In the past, the month of October might have been synonymous with market crashes (in October 1929, 1987, and 2008), but that was not the case this year as a broad market rally saw most major global indices ending the month higher. Still, the inflation debate remained front and centre, weighing on sentiment for most of the month, especially relating to concerns that inflation will not be transitory after all, as US Federal Reserve (Fed) Chair Jerome Powell commented that, “The risks are clearly now to longer and more persistent bottlenecks and, thus, to higher inflation”. In addition to inflation and supply chain bottlenecks, the COVID-19 Delta Plus variant strain inspired fear and, despite a relatively high vaccination level, the UK recorded a large increase in new COVID-19 cases, with Delta Plus blamed for the spread. Lastly, there is concern that China policymakers’ increased regulation will see that country’s economy deteriorate, dragging the global economy down with it.

The major US indices all closed October in the green, reaching records highs during the month as companies reported solid results despite global supply chain issues. Around 50% of S&P 500 companies reported quarterly results by the end of October, with over 80% of them beating consensus analysts’ earnings estimates, according to Refinitiv. The blue-chip S&P 500 (+6.9% MoM; +22.6% YTD) and the tech-heavy Nasdaq (+7.3% MoM/+20.3% YTD) posted their best MoM gains since November 2020. The Nasdaq despite notable declines among its big tech constituents earlier in the month, following disappointing sales numbers from Amazon and Apple. However, Microsoft reported stellar earnings (it now has a market cap of c. US$2.49trn vs Apple’s US$2.48trn), with Tesla (+44% MoM) also a standout performer as its results exceeded expectations with the company announcing record margins and better-than-expected volumes. The Dow Jones surged 5.8% MoM (+17.0% YTD) – its best monthly gain since March.

In terms of US economic data, the Conference Board’s consumer confidence index rose in October to 113.8 – up from a restated 109.8 in September and rebounding after three consecutive monthly declines. US 3Q21 GDP came in at 2% QoQ – slightly behind expectations of 2.6% as economic activity decelerated on the back of supply concerns and amid a resurgence of COVID-19 cases due to the Delta variant. However, personal consumption expenditure (PCE), accounting for c. 75% of US economic activity, came in ahead of expectations at 1.6% (vs 0.9% expected and 12.0% in 2Q21), largely due to higher-than-expected imports. Core GDP rose 4.5% (in line with expectations).

In Europe’s largest economy, Germany, the DAX jumped by 2.8% MoM (+14.4% YTD), while the eurozone’s second-biggest economy, France’s CAC Index soared 4.8% MoM (+23.0% YTD). On the economic data front, in 3Q21, Europe’s economy continued to rebound from the pandemic-induced recession, with preliminary Eurostat data showing that seasonally adjusted 3Q21 GDP ticked up by 2.2% QoQ in the 19-country euro area and by 2.1% QoQ in the 27-member European Union (EU). However, eurozone inflation hit a new 13-year high in October on the back of surging energy costs, with headline inflation coming in at 4.1% – the highest level since July 2008, according to Reuters, and ahead of a consensus forecast of 3.7%.

The UK’s FTSE 100 Index closed last month 2.1% higher (+12.0% YTD). In UK economic data, after slowing by 0.1% in July, GDP returned to growth in August, rising 0.4% MoM although this was still slightly below expectations. In 1H21, the UK economy recorded rapid expansion buoyed by the fast initial rollout of COVID-19 vaccines but growth has slowed since on the back of a wave of COVID-19 cases and worldwide supply chain issues, which has been worsened in the UK by post-Brexit trade restrictions. For the three months to August, GDP slowed to its weakest level since April (at 2.9%).

In Asia, worries over debt issues in China’s property sector continued to weigh on markets, with Business Day reporting that it has become a global threat with Modern Land becoming the fourth developer in China to default on an overseas debt obligation. According to Bloomberg, Chinese borrowers have defaulted on c. US$9bn of offshore bonds in 2021, with the real estate industry accounting for one-third of that amount. Evergrande’s financial issues were a catalyst for investors to start asking questions about the health of China’s economy, and it has debt of c. US$300bn, including US$20bn in international bonds. The property sector also accounts for c. 29% of China’s GDP. China’s Shanghai Composite Index closed marginally down (-0.6% MoM) in October but is still up 2.1% YTD, while Hong Kong’s Hang Seng Index rose by 3.3% MoM (-6.8% YTD).

In economic data, China’s official manufacturing purchasing managers’ index (PMI) contracted for the second straight month, shrinking to 49.2, from 49.6 in September (the 50-point mark separates expansion from contraction). However, the private Caixin/Markit manufacturing PMI came in at 50.6, showing expansion.

In Japan, the Nikkei closed 1.9% lower MoM (+5.3% YTD), while the Bank of Japan left its easy monetary policy settings unchanged and projected inflation at well below its 2% target for at least two more years.

On the commodity front, benchmark Brent crude oil prices rallied 7.5% MoM in October (+62.9% YTD). After reaching a monthly average low of below US$30/bbl in April 2020, the price of black gold has since risen to over US$84/bbl, ending October at US$84.38/bbl. This comes on the back of higher demand from China as the country, in the midst of a power crisis, is switching back to older power stations that require oil and coal, while relying less on its more modern natural gas power stations. However, with a critical supply shortage of natural gas and a spike in prices, it has become expensive to use, especially with winter starting in the Northern Hemisphere. After retreating by 3.1% in September, the gold price recorded a turnaround in October – rising 1.5% MoM, although it is still 6.1% down YTD. Iron ore fell by c. 8.4% MoM (-27.9% YTD), while the price of platinum and palladium soared, gaining 5.7% and 4.8% MoM, respectively. YTD, the price of platinum is down 4.7%, while palladium is 18.2% lower.

After two consecutive months of declines, South Africa’s (SA’s) FTSE JSE All Share Index (+5.0% MoM/ +13.6% YTD) followed global markets higher, recording a phenomenal turnaround with mining shares accounting for the bulk of gains. Commodity, platinum group metals (PGMs), and industrial counters were the star performers with the Resi-10 jumping 8.4% MoM (+9.4% YTD) and the Indi-25 rising by 6.7% MoM (+12.3% YTD). However, financial and property counters underperformed, with the SA Listed Property Index down 3.2% MoM (+16.0% YTD) and the Fini-15 losing 4.6% MoM (+15.7% YTD). Highlighting the JSE’s biggest shares by market cap, we note that Naspers and Prosus delivered a good performance in October, with Prosus, the biggest share on the JSE, recording an impressive 11.2% MoM share price jump, while Naspers managed to close 3.9% higher MoM. Among the biggest resources counters on the exchange, BHP Group rose 5.6% MoM, Glencore was up 6.0%, Anglo American Platinum (Amplats) gained 18.3% MoM, and Anglo American jumped 7.9% MoM. Anheuser Busch InBev (the JSE’s third-biggest company) soared 8.1% MoM, while the share prices of British American Tobacco and Richemont rose 0.7% and 20.9% MoM, respectively. The rand closed the month 1.1% weaker against the greenback and on a YTD basis, the local unit has declined by 3.7% against the US dollar.

In local economic data, September annual headline inflation, as measured by the consumer price index (CPI), came in at 5% YoY vs August’s 4.9% print. The increase was again largely driven by the food and non-alcoholic beverages; housing and utilities; and transport categories. Overall, we continue to believe that inflation will generally drift sideways in 4Q21 and 1Q22 and remains well within the SA Reserve Bank’s (SARB’s) target band of 3%-6%. Higher inflation will be closely monitored by the SARB’s Monetary Policy Committee (MPC), particularly with regards to its impact on inflation expectations which, if they rise strongly, may prompt the MPC to start its hiking cycle sooner than expected. September’s trade balance shrank to an R22.24bn surplus with exports decreasing 1.0% MoM and imports rising by 15.9% MoM. Eskom increased rolling blackouts in October, moving to Stage-4 loadshedding in the last week of the month and cutting c. 4,000 megawatts from the national grid as a lack of power continued to impact local businesses and the SA economy.

On the pandemic front, SA continued to experience a decline in daily COVID-19 cases. The latest Department of Health data showed that, as at 31 October, c. 22.4mn vaccines have been administered (vs 17.9mn at 30 September), while the total number of confirmed COVID-19 cases since the start of the pandemic stood at 2.92mn vs 2.90mn as at 30 September.

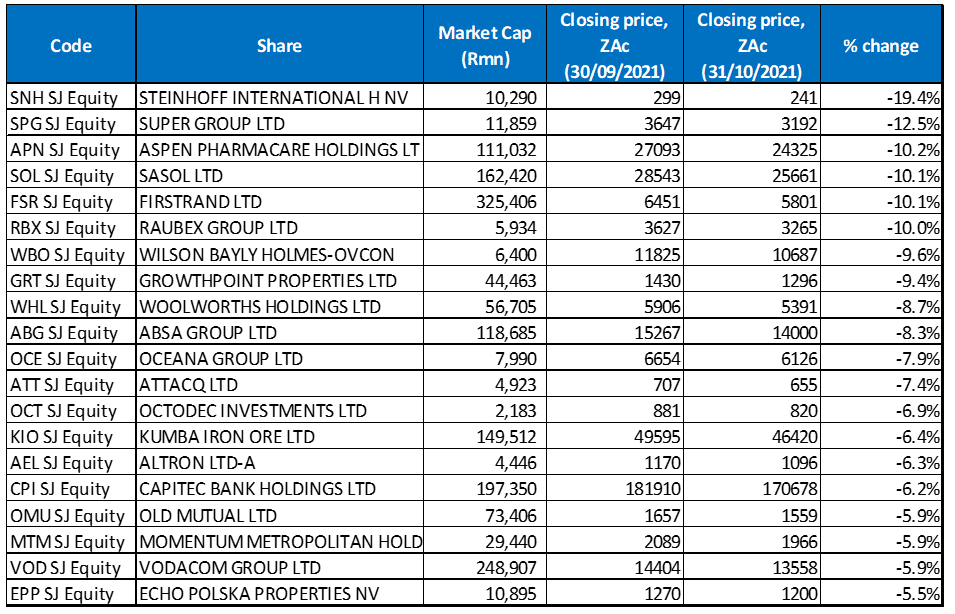

Figure 1: October 2021’s 20 best-performing shares, MoM % change

Source: Anchor, Bloomberg

Local hotel and gaming counters recorded impressive share price gains in October, with Sun International’s share price soaring 64.1% MoM, albeit from a low base, and the counter emerging as October’s best-performing share. These moves come after several key global markets lifted COVID-19 travel restrictions to the country, including the UK which finally removed SA from its red list. This could see an influx of visitors during the summer holiday season, providing a boost to the local tourism industry which has been hard hit by COVID-19 lockdown restrictions. Declining COVID-19 infections resulted in President Cyril Ramaphosa moving the country to adjusted Level-1 of lockdown restrictions on 1 October. Other hospitality counters to benefit from these events included City Lodge Hotels (+37.1% MoM), Tsogo Sun Gaming (+20.3% MoM), and Tsogo Sun Hotels (+14.8% MoM).

In second spot, perennial underperformer, health and wellness Group, Ascendis Health gained 55.6% MoM. In a market update, Ascendis indicated that it has received several unsolicited, non-binding and highly conditional proposals for potential transactions. The firm said that its board of directors will evaluate the proposals as it is obliged to do in terms of its fiduciary duties to the company and its stated objective of unlocking maximum value for shareholders. Shareholders will be updated should there be any further developments. Earlier in the month, the debt-laden firm announced that it had secured majority shareholder approval at its AGM for a recapitalisation plan to get it out of R7.7bn in debt. It was also announced that the Group’s CEO Mark Sardi had resigned with effect from 31 December 2021.

Royal Bafokeng Platinum (RBPlats; +47.6% MoM) was October’s third best-performing share, with its share price surging last week following a takeover bid from Impala Platinum (Implats; +15.3% MoM). Implats said it planned to buy RBPlats in a deal that could create the world’s biggest PGMs producer.

RBPlats was followed by City Lodge Hotels, Long4Life Ltd (+36.2% MoM), African Rainbow Capital Investments (+30.1% MoM), and Famous Brands (+27.0% MoM). Long4Life’s (the owner of retailers such as Sportsman Warehouse, Outdoor Warehouse, Sorbet etc.) share price surged after the Group released interim results for the six months to 31 August and said that it had received an unsolicited offer from a party, which it did not name, to buy all of its shares. Group revenue for the half-year to August was R1.9bn, in line with 2019, and trading profit of R214mn was up 6% vs the same period of 2019. Meanwhile, restaurant Group, Famous Brands recorded a strong 1H21 performance, despite the difficult operating environment. Group revenue rose 50% YoY to R3bn, although this is still 22% down from pre-COVID-19 levels, as SA’s restaurant operators battled with a series of trading restrictions in 2021, including for alcohol.

Rounding out the top-10 performers were financial services Group, PSG Konsult, Accelerate Property Fund, and PPC Ltd with MoM gains of 25.0%, 24.2%, and 21.9% MoM, respectively. In its 1H21 results, PSG Konsult reported that its recurring headline EPS increased by 23% YoY in 1H21 after its three key divisions achieved “market-leading” revenue and growth in earnings. Recurring headline EPS of ZAc30.6 were also 23% above pre-COVID-19 levels due to the strong performances of PSG Wealth, PSG Asset Management and PSG Insure. Finally, local cement producer PPC recorded impressive share price gains after foreign-made cement was prohibited from being used in government projects with effect from 4 November. Local cement producers stand to benefit from around 50 strategic infrastructure projects and 12 special projects that government announced in 2020 as the initial phase of a wide-ranging infrastructure spending programme to aid post-pandemic recovery efforts.

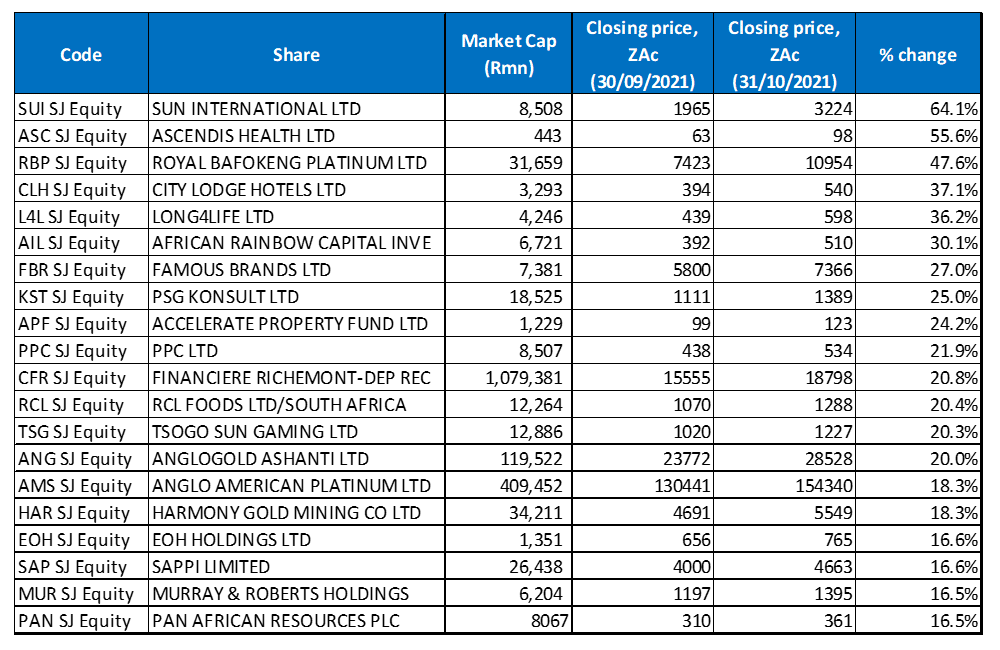

Figure 2: October 2021’s 20 worst-performing shares, MoM % change

Source: Anchor, Bloomberg

Large-cap stocks geared to the domestic economy generally had a poor month with financial counters down 4.6% MoM and most of the discretionary retailers having a difficult time as Eskom again introduced loadshedding in October. Steinhoff International was October’s worst-performing share, down 19.4% MoM. Last month, the Constitutional Court refused Steinhoff’s application for leave to appeal a Western Cape High Court ruling that found it has jurisdiction to hear a liquidation case against the retailer. The application was brought by the former owners of shoe retailer Tekkie Town, who say that Steinhoff’s former CEO Markus Jooste “duped” them into selling their business. On a separate note, the Western Cape High Court is only expected to hear a separate application by Steinhoff to approve its c. R25bn settlement plan in January 2022 – a three-month delay which has weighed on the Group’s share price.

Steinhoff was followed by Super Group (-12.5% MoM), with Aspen Pharmacare in third place with a 10.2% MoM loss. In September, Aspen’s share price rallied by 38.2% MoM, but it took a breather in October. Business Day reports that Aspen is currently in talks with Johnson & Johnson (J&J) for a voluntary licence for the J&J vaccine, which would give Aspen distribution rights in Africa, and to manufacture the active pharmaceutical ingredients used in the jab.

Sasol, despite the stronger oil price, and FirstRand were both down 10.1% MoM. In a production update. Sasol said that it recorded a 44% YoY rise in first-quarter revenue in its main chemicals business on the back of higher chemical and crude oil prices, however, sales by volume fell 8% YoY. Sasol also indicated that its mining production decreased from 8.90mn tons in 4Q21 to 8.30mn tons, while its gas production were 29.1bcf vs 29.0bcf in 4Q21.

Construction firms, Raubex Group and Wilson Bayly Holmes-Ovcon (WBHO) recorded MoM declines of 10.0% and 9.6% MoM, respectively. Last month, Raubex released an updated 1H22 trading statement saying that it expects 1H22 headline EPS to be between ZAc131.9 and ZAc140.6, which represents a c. 125%-140% YoY increase on that achieved in the pre-Covid pandemic comparative period. Raubex’s Road & earthworks division seems to be recovering following new contract awards from SANRAL after a two- to three-year hiatus.

Rounding out the bottom-10 MoM performers were Growthpoint Properties, which was down 9.4%, followed by Woolworths Holdings and ABSA Group with MoM losses of 8.7% and 8.3%, respectively.

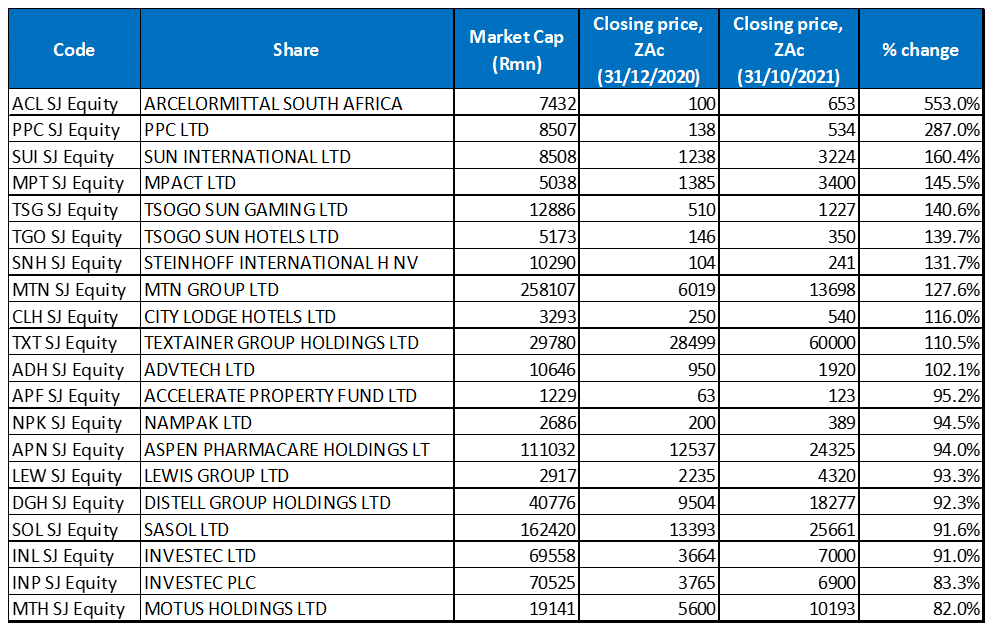

Figure 3: Top-20 October 2021, YTD

Source: Anchor, Bloomberg

Seventeen out of October’s top-20, YTD best-performing shares were unchanged from those in the year to end September, with Sun International (+160.4% YTD), City Lodge Hotels (+116.0% YTD), and Accelerate Property Fund (+95.2% YTD) replacing Arrowhead Properties, Raubex, and Invicta in October.

After gaining a further 5.5% MoM in October, Arcelor Mittal SA (+553.0% YTD) remained by far the best-performing share YTD. Earlier this year, Arcelor Mittal reported its strongest interim results (1H21) in nearly 10 years amid a c. 80% rise in the average international dollar price of steel. The company posted a headline profit of R2.5bn after recording a R2.6bn loss in 1H20, while revenue surged 55% YoY to R18.59bn due to a 10% rise in total steel sales volumes and a 42% rise in net realised steel sales prices.

Arcelor Mittal was once again followed by PPC (+287% YTD) in second spot, after the latter’s sterling performance in October. However, Steinhoff (+131.7% YTD) was bumped from its third spot in the year to end September, to seventh position, replaced by Sun International, a newcomer in third spot, with a YTD gain of 160.4%. Sun, discussed earlier, recorded an impressive 64.1% MoM share price jump as locally listed hospitality stocks (including Tsogo Sun Gaming, Tsogo Sun Hotels, and City Lodge Hotels) rallied as the UK opened its borders to travel to and from SA and declining COVID-19 infections left hotel groups with better business prospects.

Sun International was followed by SA’s largest paper and plastics packaging and recycling business, MPact (+145.5% YTD), Tsogo Sun Gaming (+140.6% YTD), and Tsogo Sun Hotels (+139.7% YTD). Then came the aforementioned Steinhoff, MTN Group (+127.6%), new entrant, City Lodge Hotels (+116.0% YTD), with Textainer (+110.5% YTD) closely behind it and rounding out the top-10 performers YTD.

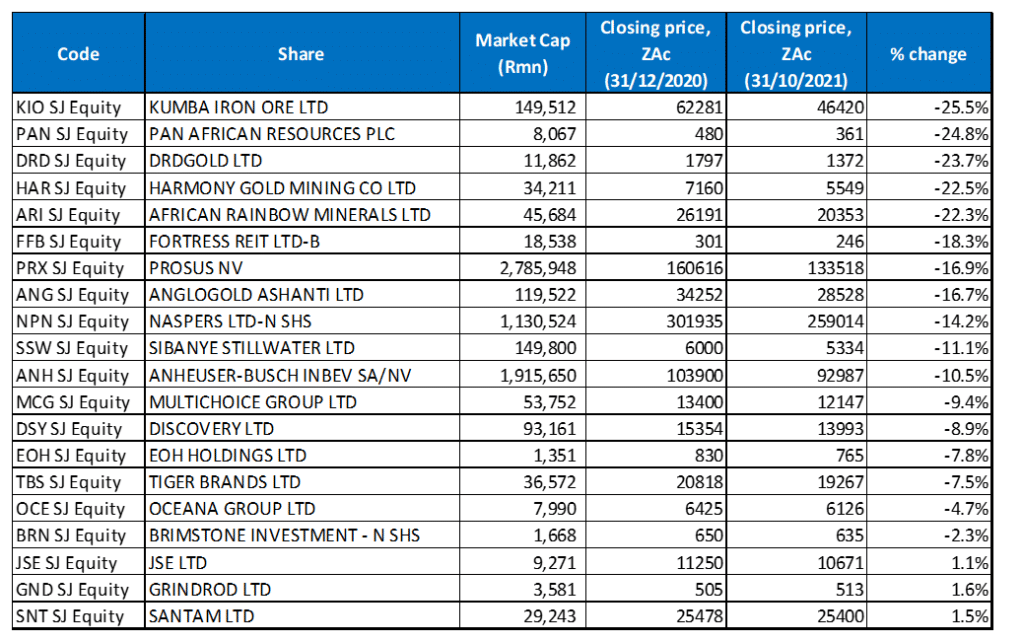

Figure 4: Bottom-20 October 2021, YTD

Source: Anchor, Bloomberg

Looking at the YTD worst performers, 16 of the 20 worst-performing shares for the year to end September again featured among the 20 worst performers for the year to end October. Newcomers in the YTD worst-performing category were Oceana Group (-4.7% YTD), Brimstone Investments -N- (-2.3% YTD), JSE Ltd (+1.15 YTD), and Santam Ltd (+1.5% YTD), which bumped Ascendis Health, African Rainbow Capital Investments, Gold Fields and Implats out of the October YTD worst-performers list.

Kumba Iron Ore (-25.5% YTD) took back the title of the worst-performing share YTD after giving it up to Pan African Resources (-24.8% YTD) in the year to end September. Pan African Resources moved to second place after gaining 16.5% last month. In October, Kumba highlighted concerns about Transnet’s rail and port challenges, which resulted in the company’s production guidance being lower. Kumba said that it expected its full-year production and sales to be at the lower end of its previous guidance due to Transnet’s rail and port logistics performing below planned levels. The iron ore producer also said that it would limit production in the coming months to end the year at the low-end of its production guidance (40.5mn tons) due to higher stock levels at its mines.

Gold tailings retreatment specialist, DRDGold (-23.7% YTD and the third worst-performing share YTD), said last month that higher sales volumes helped to offset pressure from increased electricity and labour costs in its first quarter ending September, when core profit rose 16% QoQ. Its gold production rose 7% QoQ to 1,449kg, primarily due to an 8% increase in yield, with EBITDA growing by 16% YoY to R350.8mn.

DRDGold was followed by Harmony (-22.5% YTD), African Rainbow Minerals (-22.3% YTD) and Fortress REIT Ltd -B- (-18.3% YTD). Despite gaining 11.2% in October as it followed Chinese tech counters higher, Prosus remained 16.9% in the red YTD, after a tough first nine months of the year.

Rounding out the ten worst-performing shares YTD, were AngloGold Ashanti, Naspers, and Sibanye Stillwater with YTD losses of 16.7%, 14.2%, and 11.1%, respectively. While Sibanye gained 14.7% MoM in October, it was not enough to push it out of the yTD worst-performers list. In a 3Q21 operational update, Sibanye said that mined 2E PGM production for 3Q21 was 2.0% lower YoY, while production from the Stillwater operation was also 2.0% lower vs 3Q20, primarily due to reduced heading availability in key production stopes constrained by rail restrictions and resulting in the mining of lower grade areas. Its SA PGM operations continued to perform strongly in 3Q21 with 4E PGM production (excluding third-party purchase of concentrate [PoC]) 20.0% higher YoY. Sibanye also said last month that it had successfully completed its $70.0mn strategic investment in Australian-based lithium-boron supplier, ioneer Ltd.