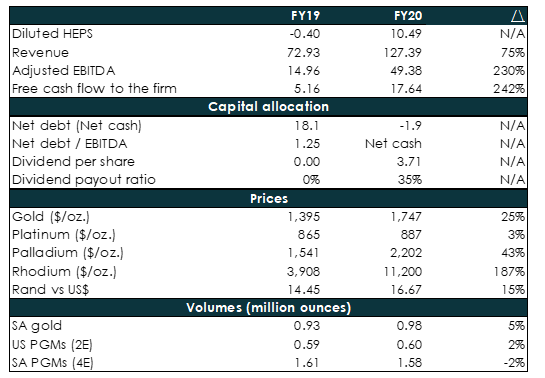

Despite the impact of the COVID-19 pandemic on the Group’s operations, Sibanye Stillwater (Sibanye) reported impressive results for the year ended 31 December 2020 (FY20) on 22 February. The miner’s FY20 revenue rose 75% YoY to R127.4bn (US$7.7bn) vs FY19’s R72.9bn (US$5.0bn). Attributable profit came in at R30.6bn (c. US$1.78bn) – 47 times higher than for FY19 and a record for the company. Headline earnings per share (HEPS) stood at ZAc1,068 (USc65). This as surging gold and platinum group metal (PGM) prices flowed through to the company’s bottom line. A total dividend of R3.71/share was declared.

Figure 1: Sibanye FY20 results overview, US$bn unless otherwise indicated

Source: Anchor, Company data

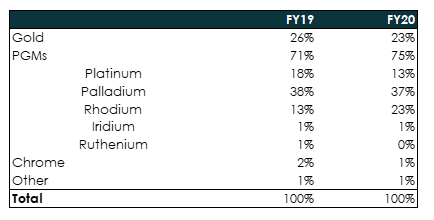

What is the contribution of each metal to Sibanye’s revenue?

As per Figure 2 below, platinum (contributing 13% of total revenue) has become (relatively) less significant compared to Sibanye’s other commodities. Platinum is now the fourth-largest revenue contributor after palladium (37%), rhodium (23%), and gold (23%).

Figure 2: Sibanye FY20 revenue by commodity

Source: Company reports

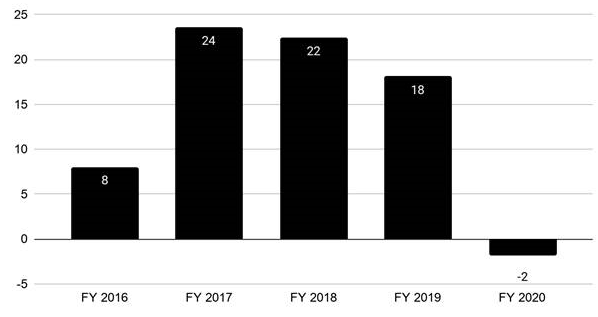

What does the FY20 balance sheet look like?

Sibanye now has R2bn of net cash – a big swing from the R18bn in net debt for FY19 (see Figure 3).

Figure 3: Sibanye net debt/ (net cash) FY16-FY20, Rbn

Source: Company reports

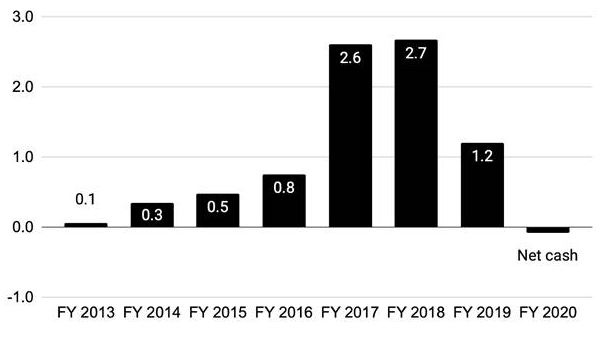

Looked at another way, leverage has declined from 2.7x net debt/ adjusted EBITDA in FY18 to net cash in FY20.

Figure 4: Sibanye net debt/adjusted EBITDA, FY13-FY20

Source: Company reports

With R2bn net cash to start FY21, in our view, a few scenarios could play out for Sibanye. If PGM prices hold, Sibanye could:

- Pile up a large net cash position, whilst paying 25%-35% of total earnings as a dividend;

- get more aggressive in terms of returns to shareholders (a higher dividend payout and/or share buybacks); and

- start doing acquisitions again.

On the earnings call, Sibanye CEO Neal Froneman did suggest that the company is looking at acquisitions, although the Group is unlikely to take on debt the way in which it did when it bought Stillwater. Bloomberg reports that Froneman said the following at the Group’s presentation: “…. What we won’t do is do what we did with Stillwater …. We took on a lot of debt with our eyes wide open, and we had a deleveraging path, but as we all know, we got interrupted along their path with unforeseen events. So it was a tough time and certainly we would not take on those sort of risks again. … Certainly, we could take on a little bit of debt to do that, but we do not. And when I say a little bit of debt, we talking probably $1bn or $2bn – that order of magnitude. Of course, our balance sheet is now, and the company size is, big enough to take on much higher amounts of debt, but that is not where we’re going. … So, it would probably be a combination of equity and debt if the equity was not enough”.

What will earnings look like going forward?

We estimate that Sibanye’s run-rate earnings are R20/share currently. This estimate assumes twelve months of current spot prices and exchange rates. Run-rate earnings (R20/share) are well ahead of FY20 earnings (R10.49/share) for two reasons:

- The PGM basket is meaningfully higher currently than it averaged in 2020; and

- Sibanye is guiding to decent PGM production volume growth for 2021.

The PGM basket is meaningfully higher currently than it averaged in 2020.

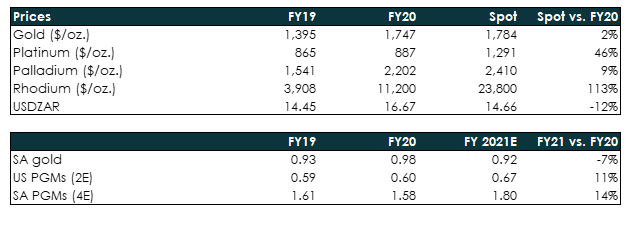

In particular, the prices of platinum and rhodium are 42% and 109% higher YoY, respectively, while the palladium price is only up c. 7% YoY. Unfortunately, rand vs US dollar strength (c. 12% stronger) offset some of the basket’s gains, albeit not by any significant amount.

Figure 5: Sibanye production volumes by commodity, FY19 vs FY20

Source: Company data, Anchor. Note Sibanye is guiding to decent PGM production volume growth in 2021.

Figure 5 is in millions of ounces.

Sibanye is guiding to decent PGM production volume growth for 2021.

US PGM production is guided to grow by 11% YoY in 2021, while SA PGM production is expected to rise 14% YoY. SA gold production, however, is guided to decline. This is important, but not as important as what happens to PGM production, especially given the fact that SA gold accounted for 22% of FY20 revenue and 16% of FY20 adjusted EBITDA.

Conclusion

In our view, there remains scope for Sibanye to achieve significant earnings growth in 2021, and we estimate that the company’s run rate earnings is R20/share currently. The share trades at c. 3.5x that number. Placing a low multiple on what may be “peak” earnings makes sense, but we nevertheless believe that 3.5x is too low, especially when considering the big improvement in its balance sheet to a net cash positive position. This net cash position could potentially grow meaningfully this year, depending on what PGM prices do and how capital is allocated. We would be buyers of Sibanye-Stillwater at current share price levels.