnings for diversified mining companies listed on the JSE. Iron ore is therefore a big driver of the sector. The iron ore price currently exceeds $200/t. The entire industry, including very high-cost marginal producers, make good margins at these prices. Assuming supply disruptions ease over time, we would expect prices to normalise to lower levels. Nevertheless, we say that whilst keeping in mind that a year ago we certainly would not have thought that a $200/t iron ore price was on the cards.

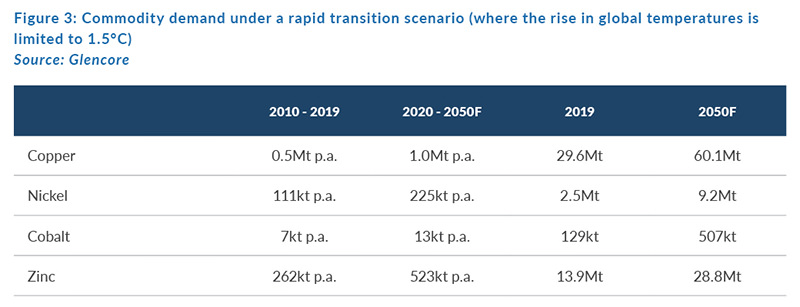

Other commodities like copper appear to have more fundamental support over the long term. Copper is one of several metals that could be important as the world transitions to a greener economy. The copper market totaled nearly 30 mt in 2019. New sources of demand in the form of renewable energy (solar and wind) and electric vehicles (EVs) could bring the copper market into a sizeable deficit. Glencore modelled commodity demand under the assumption of a rapid transition to a lower-emission economy, where the world limits the increase in the global average temperature to 1.5°C above pre-industrial levels. Under this scenario (see Figure 3), copper demand could double from 30 mt in 2019 to 60 mt in 2050. It is important to keep in mind that this forecast assumes aggressive global climate policy and a lot can happen between now and 2050 that changes this outlook. Still, it gives an idea of the potential demand growth. Under more conservative assumptions, we could still see deficits in the copper market of 5 mt to 10 mt by the end of this decade (2030). There are other commodities such as cobalt, nickel, and zinc that are similarly affected by the transition to a greener economy. The short-term picture is likely to be volatile, but we believe that the long-term, supply-demand outlook for these metals is better than for a commodity such as, say, iron ore.

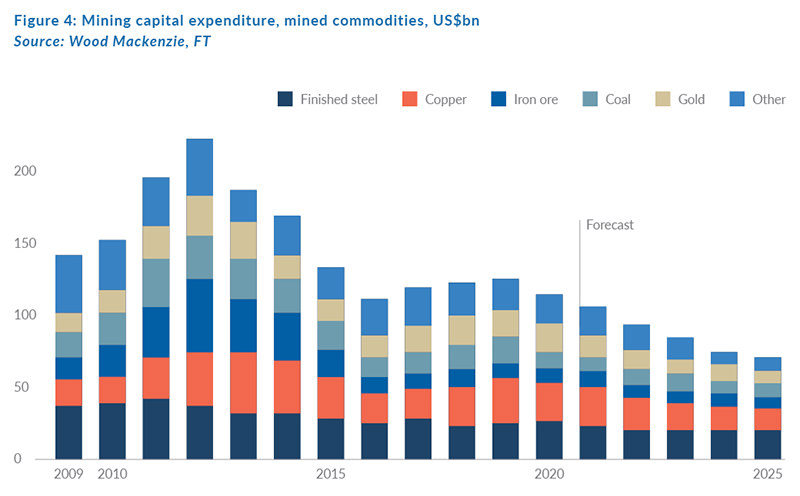

We expect companies in the sector to prioritise cash returns to shareholders over the short term as free cash flow generation in the sector is very strong at the moment. Furthermore, although we have seen a rise in capex recently, capital spending is still below the levels reached during the previous commodities supercycle. Many companies in the sector have established clear dividend policies. These policies are usually a percentage of earnings or free cash flow that the company commits to pay out in dividends. Rather than focus on large expansionary capex or M&A, companies until now have used this opportunity to strengthen their balance sheets. The combination of strong balance sheets and free cash flow generation opens the possibility of abnormally strong cash returns to shareholders via special dividends and buybacks.

Many businesses in the diversified mining and platinum group metal (PGM) spaces are trading at free cash flow yields of 15% to 25%, or more. In several cases, we estimate that dividend yields will be close to free cash flow yields because most of the free cash flow will be returned to shareholders via dividends. Investors may have the 2015 resources bear market fresh in mind when they tell management teams that they want mining companies to return cash to shareholders. Barrick Gold CEO Mark Bristow recently criticised capital markets for what he deems to be short-term thinking focused on dividends. Nevertheless, regardless of how you assess the sector’s capital allocation, it appears probable that the sector will be aggressive in the return of cash to its shareholders.

CONCLUSION

Although valuations in the mining sector look optically cheap, we believe caution is warranted. The run-up in commodity prices since March 2020 has been spurred by supply disruptions, low inventories, and a quick recovery in demand. We find it more useful to look at individual commodities rather than the market as a whole, because it is not homogenous. Certain commodities, such as iron ore, have less compelling long-term outlooks than other metals that should benefit from a transition to a lower-emission economy. We do have exposure in the sector and our decision to be invested is driven, in part, by what we see as a compelling cash return story in the near term. Dividends and share buybacks are expected to be prioritised over big acquisitions or capex drives. Given the volatility of both commodity and equity prices, the outlook can change quickly. We therefore do not view our holdings in the sector as buy-and-hold positions.