Despite COVID-19 challenges, the Spar Group reported stellar FY20 results on Wednesday (18 November). Following the results announcement, Spar’s share price soared ending Wednesday 13.5% higher – at a level last seen in December 2019.

The highlights:

- Group turnover grew 13.5% YoY and operating profit rose by 15.6% YoY. Turnover growth was buoyed by a depreciation of the rand vs the euro and Swiss franc. However, even in local currency terms, all of Spar’s divisions recorded a solid performance.

- In South Africa (SA):

- Spar’s core Grocery business grew turnover by 9.2% YoY, outperforming both Shoprite and Pick ‘n Pay, with only Woolworths reporting slightly higher food sales growth numbers for the same period.

- Tops (Spar’s liquor business) experienced a turnover decline of 15.8% YoY, due to the liquor ban imposed by the SA government during the pandemic-induced lockdowns. This business lost 30% of its trading days during the period under review. Nevertheless, according to management, Tops continued to gain market share in the local liquor market and remains the number-one liquor retailer in SA.

- Build-It reported a YoY turnover decline of 0.9%. This indicates a very strong fourth quarter performance to us, as this division had reported a YoY turnover decline of 2.4% in 1H20 and was closed for almost a month in 2H20. We believe that this trend in home improvement spending will continue into FY21.

- Total SA turnover grew by 5.8% YoY.

- In Ireland:

- Turnover grew 6.3% YoY in euro terms, of which 3.4% was organic growth and 2.2% was acquisitive.

- Turnover rose 20.4% YoY in rand.

- In Switzerland:

- Switzerland was the star performer in these results, with FY20 turnover growth of 11.6% YoY in Swiss franc and 31.7% YoY growth in rand terms.

- Much of this strong performance was due to Switzerland closing its borders during the lockdown, forcing locals to buy from community stores rather than crossing the border to buy groceries at cheaper discount stores.

- Management stated that consumers continued to support their convenient community stores even after Switzerland’s borders were opened as better buying by the Spar team had made the business slightly more competitive on pricing.

- In Poland:

- The pandemic frustrated the first year of Spar’s operations in Poland.

- Nevertheless, good progress was made in onboarding Spar retailers in Poland.

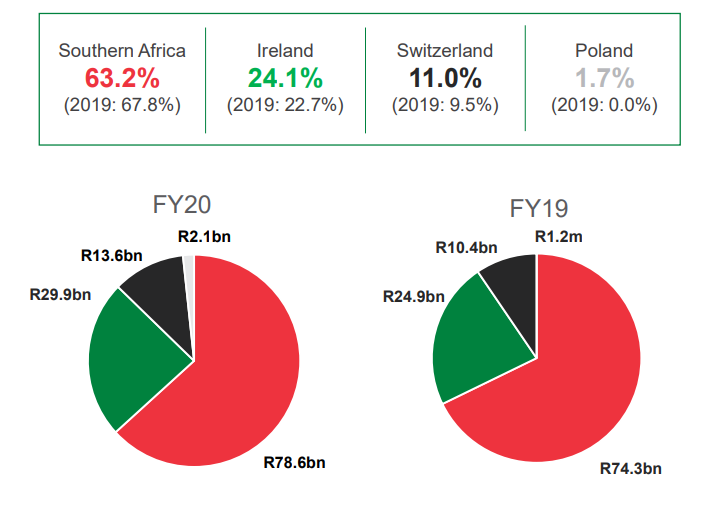

- Spar is now geographically a very diverse company, with only 63% of its turnover being generated in SA, 24% in Ireland, 11% in Switzerland and 1.7% in Poland.

- In our view, the market is not yet fully rewarding Spar for its geographically diverse footprint in its multiple as the share is still trading on a similar multiple to when it was a purely SA-based retailer.

- In South Africa (SA):

Figure 1: Spar turnover by region, FY20 vs FY19

Source: Spar Group

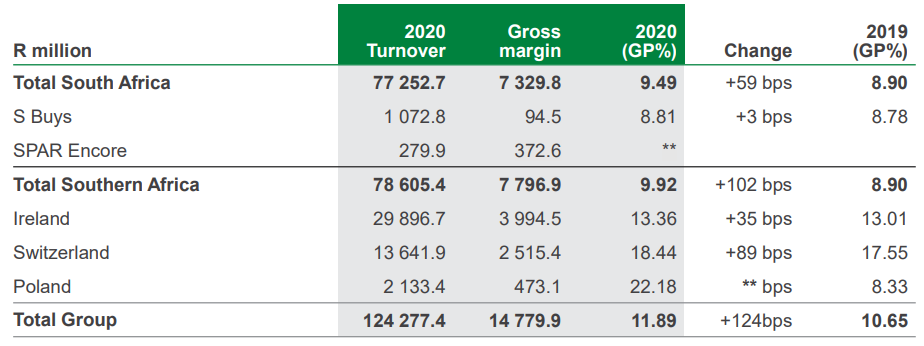

- Spar’s gross margins improved across all its business units, with Switzerland especially seeing a significant improvement as it benefitted from greater economies of scale and improved efficiency.

Figure 2: Spar financial overview

Source: Spar Group

Southern Africa – the improvement was largely due to the mixed impact of reduced liquor and Build-it sales. Ireland – a sales mix change with reduction in its Foodservice business. Switzerland – Significant growth in all channels due to lockdown restrictions forcing consumers to shop locally. Poland – Includes group of corporate stores trading at higher margins to wholesale operations.

- Spar reported normalised headline earnings per share (NHEPS) growth of 8.6% YoY.

- However, if we were to exclude the losses from Poland (which were in essence due to the pandemic and management’s inability to bed down its 2019 acquisition), NHEPS was up 21.9% YoY.

- Management has stated that they are aiming to reach breakeven in Poland in 2021.

- After declaring only a R2/share dividend (due to a lower payout ratio) in 1H20, Spar management declared a very generous 2H20 dividend of R6.65/share, bringing the full-year dividend to R8.65/share – up 8.1% YoY.

- Management were comfortable in declaring this dividend after continued strong cash generation from the core business and a strong balance sheet.

The positives:

- There is very little we did not like from these results, but below we point out some of the FY20 highlights for us:

- Build It is set to continue to benefit from the greater spend on home improvement in SA.

- Tops performed quite well, especially considering the liquor ban during some levels of the local lockdown. The business should show some growth as we start to lap that period in 2H21.

- The entrepreneurial nature of Spar store owners continued to shine through during the tough economic times brought about by the pandemic and we expect Spar to continue gaining market share to the detriment of its competitors during these difficult economic times.

- Spar continues to grow its House Brands and Private Labels categories. These categories represent more than 30% of total wholesale turnover in SA! Management also believe that they can grow these categories further as these brands continue to grow faster than the broader categories in which they compete. This should continue to provide some support to the company’s gross profit (GP) margin expansion.

- BWG Group (Spar’s Irish and South-West England subsidiary) exceeded expectations and more than compensated for the Cash & Carry and Foodservice businesses that were, and still are, being severely impacted by COVID-19. If neighbourhood stores and EuroSpar stores can continue to perform well, then the normalisation of the other two businesses should provide growth going forward.

- The turnaround from Spar’s problem child, Switzerland, was exceptional. Much of this was due to the changes in the shopping patterns of the Swiss consumer, but management has stated that they have been able to keep some of this momentum post year-end.

The negatives:

- There really were not many negatives in these results but we highlight that:

- Spar has come very close to achieving our FY21 NHEPS forecast in this financial year. Although we will likely upgrade our numbers, the base effect is going to mean that growth in FY21 will be lower. Poland is the one division that may prove us wrong, but there is also a great amount of forecast risk in that division.

- It is difficult to judge just how sustainable Switzerland’s performance will be for Spar. Although management stated that Spar is now far more competitive on price vs its cross-border competitors, Spar is still more expensive and we expect the Swiss consumer to revert to their old habits, at least to some degree.

Valuation:

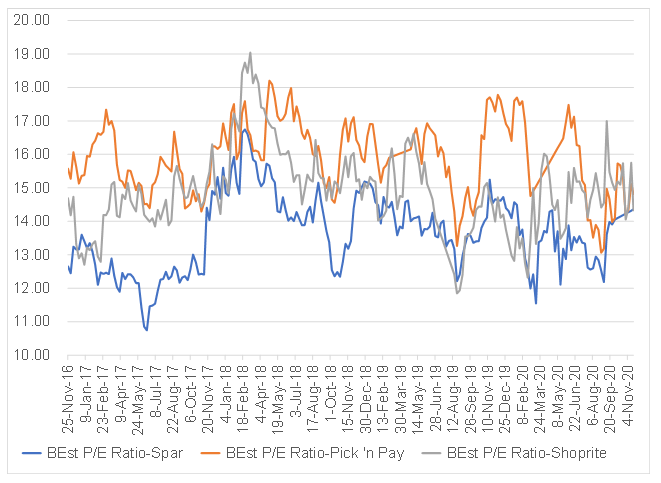

- Spar is still trading at a discount to its SA peers, although this discount has narrowed.

- We continue to believe that Spar’s SA business should trade at a discount due to the lower profitability and return metrics, but the offshore businesses can trade at a slight premium due to their superior growth potential and diversification benefits in an SA context.

- As such, we expect to see a re-rating of Spar as the market starts to show a greater appreciation for the more robust portfolio it has developed under the current management team.

Figure 3: Spar BEst P/E ratio (blended 24 months)

Source: Bloomberg, Anchor

Conclusion

These set of results were even better than our already lofty expectations. Credit must be given to the Spar management team and how they were able to take lemons (the various lockdowns) and make lemonade! Although many of Spar’s underlying businesses were severely impacted by the various lockdowns globally, many of the other operating entities took advantage of their positioning as community retailers to benefit from the more localised shopping patterns during the pandemic.

We believe that many of these benefits will continue to serve Spar well into the next financial year (FY21), with the Group’s other divisions, that were negatively impacted by lockdowns, normalising to provide growth. We expect the sell-side to significantly upgrade their earnings forecasts for Spar from here and we will continue to buy the stock even after this week’s share price rally.