On Tuesday (18 August), Sasol reported results for the year ended 30 June 2020 (FY20). As widely expected, FY20 earnings were poor, with Sasol posting a headline loss of c. R7.3bn, representing a significant drop from its FY19 profit of R18.9bn. Headline EPS fell from FY19’s already disappointing R30.72 to a FY20 loss of R11.79. Still, the poor earnings were expected and were not really the focus of these results, especially with a rights issue now being the base-case scenario for Sasol. The rights issue is expected to happen in 2H21 (i.e. the first six months of calendar year 2021).

Confirmation from the company that a rights issue is a given means either:

a) Sasol’s asset sale proceeds will be light, and a rights issue is therefore needed to get to its $4bn-$6bn capital raising target; or

b) asset sale proceeds, in addition to self-help measures, will get the company to its $4bn-$6bn capital raising target, but Sasol wants to use this as an opportunity to deleverage its balance sheet even further.

At this stage, it is hard to know which of the above two scenarios are true. However, we note that management also said that the current macro operating environment is better than they had expected (with the oil price at around R787/bbl vs management’s budget for a low R600/bbl oil price) and the rights issue has been delayed to 2H21 due, in part, to this reason.

In addition, the company said that a 50% partner for its US base chemicals operations will be announced within “weeks rather than months”. The size of the proceeds received for this is key to the size of the rights issue. In our view, $3bn for a 50% stake in the company’s US base chemicals operations would likely get Sasol to $6bn in capital raised and would, presumably, be received extremely positively by the market.

We expect Sasol’s earnings to improve materially in FY22, although it will likely remain muted in FY21 unless there is a major improvement in oil and chemicals prices. Although FY22’s earnings picture does look much improved, there remains significant uncertainty between now and then.

Whilst we acknowledge that selling half of its US base chemicals business at a decent valuation would likely be well received by the market, it is difficult for us to be overly bullish on Sasol when the thesis depends on mergers and acquisitions (M&A) into which we have no special insight. Still, some of our funds have exposure to Sasol and while we highlight that, at current share price levels, short-term risks remain we also note that there is some optionality available at current price levels over the medium term. So, while cogniscant of the risks, we believe that the risk-reward equation warrants holding on to our Sasol position at present.

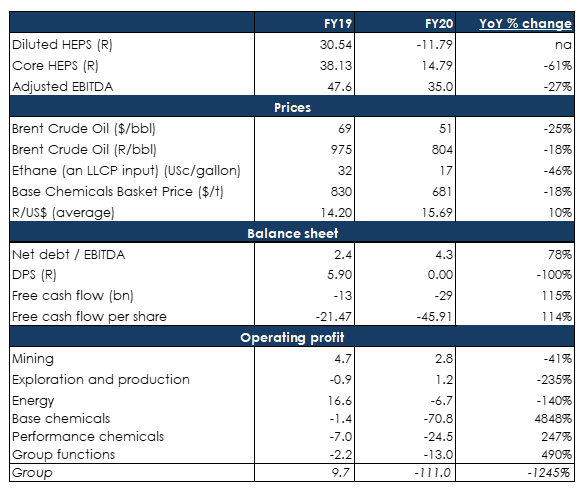

Figure 1: Sasol FY20 results overview, Rbn unless otherwise indicated

Source: Company data, Anchor

What is wrong with Sasol’s balance sheet?

Looking at Sasol’s balance sheet, we highlight the following issues which we have identified

- Its net debt/EBITDA stood at 4.3x as at 30 June 2020.

- The net debt / EBITDA covenant is:

- waived for 30 June 2020;

- stands at 4.0x for 31 December 20.20; and

- is expected to be 3.0x for 30 June 2021.

- According to our calculations, net debt/EBITDA will have to fall to below 2.0x for the company to consider paying a dividend again.

How much capital does Sasol want to raise to solve its balance sheet issue?

Sasol wants to raise capital of $4bn-$6bn

How does Sasol plan to raise that capital and how is that plan going so far?

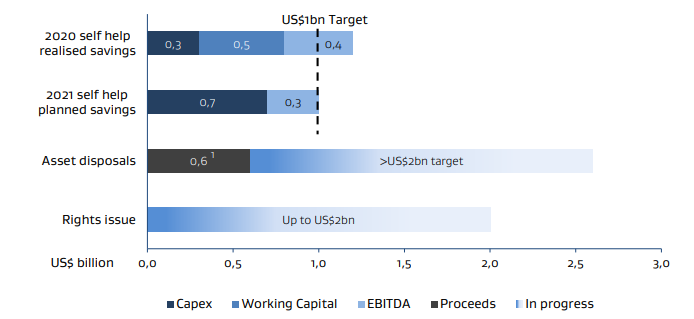

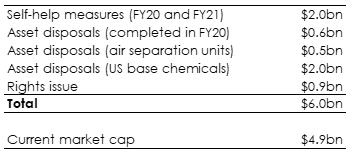

Figure 2: Sasol’s response plan – possible actions to raise capital

Source: Sasol

The rights issue

- Sasol’s rights issue is now scheduled for the second half of calendar year 2020.

- Sasol has delayed the rights issue to see how the macroeconomic environment and the size of its asset sales evolve.

- Sasol has gone from viewing a rights issue as a last resort to now seeing it as a base case option.

- All that remains to be decided is how big the rights issue will be. This will depend largely on the size of its asset sales, particularly in its US operations.

- Sasol’s rationale behind this is that it gives the company the opportunity to reset its balance sheet.

Self-help measures which Sasol has implemented

In the interim, Sasol has implemented the following self-help measures:

- The company’s working capital is now at three-year lows.

- Sasol’s working capital/sales is at 12.5% (which we believe is not sustainable).

- Sasol CFO Paul Victor has indicated that working capital/sales at 14% may be more reasonable. In addition, Victor is “very confident” that at least $2bn in savings will be achieved from these self-help measures by FY21.

Asset disposals

- Sasol’s asset disposals have delivered more than $1bn to the company since November 2017.

- Negotiations are now at a “well advanced” stage for Sasol to get a partner for its US base chemicals operations (weeks from now rather than months, according to the company).

- Sasol’s sale of Oryx remains a possibility, but management do not currently view it as a priority.

- Sasol’s asset sales will have a R500mn-R600mn positive impact on FY21 earnings or c. R1/share (we note that Sasol’s explosives business and its gas-to-liquids [GTL] assets are loss-making).

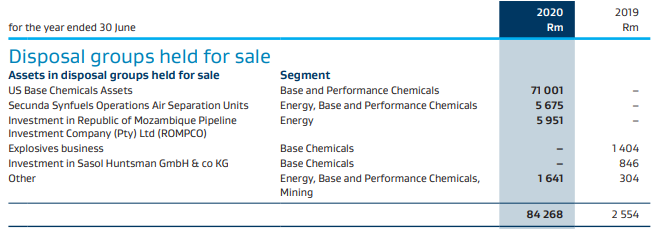

Figure 3 below shows the assets currently being held for sale.

Figure 3: Sasol assets currently held for sale

Source: Sasol

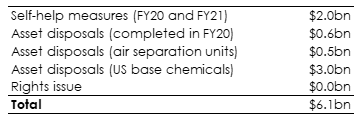

If Sasol receives $3.0bn in proceeds from the 50% sale of its US base chemicals business, the company could raise c. $6.1 bn without a rights issue (Figure 4). In our view, it would be logical to believe that, in the event of this happening, Sasol would no longer require a rights issue since it would have reached its target of raising $4bn-$6bn in proceeds.

Figure 4: How Sasol would raise the capital without a rights issue

Source: Sasol, Anchor

As stated earlier, Sasol now seems to view a future rights issue as a base-case rather than a worst-case scenario. However, if, for example, Sasol received $2.0bn for 50% of its US base chemicals business, there could be a rights issue of only $900mn or 18% of the company’s current $4.9bn market cap.

Figure 5: Sasol rights issue if 50% of the US base chemicals business is sold

Source: Sasol, Anchor

We think that all will depend on the size of Sasol’s asset disposals and, in particular, the 50% sale of its US base chemicals business.

How much in earnings/free cash flow to firm (FCFF) can Sasol generate going forward?

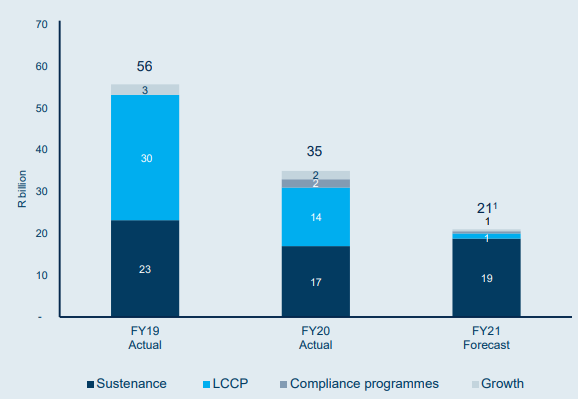

The fact that Sasol’s capital expenditure (capex) should significantly decline this coming year (Figure 6), since spending on its Lake Charles Chemicals Project (LCCP) is complete, will work in the company’s favour.

Figure 6: Sasol capex FY19-FY21 (Rbn)

Source: Sasol.

1. Forecast based on R15.71/US$ for FY21

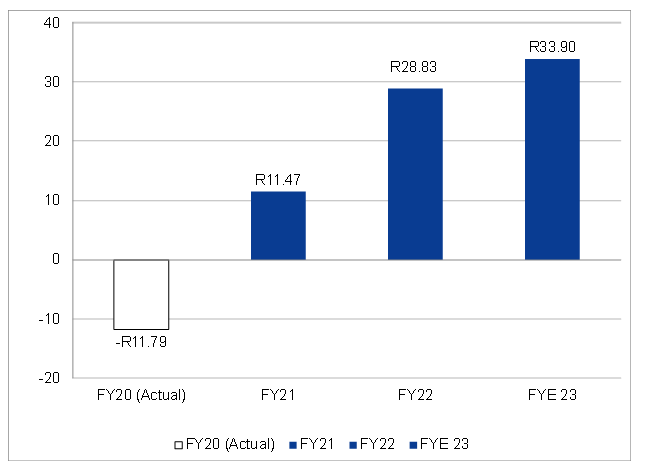

Bloomberg consensus analyst EPS forecasts are expecting c. R11.50 in FY21 and around R30 in FY22.

Figure 7: Bloomberg consensus analyst forecasts for Sasol EPS (FY21-FY23)

Source: Bloomberg, Anchor.

While we expect Sasol’s FY22 EPS will be significantly stronger than in FY20, it is nevertheless important to highlight that these numbers do not take a 50% US base chemicals divestment into account.