Most major world markets closed May higher, although gains for some indices were modest. This as buying interest remained somewhat subdued on concerns over inflation and the pace of the global economic recovery continued to weigh on sentiment. Still, for the most part, this past month also saw optimism around the US economic recovery (as well as some strong US economic data) and the prospect of further stimulus measures as investors closely watched negotiations in Washington. Last week, Senate Republicans unveiled a US$928bn infrastructure counteroffer, well-below US President Joe Biden’s most recent proposal of a US$1.7trn infrastructure spending package aimed at further bolstering the US economic recovery.

Two of the major US indices closed May in the green, with the blue-chip S&P 500 notching up its fourth-straight month of gains (up 0.5% MoM and 11.9% YTD) and coming within a whisker of an all-time high on Friday (28 May), while the Dow Jones rose 1.9% MoM (+12.8% YTD). The tech-heavy Nasdaq (-1.5% MoM; +6.7% YTD) underperformed major equity benchmarks, ending a six-month positive run and recording its first MoM decline since October 2020, despite the index gaining 2.1% last week, according to CNBC.

On the US economic front, data released on Thursday (27 May), showed that the US jobs market was getting closer to pre-pandemic levels, as first-time jobless claims totaled 406,000 for the week ended 22 May – still significantly above the pre-COVID-19 norm but a drop from the prior week’s 444,000 and a new pandemic low according to the US Labor Department. US 1Q21 GDP grew an annualised 6.4% – matching the initial estimate and quite a bit higher than 4Q20’s 4.3% GDP growth. April core personal consumption expenditure (PCE) inflation advanced 0.7% MoM, while YoY core PCE (the Federal Reserve’s preferred inflation gauge) jumped by a higher-than-expected 3.1% vs March’s 1.9% YoY gain (and consensus expectations of a 2.9% rise). After reaching a pandemic high print of 88.3 in April, The University of Michigan’s consumer sentiment index dropped to 82.8 in May – the lowest reading since February. This as confidence in the US economy declined, likely brought about by higher living costs and as the euphoria around, and momentum from, the economy reopening starts to wane. April US payrolls data released in May was the biggest miss in the series’ history coming in c. 750,000 – lower-than-expected and showing a weak 266,000 gain.

Elsewhere, optimism around Europe’s economic recovery prospects continued to drive markets higher with the region’s largest economy, Germany’s DAX rising 1.9% MoM (+12.4% YTD), while the eurozone’s second-biggest economy, France saw its CAC Index end May 2.8% higher (+16.1% YTD). In terms of economic data, May eurozone economic sentiment climbed more than expected (to a three-year high), as the European Commission’s index rose to 114.5 points vs 110.5 in April. However, France’s initial stronger-than-expected 1Q21 GDP growth print of 0.4% was revised lower in May, with the country’s economy contracting 0.1% in 1Q21, according to final data released on 28 May, and sliding into a technical recession.

The UK’s FTSE 100 Index gained 0.8% MoM (+8.7% YTD), while the UK economy recorded a GDP decline of 1.5% in 1Q21 (when the country was under a third lockdown) – slightly better than initially feared. The Bank of England said in May that the UK economy was on course to grow by c. 5% in 2Q21 as the country moves forward with Europe’s fastest vaccination programme and if COVID-19 restrictions are lifted. Unfortunately, Prime Minister Boris Johnson last week warned that a full lifting of restrictions on 21 June may have to be postponed as cases of the COVID-19 variant first detected in India doubled over the past week.

In Asia, Chinese markets recorded good performances as Hong Kong’s Hang Seng Index gained 1.5% MoM (+7.1% YTD), while the Shanghai Composite Index jumped by an impressive 4.9% MoM (+4.1% YTD). In terms of economic data, China’s official May manufacturing purchasing managers’ index (PMI) contracted slightly to 51.0 (a three-month low) vs April (51.1) and Reuters consensus analyst expectations of 51.1. The 50-point mark separates expansion from contraction. However, services PMI rose to 55.2 in May from April’s 54.9 print – a fourteenth-straight month of growth. Japan’s Nikkei closed the month 0.2% up (+5.2% YTD), while the total value of the country’s April retail sales fell by a seasonally adjusted 4.5% MoM, missing consensus expectations of a 2% MoM gain. YoY, retail sales jumped 12.0% (off a low base), but again missed consensus expectations of a 15.3% YoY gain.

On the commodity front, oil prices (+3.1% MoM/+33.8% YTD) firmed in May gaining c. 5% in the last week of the month alone and reaching two-year highs (close to the US$70/bbl level) on the back of expectations of a rebound in global oil demand. Gold rose 7.8% MoM (+0.4% YTD), as concerns around global inflation, a weaker US dollar, and extreme volatility in cryptocurrencies buoyed the yellow metal, which last week scaled five-month highs. A rally in the iron ore price this year (+78.4% YTD) has been compounded by tight supply from Brazil and Australia and rising steel demand, especially from China, amid a global building boom funded by worldwide infrastructure spending. MoM, iron ore rose 13.6%, supported by increasing billet prices in China and a potential easing of steelmaking restrictions in Tangshan, the largest steel manufacturing hub in the world, accounting for c. 14% and 8% of China and the world’s total crude steel production, respectively. Palladium, which is used in catalytic converters to curb emissions by petrol-powered vehicles, was down 3.8% MoM after hitting an all-time high in April and the platinum price closed May c. 1% lower MoM.

On the JSE, South Africa’s (SA’s) FTSE JSE All Share Index rose for a seventh-straight month, posting an impressive 1.5% gain for May, with financials doing most of the heavy lifting (the Fini-15 jumped 9.0% MoM and is now up 11.6% YTD), along with gold counters, and retailers. YTD, the local bourse has given investors a double-digit return having soared 14.4%. Among the sub-indices, the Resi fell 1.4% MoM (+17.5% YTD) and the Indi-25 eked out a 0.9% MoM gain (+11.5% YTD). Looking at the top-20 shares by market cap, Gold Fields (+26.5% MoM) was an outperformer, followed by AngloGold Ashanti (+13.4% MoM), Standard Bank (+15.0% MoM), Capitec (+12.1% MoM), Richemont (+11.1% MoM), FirstRand (+9.8% MoM), MTN Group (+8.5% MoM), and Glencore (+8.4% MoM). The rand put in an impressive performance, strengthening 5.2% MoM (+6.5% YTD) as a confluence of factors supported the local unit including the weaker-than-expected US job numbers in May, which fuelled a bout of US dollar weakness, the rand’s excessive sell-off through the COVID-19 crisis last year, and stronger commodity prices on the back of global demand being driven by the ongoing economic recovery from the pandemic.

In local economic and related news, at its May meeting the SA Reserve Bank’s (SARB) Monetary Policy Committee (MPC) unanimously decided to keep rates at 3.5%, as was widely expected. However, the SARB’s 2021 GDP forecast was revised higher to 4.2% YoY (from 3.8% in March). This stronger growth forecast for 2021 is reflective of better sectoral growth performances and more robust terms of trade in 1Q21. However, the SARB highlighted that slow progress on vaccinations, limited energy supply, and policy uncertainty continue to pose downside risks to growth. In a move that should assist in calming market concerns around inflation, the SARB’s forecast for 2021 CPI is slightly lower at 4.2% (down from 4.3%) and for 2022 and 2023 unchanged at 4.4% and 4.5%, respectively. April‘s annual headline inflation, as measured by the consumer price index (CPI), jumped to 4.4% vs 3.2% in March. This was largely due to a combination of higher fuel prices in the month and base effects created by price imputations during 2020. Whilst this is the highest inflation reading since before the COVID-19 induced lockdown (inflation was at 4.6% in February 2020), we note that inflation remains well within the SARB’s 3%-6% target band. Seasonally adjusted March retail sales decreased 3.7% MoM, following a 6.9% MoM rise in February and a 2.3% MoM decline in January 2021. The print came in against expectations of a marginal increase, reflective of the underlying weakness currently being experienced across SA households. April’s trade balance recorded a better-than-expected surplus of R51bn vs March’s revised R52.5bn surplus, while exports decreased 3.9% MoM to R161bn and imports declined 4.6% MoM to R110bn.

On the pandemic front, in an address to the nation on 30 May, President Cyril Ramaphosa announced that SA would reimpose stricter COVID-19 measures (effective 31 May) in light of the third wave of the pandemic having already impacted four of the country’s nine provinces. The restrictions include limiting the number of people allowed at public gatherings, funerals etc. and non-essential businesses (restaurants, bars, etc.) having to close by 10PM with a curfew now starting at 11PM and ending at 4AM. The latest Department of Health data show that at 31 May, total confirmed COVID-19 cases stood at 1.67mn vs end-April’s 1.58mn. Thus far only c. 968,319 people have been vaccinated (although the vaccination drive does seem to have gained some traction over the past few weeks).

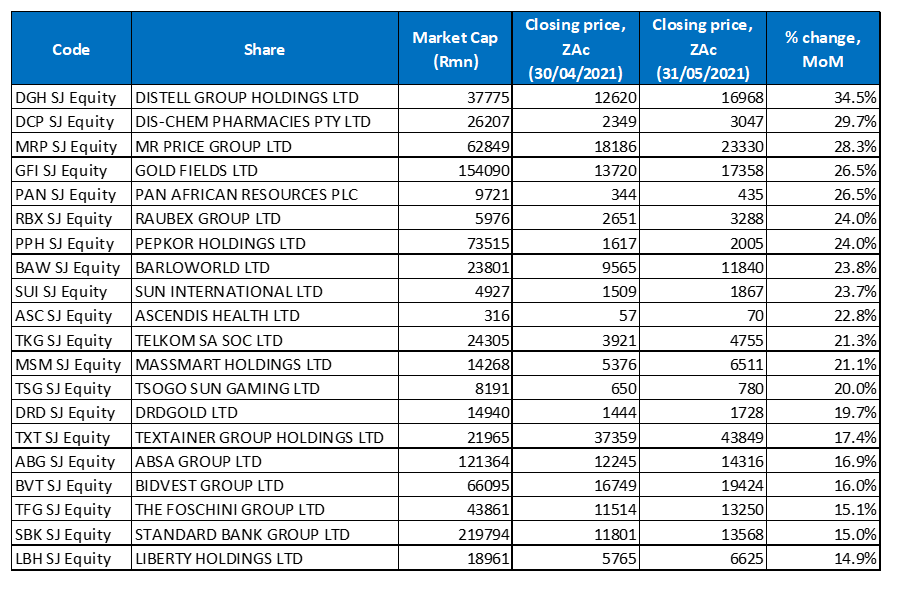

Figure 1: May 2021’s 20 best-performing shares, MoM % change

Source: Anchor, Bloomberg

Distell Group Holdings was May’s best-performing share, rising 34.5% MoM after Dutch brewer, Heineken NV confirmed that it was in talks with Distell about acquiring the majority of its business. Distell makes wines and spirits and is the world’s second-largest cider maker, a segment of the market in which Heineken is heavily involved. Discussions are reportedly ongoing with no certainty that a deal will be reached.

Distell was followed by Dis-Chem Pharmacies in second place, with a MoM share price gain of 29.7%. Dis-Chem reported a solid 11.8% YoY rise in its FY21 headline earnings per share (HEPS) and reinstated its dividend, despite the company’s FY21 coinciding with the COVID-19 outbreak. The Group said it suffered direct pandemic-related costs of R56.6mn in the year to end February 2021, even though its pharmacies remained open as an essential services provider during the hard lockdown.

In third place, Mr Price Group (+28.3% MoM) reported solid FY21 results for the 53 weeks ended 3 April 2021, beating consensus analyst expectations across most metrics and announcing a bumper full-year dividend. The Group’s operational performance was driven by market share gains and a stronger second-half performance. Following the results release, the share closed the day c. 11.7% higher with the share price gains likely driven by the solid result and its newly outlined strategy, which was positively received by the market.

Mr Price was followed by gold companies, Gold Fields, and Pan African Resources, which were both up 26.5% MoM. Pan African, a mid-tier gold producer listed in London and on the JSE, saw its share price buoyed on 21 May after announcing it had reprioritised its capital programme after a study confirmed promising prospects for two tailings projects owned by Mintails Mining, which Pan African agreed to acquire in November 2020 for up to R50mn (after the assets were placed in provisional liquidation in 2018). Pan African noted that an independent fatal flaw and subsequent concept study into these assets had been positive.

Construction Group Raubex recorded a 24.0% MoM jump in its share price as did Pepkor Holdings, while Barloworld shares rose by 23.8% MoM. Raubex released FY21 results on 10 May, with the results a tale of two halves as its operations were severely impacted by COVID-19 restrictions across all its segments during 1H21 (the six months ended 31 August 2020). However, in 2H21, its operations recovered well and some segments even reverted to normalised levels of operational efficiency, which we expect to continue into FY22. From the results presentation we highlight the Group’s outstanding order book growth, and we expect a better margin performance from Raubex within the next 2-3 years as the SA construction sector gathers momentum. Retailer Pepkor, meanwhile, posted a 50.8% YoY jump in its half-year HEPS from continuing operations, which rose to ZAc68.8 from ZAc45.6 in 1H20. Its revenue grew 8.1% YoY to R36.5bn, driven by a strong operational performance and a reduction in net debt. In its 1H21 results, Barloworld revealed that its revenue advanced 6.5% YoY to R28.6bn, while HEPS leapt to ZAc367, vs ZAc70 in 1H20. Barloworld also resumed dividend payments and returned a special dividend of ZAc200/share to shareholders.

Rounding out last month’s ten best-performing shares were Sun International and Ascendis Health with MoM gains of 23.7% and 22.8%, respectively. In mid-May, Ascendis reached agreement with lenders for the restructuring and recapitalisation with its creditors for the settlement of its outstanding debt of c. R7.6bn. CEO Mark Sardi described the agreement with lenders as “… the best outcome for all stakeholders, given the company’s unsustainable debt levels,”. The proposed agreement still requires 75% of Ascendis shareholders’ approval.

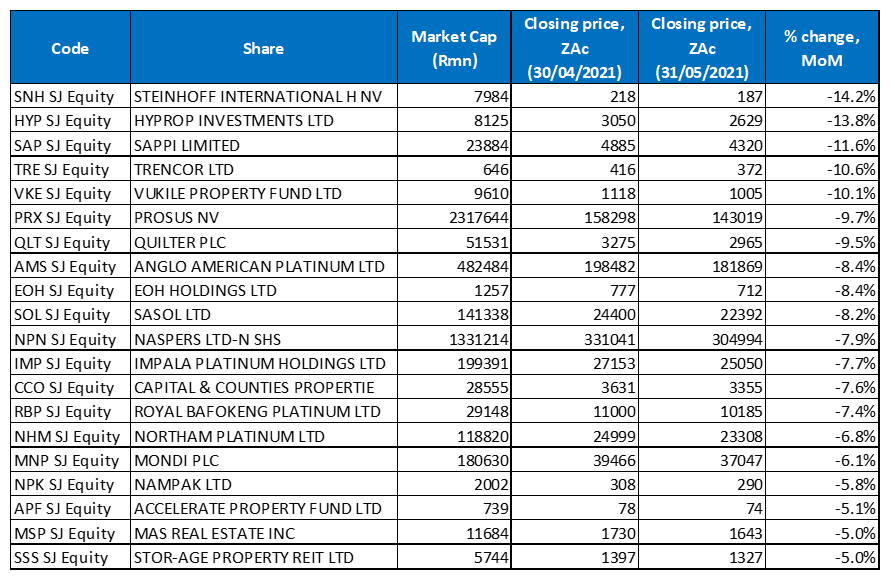

Figure 2: May 2021’s 20 worst-performing shares, MoM % change

Source: Anchor, Bloomberg

Steinhoff International (-14.2% MoM) was May’s worst-performing share. Early last month, Steinhoff shareholders once again rejected some of the resolutions during the company’s annual general meeting – voting against three of the five resolutions.

May’s second-worst performing share was Hyprop (down 13.8% MoM). The pressure on its share price was likely due to a combination of factors including the bookbuild and the proposed Ikeja disposal, which is at risk of not going through. Hyprop was quite reliant on the Ikeja deal to reduce its US dollar-denominated debt and as a way for it to exit its investment in sub-Saharan Africa.

In third spot, Sappi’s share price (-11.6% MoM) fell after it reported 1H21 results on 7 May, with the Group posting a US$40mn (R570mn) half-year loss vs a profit in 1H20. Sales declined 6% YoY to US$2.44bn and EBITDA fell 22% YoY to US$210mn although Sappi’s 2Q21 EBITDA had improved by 14% QoQ, boosted by the performance of its packaging and specialities segment as well its dissolving wood pulp business. Sappi’s leverage is currently high and exacerbated by the decline in EBITDA (-22% YoY). It has received waivers for its net debt/EBITDA covenant until December 2021 and the dividend remains suspended.

Sappi was followed by Trencor (-10.6% MoM), Vukile Property Fund (-10.1% MoM), and Prosus (-9.7% MoM). Vukile released a trading statement in May saying that it expected its FY21 DPS to be between ZAc99.5 and ZAc102.6, which is between 20.5% and 22.9% lower YoY. There was mixed market reaction and investors were generally underwhelmed following the news that Prosus intends to acquire more of Naspers in a share swap scheme later this year. Added to that the continued general unhappiness with regulatory issues, disappointment with the announced increased investment and “social spend” revealed in Tencent’s results, and a strengthening rand and you have quite a negative cocktail for both Prosus (and Naspers’) share prices.

Rounding out the 10 worst-performing shares were Quilter (-9.5% MoM), Anglo American Platinum (Amplats; -8.4% MoM), EOH Holdings (-8.4% MoM), and Sasol (-8.2% MoM). The weaker platinum price weighed on Amplats, while troubled technology Group, EOH said in May that it stands behind the DA’s decision to take legal action against previous management at the company implicated in underhanded dealings with government. EOH has been working to regain its reputation following a corporate governance scandal. Last month, Sasol agreed to sell a 30% stake in its natural-gas pipeline running from Mozambique to SA to pay down debt. There will be an initial payment of R4.145bn, with the deal including a deferred payment of R1bn if certain conditions are met by June 2024.

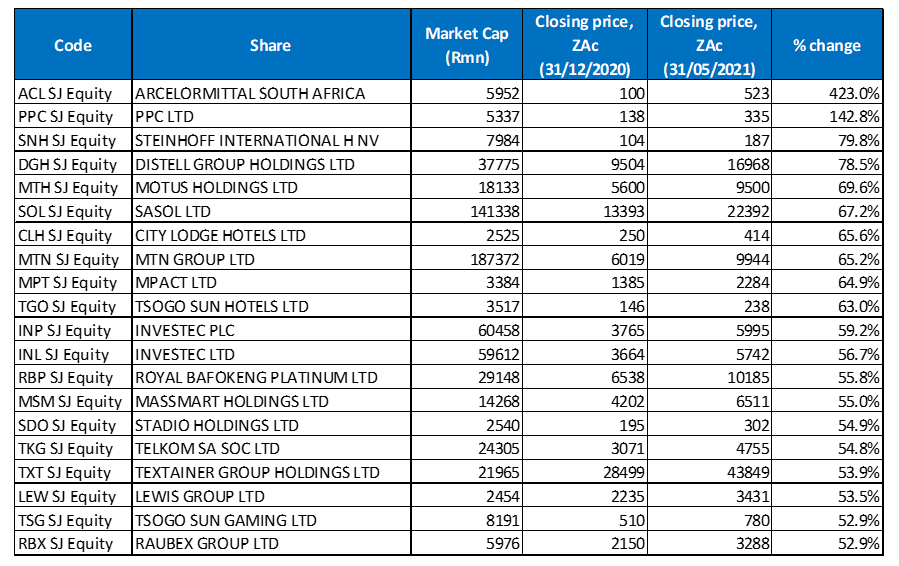

Figure 3: Top-20 May 2021, YTD

Source: Anchor, Bloomberg

Seven of May’s top-10 YTD best-performing shares were unchanged from April, with the new entrants among the top-10 being Distell (+78.5% YTD), following its stellar performance in May, which we discussed earlier, MTN Group (+65.2% YTD), and Tsogo Sun Hotels (+63.0% YTD). ArcelorMittal SA (Amsa; +423.0% YTD) again took the top spot, after gaining a further 13.0% in May. The company said on 31 May that, following a raft of challenges, all its operations were now back up and running, allowing SA’s primary steelmaker to meet national demand for steel for the first time in months. The higher iron ore price (+13.6% MoM and a c. 78% jump YTD) has also buoyed the share price.

PPC (+142.8% YTD) remained in second position after gaining another 12.0% in May, while third place once again went to Steinhoff International (+79.8% YTD), despite its 14.2% share price wobble in May. As part of its restructuring, PPC last month sold its PPC Lime business for R515mn in a transaction that will help ease its debt burden, making the prospects of a rights issue less likely. PPC said that its lenders have agreed to review the need for a minimum R750mn capital raise, if the Group’s SA operations continue to make progress with reducing debt.

Distell’s 34.5% MoM gain last month saw it move up to fourth position in the rankings and YTD, its share price has now risen by 78.5%. Motus Holdings (+69.6% YTD), one of SA’s four major listed motor vehicle retailers, was in fifth spot after the share gained a further 4.2% in May. Sasol came in sixth, despite May’s 8.2% share price decline.

Meanwhile, City Lodge gave back 3.7% of its 12.3% MoM gain in April resulting in the share moving down from fifth best-performer YTD in April to seventh spot in the year to end May, while MTN (+65.2% YTD) moved up to eighth spot (from thirteenth in April) after its share price jumped 8.5% last month. This after the mobile operator posted strong 1Q21 growth with its services revenue exceeding its own guidance, driven by gains in data and fintech revenue. There was strong demand for data because of work-from-home users, resulting in MTN’s mobile data revenue growing 18.5% YoY. The Group’s service revenue rose 17.8% YoY, and MTN SA’s service revenue rose 11.8% YoY.

Rounding out the top-10 YTD performers were Mpact (+64.9% YTD), and the country’s largest hotel operator, Tsogo Sun Hotels (+63.0% YTD). Last week, Tsogo Sun Hotels reported a FY21 revenue plunge of c. R3.3bn, resulting in an operating loss of R177mn. It also saw its overall hotel occupancies plummet to a record low of just 12% for the financial year, largely due to pandemic-induced government restrictions on travel, events, hotel operations etc.

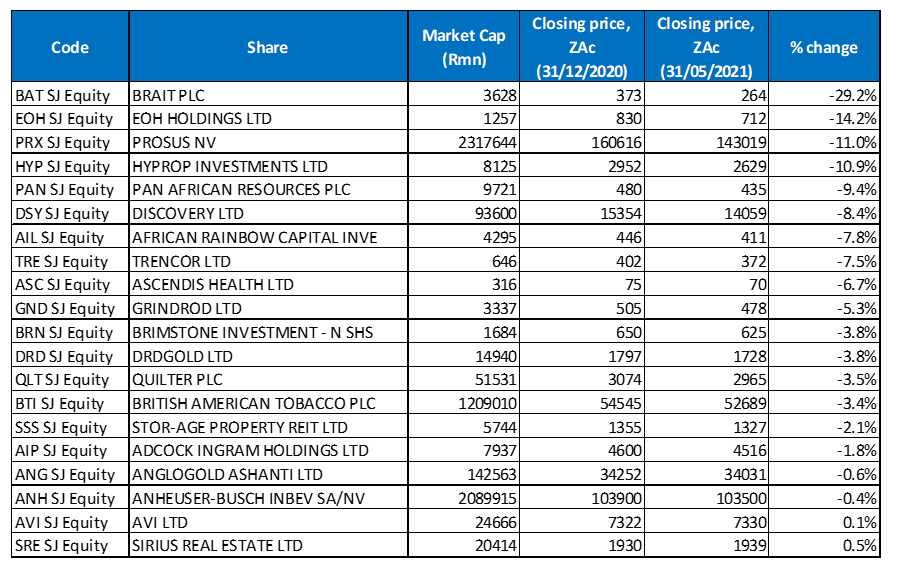

Figure 4: Bottom-20 May 2021, YTD

Source: Anchor, Bloomberg

Looking at the YTD worst performers, five of the ten-worst performing counters for the year to end April, again featured among the 10 worst performers for the year to end May. Investment Group, Brait (-29.2%) was the worst-performing share YTD for a second month running but Pan African Resources (-9.4% YTD) was bumped from second spot by EOH Holdings (-14.2% YTD and discussed earlier) after Pan African posted a 26.5% MoM gain in May. Meanwhile, April’s third worst-performing share, Ascendis Health, came in ninth with a YTD decline of 6.7% after the share gained 22.8% in May (discussed earlier). Prosus (-11.0% YTD, discussed earlier) took over Ascendis’ third worst-performing share YTD spot.

Gold counters such as DRDGold (-3.8% YTD), AngloGold Ashanti (-0.6% YTD), and Harmony (+3.4% YTD), which featured prominently among April’s YTD worst performers, recorded such robust gains in May that these counters all moved out of the top-10 list of worst performers YTD. A strong gold price (up 7.8% MoM) buoyed their share prices, with Harmony’s 12% share price gain in May pushing the share price 3.4% higher YTD.

Hyprop Investments (-10.9% YTD), Pan African Resources (-9.4% YTD), Discovery (-8.45 YTD), and African Rainbow Capital Investments (ARC; -7.8%YTD) followed Prosus, with Trencor (-7.5% YTD), Ascendis (-6.7% YTD), and Grindrod (-5.3% YTD), rounding out the 10 worst-performing shares YTD.