Historically, September has been the worst month for US equities (with October a close second), and this year was no exception in a tumultuous month which saw a wave of selling and the main US equity benchmarks recording their first monthly losses since the start of the recovery rally in late March. Concerns over the COVID-19 pandemic in the coming US fall and winter, Europe battling the start of a second wave of infections, and conflicting signals around a possible coronavirus relief bill in the US weighed on sentiment. Democrats unveiled a $2.2trn pandemic relief package but, following the death of long-serving Supreme Court Justice Ruth Bader Ginsburg and US President Donald Trump’s vow to replace her before the election, prospects of Democrats and Republicans agreeing on stimulus measures have diminished significantly. In addition, political uncertainties surrounding what is likely to be a very acrimonious US Presidential Election in November were exacerbated by a disastrous first presidential debate between Trump and his Democratic challenger Joe Biden and Trump declining to categorically state that he will accept the election result if he loses.

Among the three major US indices, the S&P 500 seesawed for most of the month before ending its five-month winning streak to close September 3.9% lower (up 4.1% YTD). The Dow Jones Industrial Average (Dow) ended September with a 2.3% MoM decline and is now down 2.7% YTD. Some steep sell-offs in tech counters saw the usually reliable Nasdaq register a 5.2% MoM decline (+24.5% YTD) after five consecutive monthly gains. Nevertheless, despite the difficult September, for 3Q20 the S&P 500 (+8.5%) and the Dow (+7.6%) still recorded their best back-to-back quarters since 2009, while the Nasdaq’s 11.0% gain in 3Q20, as tech counter rallied sharply in July and August before returning some gains last month, marked its best two consecutive quarters since the early 2000s, according to The Washington Post.

At its mid-September meeting the US Federal Reserve (Fed) left benchmark rates on hold, as expected, and indicated it anticipates the interest rate to remain at nearly zero at least through 2023. While US inflation has ticked up, it remains well below the Fed’s 2% target range, with the Fed stating that it “will aim to achieve inflation moderately above 2% for some time …”, confirming it will tolerate inflation above the target for a while before reacting, further reinforcing the lower-for-longer mantra.

On the economic data front, US consumer confidence bounced back in September, with the Conference Board reporting that its index recorded its sharpest rise in 17 years, surging 15.5 points MoM to a reading of 101.8. August pending home sales, released on Wednesday (30 September) by the National Association of Realtors, posted an 8.8% monthly surge, well ahead of consensus estimates for a 3.1% rise and the index’s fourth straight monthly increase. Unemployment data, however, remained elevated with the Labor Department reporting that initial jobless claims for the week ending 19 September came in at 870,000. The US also surpassed the unfortunate 206,000 COVID-19 deaths milestone in September, with at least 22 states reporting an increase in new cases.

European markets came under pressure over concerns around a surge in COVID-19 cases, prompting countries such as France, Spain, and the UK to implement stricter containment measures. Advisers to the UK government warned that without urgent action COVID-19 infections and deaths could soar, resulting in Prime Minister Boris Johnson imposing a raft of restrictions and even fines for non-compliance, which he said could last for six months. UK equity markets came under pressure, with the FTSE 100 Index dropping 1.6% last month (-22.2% YTD and -4.9% QoQ). Major European equity markets also closed in the red, with Germany’s Dax retreating 1.4% MoM (-3.7% YTD and +3.7% QoQ), while France’s CAC fell by 2.9% MoM (-19.6% YTD and -2.7% QoQ). On the data front, there were signs that Europe’s economic recovery may be stalling with the IHS Markit composite purchasing managers index (PMI) slipping below 50 to a four-month low and showing that eurozone September business activity lost steam as demand in the services sector weakened. Above 50 signals expansion, while below 50 indicates contraction.

In Asia, Japan’s Nikkei ended only 0.2% higher MoM and the index is now down 2.0% YTD but up 4.0% QoQ. September also saw Yoshihide Suga take over from Shinzo Abe as Japan’s prime minister after Abe resigned in August due to deteriorating health. China’s Shanghai Composite Index fell 5.2% MoM (up 5.5% YTD and 7.8% QoQ) and Hong Kong’s Hang Seng plummeted 6.8% MoM (-16.8% YTD and -4.0% QoQ). China’s economic activity continued to rebound in September with expansion in the country’s manufacturing sector continuing as the official manufacturing PMI rose to 51.5 vs 51.0 in August. The private Caixin/ Markit PMI came in at 53.0, also showing an increase in September manufacturing activity.

On the commodities front, iron ore prices, up c. 30% YTD, saw some pullback in September before it bounced again on the last day of the month after Vale announced an output halt at its Viga concentration plant, taking 11,000 per day off the market. Strong demand from China, which has implemented significant stimulus measures post-COVID, particularly on infrastructure spending (a steel-intensive sector), has been a key driver of the steel-making ingredient’s resilience. The platinum price was c. 4% lower MoM, while gold racked up its second consecutive monthly decline with the price of the yellow metal down 4.2% MoM (YTD the gold price is still 24.3% higher).

Crude oil prices ended the month c. 10% lower, reaching $40.95/bbl by month-end with the oil price down c. 40% YTD. Oil prices were stronger around mid-month on the back of a drop in US oil inventories as Hurricane Sally forced several US oil production plants to close, but optimism around a demand-led recovery waned with crude oil consumption down over 5% from pre-pandemic levels. The Financial Times (FT) reported last week that “a host of senior oil trading executives and fund managers” told an FT conference the oil price will be stuck at c. $40/bbl “ … until there was an effective COVID-19 vaccine.”

IN South Africa (SA), the FTSE JSE All Share Index ended September 2.2% in the red (-4.9% YTD and -0.2% QoQ), as the local market tracked global equity markets lower. Some large-cap resource shares and major index constituents such as Glencore (-13.3% MoM), Prosus (-9.3% MoM), Annheuser Busch InBev (-7.9% MoM), BHP Group (-5.6% MoM), and Naspers (-4.3% MoM) recorded significant share prices drops. Large-cap gold counters including AngloGold Ashanti (-12.4% MoM), Harmony (-19.4% MoM), and Gold Fields (-7.2% MoM) plummeted as the gold price weakened by 4.2% for the month. The Resi-10 fell by 4.0% MoM (-+8.4% YTD and +4.1% QoQ), followed by the Indi-25 with a 2.1% MoM decline (+5.6% YTD and -3.0% QoQ). The Fini-15 outperformed, gaining 3.3% in September (-35.7% YTD and -+0.4% QoQ) as major constituents including Capitec Bank, ABSA, FirstRand, Nedbank, and Standard Bank posted share price jumps of 24.2%, 15.6%, 8.9%, 5.0%, and 2.3% MoM, respectively.

While the rand reached its highest level in c. six month earlier in September, from around mid-month the local unit was weighed down by US dollar strength as the potential for additional stimulus measures from the US Fed seemed more unlikely and other global factors weighed on emerging markets sentiment. Still, the rand did stage a recovery again on 30 September, breaking through the R17/US$1 level. MoM the rand was 1.1% stronger vs the greenback, but YTD the local unit is down c. 20% against the dollar.

It was a busy month for local economic data, SA’s 2Q20 GDP data and the second quarter’s Quarterly Labour Force Survey (QLFS), which Statistics SA had to delay twice because of the pandemic, were finally released. GDP dropped 16.4% QoQ seasonally adjusted, or 17.1% YoY, pushing the country deeper into a recession. This was SA’s fourth consecutive quarterly GDP decline, although we note that the data reflect the months of April, May, and June – the worst period of the COVID-19 lockdown. Meanwhile, the QLFS showed that 2.2mn jobs were lost in 2Q20 (representing c. 14% of all jobs at the start of the quarter). Again, the period under review accounted for most of the hard lockdown months and the worst impact of the pandemic (level-1 lockdown started on 26 March and the hard lockdown, which halted most economic activities, lasted from 26 March until June). August annual consumer price inflation (CPI) slowed to 3.1% YoY – barely within the SA Reserve Bank’s (SARB’s) 3% to 6% target range and a decrease from July’s 3.2% YoY annual inflation rate. MoM, prices rose 0.2%, largely driven by the higher costs of food and beverages, housing, and utilities, along with miscellaneous goods and services. Core inflation which excludes food, non-alcoholic beverages and fuel and energy prices, accelerated to 3.3% YoY vs July’s 3.2%. At its September meeting, the SARB’s Monetary Policy Committee kept the repo rate at 3.5% with Governor Lesetja Kganyago saying the bank now forecasts a GDP contraction of 8.2% in 2020 vs its July forecast of a 7.3% contraction for the year.

With local COVID-19 infections continuing to plateau, the country moved to level-1, the lowest level of the lockdown, on 21 September. On 30 September, the Health Department said that 1,767 new cases had been identified in a 24-hour period, with a total of 674,339 confirmed cases in SA to date. The local recovery rate now stands at 90% vs 86% at the end of August. The US remains the country with the most COVID-19 infections at 7.5mn, followed by India (6.3mn), Brazil (4.8mn), the Russian Federation (1.2mn) and Colombia (829,679) in fifth spot. SA is now the tenth worst-impacted country globally.

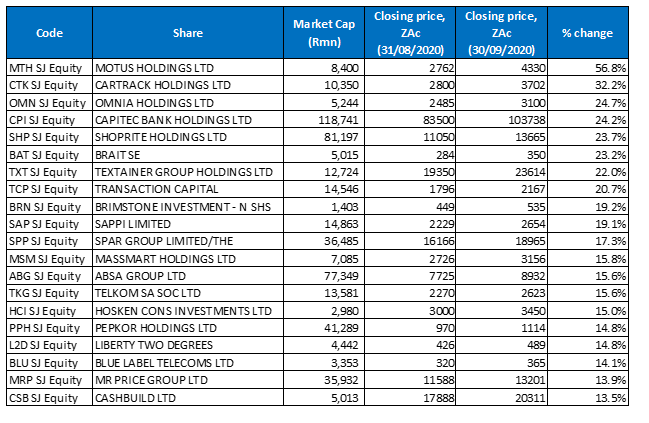

Figure 1: The 20 best-performing shares in September 2020, MoM

Source: Anchor, Bloomberg

Auto dealership and car rental (through Europcar and Tempest) Group, Motus was September’s best-performing share, with its share price rocketing 56.8% MoM, albeit from a low base. The share had more than halved this year but on 16 September, after releasing results, its fortunes turned, and the share price surged over 20% on the day. The company withheld a final dividend as profits came under pressure on vehicles sales locally as well as in the UK and Australia due to the impact of the COVID-19 lockdowns, while its car rental business was negatively impacted by travel restrictions. Revenue declined 7.9% YoY to R73.4bn, while once-off costs including goodwill and intangible asset impairments, retrenchment, and other closure-related expenses left EPS 83% lower YoY at ZAc165 and headline EPS down 71% YoY at ZAc296. However, the company was upbeat that it could weather the storm in SA’s vehicle market and CEO Osman Arbee said that Motus, which had cut its car rental fleet and staff by almost half, was “fit and lean” to navigate the economic downturn. Business Day writes that Motus could fare better than its competitors due to its diversified business model that includes selling car replacement parts and it could also benefit from consumers delaying buying new cars. According to Arbee, Motus had “… found the right structure …” to carry it through post-COVID, adding that it was already seeing robust demand for aftermarket parts.

In second spot, vehicle tracking busines, Cartrack (+32.2% MoM) released a favourable trading update for the six months to end August last week, saying it expects half-year headline EPS to rise by between 20% and 22% YoY, to between ZAc87 and ZAc88. The company said that, despite the pandemic, demand for its software platform has not fallen.

Agricultural and chemicals company, Omnia (+24.7% MoM) was September’s third best-performing share as it emerged from the pandemic with better liquidity and expansion plans vs big financial losses and increasing debt previously. According to Bloomberg, Omnia’s CEO indicated that a combination of debt restructuring through a R2bn rights issue, operational cost cutting, and management changes were part of the reasons for this. In addition, Omnia said that its agricultural, mining explosives, and basic chemicals businesses proved extremely resilient despite the coronavirus outbreak. Mining Weekly reported last month that Omnia’s mining division (Protea Mining Chemicals and BME) has become the first in its field to develop a solution that helps copper and cobalt mines “reduce product contamination by improving metal purity levels and maximising throughput in the solvent extraction process.” The report says the discovery is expected to extend the life of copper and cobalt mines and assist in increasing profits.

Capitec Bank (+24.2% MoM) released 1H20 results this week, which showed a massive hit from COVID-19, with net income falling to R4.9bn from R7.84bn recorded in 1H19 and diluted EPS decreasing to ZAc537 – down significantly from the ZAc2,545 reported in the corresponding period of 2019. However, despite the sharp earnings decline, things are looking up as Capitec said that it had recorded a sharp recovery in its second quarter (June to August), growing headline earnings to R1bn-plus after a headline loss of R404mn in its first quarter (March to May). Capitec also added 800,000 new clients in 1H20 – to a total of 14.7mn clients as at end August.

Shoprite (+23.7% MoM) reported impressive FY20 results on 8 September and, in a challenging year, the retailer recorded a 6.4% YoY jump in turnover to R159.6bn, despite COVID-19 induced lockdown restrictions. The results were significant because of Shoprite’s strong cash generation and degearing of its balance sheet. The degearing was remarkable as much for the quantum, as for the speed at which Shoprite was able to achieve this. According to management, much of the degearing success was due to its new SAP system, which has allowed it to release R6.1bn in working capital in just 12 months! Another key contributor to the strong cash realisation was a more efficient allocation of capital. With the Group moving away from a growth-at-all-costs approach in Africa, capital spending declined by R2.1bn during the period. Shoprite spent R3.2bn in FY20, of which R2.5bn was spent in SA, with just R0.7bn spent in Africa. The retailer guided that its capital spending will increase to R4.8bn in FY21, with the largest contribution again going to SA.

Brait’s share price rose 23.2% MoM, also from a low base, having dropped by c. 65% YTD, while Textainer Group, which leases shipping containers, and Transaction Capital, an operator of credit-orientate alternative assets, recorded MoM gains of 22.0% and 20.7%, respectively. Textainer’s share price has seen some positive momentum recently, gaining 33.9% in August after reporting better-than-expected results and with the share’s primary listing being in the US, it has benefitted from robust US market gains in previous months. In September, Textainer said it had $829mn (c. R13.9bn) in asset-backed bonds and has used the proceeds to pay off other debts and take advantage of low interest rates. Last month, Transaction Capital, which has divisions that include SA Taxi and Transaction Capital Risk Services, announced the conclusion of an agreement to buy a 49.9% stake in car-purchasing platform, WeBuyCars. The market reacted positively to the deal, with Transaction Capital’s share price up c. 19% since the deal was announced on 8 September.

Rounding out September’s best-performing shares were Brimstone Investments (+19.2% MoM) and Sappi Ltd (+19.1% MoM).

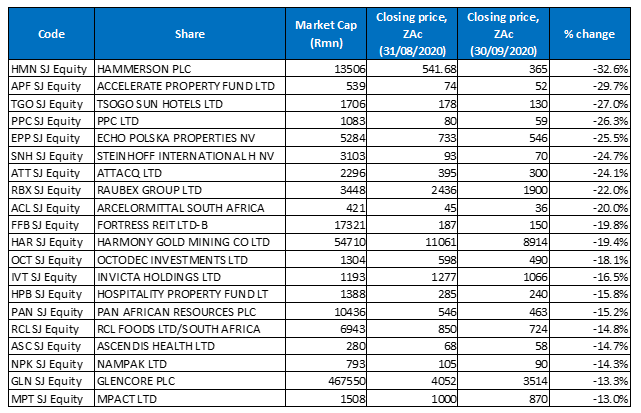

Figure 2: The 20 worst-performing shares in September 2020, MoM

Source: Anchor, Bloomberg

The listed property sector was already under pressure before COVID-19, due to weak fundamentals and the local economy being in a technical recession. However, the subsequent COVID-19-related lockdowns imposed by various governments globally has resulted in listed property firms facing their most challenging year yet as the pandemic also accelerated a digitisation of business and commerce. This was again reflected in the performance of property counters in September, with five out of last month’s ten worst-performing shares coming from this sector. London and JSE-listed property development and investment company, Hammerson Plc was September’s worst performer, with a 32.6% MoM loss. Hammerson’s share price fell last week as it wrapped up a highly dilutive rights issue and capital reorganisation aimed at shoring up its balance sheet. The company said shareholders representing 94.9% of its share capital took up their rights in the 24 for 1 rights issue. The COVID-19 outbreak in March and consequent trading restrictions on shopping centres has seen accelerated losses for retail property owners around the world, and Hammerson has been one of many UK-focused shopping centre owners hit hard by the pandemic and negative investor sentiment.

Accelerate Property Fund was last month’s second worst-performing share, with a 29.7% MoM fall, followed by Tsogo Sun Hotels, which recorded a 27.0% MoM decline, in third spot. In a trading statement released in September, Accelerate said that it will retain cash and not pay distributions for the 30 September 2020 and 31 March 2021 reporting periods. Accelerate also highlighted that distributable income for the period ending 30 September 2020 and 31 March 2021 was expected to be more than 15% lower vs the corresponding preceding periods, due to the COVID-19 assistance it has granted to tenants.

SA’s largest cement manufacturer, PPC’s (-26.3% MoM) share price plunged after the company announced it will conduct a capital raise and sell assets as part of restructuring agreements with its SA lenders. The company is grappling with a debt burden of R5.1bn as at the end of 1H20 (more than its c. R1bn market cap), while the results for its year to end-March have been repeatedly delayed, in part due to the company’s need to reach a new agreement with lenders.

Last week, property Group EPP (-25.5% MoM) said it would not pay an interim dividend and may sell some assets or introduce partners to some of its operations to bring down debt. In a further trading statement, EPP revised its earnings guidance for the year to end-December upwards – to between EUc4.75 and EUc5.25/share, attributing the improvement to a recovery in its operations and the progress made over the past few months with renegotiated leases.

Steinhoff International, Attacq, and Raubex recorded MoM declines of 24.7%, 24.1% and 22.0%, respectively. In its FY20 results, released last week, real estate investment firm, Attacq, said that its revenue decreased to R2.19bn from R2.28bn posted in FY19, while it delivered core FY20 DIPS of ZAc73.1 ― a 10.5% YoY decline in difficult trading conditions. A distribution of ZAc45 was paid at its interim results, but no 2H20 dividend was declared. The firm said that its SA portfolio experienced difficult trading conditions due to disruptions associated with the COVID-19 pandemic. It also reported an 8.6%, or R1.7bn, devaluation in its local portfolio.

Rounding out the ten worst-performing shares were steel producer ArcelorMittal SA and Fortress REIT -B- with MoM declines of 20.0% and 19.8%, respectively. ArcelorMittal said last month that it would restart the second blast furnace at its Vanderbijlpark operations in January 2021 on the back of higher steel demand. The firm indicated that steel demand had increased faster than initially expected due to lockdown-affected construction projects now being completed, increased sales at retail outlets, and running at lower stock levels prior to the lockdown. The property investment company, Fortress, in its FY20 results, said its revenue decreased to R3.62bn from R3.63bn posted in the previous year. The Group declared a 2H20 dividend of ZAc23.00 per Fortress -A- share but said that Fortress -B- shareholders will not receive any distribution for 2H20.

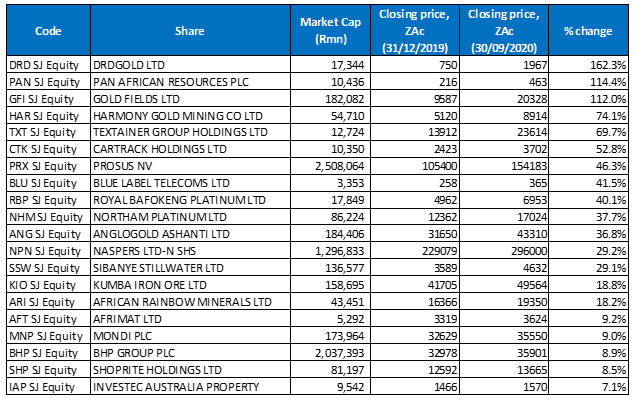

Figure 3: Top-20 YTD performers (to end September 2020)

Source: Anchor, Bloomberg

Although the gold price fell by 4.2% in September, it is still up 24.3% YTD. The price of the yellow metal has been soaring for most of this year due to a weaker dollar, increased global risk brought about by the pandemic, and continued monetary stimulus pushing gold’s rally as a risk hedge. Unsurprisingly, gold YTD performance has resulted in the four best-performing shares YTD (DRD Gold [+162.3%], Pan African Resources [+114.4%], Gold Field [+112.0%] and Harmony Gold [74.1%]), being the same gold counters and unchanged from July and August’s YTD four best-performing shares. For the year to end September, six of the ten best-performing stocks were gold and platinum shares – DRD Gold, Pan African Resources, Goldfields, Harmony Gold, Royal Bafokeng Platinum, and Northam Platinum.

Market heavyweights, Prosus and Naspers have also put in a strong performance this year with the share prices up 46.3% and 29.2% YTD, respectively, while Textainer and Cartrack’s sterling performances in September pushed the shares 69.7% and 52.8% higher YTD.

Seventeen of August’s YTD best-performing shares remained among the 20 best performers for the year to end September. Three shares – Mondi Plc (+9.0% YTD), Shoprite Holdings (+8.5% YTD), and Investec Australia Property (+7.1% YTD) were last month’s new entrants into the YTD top-20, bumping Reinet Investments, Aspen Pharmacare, and Vodacom out of the YTD top-performers list.

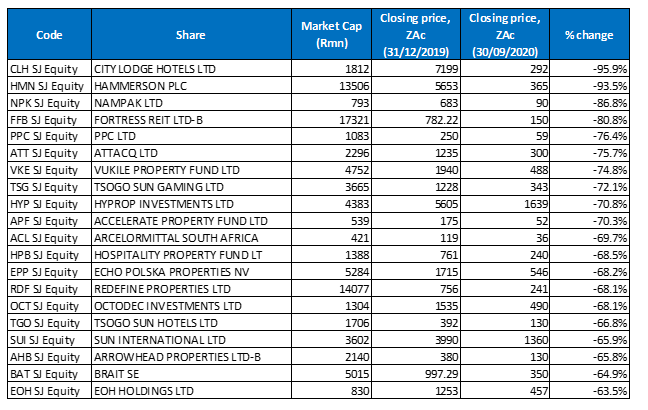

Figure 4: Bottom-20 YTD performers (to end September 2020)

Source: Anchor, Bloomberg

Much like September’s worst MoM performers, six out of the 10 worst-performing shares YTD were from the listed property sector, while three shares entered the 20 worst performers YTD list – Accelerate Property Fund (-70.3% YTD), EPP (-68.2% YTD), and Tsogo Sun Hotels (-66.8% YTD), replacing Hosken Consolidated Investments, Motus, and SA Corporate Real Estate. This, after Motus (discussed earlier), SA Corporate, and Hosken recorded share price gains of 56.8%, 9.4% and 5.0% MoM in September, while EOH was fortunate to limit its share price losses last month to a 4.8% decline. In addition, much the same as with the MoM worst performers, 11 of the 20 counters were property and property-related shares.

Looking at the three worst-performing shares, City Lodge (-95.9% YTD) claimed the worst-performer title for the second month in a row, followed by UK and European shopping centre owner, Hammerson (-79.2% YTD), which swopped spots with Nampak – Hammerson was the second worst-performing share and Nampak came in third.

Nampak was followed by Fortress REIT -B- (-80.8% YTD), PPC (-76.4%), Attacq (-75.7%), Vukile Property Fund (-74.8% YTD), and Tsogo Sun Gaming (-72.1% YTD), with Hyprop (-70.8% YTD) and Accelerate (-70.3% YTD) rounding out September’s ten worst-performing shares YTD.