Southwest is a famous name in the airline industry. It was the first of the low-cost airlines, and has an operating model that has been copied many times over across the globe – think Ryanair, Kulula etc. Southwest started in the early 1970s, flying out of Dallas, Texas and adopting a point-to-point system of flying, as opposed to the hub-and-spoke system used by the now legacy carriers, Delta, United and American. This combined with a focus on only using certain single-aisle Boeing aircraft, plus a jovial culture, allowed it to become the lowest-cost operator in the industry. According to Fortune, Southwest is now the most admired of all airlines and the 8th most-admired company in the world. It is also the largest domestic airline in the US.

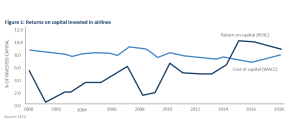

However, this is a tough industry. Cumulative losses in the US airline industry alone were $35bn from deregulation in 1978/79 to 2014. Globally, airlines go bankrupt on a regular basis. The returns on capital for the global airline industry are low, seldom rising above the cost of capital.

Figure 1: Returns on capital invested in airlines

Source: IATA

According to IATA, Africa is the most financially precarious of all the geographies for airlines. Airlines have a huge fixed-cost base and, as Gary Kelly CEO of Southwest explains, ‘there is tremendous operating leverage in an airline’. They are also stuck between an aircraft industry with two major producers – Boeing and Airbus – and an airport industry where there is typically very little competition. Most employees are members of unions. So, like the railway industry, the airline industry is typically only financially viable when there are a few large airlines – i.e. when competition is limited and when it behaves responsibly. After US Airways and American Airlines merged in 2013, the ‘Big 6’ became the ‘Big 4’ and things appeared to change. When oil prices dropped in late 2014 and airline load factors rose (underpinned by industry consolidation), US airline industry profitability never looked back. Profits are not spectacular, but they exceed the cost of capital and operating margins are higher than in all other major geographies in the world. For the first time since the deregulation of the US airline sector in 1978, industry prospects are more stable. Warren Buffett noticed the change and, in 2016, bought stakes in all four major US airlines.

Southwest has been the most consistently profitable of the ‘Big-4’ airlines, with the others all having sought bankruptcy protection at some point. Although operating margins at the low-cost carrier peaked in 2015 at 20.8% after a strong increase from a low of 3.6% in 2012, they remain solidly in double-digits (16.6% in 2017). The rising oil price means that margins will continue to decline in 2018. But the drop in the US corporate tax rate, will push earnings per share higher by some 19% in 2018. Capacity growth (i.e. available seat miles) will grow by 4% in 2018, in-line with the growth in 2017. With the US economy performing well, Southwest aircraft are full of passengers with load factors in recent years consistently over 80%. Ticket prices are declining modestly. The key point is that the industry is demonstrating ‘capacity discipline’ which is what you may expect in a more concentrated market. This bodes well for the future.

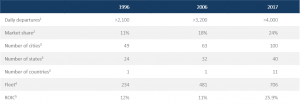

Figure 2: The evolution of Southwest’s network

Source: Southwest Airlines

1During peak travel seasons.

21996 market share based on enplaned passengers; 2006 and 2017 market share based on revenue passengers. 2017 market share data presented herein as measured by the Department of Transportation O&D Survey for the twelve months

ended September 30, 2017 based on domestic originating passengers boarded. O&D stands for Origin and Destination.

32006 includes 32 states and the District of Columbia; 2017 includes 40 states, the District of Columbia, and the Commonwealth of Puerto Rico.

4Fleet is as of December 31 for each year shown.

5ROIC is defined as annual pre-tax return on invested capital, excluding special items and is for the twelve months ended December 31 for each year shown.

6These results will be recast primarily due to the retrospective application transition option selected as part of the Company’s adoption of Accounting Standards Update 2014-09, Revenue from Contracts with Customers. See the Company’s Current Report on Form 8-K furnished to the Securities and Exchange Commission on March 20, 2018 for further information.

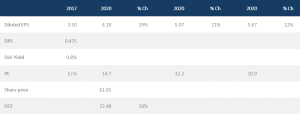

Although we like management, the cost structure, and the future prospects for Southwest, we are not suggesting that our clients buy the shares now. At a recent price of $62/ share, the upside potential is not enticing enough. Our discounted cash flow (DCF) value for the business is $72.50, or 17% higher than the share price. We would recommend a buy closer to $50/share – a level that was previously reached in May and June of this year.

Figure 3: Earnings estimates and valuation

Source: Anchor

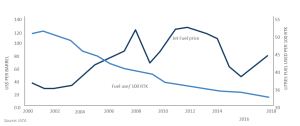

What might cause the share price to drop? With oil prices rising due to lower above-ground global oil stocks and concerns about underinvestment in new oil discoveries in recent years, this is one factor posing problems for airlines. In 2017, fuel costs represented 18.6% of Southwest’s revenues. This number had risen to 20.8% in 1H18. Although Southwest does hedge against the oil price, with hedging ‘really kicking in at $80 per barrel of oil’, they will be materially impacted by the higher price if it is sustained. It will be interesting to see what happens to US airline ticket prices if oil prices continue to rise. Will prices drift upwards again? This would be noteworthy because when oil prices dropped in 2014 and 2015, ticket prices did not decline very much (unlike Europe, where the drop in oil prices triggered a fare war).

Figure 4: Fuel efficiency and the price of jet fuel

Source: IATA

Aside from oil, employee wage demands may escalate in a tight US employment market. We note that 83% of Southwest staff are unionised. Finally, a downturn in the airline business cycle would depress load factors, hurting operating profits.

We conclude that, while we like the change in the US airline industry dynamics, we would prefer investing in the leading low-cost carrier, Southwest Airlines, at a lower price. Such a share price decline may happen if oil prices continue to rise. We highlight that the good news is that Southwest now operates in a more rational industry.

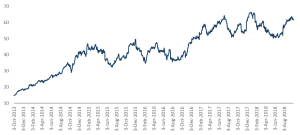

Figure 5: Southwest share price performance, $

Source: Bloomberg, Anchor