Most world markets, including South Africa (SA), retreated from recent highs and closed June on a disappointing note, with modest gains or MoM declines. This as market jitters emerged on the back of fears over the highly contagious Delta variant, while investors also took profits as 1H21 came to a close. As of end-June, around 54% of the US population and c. 49% of the population in Europe have been partially vaccinated, while in the UK this figure stands at c. 60%. Despite a tepid month for most world markets, optimism about the US economic recovery saw the major US indices close at, or near, record highs, on Wednesday (30 June). The blue-chip S&P 500 notched up its fifth-straight month of gains (+2.2% MoM/+8.2% in 2Q21/+14.4% YTD), ending June at a record high, while the tech-heavy Nasdaq (+5.5% MoM/+9.5% in 2Q21/+12.5% YTD) posted a record close on Tuesday (29 June) and an impressive turnaround from its lacklustre performance in May as tech counters drove the June rally with investors rotating back into tech names. The Dow Jones declined 0.1% in June although YTD the Dow has surged 12.7% and is up 4.6% for 2Q21.

The US Federal Reserve (Fed) concluded its June meeting mid-month, keeping the benchmark rate at c. zero (as was broadly expected), while its 2021 inflation forecasts crept a little higher (in line with expectations), albeit not meaningfully so. However, most market participants were caught off guard by the Fed signalling that there could be two rate hikes in 2023. The main surprises being that the Fed seemed to have pulled the expectation of its first rate hike forward from early 2024 to 3Q23 in its dot plot estimates of future rates. At the post-meeting press conference, Fed Chair Jerome Powell indicated that initial discussions around when the Fed should talk about tapering bond purchases have now started. In our view, inflation spikes are mostly transitory, and a combination of base effects (from the height of the initial 2020 lockdown when inflation fell) and temporary supply bottlenecks. The US dollar gained c. 2.6% against a basket of currencies in June, partly in the wake of the Fed’s hawkish tilt.

On the US economic data front, the Conference Board’s June consumer confidence soared to a better-than-expected 127.3 – its highest level in c. 18 months and up from 120.0 in May, on the back of growing US labour market optimism amid a reopening of the economy, which seems to have also offset inflation concerns. Still, May core personal consumption expenditure (PCE) inflation advanced 0.4% MoM following a 0.7% MoM advance in April, while YoY core PCE (the Fed’s preferred inflation gauge) jumped 3.4% vs April’s 3.1% YoY gain.

Elsewhere, Europe’s largest economy, Germany’s DAX advanced 0.7% MoM (+13.2% YTD/+7.3% in 2Q21), while the eurozone’s second-biggest economy, France’s CAC Index ended June 0.9% in the green (+17.2% YTD/+7.35 in 2Q21). In terms of economic data, June eurozone inflation fell back to 1.9% (within the European Central Bank’s [ECB’s] target range) vs its 2.0% print for May. Core inflation, which excludes food, energy, alcohol, and tobacco, slipped to 0.9% in June from 1.0% in May. Unemployment in Germany, Europe’s biggest economy, declined in June with the number of people out of work down 38,000 in seasonally adjusted terms to 2.69mn, while the unemployment rate remained at 5.9%.

The UK’s FTSE 100 Index gained 0.2% MoM (+8.9% YTD/+4.8% in 2Q21), while the UK economy shrank by a higher-than-expected 1.6% in 1Q21 (initial estimates were for a GDP contraction of 1.5%), meaning that the country’s economy was 8.8% lower vs pre-pandemic levels. The decline was driven by a drop in the services (-2.1% in 1Q21) sector, especially education, wholesale, and retail trade as well as the accommodation and food services industries (the data covers the period when the country was under a third lockdown). Last month, UK Prime Minister Boris Johnson also delayed the full lifting of restrictions (initially scheduled for 21 June), amid renewed concerns over the spread of the Delta variant, to 19 July. Johnson said people in England were “very likely” to be able to return to “pretty much life before COVID” on that date.

In Asia, markets closed mixed on Wednesday (30 June) – Chinese markets disappointed as Hong Kong’s Hang Seng Index fell 1.1% MoM (+5.9% YTD/+1.6% in 2Q21), while the Shanghai Composite Index retreated by 0.7% MoM (+3.4% YTD/+4.3% in 2Q21). In terms of economic data, China’s official manufacturing purchasing managers’ index (PMI) contracted to 50.9 in June vs May’s 51.0 print, negatively impacted by new COVID-19 cases and chip shortages impacting factory output (the 50-point mark separates expansion from contraction). In Japan, the Nikkei closed down 0.2% MoM (+4.9% YTD/-1.3% in 2Q21), while the country’s May unemployment rate fell to 3.0% (vs 2.8% in April) – the highest level in five months as Japan’s government-declared state of emergency over the pandemic was extended to more parts of the country.

On the commodity front, oil prices rallied (+8.7% MoM/+45.0% YTD/+18.2% in 2Q21) for most of June but retreated slightly this week on the back of a rise in COVID-19 cases in Europe and Asia. After jumping 7.8% MoM in May, gold gave up nearly all those gains, falling 7.2% MoM in June (-6.8% YTD/+5.3% in 2Q21), as concerns around global inflation, and a stronger US dollar, weighed on the yellow metal. The rally in iron ore this year (+38% YTD/+36.8% in 2Q21) continued, with the steel-making ingredient up 5.0% MoM. The price of Palladium, which is used in catalytic converters to curb emissions by petrol-powered vehicles, was down 1.7% MoM and the platinum price fell c. 9.6% MoM.

On the JSE, SA’s FTSE JSE All Share Index recorded its first MoM decline after seven-consecutive monthly gains – down 2.5% in June but still up an impressive 11.5% YTD (it was basically unchanged for 2Q21). Commodity and industrial counters saw sharp declines in June, with the Resi10 down 6.5% MoM (+9.8% YTD), while financials were down 2.6% MoM (+8.6% YTD). The SA Listed Property Index had a great month, recording a 3.2% rebound (+15.5% YTD), while the Indi-25 eked out a 0.4% MoM advance (+12.0% YTD). Looking at the top-20 shares by market cap, BHP Group, now the biggest company on the JSE by market cap, advanced 0.4% MoM, while British American Tobacco and Richemont posted gains of 5.2% and 4.1% MoM, respectively. Prosus recorded a 1.8% MoM decline, while Naspers was down 1.7% MoM. Among the large-cap commodities firms, Anglo American Platinum (Amplats) fell 9.3% MoM, while Anglo American and Glencore plc recorded MoM declines of 7.9% and 5.2%, respectively.

The weaker dollar, SA’s strong terms of trade supporting a current account surplus, and lower US interest rates were all supportive of a stronger rand in the first half of June. However, the Fed signalling that there could be two rate hikes in 2023, weighed on the local unit resulting in the currency trading with a bearish tone and closing the month c. 3.8% lower (+2.9% YTD/+3.4% in 2Q21).

In local economic news, May annual headline inflation, as measured by the consumer price index (CPI), jumped 5.2% YoY vs April’s 4.4%. The higher print was widely expected and comes off the very low base recorded in May 2020, when fuel prices were low. Core inflation (which excludes food and non-alcoholic beverages, fuel, and energy) came in at 3.1% YoY, much lower than the headline rate. This hints at the notable impact that fuel and food inflation has had on overall (headline) inflation levels, and subsequently also the effects of supply side price pressures on domestic inflation, with domestic demand-side price pressures remaining muted. The rebound in fuel prices especially would have contributed to May’s spike, with the petrol price falling to R12.22/litre in May 2020 and recovering to R17.23/litre by May 2021. Overall, this latest print affirms the idea that inflation in SA will prove transitory – although it has taken inflation to above the 4.5% mid-point of the SA Reserve Bank’s (SARB’s) inflation target range of between 3% and 6% for the first time since February 2020 (when inflation stood at 4.6% YoY).

SA GDP rose an annualised 4.6% QoQ in 1Q21, quite a bit above Bloomberg consensus forecasts of c. 3.2% QoQ growth and the SARB’s projections of 2.7% QoQ growth (also annualised). However, this does represent a deceleration from 4Q20’s revised annualised 5.8% growth rate (4Q20 growth was revised downwards from an initial 6.3% estimate). Eight out of the 10 industries reported positive 1Q21 gains, with the largest positive contributors to growth being mining (+18.1% QoQ and contributing 1.2 ppts), finance (+7.4% QoQ and contributing 1.5 ppts), and trade (+6.2% QoQ and contributing 0.8 ppts), while household spending (+4.7% QoQ and contributing 3.0 ppts) and changes in inventories helped spur growth on the expenditure side.

May’s trade balance came in at a surplus of R54.6bn vs April’s revised surplus of R51.3bn, while exports increased 1.5% MoM to R163.5bn and imports declined by R97mn MoM to R108.9bn. Elsewhere, data from the FNB/Bureau for Economic Research (BER) Consumer Confidence Index (CCI), showed that the FNB/BER CCI backtracked to -13 in 2Q21, after recovering from -12 (in 4Q20) to -9 index points in 1Q21. This latest reading remains well below the average CCI reading (of +2 since 1994), indicating very depressed consumer confidence levels, albeit less negative vs the extraordinarily pessimistic readings of -33 and -23 recorded during 2Q20 and 3Q20, respectively.

On the pandemic front, President Cyril Ramaphosa announced that SA will move to amended Level-4 lockdown (effective 28 June) due to the surge in infections caused by the highly contagious Delta COVID-19 variant. The restrictions (to remain in place for 14 days before being reassessed) include banning alcohol sales, prohibiting indoor and outdoor gatherings, limiting funeral attendance to no more than 50 people, and with curfew now starting at 9 PM and ending at 4 AM. The latest Department of Health data show that as at 30 June, the total number of confirmed COVID-19 cases since the start of the pandemic stood at 1.97mn vs end-May’s 1.67mn cases. To 30 June, 3,026,636 people have been vaccinated. On 30 June, there were 19,506 new cases in SA – the fifth highest daily rate of new infections recorded so far.

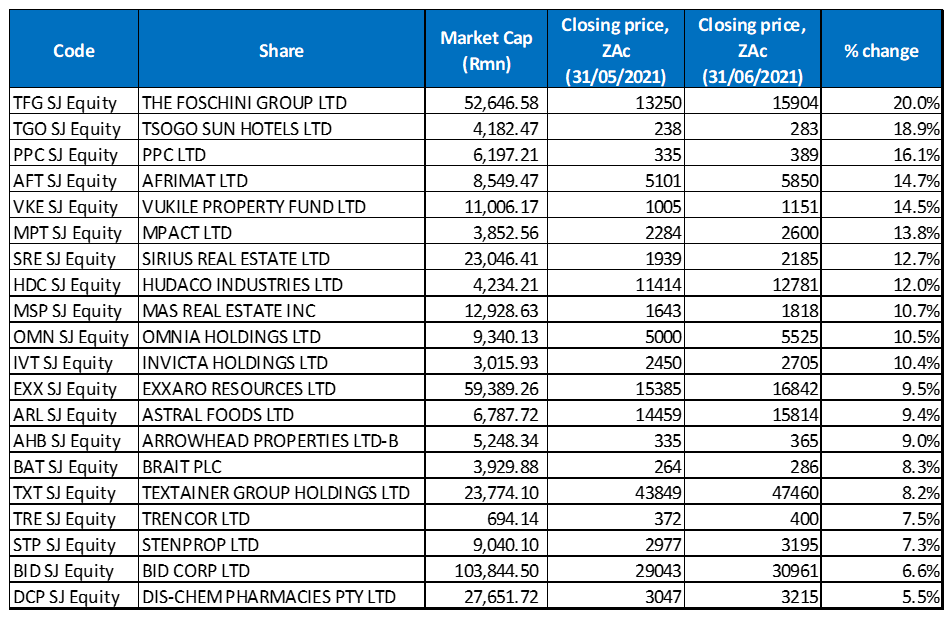

Figure 1: June 2021’s 20 best-performing shares, MoM % change

Source: Anchor, Bloomberg

The Foschini Group was June’s best-performing share, rising 20.0% MoM, despite reporting an FY21 operating loss of R719.2mn, impacted by the pandemic and resulting lockdowns in its various territories. However, Foschini also said that it had delivered sales growth for the first 10 weeks of FY22 (vs the comparable period of 2019 [pre-pandemic]) in both SA (+32.2%) and Australia (+36.5%), so its performance post year-end has been strong. In addition, the company last week announced the launch of TFGLabs, its new tech hub, to drive the Group’s omnichannel and e-commerce growth ambitions.

Despite its share price taking a hit this week following the president’s announcement of stricter lockdown measures, Tsogo Sun Hotels (+18.9% MoM) was June’s second best-performing share, albeit from a low base. Up until this week, the market had been more positive on the local leisure- and hotel counters’ recovery prospects, assisted by the vaccine rollout and especially considering the low levels their share prices have reached.

In third spot, PPC’s share price rose 16.1% MoM. The cement manufacturer’s share price shot up after it announced a debt-restructuring deal with lenders (the debt is related to the Group’s operations in the Democratic Republic of the Congo). PPC CEO Roland van Wijnen said that the company and its SA lenders have agreed to defer the assessment of a need to raise capital through a rights issue until September. PPC has been trying to avoid a rights issue, which would dilute its shares, so it can lessen its debt load and associated financing costs. In an interview with Business Day, van Wijnen said PPC had signed an agreement with lenders which removed the R2.5bn debt liability by terminating their right to recourse to PPC and, as a result, PPC’s gross debt effectively declined to R2.62bn from the previous R5.8bn.

Mining and materials Group, Afrimat (+14.7% MoM), last month signed its biggest purchase yet, with the R650mn acquisition of manganese mine, Gravenhage. Afrimat was followed by Vukile Property Fund, Mpact, and Sirius Real Estate, which recorded MoM gains of 14.5%, 13.8%, and 12.7%. Vukile reported a notable improvement across the board in its FY21 results, with its operating metrics managing to hold up despite the tough macroeconomic environment. In addition, its LTV ratio recorded an improvement well ahead of expectations and the FY21 DIPS was resilient relative to other property counters, especially considering that it was exposed to 12 full months of the pandemic.

On 30 June, Mpact, the biggest paper and plastics packaging business and recycler in southern Africa, saw its share price jump to a 12-month high (of R27.51/share) during the trading session before closing the day at R26.00/share. This came after Mpact released a market update stating that it had received a letter from the Competition Commission, notifying it that Caxton wanted to increase its stake in the company from c. 32% to a possible controlling stake. No formal offer has yet been made to Mpact’s board of directors but if the acquisition is approved, Caxton will take control of the company.

Meanwhile, Sirius Real Estate, which owns branded business and industrial parks in Germany, also recorded a good performance in FY21, declaring a higher dividend for its 14th consecutive reporting period as DPS rose 6.4% YoY, from EUc3.57 (FY20) to EUc3.80. According to Business Report, CEO Andrew Coombs said that Sirius had generated an accounting return of 19.5%, bringing to seven the number of years of double-digit growth, with the average accounting return at just over 16%.

Rounding out the top-10 were Hudaco (12.0% MoM), MAS Real Estate (+10.7% MoM), and Omnia Holdings (+10.5% MoM). Hudaco reported solid interim results last week, posting an operating profit of R357mn – soaring 351% YoY, although the company advised shareholders to rather compare these results with 1H19 (and its operating profit of R297mn) due to the impact of COVID-19 in 1H20. Basic EPS came in at ZAc686 vs ZAc533 in 1H19 and a loss per share of ZAc738 in 1H20. Hudaco’s financial position also strengthened with bank borrowings at R594mn – down R50mn vs end-November 2021.

Diversified chemicals group, Omnia Holdings also posted strong FY21 results and declared an ordinary dividend of ZAc200/share (the first since 2018), and a special dividend of ZAc400 for the year to end March 2021, buoyed by strong cash generation of R2.3bn during the period. Headline EPS from continuing operations increased 154% YoY to ZAc391 (from ZAc154), despite the impact of COVID-19 disruptions in some of its businesses (the company did operate as an essential services provider during the year in some segments such as agriculture, mining, and chemicals).

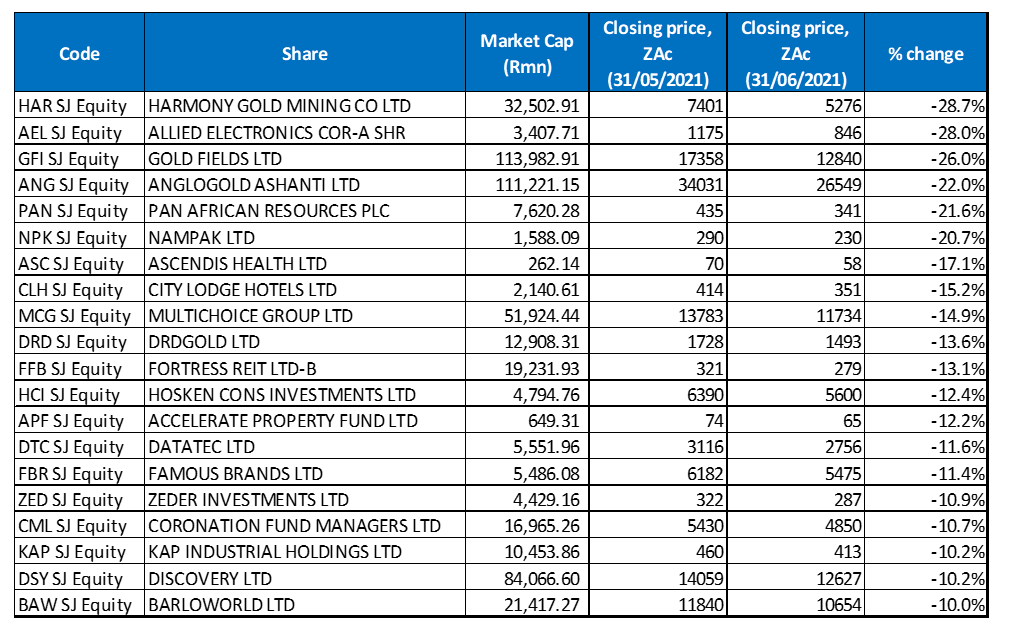

Figure 2: June 2021’s 20 worst-performing shares, MoM % change

Source: Anchor, Bloomberg

Following the gold price’s biggest decline in c. five months in June (down c. 7.2% MoM), several gold mining companies featured prominently among last month’s worst-performing shares. Harmony was the overall worst performer, with its share price dropping 28.7% MoM. It was followed by IT services management company, Allied Electronics (Altron; -28.0% MoM) in second spot, with more gold companies accounting for the remainder of June’s five worst-performing shares. Gold Fields, AngloGold Ashanti, and Pan African Resources all recorded steep declines – down 26.0%, 22.0%, and 21.6% MoM, respectively.

A more hawkish tone from the Fed resulted in the gold price coming under significant pressure and, added to that, the Fed also released forecasts showing it anticipates two US interest rate increases by the end of 2023 – sooner than everyone had expected. This in turn boosted the greenback and US bond yields but weighed on the gold price, which has led to broad-based weakness across the gold mining counters. In our view, the performance of these gold miners over the short term will likely continue to depend on gold price dynamics.

Nampak was down 20.7% MoM, while Ascendis Health fell by 17.1% MoM. Ascendis said in a statement last week that it will sell its 49% stake in Spanish pharmaceutical company, Farmalider to MMC International Health for c. R84.1mn as part of its plan to recapitalise the local Group. The Farmalider interest was initially expected to be part of a group of disposals by Ascendis, but its creditors have approved the separate disposal of Farmalider. Ascendis will use the proceeds to reduce its debt.

City Lodge Hotels (-15.2% MoM) was once again the victim of government’s decision to introduce more stringent lockdown measures for the next two weeks, which impacted the already hard-hit hospitality industry. The JSE’s Travel and Leisure Index plummeted 7.5% on Monday (28 June) to a c. one-month low, when the new regulations took effect. City Lodge, Tsogo Sun Gaming, Tsogo Sun Hotels, and Sun International were all down significantly on the day.

Multichoice Group (-14.9% MoM) released decent FY21 results on 10 June, reporting a 4% YoY increase in revenue to R53.3bn from R51.4bn in FY20, while headline EPS climbed ZAc128 to ZAc496 for the year. The company added 500,000 subscribers in SA (+6% YoY), noting that the business “held up well” despite the tough economic environment. However, the dividend of ZAc565/share, unchanged YoY, came in below expectations, and disappointed the market. The company also gave rather cautious guidance, highlighting that R1.1bn in content costs, which would normally have been taken in the last financial year, have been pushed into FY22 due to the rescheduling of sports events. While the screening of these events is generally good for subscriber acquisition, this revenue boost is far lighter than the cost and this may also have disappointed expectations.

Finally, another gold company, DRD Gold (-13.1% MoM), was also weighed down by the much lower gold price and rounded out the 10 worst-performing shares for June.

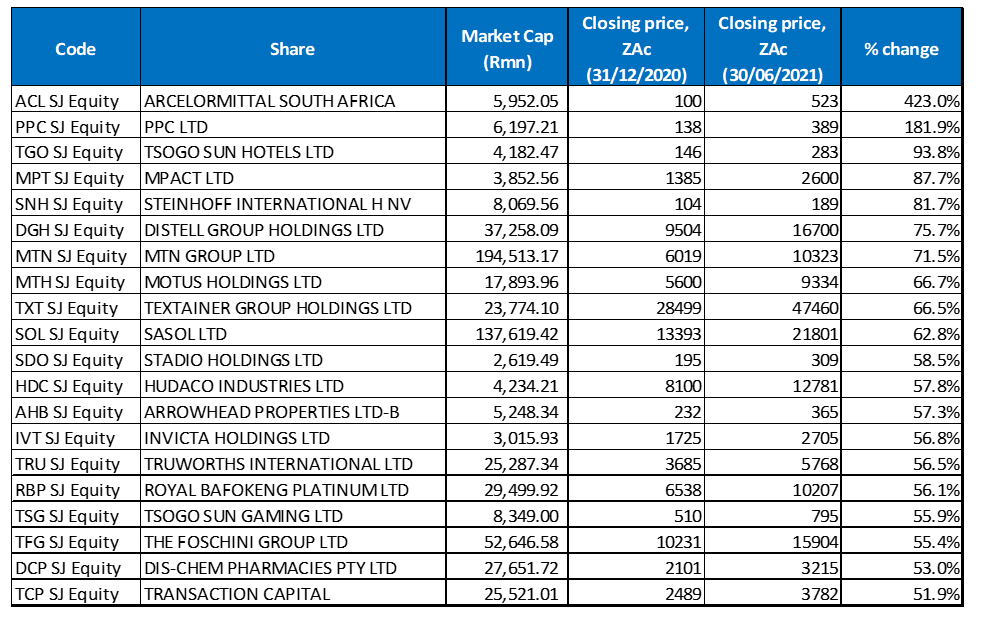

Figure 3: Top-20 June 2021, YTD

Source: Anchor, Bloomberg

Nine out of June’s top-10 YTD best-performing shares were unchanged from those in the year to end May, with only City Lodge falling out of the top-10 after the government-announced stricter lockdown restrictions weighed on the share price. Nevertheless, the share is still up 40.4% YTD, albeit from an oversold base. The new top-10 entrant was Textainer Group (+66.5% YTD), buoyed by a good performance in June, when the share price rose 8.8% MoM.

ArcelorMittal SA (Amsa; +423.0% YTD) again took the top-performer spot, despite the share price being flat in June, while PPC (+181.9% YTD) remained in second position after gaining another 16.1% in June (as discussed earlier). For the year to end June, Steinhoff was pushed out of third position and replaced by Tsogo Sun Hotels (+93.8% YTD), which had a great run last month (it was up 18.9%), until the stricter lockdown announcements, earlier this week, dragged the share lower.

Distell’s 34.5% MoM gain in May saw it move up to fourth position in the rankings for the year to end May, but a 1.6% MoM decline in June pulled the share lower to sixth spot, with a 75.7% YTD gain. Fourth position YTD is now occupied by Mpact (+87.7% YTD), following its share price jump after it emerged that Caxton was planning a possible takeover of the company.

MTN (+71.5% YTD) moved up to seventh spot (from eighth in May) after its share price gained a further 3.8% last month, while Motus Holdings (+66.7% YTD), one of SA’s four major listed motor vehicle retailers, fell from its fifth spot in May to eighth position, following a share price loss of 1.8% in June. Rounding out the top-10 best-performing shares YTD was Sasol with a 62.8% gain.

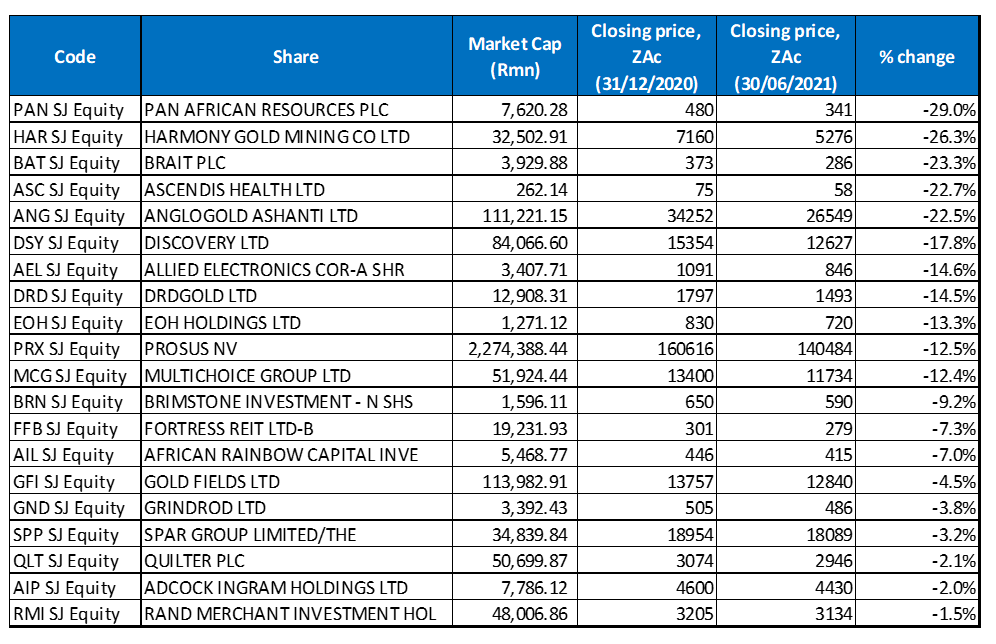

Figure 4: Bottom-20 June2021, YTD

Source: Anchor, Bloomberg

Looking at the YTD worst performers, eight of the ten-worst performing counters for the year to end May, once again featured among the 10 worst performers for the year to end June. Investment Group, Brait (-23.3%) moved from the worst-performing share YTD to third spot, with Pan African Resources (-29.0% YTD) now taking the title of the worst-performing share YTD, after gold counters were hit hard by June’s much lower gold price (discussed earlier). Another gold counter, Harmony (-26.3% YTD), entered the worst-performing shares YTD list after a 28.7% MoM drop in its share price and it subsequently bumped EOH Holdings from second spot.

Perennial underperformer Ascendis Health came in fourth with a YTD decline of 22.7% after the share lost 17.1% MoM in June (discussed earlier). AngloGold Ashanti (-22.5% YTD) moved into fifth worst-performing share position as the lower gold price dragged the share price lower in June. AngloGold was followed by Discovery (-17.8% YTD) in sixth position.

Altron (-14.6% YTD) came in seventh, following its poor performance in June, with DRDGold (-14.5% YTD), EOH Holdings (-13.3% YTD), and Prosus (-12.5% YTD) rounding out the ten worst-performing shares YTD.