Investors are anxious. In fact, they are as bearish today as they were at the depths of previous bear markets. Economic and political uncertainty have soared as the Trump administration launched the initial phase of its policy agenda, with a particular emphasis on tariffs. As market participants shift into survival mode, their time horizons shrink, and they tend to lose sight of what counts over the long term. But let us zoom out. What really matters for equity returns? Is it politics? Trade policy? Or something deeper and more fundamental?

The Magic of Growth

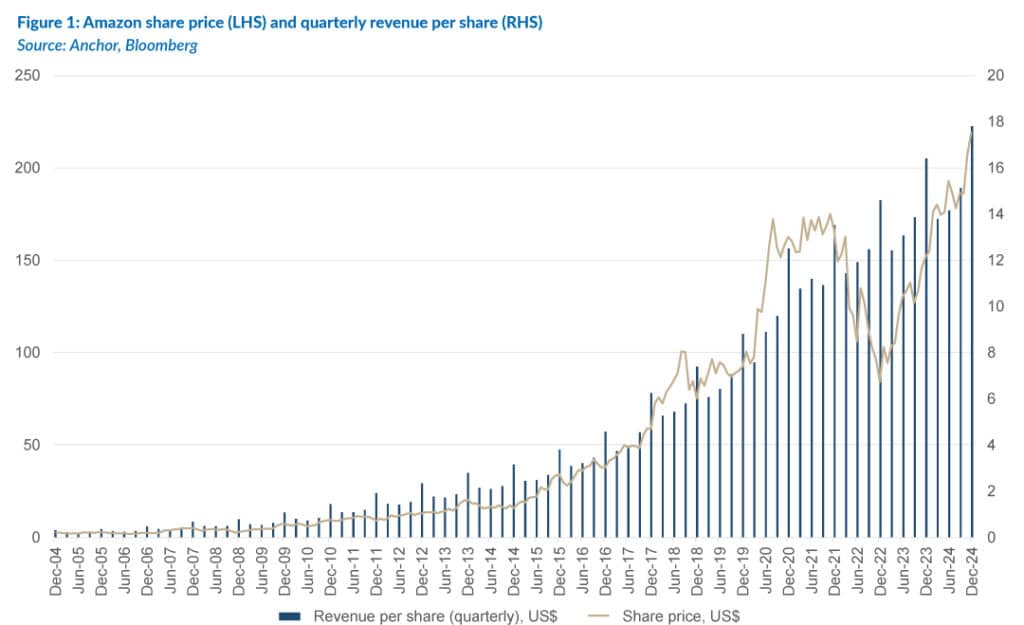

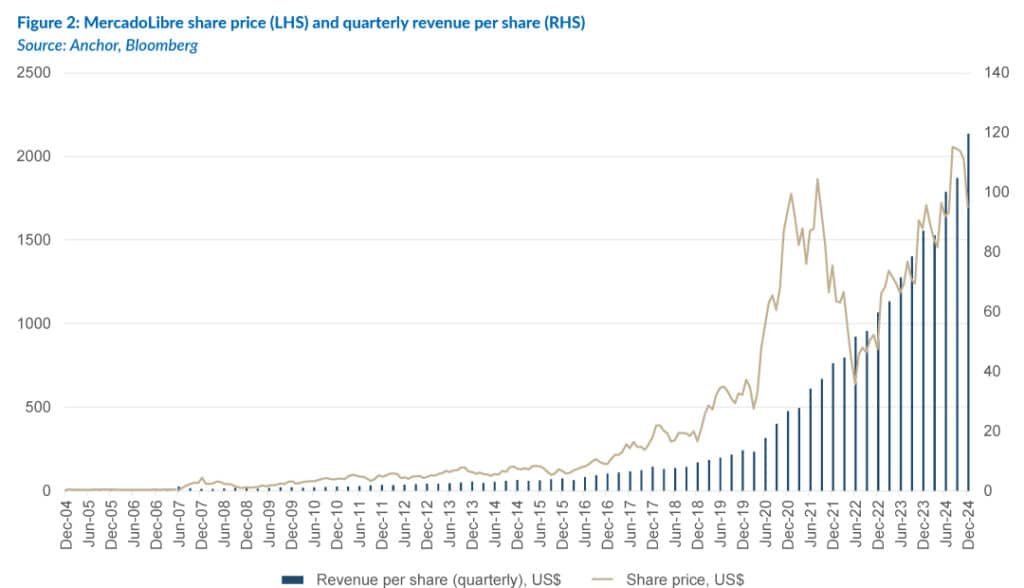

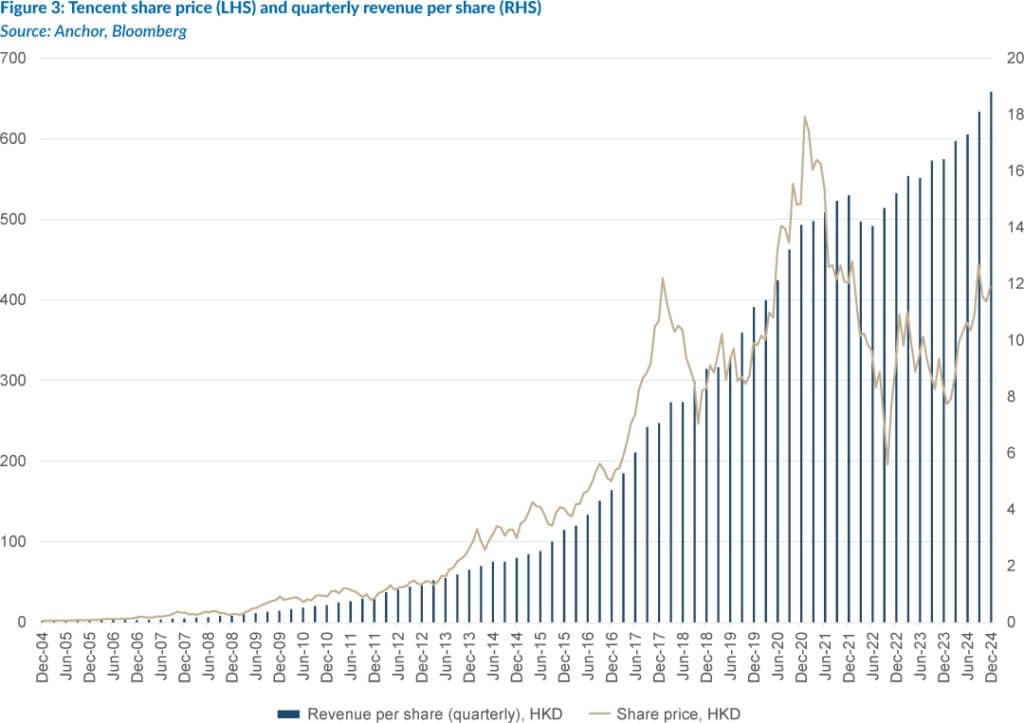

The 20-year charts of three long-term winners – Amazon, MercadoLibre, and Tencent – provide us with a clue. Note how the gold line (share price) tends to follow the growth of the underlying business, as measured by revenue per share (dark blue bars), over the long term.

Retired hedge fund manager and television host Jim Cramer captured it best in his book Jim Cramer’s Real Money: Sane Investing in an Insane World:

“Growth is the focus, the be-all, the end-all of investing, the mother’s milk. Nothing trumps growth.”

Ultimately, growth in company fundamentals – revenue, earnings and free cash flow (on a per-share basis, we might add) – matters over the long term.

Four timeless lessons from market champions

- Stock prices and fundamentals can disconnect – use it to your advantage

Share prices and underlying fundamentals can deviate for extended periods. Occasionally, to an extreme degree. The longer one’s investment horizon, the better served one is to anchor on company fundamentals rather than share prices. Better yet, investors can use these dislocations to increase their holdings in great growth companies.

- Winning companies can thrive despite a tough macro backdrop

MercadoLibre, described as the Amazon.com of Latin America, has operated in a challenging macroeconomic environment for most of its life as a listed company. While the broader economy influences company fundamentals, it is not the only factor, or even the dominant factor, for companies in the earlier stages of their growth curve.

- Policy shocks hurt, but great companies prevail

None of this is to say that adverse policies cannot hurt great companies. China’s clamp-down on its gaming industry was undoubtedly disruptive to Tencent in 2021 and 2022. Even so, the impact was modest, as Tencent subsequently recovered and continues to grow at a healthy pace.

- Growth is a winding road, but time is the ultimate ally

Growth shares inevitably take two steps forward and one step back. Or sometimes three steps back. The process is never linear. Like an acorn growing into an oak tree, it is only over the slow, painstaking passage of time that compounding makes a meaningful difference in a portfolio.

2024: The power of growth in action

In 2024, we saw the primacy of growth play out within the Anchor Global Equity Fund, which rose by over 27% for the year. Nvidia was a key performance contributor with its remarkable 171% share price surge in 2024, primarily driven by its AI-related Data Centre revenues, which grew 142% YoY. Elsewhere in the fund, Southeast Asian e-commerce, fintech and gaming powerhouse Sea Limited was a strong contributor, as its share price rose 162% for the year. Sea’s revenues grew a robust 28% YoY, while net profit grew an astonishing 175% YoY.

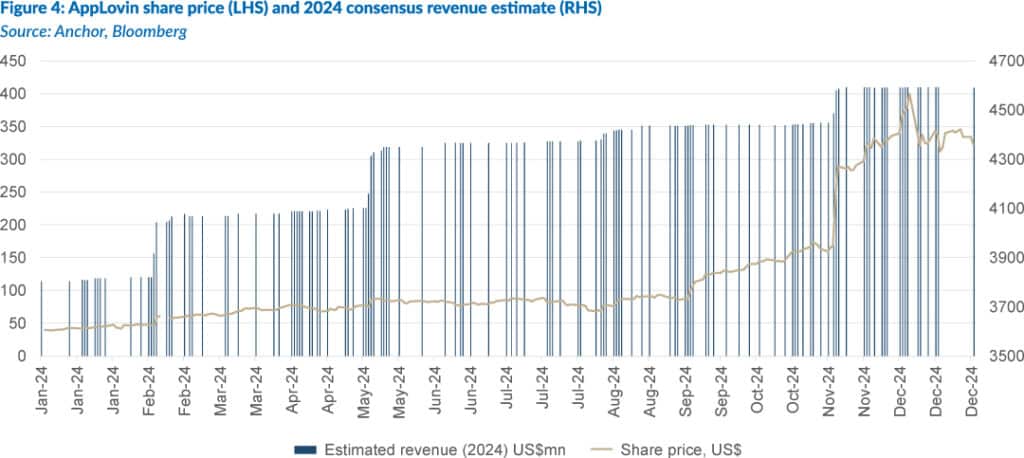

While high absolute growth rates are typically a tailwind for stocks, what is even more important is growth that exceeds investors’ expectations. Jim Cramer describes this concept:

“If you understand that seeking growth, or more important, seeking changes in the growth rate that may be unexpected by others, is the most important factor to focus on as an investor, you will catch all the major spurts in stocks that can be had. That is because stocks move in relation to changes in growth of earnings at the underlying company.”

The little-known advertising company AppLovin best illustrated this dynamic in the Anchor Global Equity Fund in 2024. AppLovin rose over 436% between our first purchase in February and year-end. At the start of 2024, sell-side analysts expected AppLovin to generate US$3.8bn in revenue in 2024; by the end of the year, that estimate had climbed to almost US$4.6bn, a rise of 21%. As margins improved, earnings per share (EPS) estimates increased almost 160% over the year. AppLovin enjoyed a further tailwind as the stock’s P/E multiple more than doubled from 25.4x to 56x.

Calm in the storm: From acorns to oak trees

Investors are fixated on Trump’s trade and fiscal policies and their implications for GDP growth and corporate earnings. Growth shares have fallen sharply as investors’ time horizons have shrunk in the face of unbearable uncertainty.

In this context, we advocate the following approach and mindset:

- Think long-term and exploit deviations

When the market is laser-focused on the present, it pays to think longer term. When share prices and fundamentals disconnect, we look for opportunities to buy companies with the potential to deliver sustainably sturdy growth in revenue and EPS.

- Stay rational – leave your politics at home!

Politics and investing do not mix well. Investors who are easily triggered by politicians or parties – either positively or negatively – are at a significant disadvantage vs those who can remain dispassionate. In the age of social media, fear and loathing transmit faster and with more intensity than ever. With an explosive cocktail of options and triple-leveraged exchange-traded funds (ETFs), investment views can be expressed instantaneously and aggressively. This potent combination of factors leads to violent but exploitable opportunities in markets.

Nvidia, AppLovin, Amazon, MercadoLibre, Tencent—these companies embody the power of long-term, compounding growth. Some are overnight sensations, while others take years to mature, but all reward patient investors handsomely.

Forget the fear. Tune out the noise. Let your acorns grow into oak trees.