The US and other major global equity markets ended August in the green despite a few hiccups along the way. Investor sentiment had been dented by some disappointing US economic data releases during the month (indicating that the robust economic growth from the depths of the pandemic could be losing some steam) and continued reports of supply chain bottlenecks, which accompanied a resurgence of the more infectious COVID-19 Delta strain in the US and other parts of the globe. The potential geopolitical implications of the collapse of the Afghanistan government also weighed on sentiment. However, major US equity benchmarks hit all-time highs on Monday (30 August), as the US Federal Reserve (Fed) appeared in no rush to move away from its massive stimulus programme. This follows dovish comments made by Fed Chair Jerome Powell in his address at The Jackson Hole Economic Symposium held on 27 August. Although Powell admitted tapering could start by the end of 2021, he did not lay out an exact timeline for when the tapering of bond-purchasing will begin, noting that the Fed would remain cautious.

US equities recorded their seventh straight month of gains in August on the back of strong corporate profits (and Powell’s comments), with the blue-chip S&P 500 notching up its seventh consecutive positive month (+2.9% MoM/+20.4% YTD) and closing at all-time highs a total of 12 times during the month – more than any other August in history, according to Forbes. The tech-heavy Nasdaq added 4.0% MoM (+18.4% YTD) and the Dow Jones rose by 1.2% MoM (+15.5% YTD).

In terms of US economic data, several releases in August disappointed – consumer confidence fell sharply, while reports on retail sales and the pace of new home construction were weaker than expected. US consumer sentiment fell to its lowest level in c. 11 years on the back of growing concern around the economy’s prospects, inflation, and the surge in COVID-19 cases caused by the more contagious Delta variant. July retail sales declined 1.1% MoM as consumer spending dropped across all categories. July core personal consumption expenditure (PCE) inflation rose 0.3% MoM (unchanged from June), while July core PCE (the Fed’s preferred inflation gauge, which strips out the volatile food and energy prices) soared 3.6% YoY, its highest level since May 1991, according to CNBC. However, the US house price boom continued and, according to June’s S&P CoreLogic Case-Shiller Index, the price of a single-family home surged 18.6% YoY – the thirteenth consecutive month of accelerating prices since the first lockdown started driving demand for larger houses away from urban centres.

Elsewhere, in Europe’s largest economy, Germany’s DAX advanced by 1.9% MoM (+15.4% YTD), while in the eurozone’s second-biggest economy, France’s CAC Index ended August 1.0% higher (+20.3% YTD). On the economic data front, the European Commission’s August economic sentiment index recorded a larger-than-expected decline to 117.5, from an all-time high of 119.0 in July, negatively impacted by a sharp drop in consumer optimism in France and the Netherlands, with optimism deteriorating in all major sectors. Data also showed that eurozone inflation surged to a decade high in August (at 3% on an annual basis), significantly above the European Central Bank’s target.

The UK’s FTSE 100 Index closed August 1.2% higher (+10.2% YTD), after a lacklustre performance in July. In economic data, UK GDP grew 4.8% QoQ in 2Q21 and by 1.0% in June 2021 (compared to May) – its fifth consecutive month of growth. However, June GDP remained 2.2% below the pre-pandemic levels of February 2020 and expectations are that the Delta variant will likely also slow progress in July.

In Asia, Chinese stocks had another volatile month following July’s huge losses as disappointing economic data and ongoing concerns around that country’s regulatory clampdowns weighed on markets. This week, China announced it will restrict the time spent by children playing video games and signalled that the country will escalate its fight against anti-competitive behaviour and pollution. Nevertheless, Hong Kong’s Hang Seng Index slid by only 0.3% MoM (-5.0% YTD), while China’s Shanghai Composite Index regained some of July’s lost ground, closing 4.3% higher MoM (+2.0% YTD).

In economic data, China’s official manufacturing purchasing managers’ index (PMI) slowed further in August, contracting to 50.1, from 50.4 in July (the 50-point mark separates expansion from contraction). This was the lowest level since the index fell to an all-time low of 35.7 in February 2020. August services sector activity also contracted to the second-lowest level on record, further adding to evidence of a slowing economy. The official non-manufacturing PMI – which measures morale in the services and construction sectors – fell to 47.5 in August, from July’s 53.3 print. CNBC reports that the slowdown was driven by a steep drop in the services index from 52.5 to 45.2, attributed to COVID-19 restrictions being reimposed and more cautious consumers.

In Japan, the Nikkei closed 3.0% up MoM (+2.4% YTD), while on the economic data front, preliminary GDP data released in August, showed that the country’s economy rebounded more than forecast in 2Q21, growing by an annualised 1.3% following a revised 3.7% slump in 1Q21.

On the commodity front, oil prices came under pressure in August (-4.4% MoM/+40.9% YTD) as a spike in COVID-19 Delta variant cases threatened to slow a demand-fuelled recovery. The oil price was also weighed down by concerns that power outages and flooding in Louisiana after Hurricane Ida would cut crude demand from refineries while global producers plan to raise output. After gaining 2.5% MoM in July, the gold price was basically unchanged in August (-0.03% MoM/-4.5% YTD). Iron ore was down c. 14.0% MoM (+0.1% YTD). The price of palladium, which is used in catalytic converters to curb emissions by internal combustion vehicles, fell 7.2% MoM (+0.9% YTD) and the platinum price declined by 3.4% MoM (-5.3% YTD).

On the JSE, South Africa’s (SA’s) FTSE JSE All Share Index retreated by 2.2% MoM, although the index is still 13.5% up YTD. Commodity, industrial metals, and materials counters weighed on the local bourse. The Resi10 fell 6.1% MoM (+15.3% YTD), while the Indi-25 dropped by 5.2% MoM (+7.1% YTD). However, financials (+12.4% MoM/+20.3% YTD) and property counters (+7.4% MoM/+22.7% YTD) recorded good gains. Highlighting the top shares by market cap, we note that Prosus and Naspers retreated by 2.7% and 12.1% MoM, respectively, weighed down by ongoing regulatory tightening in China. In late August, China said it will limit online gaming by minors to three hours per week and with its c. 28.9% stake, Prosus is the biggest shareholder of Chinese gaming and internet group, Tencent. BHP Group, which was this month overtaken by Prosus as the biggest company on the JSE by market cap, declined 4.4% MoM, while Anheuser Busch InBev, British American Tobacco, Richemont, and Glencore declined by 4.0%, 0.7%, 14.3%, and 0.8% MoM. Among the largest banking counters by market cap, FirstRand rose 13.9% MoM, while Capitec jumped 16.7% MoM, and Standard Bank soared 20.4% MoM. The rand firmed 0.6% against the greenback and on a YTD basis, the local unit has strengthened by 1.2% against the US dollar.

In local economic data, July annual headline inflation, as measured by the consumer price index (CPI), came in at 4.6% YoY – down from June’s 4.9% print, with the main contributors once again being food and non-alcoholic beverages, housing, and utilities and transport. Overall, inflationary pressures continue to moderate downwards as expected, as base effects (from fuel price movements and the imputations of unavailable pricing data during the hard lockdowns last year) dissipate. Notably, more muted inflation such we are witnessing now will help assist the SA Reserve Bank (SARB) in keeping rates lower for longer. August’s trade balance shrank to a R36.96bn surplus vs a revised R54.48bn surplus in July, while exports were down 11.2% MoM to R145.01bn and imports declined 0.7% MoM to R108.04bn. Stats SA released the 2Q21 Quarterly Labour Force Survey (QFLS) in August, which showed that the SA unemployment rate has risen to 34.4% – another record high but in line with expectations. More concerning to us is that the expanded definition of unemployment (which includes discouraged work-seekers and is thus more reflective of the true level of unemployment) increased 1.2 percentage points to 44.4% in 2Q21 vs 1Q21.

On the pandemic front, Cabinet approved the decision to leave the country on adjusted Level 3 of lockdown restrictions, despite a decrease in the number of daily COVID-19 cases. Registration and vaccination for the last age bracket, 18- to 34-year-olds, opened on 20 August and, according to the latest Department of Health data as at 31 August, c. 12.6mn vaccines have been administered. The total number of confirmed COVID-19 cases since the start of the pandemic to end-August 2021 stood at 2.78mn vs end-July’s 2.45mn.

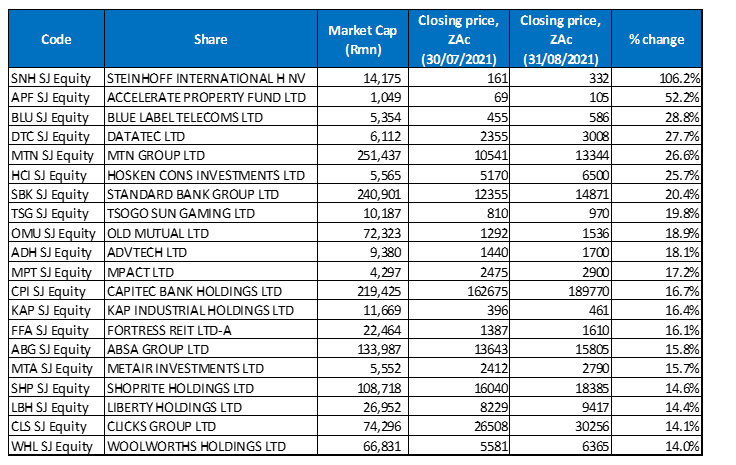

Figure 1: August 2021’s 20 best-performing shares, MoM % change

Source: Anchor, Bloomberg

Steinhoff International was by far the best-performing share in August (after dropping 14.8% MoM in July), with a MoM gain of 106.2%. The share price surge came after the company released a trading update which showed that the gradual easing of global lockdown restrictions had boosted its revenue. Steinhoff reported a 15% YoY rise in revenue to EUR6.81bn (R118bn) in the first nine months of its FY21. The Group said all of its operations had performed well in the company’s third quarter – revenue rose 16% YoY to EUR3.03bn for Pepco Group in Europe as customer restrictions were progressively eased, while US-based Mattress Firm posted a 29% YoY jump in revenue to EUR2.63bn, despite a 3.7% YoY store base reduction/closures due to the pandemic. JSE-listed Pepkor Afrika recorded a 12% YoY revenue increase to EUR3bn, despite volatile trading in the Group’s third quarter, which the company said had moderated in April.

Accelerate Property Fund was the month’s second-best performer – up 52.2% MoM. Last month, it was announced that The iGroup had acquired a significant stake in Accelerate. In a SENS announcement, Accelerate said that The iGroup’s total interest in its ordinary shares now amounts to 8.64%.

Blue Label Telecoms came in third with an August gain of 28.8%. Last week, the Group reported FY21 results, showing that revenue generated by continuing operations declined 11% YoY from R20.9bn to R18.8bn. However, it posted a marked improvement in headline earnings of ZAc86.16/share – up from ZAc58.16/share recorded in the prior reporting period. The company highlighted the partial recoupment of losses by the Retail division of its WiConnect stores and the non-re-occurrence of impairments of goodwill and fair-value downward adjustments in the prior year.

Datatec, MTN, and Hosken Consolidated Investments reported gains of 27.7%, 26.6%, and 25.7% MoM, respectively. MTN posted solid 1H21 results last month, showing growth in revenue and subscribers in SA. Group service revenue increased by 19.7% YoY to R81.9bn led by growth of 9.3% in MTN SA, 23.8% in MTN Nigeria, and 25.5% in MTN Ghana. MTN also benefited from double-digit, overall top-line growth from these regions. Data revenue expanded 32.2% on the back of a 56.4% increase in data usage, with sustained levels of online demand brought about by the effects of the pandemic.

Standard Bank Group’s (+20.4% MoM) SA business rebounded in 1H21 and the bank said its revenue rose to R64.82bn vs R61.52bn posted in 1H20, while HEPS rocketed by 52% YoY to ZAc721.4. Further, in its FY21 trading statement, the bank said that it expected HEPS to increase by more than 20.0%, compared with HEPS of R10.03 recorded in the corresponding previous year.

Tsogo Sun Gaming, which was hard hit by the various COVID-induced government lockdowns, recorded a 19.8% MoM gain albeit from a low base. Meanwhile, Old Mutual rose 18.9% MoM and in its 1H21 results, the insurance company said that its revenue stood at R41.04bn compared with R39.74bn recorded in 1H20, while diluted EPS came in at ZAc67 vs a diluted loss per share of ZAc125.90c recorded in 1H20.

Rounding out August’s top-10 shares was ADvTECH, with a 18.1% MoM gain. The education and recruitment company reported a strong 1H21 performance, with revenue advancing 1.1% YoY to R2.86bn, while diluted EPS stood at ZAc56.90, compared with ZAc33.60 recorded in 1H20. Growth in the African school market (especially in Kenya and Botswana), has been one of the standout stories driving the Group in recent years with school enrolments up 6% for the year to June 2021 and rising by 5% for ADvTECH’s tertiary institutions.

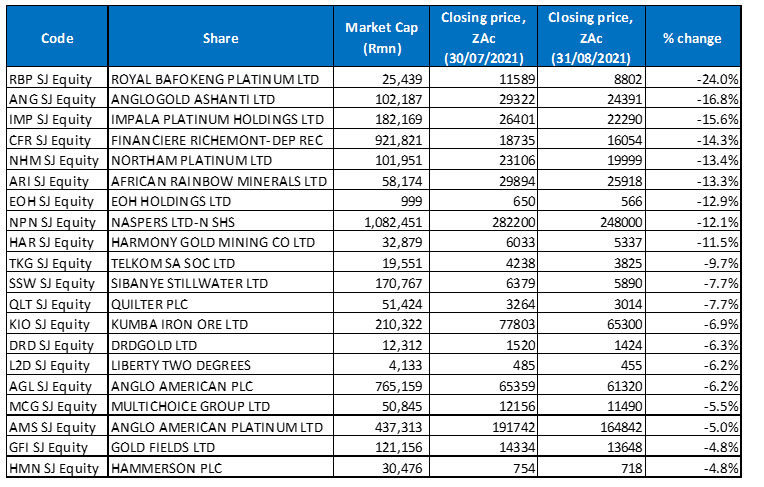

Figure 2: August 2021’s 20 worst-performing shares, MoM % change

Source: Anchor, Bloomberg

Most of last month’s worst-performing shares came from the resources and precious metals sectors as commodity prices came under pressure in August. The prices of gold, iron ore, platinum, and palladium fell by 0.03%, 11.3%, 3.4%, and 7.2% MoM, respectively, dragging the share prices of mining counters lower. Platinum has tumbled over 20% since this year’s peak in February, on the back of a computer-chip shortage that has curbed auto production and as higher electric vehicle sales impact the medium-to-long-term consumption outlook for some platinum group metals (PGMs). In addition, concerns about the COVID-19 Delta variant and production misses by car manufacturers due to supply chain issues, have weighed on industrial precious metals prices.

In light of the above, Royal Bafokeng Platinum (-24.0% MoM) was last month’s worst-performing share despite announcing record interim profits on the back of a healthy rise in production and a 50% improvement in the average rand-denominated 4E PGM to R42,600/oz for the six-month period. Royal Bafokeng declared an interim dividend of ZAc535/share during the half-year to the end of June, equating to R1.5bn on the back of the strong metal price environment and the Group’s robust operational performance.

August’s second worst-performing share was AngloGold Ashanti (-16.8% MoM), which reported a 10% YoY drop in 1H21 headline earnings (to US$363mn) in August. The results were negatively impacted by a combination of lower grades, COVID-19-related disruptions, higher costs, and the suspension of underground mining activities at its Obuasi Mine in Ghana following a fatal accident in May. HEPS totalled US$0.87 for the six-month period, compared with HEPS of US$0.97 in 1H20. The company also lowered its full-year production guidance by c. 300,000 oz to between 2.45mn and 2.6mn ounces. Rounding out the three worst-performing shares, AngloGold was followed by Impala Platinum (-15.6% MoM) in the third spot.

Richemont, Northam Platinum, and African Rainbow Minerals recorded MoM declines of 14.3%, 13.4%, and 13.3%. In its FY21 trading update, Northam Platinum indicated that it expects its HEPS to be between R26.57 and R27.19, vs the R6.20 recorded in FY20.

EOH Holdings lost a further 12.9% MoM as the company continues struggling to rid itself of the stigma of corruption. In August, Business Day reported that EOH is still facing the threat of being blacklisted from doing business with the government as punishment for a tender fraud scandal that surfaced three years ago. Such a ban would be a major setback for EOH, which has been on a massive clean-up campaign under its current CEO Stephen van Coller, after revelations surfaced of dodgy deals between its employees and public sector officials. About 20% of EOH’s annual revenue comes from the government.

China’s regulatory crackdown on private industries continued to weigh on sentiment, with Naspers down 12.1% MoM as investors fear further regulation. This week China said it would forbid minors from gaming more than three hours most weeks, imposing its strictest controls yet on youth entertainment. At the same time, the most recent attempt to unlock value between the companies (Naspers and Prosus) has been the swap of Naspers shares for new issue Prosus shares. However, this has not helped the Naspers cause as index tracking rebalancing has seen a near-term underperformance of the share vs Prosus.

Rounding out the ten worst-performing shares for August is Harmony Gold Mining (-11.5% MoM) and Telkom (-9.7% MoM). In its FY21 results released this week, Harmony said that its revenue increased to R41.73bn from R29.25bn posted in FY20, while its diluted EPS stood at R9.01, compared with a diluted loss per share of R1.66 in the prior year. Meanwhile, Telkom remained under pressure following the announcement that its CEO Sipho Maseko would step down at the end of June 2022, after more than eight years at the helm. Under Maseko’s leadership, Telkom’s mobile business grew to become the third-largest in SA, with over 15mn customers, generating R20bn in revenue.

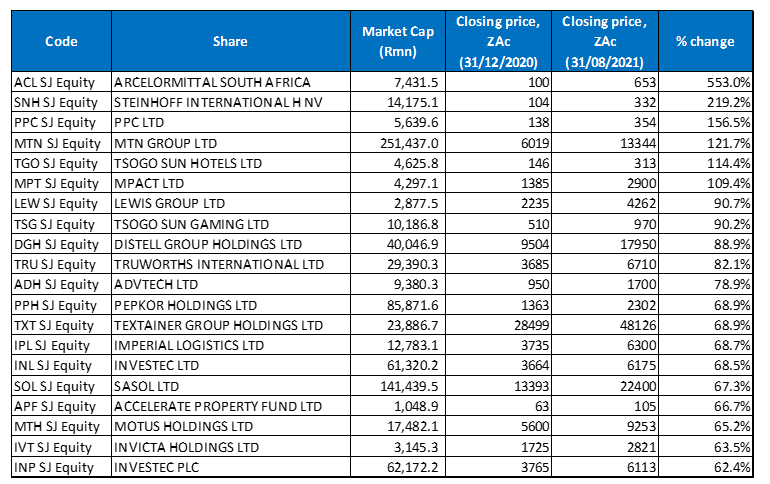

Figure 3: Top-20 August 2021, YTD

Source: Anchor, Bloomberg

Sixteen out of August’s top-20, YTD best-performing shares were unchanged from those in the year to end July, with the new entrants being ADvTech (+78.9% YTD), Investec Ltd (+68.5% YTD), Accelerate Property Fund (+66.7% YTD), and Investec Plc (+62.4%). These counters replaced Royal Bafokeng, City Lodge, Hudaco, and Stadio Holdings in July.

Arcelor Mittal SA (+553.0% YTD) remained the best-performing share YTD, followed by newcomer Steinhoff (+219.2% YTD) in second place, after the latter’s sterling performance in August. PPC Ltd moved from the second position in the year to end July to the third spot in the year to end August, with its share price now 156.5% higher YTD.

PPC was followed by MTN (+121.7% YTD) and Tsogo Sun Hotels (+114.4% YTD), which both had good runs in August (MTN rose 26.6% MoM, while Tsogo Sun Hotels was up 4.3% MoM).

MPact (109.4% YTD) dropped from fifth position YTD in July to the sixth spot – the share was up 17.2% MoM. Mpact was followed by furniture retailer, Lewis Group (+90.7% YTD), which recorded a share price jump of 10.7% in August.

Tsogo Sun Gaming (+90.2% YTD), brewer Distell Group (+88.9% YTD), and Truworths International (+82.1% YTD) rounded out the ten best-performing shares YTD. In its FY21 results, Distell reported a 26.3% YoY revenue increase to R28.25bn (from R22.37bn), while HEPS soared by an impressive 227.1% YoY to ZAc769.6. However, Distell said it had held the dividend pending the outcome of takeover talks with the world’s second-biggest brewer, Heineken, but that it should conclude these talks by the end of September. Meanwhile, in its FY21 trading statement, Truworths said that it expects its HEPS to be between ZAc503 and ZAc523 higher as compared with the ZAc410 recorded in the corresponding previous year.

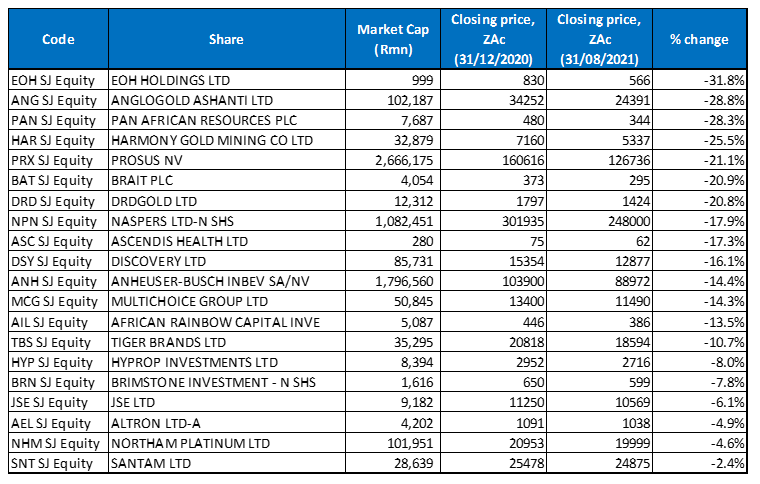

Figure 4: Bottom-20 August 2021, YTD

Source: Anchor, Bloomberg

Looking at the YTD worst performers, 15 of the 20 worst-performing shares for the year to end July, once again featured among the 20 worst performers for the year to end August. Newcomers in the YTD worst-performing category included Tiger Brands (-10.7%), Hyprop Investments (-8.0%), JSE Ltd (-6.1%), Altron (-4.9%) and Northam Platinum (-4.6%). These counters bumped Grindrod, Hosken Consolidated Investments, Rand Merchant Investment Holdings, Spar, and Oceana out of the August YTD list.

Pan African Resources (-28.3% YTD), which took the title of the worst-performing share YTD for two months running, gave it up in August to EOH Holdings (-31.8% YTD), which was the worst-performing share YTD. EOH was followed by AngloGold Ashanti (-28.8% YTD) in the second spot, with the aforementioned Pan African Resources (-28.3% YTD) now in the third position.

Pan African Resources was followed by Harmony Gold (-25.5% YTD), Prosus (-21.1% YTD), Brait (-20.9% YTD), DRDGold (-20.8% YTD), and Naspers (-17.9% YTD).

Perennial underperformer, Ascendis Health (-17.3% YTD), which gained 6.9% MoM in August, strengthened from the fourth position to the ninth spot in the year to end August, with Discovery (-16.1% YTD) rounding out the ten worst performers YTD.