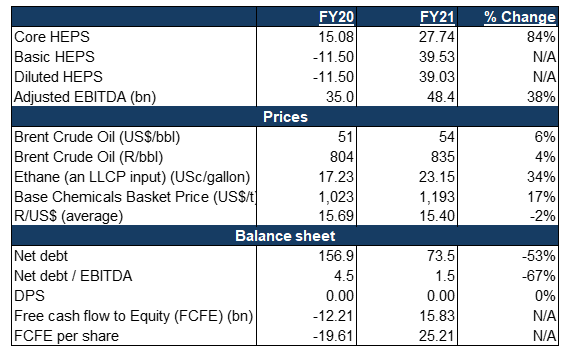

Sasol reported results for the year ended 30 June 2021 (FY21) on Monday (16 August). The Group’s key numbers (core HEPS, adjusted earnings before interest, taxes, depreciation, and amortisation [EBITDA]) were at the lower end of the trading statement guidance. Nevertheless, core headline EPS were up 84% YoY, while adjusted EBITDA rose by 38% YoY and, following Sasol’s asset sale/divestment programme, total debt fell 46% YoY. Sasol’s net debt more than halved from R157bn to R74bn. The divestment programme has enabled Sasol to repay c. R81bn in debt, including settling its rand-denominated banking facilities of c. R4bn. Net debt/EBITDA has come down to 1.5x and, while Sasol has previously said it would consider paying a dividend when that ratio declined to below 2.0x, it decided not to declare a dividend in this set of results out of caution.

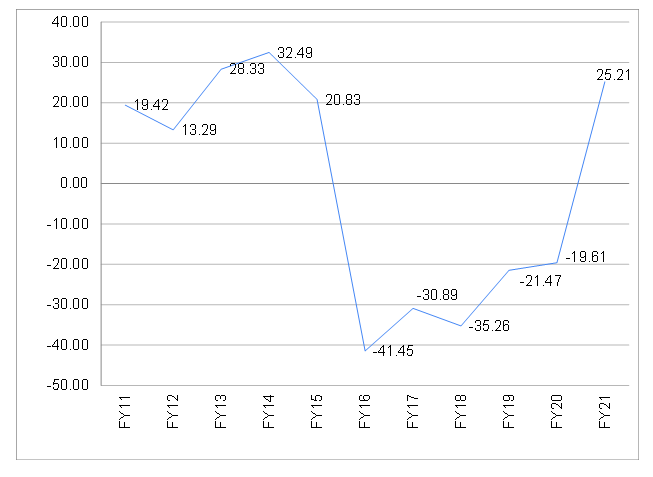

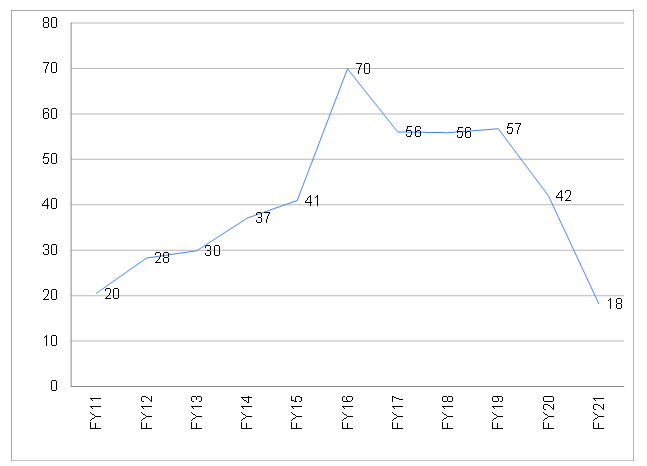

Capital expenditure (capex) is now significantly lower following the completion of the Lake Charles Chemicals Project (LCCP), dropping from R42bn in FY20 to R18bn in FY21. Importantly, this has allowed Sasol to generate c. R25/share of free cash flow (FCF) this financial year. The last time that Sasol was FCF positive was in FY15.

Figure 1: Sasol FY21 results overview, in Rbn except per share

Source: Anchor, Bloomberg

Figure 2: Sasol FCFE per share, ZAc

Source: Anchor, Bloomberg

Figure 3: Sasol capex Rbn

Source: Anchor, Bloomberg

Going forward, capex should be lower than during the LCCP construction years, with FY22 capex guidance at R20bn-R25bn. We estimate that FY22 EPS will be in the range of R40-R50, depending on oil and chemical prices (FY22 consensus EPS: R39). Our base case is that strong FY22 earnings, and an improved balance sheet, will move the share price higher towards the R270-plus level (c. 6x FY22 earnings), at which point we can look to close our position in the share. Longer-term, there are question marks for Sasol such as how it will operate in a world aiming to reduce carbon emissions (and what that will mean for capex, etc.)?

Despite what appeared to be solid operational results, Sasol’s share price fell c. 5% on Monday. The reason for this could be twofold – the Group’s decision to not declare a dividend and/or due to comments made by Sasol’s CEO that the company intends to increase its 2030 carbon emission reduction target as pressure rises for the company to curb its emissions. At this stage this could result in a still-to-be-disclosed amount of capex.