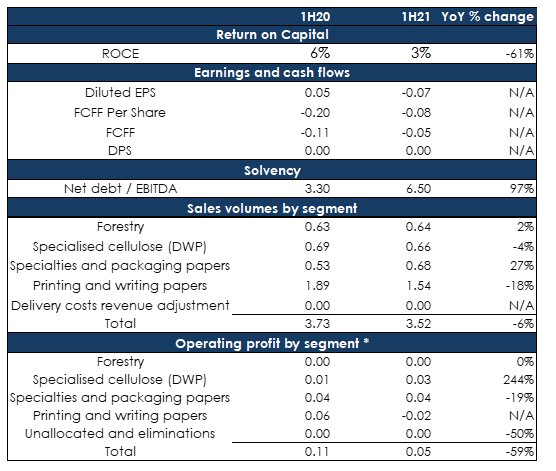

Sappi reported results for the six months ended 31 March 2021 (1H21) on 7 May, with the Group posting a half-year loss of US$40mn (c. R570mn) vs a profit of US$26mn in 1H20. Sales declined 6% YoY to US$2.44bn. EBITDA fell 22% YoY to US$210mn but Sappi’s 2Q21 EBITDA had improved by 14% vs 1Q21, boosted by the performance of its packaging and specialities segment as well its dissolving wood pulp (DWP) business. Sappi’s leverage is currently high (net debt/EBITDA: 6.5x) and exacerbated by the decline in EBITDA (-22% YoY). Sappi has also received waivers for its net debt/EBITDA covenant until December 2021. The dividend remains suspended.

Figure 1: Sappi 1H21 results overview, in US$bn except per share

Source: Anchor, Company data

*Excludes special items

The DWP segment, Sappi’s most attractive business, has recovered well (DWP operating profit: +244% YoY) as DWP prices bounced sharply from their lows. There is a lag between price movements and when those prices are actually incorporated into contracts, so DWP’s price improvements will come through in future reporting periods.

Sappi’s graphic paper segment (aka printing and writing papers) is mostly in Europe. It is in a structural decline and COVID-19 has accelerated the pressure on this segment of the market and remains a headwind for the company as it negatively impacts demand for coated paper (its largest segment) and its biggest market (Europe, which has been grappling with a third wave of the pandemic). Sappi is also guiding for conditions to get worse in its 3Q21. The share price fell c. 6% on the day the results were released but YTD (to Thursday, 13 May 2021’s close), Sappi’s share price is up c. 36%.

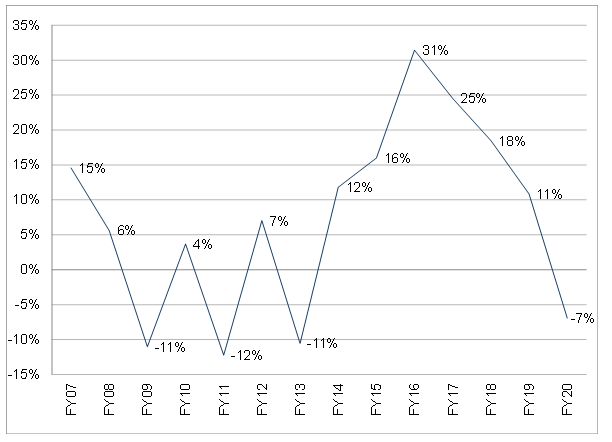

We do not view Sappi as a buy-and-hold business as it does not have a history of good returns on capital (see Figure 2 below).

Figure 2: Sappi return on equity, FY07-FY20

Source: Anchor, Bloomberg

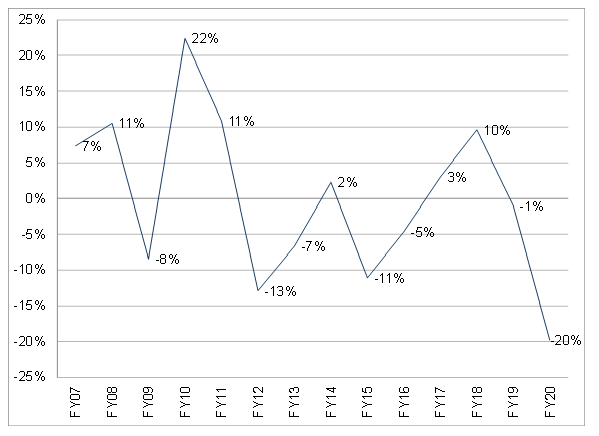

In addition, Figure 3 also shows the cyclicality in Sappi’s historic sales growth. From 2014 to 2019, (i.e., over a period excluding the pandemic), sales compounded at -1% p.a. We also note that it is a similar story if you look over longer time periods to the end of FY19.

Figure 3: Sappi sales growth, FY07-FY20

Source: Anchor, Bloomberg

Sappi is a highly geared, cyclical company. The combination of high balance sheet leverage and improving DWP conditions (prices, demand, etc.) have created the opportunity for a strong bounce in the share price (we note that the share price has doubled from its early November 2020 levels). The share is now trading at 9x FY19 earnings, which we are using as a rough proxy for normalised earnings. Although the DWP segment, which is a good business, is improving, we continue to believe Sappi’s graphic paper business is in a structural decline. That, combined with a history of unattractive returns on capital and high leverage, makes us sellers of the share.