Dr. Duarte Da Silva has worked in the local investment industry since 1994. He is a past director of Merrill Lynch South Africa (MLSA) and, during his tenure at MLSA (from 1994 to 1998), he was rated as the number one technology/electronics and industrials/diversified sectors analyst by the prestigious Financial Mail: Ranking the Analysts survey. He was also CEO of Macquarie First South (MFS), a joint venture established in 2006 between Macquarie Bank of Australia and First South Financial Services, which da Silva founded. In addition, he previously worked as J&J Group’s chief investment officer, deputy chairman of McCarthy Bank and, in 2016, joined Huge Group as an independent non-executive chairperson. Da Silva holds a doctorate of Philosophy in Engineering from the University of the Witwatersrand. In 1988/1989, he lectured on thermodynamics and propulsion systems at Wits University.

Anchor recently hosted an internal zoom discussion with Dr Duarte da Silva on the tech sector’s current and possible future valuations, which included a look back at tech shares’ heyday in the late-1990s and early-2000s. Da Silva also gave us his view of the current global market environment. This document outlines his thoughts and views.

Da Silva has had a front-row seat to several bull and bear markets, and tech booms and crashes, throughout his years in the industry. In the late-90s the Internet frenzy drove local and international investors into the IT/technology (tech) space. In South Africa (SA), Dimension Data (DiData) reigned supreme in this sector and at the height of the tech boom the company had a R100bn market cap – higher than the value of the JSE’s resources sector at the time. With tech touted as the wave of the future it was an era when investors tossed money at ideas and even concepts instead of assets and cashflows. DiData eventually fell spectacularly (from over R80 to under R10) after its listing on the London Stock Exchange, and never reached the lofty levels of the late-1990s and early-2000s again. It was eventually bought out and delisted in 2010.

Tech companies’ PEs do not fully illustrate the value of such a company. Even some startups, especially those that are well known prior to listing (WeWork), are often valued far higher than what their fundamentals may suggest they are worth. Da Silva has always believed in using price earnings to growth (PEG) ratios when valuing these type of tech businesses, since only then do these extreme valuations start to make sense. A PEG ratio measures a share’s value by factoring in its growth rate and is basically a company’s price-to-earnings (PE) ratio divided by its estimated growth rate. The conclusion was that the tech sector’s valuations were excessive because the tech companies’ growth expectations were unrealistic.

At the same time, in the new tech world or reality in which we live, the PEG ratio indicator may not truly capture an important factor in valuing tech businesses – their network effects. Network effect is the phenomenon where increased numbers of people improve the value of goods or services, so each new user of a good/service adds value to some or even all other users for example, using the Internet. Initially, very few people were using it as it was of very little value to anyone outside of scientists or some government officials. However, as more users gained access to the Internet, these users produced content, services etc. As the Internet experienced increases in traffic, it started to offer more value to its users thus leading to a network effect. In the simplest terms, a network effect is exponential growth which sees the value of products and services increase according to the number of people utilising that product or service – the network growth is exponential.

A company which makes great use of network effects is Apple. Apple uses its ecosystem to make it easier (and more rewarding) for those using Apple products, such as a Mac or iOS, to use Apple’s other technologies alongside it. Individuals may decide to buy an iPhone so they can communicate using iMessage, or more easily use Apple’s AirPods – these are just some examples of network effects which add more value to the overall Apple ecosystem and user experience.

Conversely, value investing involves selecting those shares that appear to be trading at less than their intrinsic or book value – a concrete number calculated through various analysis techniques such as discounted cashflow (DCF). While growth investors (such as tech) are more concerned about the story behind the stock or possibilities of a future others may not or cannot see as yet (e.g. a company like Amazon, started by selling books but has turned into a global retail juggernaut and also offers Amazon Web Services [AWS] – currently the biggest contributor to its bottom line). Value investors focus on the numbers, buying those shares they believe the market is undervaluing.

During the 1990s and early 2000s, some asset managers prescribed to value investing and did not buy a single tech stock at the height of the local tech boom (e.g. Allan Gray). While it may have weighed on these asset managers when the local tech sector boomed, once the crash came, they outperformed because of their holdings in other sectors such as resources. Elsewhere, asset managers made a profit on tech, banked that profit, and won the game (e.g. Coronation). Others missed the party completely, joining at the end of the boom (one big Johannesburg-based asset manager) and in the process damaged their business.

For every (market) super cycle there is also an age of discovery, which comes with great excitement, this is usually followed by a struggle to find that cycle’s valuation parameters, leading to the inevitable collapse as the pendulum overshoots.

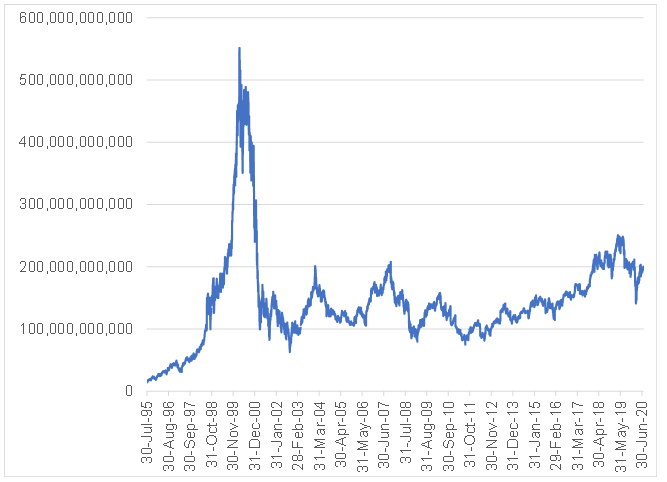

In the 1990s as the Internet came of age and the threat of Y2K loomed large, it was a catalyst for global tech companies’ spending. Businesses such as networking giant Cisco Systems, were the disruptors of the time and their market caps climbed to lofty highs (see Figure 1). During that period, the different tech firms each rolled out their own relevant hardware, until Cisco came along and started making products that connected all of the various hardware released by these different tech firms. At its height in the early 2000s, Cisco reached a market cap of c. $551bn and by early 2002 it had surpassed (albeit temporarily) Microsoft as the most valuable company in the world. Cisco never did its own research and development (R&D), with the company seeing R&D as a waste of money when it could instead let entrepreneurs develop their own tech, which it could then sift through and buy, in many instances paying over the top prices.

Cisco was, and is, a great business. However, when the tech crash happened in the 2000s its market cap dropped down to c. $70bn. The tech crash also saw the Nasdaq Index, which had risen five-fold between 1995 and 2000, tumble from a then-peak of 5,048 on 10 March 2000, to 1,114 on 9 October 2002 – a c. 78% drop. By the end of 2001, most dotcom stocks had gone bust and share prices of even blue-chip tech counters such as Cisco, Intel and Oracle had lost over 80% of their value. Nevertheless, Cisco persevered and the company remains a formidable player in the networking space even today, albeit with a far lower market cap of c. $199bn. An important lesson from the days of dot.com bubble is that sometimes great companies, like those mentioned above and a business such as Microsoft, can be swept up in the frenzy and trade at eye-watering multiples. But, even though these companies have continued to perform admirably in the period since the market correction, they only reached the heady price levels achieved during the dotcom madness more than a decade later (some are still to reach these previous highs). While we remain proponents of buying and holding great compounding companies, more than a decade is a long time to wait for a return on your investment so valuations matter.

Figure 1: Cisco market cap, July 1995 to date ($)

Source: Anchor, Bloomberg.

What results in a market crack in terms of valuation is not always obvious. Microsoft, for example, lost an anti-competitive practice hearing in Europe, where it was accused of abusing its dominant market position. The loss had a significant impact on Microsoft’s market domination at the time and resulted in the tech-heavy Nasdaq falling 1,000 points that same week (+/-20%), showing that when valuations are heady it can drive down an entire sector. Major, unexpected events such as 9/11 and the current COVID-19 pandemic have an immense impact on perceptions which can easily result in everything in a market changing in a heartbeat. Once panic sets in, it starts an avalanche as the herd mentality takes over and becomes prevalent. Still, tech businesses can dominate marketplaces and also have the aforementioned network effect working in their favour. In addition, tech companies make major investments in their future.

The great thing about market disruptors is that you will never know where and when these disruptors will come from. The biggest tech company of the 1980s and 1990s was Xerox, which developed the personal computer (PC), the Internet, ethernet cards and networking. But today the company remains a manufacturer of copiers and printers – that is what it is known for after having sold off its tech innovations to other companies which did not even exist at the time Xerox was doing most of its innovating.

What the past 30 years has taught us is that disruption does not necessarily come from the incumbent but from the outside. In late 1995, Jeff Bezos had just started Amazon and many were skeptical of the business, noting that in order to justify Amazon’s valuation at that time it needed to literally be selling all the books in the world. However, what those people missed was the fact that the Amazon’s actual business eventually was hardly books. Bezos was instead creating a network footprint as well as adding layers upon layers to the business. Fast forward to today and Amazon is the largest online retailer in the world and anything but a bookstore. Still, it remains difficult to see how a company the size of Amazon can still grow tenfold from its current market position. Once a company’s base is saturated, investors usually look at GDP growth and CPI to establish a growth rate for that company. While R&D remains important for tech companies it is also not the ultimate defense which most tech investors would like to believe it to be.

Calling the very bottom or the top of any market cycle is virtually impossible and a fool’s errand. The market will crack at some point, as it always does and as it did in March this year. The onus is on those of us who manage our clients’ money to demonstrate sensibility in investing and protecting our clients’ wealth. It is all about preserving value and not necessarily creating massive value for an investor.

It is always wise to take some profit of the table and to preserve a client’s initial investment along with a reasonable return. As money managers we are paid to not only deliver performance but also to PRESERVE investments and it follows that we need to be sensible in our approach. There will always be the spectre of an unpredictable event that could impact your investments – a black swan event. They are referred to as black swan events because you cannot reasonably predict when or where it will happen – it will instead come as a surprise, and it will have a major impact on financial markets but, while it comes as a surprise, it is sometimes considered as obvious in hindsight. These types of events put even great companies at risk as they can move at a staggering pace so it is important not to lull yourself into a false sense of security – anything can happen globally and that is yet another reason why it is of paramount importance to diversify your portfolio.

Q and A:

Q: Looking at current tech valuations, while the S&P 500 Index’s YTD market cap is flat as more cyclical companies have derated meaningfully and a significant number of shares are down, the tech-heavy Nasdaq has gained c. 20% YTD. To what extent, in your view, is the rotation into tech structural?

A: Nothing in life is permanent. A premium valuation for tech can be vindicated because there is a value for everything, and it all comes down to the fundamental prospects for a business. For example, while at present I would be careful buying shares in the hospitality industry due to the COVID-19 pandemic and lockdown restrictions, I am also aware how cheap some hospitality shares are currently. While we can live without a company such as Amazon, we cannot live without food and must eat every day. This tells me that good value can also be found in the food services sector. At present, it appears that markets in general are trying to settle down and establish where value lies.

While tech may structurally remain a large component of major global markets and indices, when investing you have to keep in mind that, if you have already had a tenfold return on a share, growing that very same counter by a further 40% is much harder than, for example, growing a company that has hit rock bottom but is showing value. So, it is important to deploy some of your profit in other preferred sectors.

While tech is structurally a larger component of the market, as the valuations of these tech companies rise, levels of investor nervousness will in all likelihood also grow until there is an event (as has happened in the past) and it cracks. A rerating of tech will come at some point but trying to pinpoint when that will happen is virtually impossible. That is why it is important to diversify risk and protect at least a component of your investments.

Q: What is the biggest known macroeconomic risk currently and how would you construct a diversified asset allocation portfolio in the current environment?

A: As highlighted earlier, a black swan event happens when you least expect it. If the COVID-19 pandemic peters out in next six months, it would likely be wise to diversify outside of tech and back into the physical world. In time, the impact of a major black swan event always fades, which means in a tech scenario there will be a return to the physical (sporting events, restaurants, etc.). However, the resumption of a tit-for-tat trade dispute between the US and China, in a time of immense global hardship, has the potential to create a massive amount of poverty across the globe. In addition, with global tensions running high (China and India, China and its crackdown in Hong Kong, territorial disputes in the South China Sea, ongoing war in Afghanistan, tensions between the US and Iran etc.) even a war is not completely off the table (albeit unlikely). Gold trading at record levels also indicates to me that many investors do not trust currencies – gold is a store of value that suggests a discomfort with current market conditions.

Q: A client wants to invest $1mn, what are the key tech themes to watch currently?

A: The online consumer or “Amazonesque” companies and the shift to digital. Also, those software businesses that are collaborative and associated with connectivity. Mobility and connectivity are the big themes at presnt. Concerns remain around Apple for me, especially regarding how long the company can continue to innovate? Each new idea has to be huge in order to move the dial for a large company such as Apple, which makes me nervous by virtue of its current size.

The financial technology (fintech) space is an important segment to watch as there has to be some disruption to traditional banking models. Currently, I see fintech as being in a discovery phase so there should still be good “unicorns” to identify in this segment. Banks and financial services are sure to be disrupted by external forces targeting their most profitable earnings lines and it would be wise to hunt around in this particular space for the next 10-bagger (a share that increases in value by at least 10 times its purchase price or at least 900%). It is also worth identifying those companies that work in essentials such as food and logistics, and even accommodation, and which have been especially hard hit by the sell-off due to the pandemic. There are likely bargains to be had among these businesses.

Conclusion

Anchor is positive on the tech sector and fortuitously (from a timing point of view) established the Anchor BCI Global Technology Fund in June 2019 to focus on investing in the most innovative and leading firms in the various tech fields, where network effects often result in superior long-term market returns. Over the past year, companies such as Delivery Hero, Amazon, Naspers/Prosus, Chegg, Microsoft, Activision Blizzard, Spotify, Apple, and other holdings have produced stellar returns. The overall performance of the Tech Fund (up 36% in US$ in 12 months to end June 2020) was achieved despite having to manage consistently strong inflows – the fund started with around R50mn in assets but had reached over R400mn by 30 June 2020.

We note that our benchmark is dominated by Apple and Microsoft (with a combined weighting of almost 35%), both of which also kept us on our toes by performing very well over the period. The Anchor Global Equity Fund, which invests across the market, but currently has a tech bias, is up 40% in US$ in the 12 months to June 2020. Tech shares have performed well over the past year, and particularly post the COVID-19 related market sell-off in March 2020. The pandemic is expected to accelerate the shift to digital ways of doing business – likely further benefiting the tech sector.

At Anchor, we believe that the tech giants have, at the very least, an extended runway. We must also be very careful to separate fundamentals and valuation, and caution against negativity around a company because it appears expensive. This is a natural human tendency. We believe that the key reminder from Duarte (who is a big bull at heart) is that markets can change very quickly, often for reasons we do not, or cannot, anticipate and often these are reasons unrelated to a particular industry. After dramatic share price rises, the risks of a correction are elevated. Vigilance, risk management and diversification are top of mind, but the long-term course is an attractive one.