Swiss luxury goods Group, Richemont on Friday (16 July) released a very strong 1Q21 sales update (for its quarter ended 30 June 2021), reflecting a huge appetite for luxury spending, as customers emerge from the pandemic, predominantly in their home markets. Only Europe and Japan were unable to recover to above pre-COVID-19 levels as the pandemic continues to impact tourism to these destinations. Overall, however, sales almost doubled YoY and vs 2019 sales were up 22% in the company’s 1Q21 period.

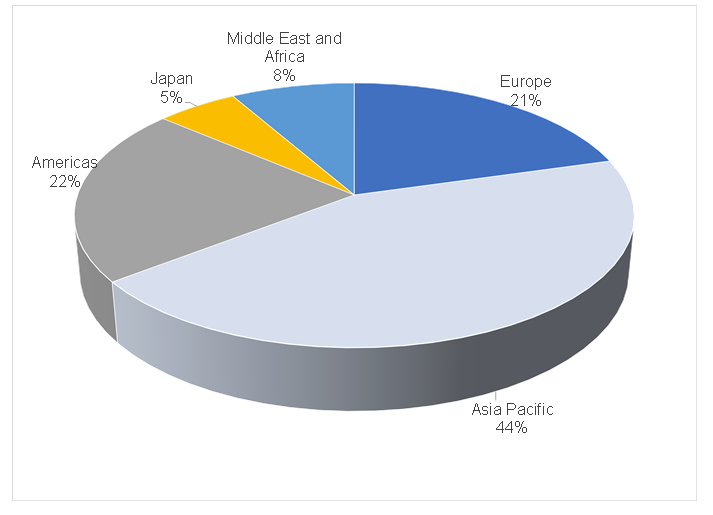

By region, the performances were as follows:

- Asia Pacific excluding Japan (APAC ex Japan) sales, which accounted for c. 37% of sales pre-pandemic, rose by 40% in constant currency terms vs 2019 (pre-COVID pandemic).

- The Americas (c. 18% of sales pre-pandemic) recorded a strong performance jumping 47% in constant currency terms vs 2019 (pre-pandemic).

- The Middle East and Africa (c. 7% of pre-pandemic sales) posted a 55% rise in constant currency terms vs 2019 (pre-pandemic).

- Europe (which relies heavily on spending by international tourists and accounted for c. 30% of pre-pandemic sales) remained at c. 15% below its pre-pandemic levels.

- Japan (c. 8% of pre-pandemic sales) also came in at c. 14% below pre-COVID levels.

In Figure 1 below, we highlight the current contributions to sales by region.

Figure 1: Current sales by region, 1Q21

Source: Anchor, Company data

On a constant currency basis, sales at the Group level grew by 18% YoY (vs Bloomberg consensus analyst expectations of 9% YoY growth), with a particularly strong beat from its Jewellery division (Richemont’s largest and most profitable division at c. 90%-plus of EBIT), which saw sales soar 43% YoY vs Bloomberg consensus expectations of 28% YoY sales growth.

As part of the update, Richemont also announced a governance reshuffle, essentially demoting the CEOs of its two biggest jewellery brands (Cartier and Van Cleef & Arpels) and the CEOs of its fashion & accessories and specialist watchmaker divisions, from the executive committee and relegating them exclusively to the day-to-day management of their respective divisions. Chairman Johan Rupert and Group CEO Jerome Lambert will remain on the executive committee, which will focus on strategic decisions and capital allocation.

As per usual, there was no guidance given or a conference call post this sales update.

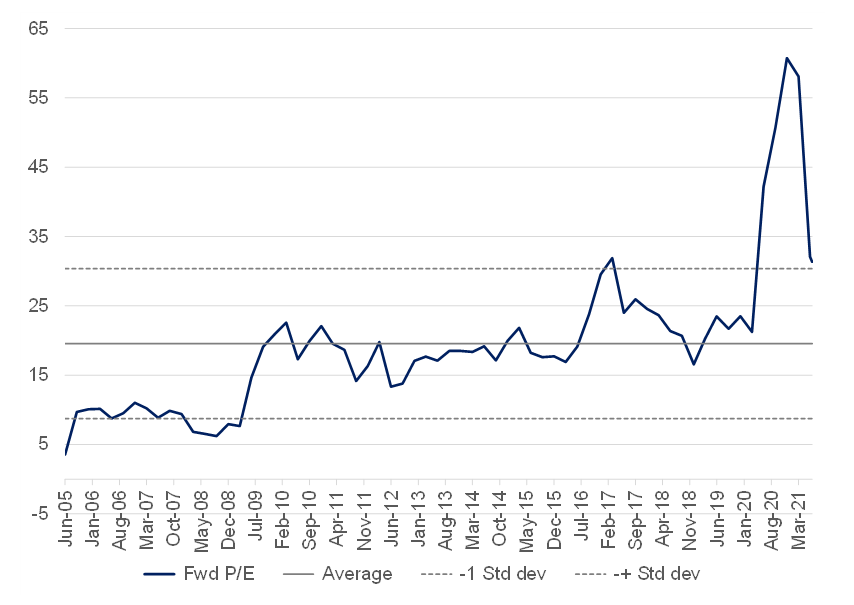

We expect that this update is likely to be well received by the market. For the bulls, this is another data point confirming the “luxury super-cycle” thesis and certainly concerns that spending will shift from goods to experiences as economies reopen has not yet materialised in luxury spending. It is also likely that we will see analysts needing to upgrade their current earnings estimates, perhaps in the mid single-digit range. We remain of the view that this counter is fully priced at 28.4x consensus estimated earnings to March 2023 (well above its 19x historical average). Even if you see a 10% upgrade to its FY23 earnings, that still leaves the stock on 25.8x earnings two years out. We would not be buyers of the share at current levels.

Figure 2: Richemont forward P/E, x

Source: Anchor, Bloomberg