Tencent released its 1Q20 results (to the end of March) on Wednesday (13 May). The result included the period during which China was heavily locked down, and it is clear that Tencent was a big beneficiary of this, which drove its results to come in ahead of expectation. However, we note that Tencent cautioned that the significant benefits of the China lockdown have normalised to a large extent in 2Q20 as people in that country have returned to work. In addition, the company highlighted that it is seeing more headwinds from the economic impact of the pandemic now coming through.

The following stood out for us from these results:

- To give some context, before looking at this result specifically, what we have seen from Tencent over the last while has been generally good revenue growth but less impressive bottom-line growth. The reason for this is that its high-margin legacy consumer internet business (gaming mainly, but also its social media portal, WeChat) has started to bump up against the law of large numbers and has begun to slow down, while the new areas of growth that represent the future for Tencent (financial and technology [fintech], advertising, media content distribution, and industrial internet to which Tencent is pivoting – cloud and business-to-business [B2B]) are growing revenue fast, but are much lower margin/loss-making at the moment. Thrown into this mix is a rump of investments that Tencent has built up in recent years, which now add quite a bit of volatility to its results from one quarter to the next, depending on fair-value movements/listings etc.

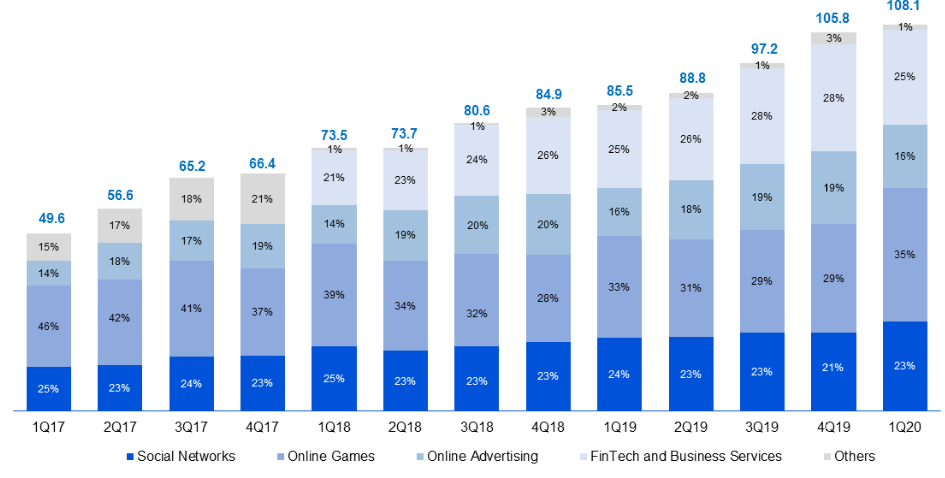

- There is no doubt that this was a solid set of results. Revenue grew 26% YoY and, importantly, for once this was driven heavily by the high-margin areas of the business. This meant that we saw margins expand, driving bottom-line growth of 29% YoY. This bottom-line growth was achieved despite the volatile “other net gains”, coming from that rump investment portfolio, which were down 64% YoY, so this was a pretty good quality result. We give investors a sense of the materiality of the various revenue components in Figure 1 The 26% revenue growth in this quarter continues the company’s pleasing sequential acceleration in revenue growth over the past seven quarters …

Figure 1: Tencent revenue by segment, 1Q17 to 1Q20 (RMBbn)

Source: Tencent.

*Note that starting in 1Q19, Tencent moved FinTech and Business Services revenues out of the Others segment to form a new segment.

- Online gaming, which analysts estimate drives about 80% of Tencent’s profit was really strong, with revenue up 31% YoY. The fact that most of China was parked on the couch in 1Q20 means that one should probably not be surprised by this. On the conference call, management was careful to stress that trends have normalised significantly in China in the current quarter (2Q20). However, this is without a doubt Tencent’s most globalised business and it was pointed out that there is a c. two-month lag in lockdowns in China vs the rest of the world, meaning that strong gaming trends seen in China in 1Q20 have been mirrored elsewhere in the world in 2Q20, albeit not to the same extent. Tencent management was also bullish on its pipeline of new games that are coming on stream at the moment, so potentially another offset to a deterioration in gaming revenue over the balance of this year.

- Advertising revenue was surprisingly strong, up 32% YoY, and likely to be a big positive surprise to the market. Tencent has been very careful not to push advertising too aggressively across its various internet platforms and it has always pushed the user experience ahead of revenue maximisation. Its ad loads are significantly below those of Facebook, for example, and it is a lot less reliant on advertising revenue than its peers. That being said, this has been a pretty volatile area and was no doubt one that the market was bracing for bad news in this result. As it turned out, the big uptick in the amount of time people spent glued to their screens was very positive for ad impressions and click-throughs for direct advertisers. Again, this is an area where Tencent cautioned that it is seeing trends normalising. Furthermore, it pointed out that about 50% of advertising on its video content is from multi-nationals, which have cut back their advertising as CV-19 has hit their markets.

- The FinTech and Business Services segments were a somewhat weaker area from a revenue growth perspective, growing revenue 22% YoY. Management blames this on the fact that offline payment activity pretty much ground to a halt in the quarter. However, it was pointed out that the higher-margin lending and wealth management segments did well.

- From a margin perspective, there were lots of positives. Aside from the mix in FinTech mentioned above, Tencent benefitted from the fact that it was its high-margin businesses that grew most strongly. In addition, the company pointed out that its strongest games in the period were the in-house ones, which are highest margin. Furthermore, reduced content costs because of the loss of live sports and a temporary termination of content production was a boost (something to watch for with MultiChoice’s results in a few weeks’ time?).

- As for the balance sheet, net debt stood at c. US$800mn at the end of the quarter. To put this in context, free cash flow generated in the quarter was c. US$5.6bn. It continues to be a very strong cash generator. In recent years, it has been using this cash to build a sizeable list of minority stakes in a myriad of other tech companies … and Tesla! It estimates that the value of these investments was US$58bn at the end of 1Q20. This equates to about 11% of its market cap, while Tencent’s share of associates’ earnings is a small loss (it is notable that this loss narrowed quite a bit in this quarter). The presence of this growing investment portfolio rump, which is loss-making from an income statement perspective, is one of the things to keep in mind when evaluating this stock. When comparing its PE to history, the bulls will argue that it is cheaper than it looks today because 4-5 years ago this investment portfolio was immaterial.

- One of the more interesting questions coming out of the presentation was what Tencent thinks the big secular changes are coming out of CV-19 in China. Management highlighted the need for businesses to have an online presence – this may seem pretty obvious, but what you realise is that it is perhaps not something that is quite as developed for businesses in China as one may assume. Online education and online healthcare were also mentioned.

So, to sum up, it was a really strong quarter, driven by the high-margin divisions in the business and a lot less reliant on the lumpy 1PE-type investment gains that have propped up past results. Free cash generation was very strong, and the balance sheet is in good shape. The strong message though is that this quarter should not be extrapolated for the balance of the year.

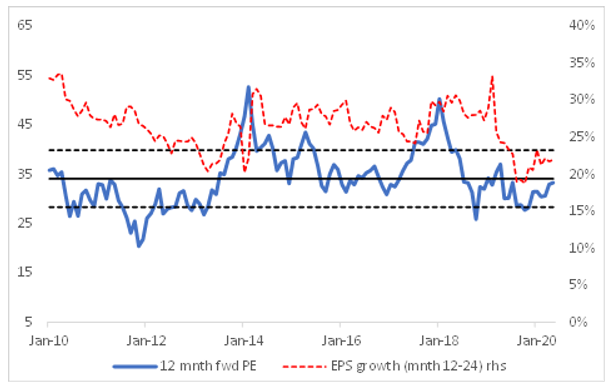

Turning to valuation, Tencent is currently trading on a 12-month forward PE of 33x. As highlighted in Figure 2 below, this is bang in line with its 10-year average. It is expected to grow earnings at a CAGR of just over 20%. As mentioned above, you might want to strip out the $58bn investment portfolio, which would put it on a forward PE of c. 29x, and undoubtedly makes it look more attractive relative to its history. We may see some modest upgrades here, but we expect the fairly cautious talk, about conditions normalising for Tencent subsequent to 1Q20, to temper this.

We may see a bounce in the share price on the back of this result, but it looks to us as if the share is getting into territory where investors have to be slightly more careful unless they are buying in for the long term and are happy to live with some bumps along the way. Bulls talk about the possible listing of Tencent’s FinTech assets in the medium term as a possible value unlock, for example.

Figure 2: Tencent 12M fwd PE and earnings growth

Source: Bloomberg, Anchor

Turning to Naspers/Prosus, we wrote about the Tencent results being potentially important for the possible early inclusion of Prosus in the Euro Stoxx 50 Index (Europe’s leading blue-chip index) in June. While you might conclude that Tencent didn’t exactly smash the ball out of the stadium vs consensus, it was still a solid beat, so we have to put a tick in the box for this important step in a Prosus context. There has been a lot more chatter from brokers about this in recent days and, by the looks of things, Prosus is currently at about position 23 if the measurement was done now (it needs to be in the top-25 at the end of May to get early inclusion in June, failing which it should be included in the normal annual re-measurement that takes place in September).

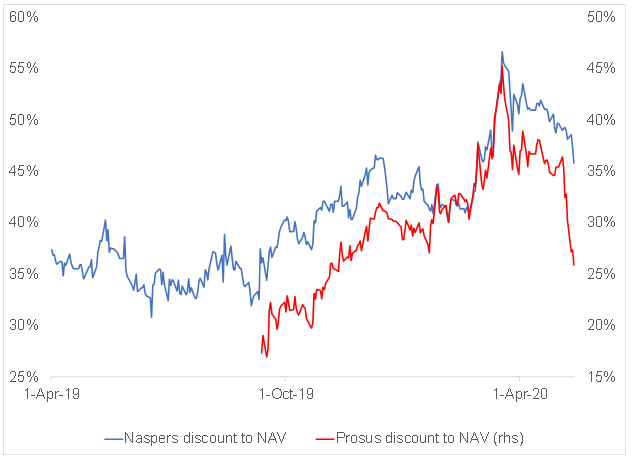

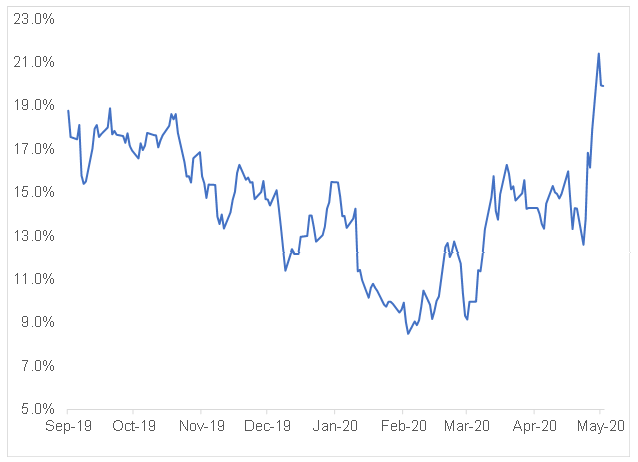

Looking at what has happened to the discounts in the last few days, it is pretty clear that the market is rapidly pricing this early inclusion into Prosus. Its discount to NAV is all the way back down to 25%, while the spread between the Naspers and Prosus discounts has blown out to the highest (at 21%), since Prosus listed on 11 September 2019. That this is the way it is playing out is entirely understandable. Maybe there is more of a squeeze on Prosus to come, but the next trick we need to be vigilant for is the time to switch from Prosus into Naspers. As we have said before, the long-term play remains the value unlock in Naspers, which is currently trading at a 45% discount to NAV.

Figure 3: Naspers and Prosus’ discount to NAV since Naspers announced the plan to list Prosus

Source: Bloomberg, Anchor

Figure 4: Gap between Naspers discount and Prosus discount to NAV

Source: Bloomberg, Anchor