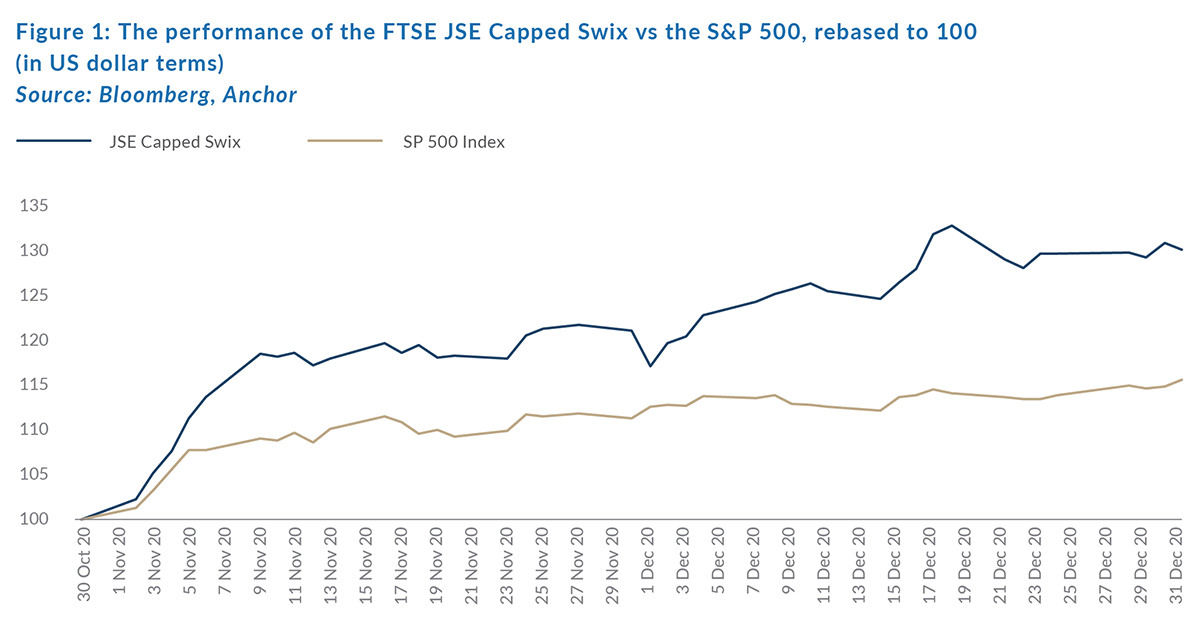

Following a few false starts in late 3Q20 and early 4Q20, the domestically focussed component of the JSE finally broke out of the range it has been in since March 2020’s pandemic-induced market downturn to take a convincing lead over the last two months of 2020. A few catalysts kicked off the early November rally. First up was the US Presidential Election, which saw a change of guard as Democratic Party candidate Joe Biden ousted Donald Trump as US president, thereby removing the overhang brought about by policy uncertainty in the world’s most important economy. Soon after, news started rolling in around the positive efficacy of several COVID-19 vaccine candidates, which kicked off the biggest one-day rotation out of growth and into value stocks that markets have ever produced. EMs were the biggest beneficiaries of this increased risk appetite and SA was no exception, with the FTSE JSE Capped Swix outperforming the S&P 500 by a convincing 14% from the start of November to 31 December (see Figure 1 below).

Global markets’ reaction to the vaccine news momentum and the fact that the world had produced several viable vaccines (first, Pfizer announced in November that it had achieved astounding success with its COVID-19 vaccine candidate, then Moderna and AstraZeneca followed in swift succession, with successful vaccine trial results of their own to entrench the positive sentiment) added to the sheer velocity of the inflection.

The question now facing many local investors, is whether the recent rally in domestic assets, including the currency (the rand clawed back c. 30% against the US dollar since its April lows), has further legs as we head into 2021 and how this will influence our thinking on JSE-listed equities in the year ahead. In a world where so much uncertainty remains around the glide path towards some sort of new “normalised” social and economic life, making bold financial projections remains fraught with an uncomfortably high forecast error and many analysts’ forecasts (including our own) are being whipsawed by continuously evolving economic developments around the world. Locally, the situation has no doubt been exacerbated by the fragile economic position the country found itself in prior to 2020. However, as the interconnectedness of markets has increased over recent years, so too have the factors outside of SA’s control, which can influence the performance of the local equity market.

In saying that, we are not merely referring to the usual notion that “the JSE offers diversified exposure due to the large component of foreign-based earnings on the exchange”, but we are making specific reference to the increased impact that global macroeconomic, and structural changes in markets are having on the prices of JSE equities (as well as on the currency and bonds). In fact, the main reasons we are constructive on the performance of JSE equities over the course of 2021, have very little to do with bottom-up, company specific drivers and are instead more premised on several higher- level, more macro-orientated drivers.

BELOW, WE OUTLINE OUR CORE VIEWS IN THIS REGARD

- Front and centre to our constructive outlook for JSE equites in 2021 is our belief that, over the course of this year, global economic conditions will gradually improve and the vaccine rollout, which will likely take most of the year, will result in society returning towards some semblance of normality. Crucial for SA is a smooth and, hopefully, uneventful vaccine rollout programme, although this already looks to be off to a controversial start with much uncertainty around the availability, and timing, of SA’s vaccine rollout. Still, we believe these issues will resolve themselves in the coming months and SA will be able to join the rest of the world in a cyclical economic upswing.

- Conventional economic wisdom suggests that equities perform best at times of loose monetary and fiscal policy and, in our view, central banks (including the SARB) and government-led stimulus measures will continue to underpin lower real rates and higher equity valuations for the foreseeable future. We are not in the camp that believes inflation will be an issue in the short term and we think that, as we have seen since the first broad-based central bank interventions began after the global financial crisis (GFC), that risk-free rates (an underpin to equity valuations) will remain low enough to continue to incentivise large/overweight allocations to equities. Adding to the attractiveness of EM equities is the lower multiples, and higher yields relative to DMs.

- The US Presidential Election, together with the early January win by the two Democratic Senate candidates in the Georgia twin runoff elections, which gives the party narrow control of the Senate, has provided some stability to the global geopolitical outlook – at least for the next 4 years. The need to reconfigure the working relationship between the world’s two most important economies (the US and China) has been bipartisan, although we believe a Democrat- led government will handle complex issues in a more predictable and diplomatic manner than the previous administration. Greater certainty should also provide investors with more comfort to deploy capital into riskier assets with the key beneficiary being EM equities.

A global economic recovery, fuelled by loose monetary and fiscal policy around the world, underpins our generally constructive view on EM equities. However, tying this into a constructive view on JSE-listed equities requires a further look at some of the core themes we expect to play out in the various components of the JSE in the year ahead.

- A value unlock from Naspers and Prosus, as guided by management who have underwhelmed thus far in providing tangible solutions to narrow the gaping discount to the underlying sum of the parts these shares have been trading at for some time.

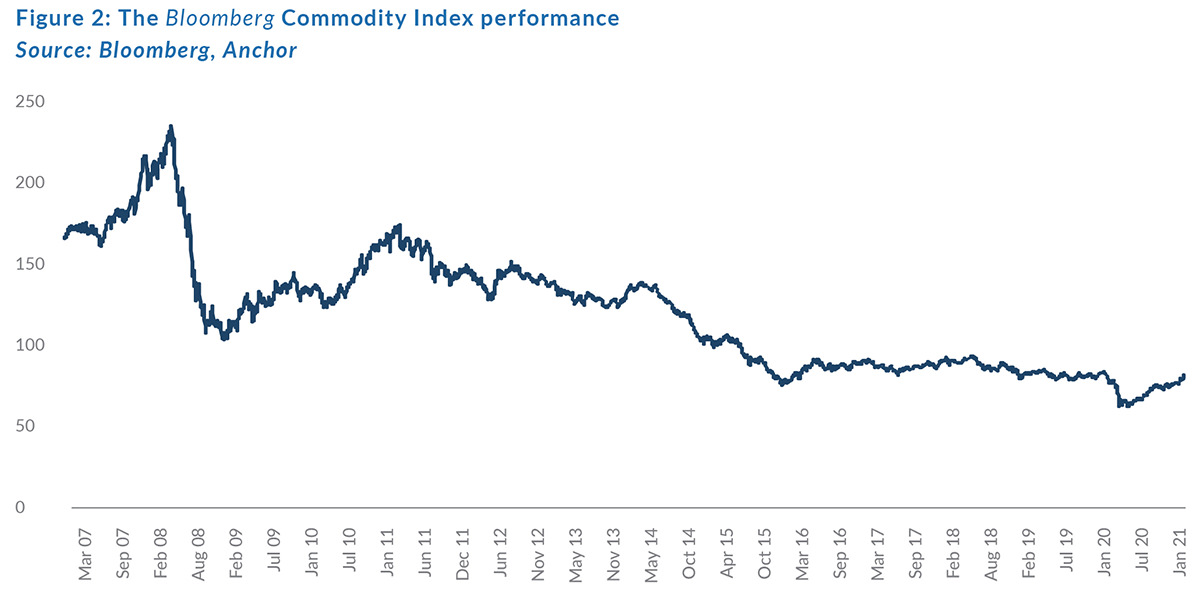

- Currently accounting for close to one-third of the FTSE JSE Capped Swix Index, the basic materials sector has been a recent outperformer relative to those companies that are more reliant on domestic economic growth. Furthermore, the larger, more diversified mining businesses are still pricing in commodity prices well below their prevailing spot prices and, with cleaner balance sheets and clearer communication around capital allocation, we expect significant upside to earnings estimates should spot commodity prices prevail. Two factors supporting our positive stance on commodities are 1) the conservative capital allocation in terms of expansion capex over the last business cycle, resulting in a tightness of key commodities; and 2) the notion that the flood of stimulus released by central banks (and resulting in increased money supply), will result in a weaker US dollar and firmer commodity prices.

- The domestically focussed stocks are those which benefit most from the economic recovery and an increase in EM flows, particularly the more liquid sectors such as banks, insurance, and retail. Consistent with historic experiences, this has already started off in the form of multiple expansion, with the outlook for earnings still very difficult to forecast, particularly in year-two and year-three of both our and Bloomberg consensus profit estimates.

- In the short term, we expect to see a sharp recovery in earnings, specifically in consumer- facing sectors (such as discretionary retail), which were forced to shut down at the peak of the lockdowns in 2Q20. However, a sustained earnings recovery and continuous higher multiples will require a concise and determined effort from SA policymakers to i) conduct an effective rollout of the COVID-19 vaccine, thus allowing market participants to look through further escalations of the pandemic; and ii) enact key structural reforms. Here, we are encouraged by recent developments, including reforms around the partial privatisation of the energy grid. We remain hopeful that policymakers are on the right path, although like most South Africans we remain frustrated at the slow pace of change.

- In terms of valuations, we concede that, over the past two months, the market has given a V-shaped domestic economic recovery the benefit of the doubt, with a healthy rerating of the larger, more liquid, domestic counters implying a sharp recovery in 2021 activity levels. Unfortunately, and more importantly for us as bottom-up stock pickers, the fading away of local entrepreneurs, no doubt stung by a decade of mismanagement under former-president Jacob Zuma’s administration, has meant that, outside of the short cycle rebound in activity levels, we have not managed to unearth the types of structural investment opportunities that we had come to expect in the past. There have been pockets of excellence (a company like Transaction Capital is a good example), and we remain hopeful that sufficient depth remains among local management teams to take advantage of any pockets of growth unearthed by policy reforms and increased infrastructure spend.

Our base-case scenario for SA equities remains an expected return of c. 11% for 2021, although getting the allocation right below the index level will be a key determinant of success.