Generative artificial intelligence (GenAI), a subset of AI, can create original content, such as chat responses, images, text, music or even videos, similar to what a human might produce. Predicting which companies will be the losers due to this new technology is much easier than predicting the long-term winners. In 2005, it was much easier to expect that Google Maps would hurt physical maps than to predict that a company like Uber would emerge because of Google Maps. Similarly, it is easier for us to say today who the immediate losers of GenAI are than it is for us to predict long-range future use cases of the technology. This article examines how some major technology incumbents have fared so far.

| I’ve always said the easier thing to do is figure out who loses. And what you really should have done in 1905 or so, when you saw what was going to happen with the auto, is you should have gone short horses. There were 20 million horses in 1900 and there’s about 4 million horses now. So it’s easy to figure out the losers, you know the loser is the horse. – Warren Buffett |

Thus far, Intel has been a prominent loser of the initial GenAI era. To be clear, Intel’s decline started well before the introduction of GenAI. When Apple was preparing its first iPhone, Intel turned down Steve Jobs’ approach to manufacture chips for the iPhone. ARM Holdings would eventually dominate the mobile market with a 99% market share. Delays in Intel’s 10 nanometre (nm) and 7nm process technologies also gave competitors using Taiwan Semiconductor Company (TSMC) a competitive advantage.

The rise of GenAI put massive pressure on Intel’s data centre business, one of its cash cows. This happened simultaneously as Intel made a very capital-intensive push to be a foundry. Foundries like TSMC manufacture chips based on their customers’ (Nvidia, Qualcomm, Broadcom, etc.) designs.

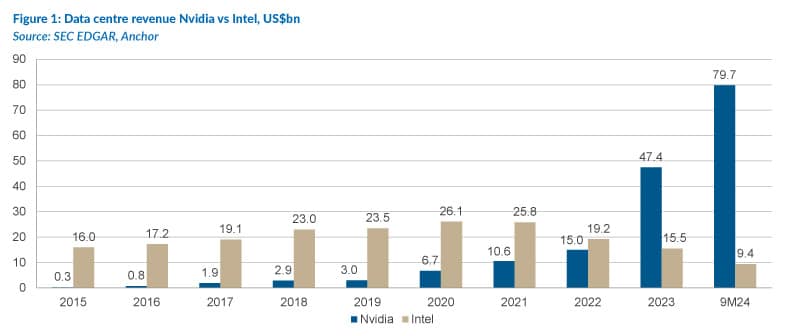

Still, the decline in the scale and speed of Intel’s data centre business is staggering. In 2020, Intel’s data centre business was four times the size of Nvidia’s. Today, Nvidia’s is eight times the size of Intel’s. Intel had a US$20bn revenue lead over Nvidia in 2020. In 2024, Nvidia generated US$70bn more data centre revenue than Intel.

As Nvidia CEO Jensen Huang explains below, the explosion in GenAI has driven data centre capex away from central processing units (CPUs), which Intel has dominated, towards graphics processing units (GPUs), which Nvidia dominates.

| “The world is moving from general purpose computing to accelerated computing. And the world builds about $1 trillion dollars’ worth of data centers — $1 trillion dollars’ worth of data centers in a few years will be all accelerated computing. In the past, no GPUs [were] in data centers, just CPUs. In the future, every single data center will have GPUs. And the reason for that is very clear. It’s because we need to accelerate workloads so that we can continue to be sustainable, continue to drive down the cost of computing so that when we do more computing — we don’t experience computing inflation.Second, we need GPUs for a new computing model called generative AI that we can all acknowledge is going to be quite transformative to the future of computing. And so I think working backwards, the way to think about that is the next trillion dollars of the world’s infrastructure will clearly be different than the last trillion, and it will be vastly accelerated.” – Jensen Huang (Nvidia CEO) |

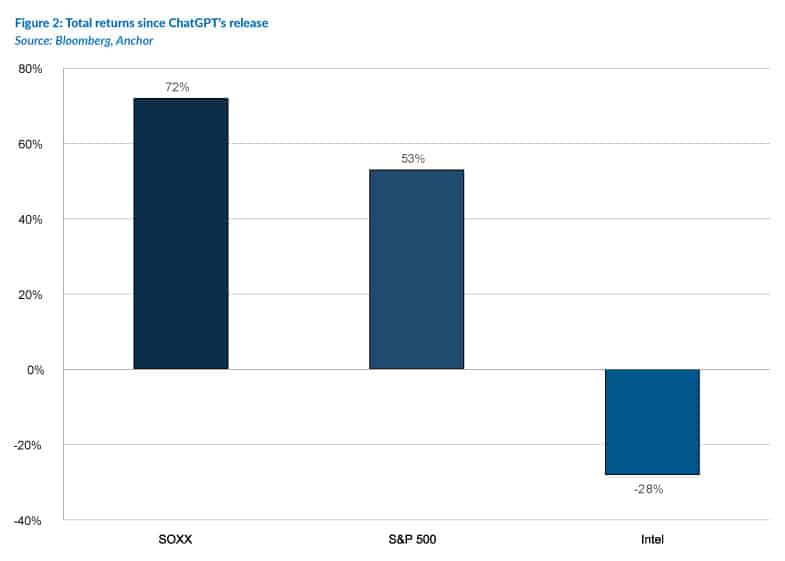

Intel’s stock has declined 28% on a total return basis since 30 November 2022 (when ChatGPT was first released). Its peers, as measured by the SOXX Index (the iShares Semiconductor ETF, which tracks the investment results of an index composed of US-listed equities in the semiconductor sector), are up 70% over the same period.

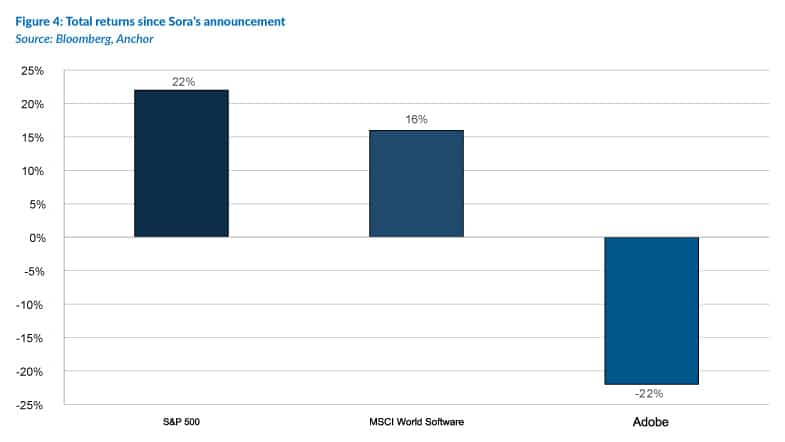

Adobe’s stock price has been under pressure since OpenAI announced its text-to-video model, Sora, on 15 February 2024. The model allows users to generate high-quality video by merely typing in text prompts describing the video. Adobe’s Creative Cloud product is the gold standard for creative professionals. It includes products like Photoshop, After Effects and Premiere Pro. These products are indispensable to graphic designers, video editors, animators and other creative professionals. OpenAI’s Sora model, and different models like it, do not have anything close to the comprehensiveness of Creative Cloud’s features. At times, the videos produced by the models do not follow the laws of physics. Other apparent errors occur. Still, these Gen AI models are the first real challengers that Adobe has come across—part of the reason is that these models represent a new workflow for creative professionals.

Adobe released its FY24 results on 11 December 2024, and the company’s share price declined by 14% following the release of the results. While the actual FY24 results were satisfactory, Adobe’s guidance of 8.9% YoY revenue growth in FY25 raised questions about the impact of competition.

Adobe argues that text-to-video models will increase demand for its video editing applications.

| Big picture, though, video I think will be even more of an accelerant for editing applications. I think this notion that the next Oppenheimer will be done using a text-to-video prompt is just — it’s not going to happen for decades. And so I think actually more so in video, there’s going to be an accelerant for people saying how do I get an on-ramp as it relates to using text to video and then edit that using our applications. And so I think I’m really particularly excited about what we can do with premiere as well as with After Effects as it relates to video. – Shantanu Narayen (Adobe CEO) |

The company has a vast installed base, and switching costs to competitive traditional products remain high. That said, Gen AI models represent the first real challengers to Adobe’s dominance.

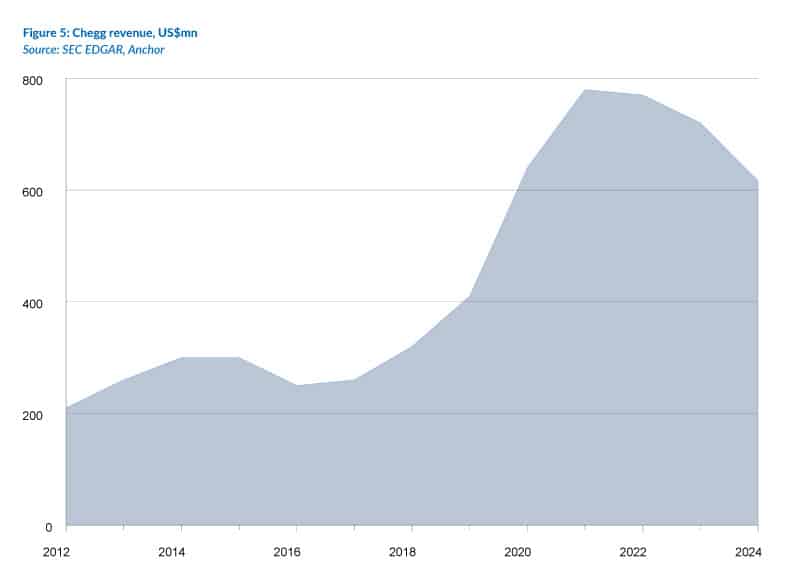

Educational technology (Edtech) players have also been negatively impacted by the introduction of GenAI. Education is a natural use-case for large language models (LLMs) like ChatGPT. Users can go as deep down a rabbit hole on a topic as they want to. GenAI offers the user a teacher with infinite time, patience and endless ways to explain a concept to the user. Yes, it could be better. There are still hallucinations (instances where the LLM presents factually incorrect information as if it is true). However, it is a model that looks very competitive compared to some incumbent EdTech players. Chegg and its peers offer users features like learner support, textbook solutions, writing tools (plagiarism, grammar checks, etc.) and step-by-step math assistance. A Chegg subscription starts at US$14.95/month. In contrast, students can use LLMs for free or pay and get access to a model that does a lot more than educate.

| Recent advancements in the AI search experience and the adoption of free and paid generative AI services by students have resulted in challenges for Chegg. – Nathan Schultz, Chegg CEO |

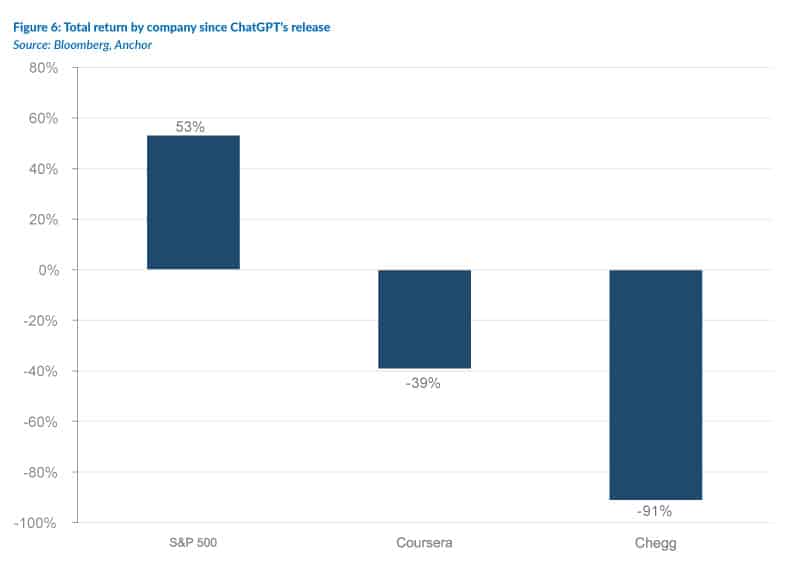

Investors have also taken note. Since ChatGPT was first released on 30 November 2022, Chegg’s share price is down 91%. Coursera, an online course provider, is down 39%. These companies have drastically underperformed the S&P 500, up 53% over the same period.

Alphabet CEO Sundar Pichai has described AI as potentially more profound than fire and electricity. Bill Gates has said, “Generative AI has the potential to change the world in ways that we can’t even imagine.” Despite the attention the technology has received, it has only been two years since the general public first interacted with an LLM. Intel, Adobe, and EdTech players are only three examples of businesses negatively impacted by GenAI. It seems likely that there will be many more in the years ahead.