Global markets had a record month in November, with extraordinary gains across the board spurred on by the prospect of a swift rollout of COVID-19 vaccines (several promising vaccines are on the way from Moderna, Pfizer, AstraZeneca, among others) and the prospect of further central bank stimulus measures, which appeared to counterbalance the surge in COVID-19 cases in the US and parts of Europe. A likely further catalyst for the outperformance, besides the prospects of vaccines allowing economies to return to normal, was optimism over Democratic candidate and President-elect Joe Biden’s victory in the US Presidential Election and the ensuing settling down of US politics as Biden’s formal transition to the presidency got underway. News came late in November that the US General Services Administration had finally started the process allowing the current administration’s officials to cooperate with the Biden team. Since Biden’s victory, US President Donald Trump has refused to concede, instead making baseless and unproven claims about electoral fraud and vote rigging. As of 30 November, at least 41 cases have been filed by the Trump administration, including some not directly involving Trump but which could still affect his standing. Of these, a total of 26 have been denied, dismissed, or withdrawn. Last week, Trump said he would leave the Oval Office if the Electoral College, which mostly votes based on the outcome of the election in their respective states, certifies Biden as the winner of the election when it meets on 14 December.

In the US, equity markets traded at record highs, with the three major US indices all recording fantastic MoM gains. The Dow Jones (Dow) hit an all-time high as it broke through the 30,000 level for the first time in November, ending the month 11.8% higher (+3.9% YTD). The S&P 500 also hit new highs during the month, closing 27 November at 3,638.38 – a record close. MoM, the S&P 500 was up 10.8% and YTD it is 12.1% higher. After the tech-heavy Nasdaq registered its second MoM decline in October, it again hit record highs last month, closing November 11.8% higher (+36.0% YTD). The Chicago Board Options Exchange (CBOE) Volatility Index or VIX, which measures the stock market’s expectations for volatility over the next 30 days, also briefly dipped below 20 on Friday (27 November) – the first time since late February. A value below 20 usually indicates stable period for markets.

On the US economic data front, last week’s initial jobless claims data showed a second straight increase consistent with Homebase small business employment data, namely, that the US labour market is deteriorating again in the face of the COVID-19 third wave as people retreat from social interactions, and authorities add restrictions to dining and other indoor commercial activity across the US. However, the second estimate of real GDP growth showed an annual increase of 33.1% YoY in 3Q20. In 2Q20, at the height of the pandemic and lockdowns, real GDP decreased by 31.4% YoY. US consumer confidence fell for a second consecutive month in November amid a resurgence of the virus across the US. The Conference Board reported that the index’s headline number stood at 96.1 – a worse-than-expected drop from October’s final reading of 101.4. With consumer spending accounting for 70% of US economic activity, consumer confidence is a closely watched metric which signals how much US households are willing to spend. The consumer confidence survey follows data releases earlier in November, which showed a moderation in October jobs growth and retail sales. Minutes from the US Federal Reserve’s (Fed’s) latest policy meeting also warned a US recovery would be tougher without a new stimulus package.

In the UK, equity markets recorded a strong run despite coming under pressure towards month-end, as investors digested news of the latest COVID-19 restrictions, which will be imposed once the current four-week partial lockdown ends. Still, it was a great month overall with the FTSE 100 Index rising by 12.4% MoM (-16.9% YTD). On the economic front, the Chancellor of the Exchequer said the UK’s economy was expected to contract by 11.3% this year due to COVID, making it that country’s biggest downturn in over 300 years. Meanwhile, the British Foreign Secretary said that discussions between the UK and the European Union (EU) were heading into a “very significant” week, as time is running out for the two sides to agree on their post-Brexit trading relationship.

It was also a bullish month for European markets, which were sharply higher in November thanks to a string of positive COVID-19 vaccine news cheering investors despite a second wave of infections continuing in some European countries. Germany’s Dax jumped 15.0% MoM, pushing into positive territory YTD (+0.3%), while France’s CAC surged 20.1% MoM, but is still down YTD (-7.7%).

On the economic data front, October EU inflation came in at -0.3%, lagging the European Central Bank’s (ECB’s) goal of below, but close to, 2%. ECB President Christine Lagarde warned last month that the economy could face a “stop-start” recovery, noting that there was a risk that fearful consumers could drag out the economic rebound, and that governments and central banks will need policies that bridge the gap until vaccination is widespread. At the ECB’s last meeting in October, Lagarde said there was “little doubt” it would step up its stimulus efforts at its 10 December meeting. As a result of the reintroduction of containment measures, services sector activity contracted in France, Germany, and across the eurozone. However, France’s services sector was the hardest hit, with the services purchasing managers index (PMI) tumbling from 46.5 to 38.0, while Germany’s fell to 46.2, and the eurozone’s dropped from 46.9 to 41.3. Although Germany’s manufacturing sector did not contract, France’s manufacturing PMI fell from 51.3 to 49.1, dragging eurozone Composite PMI lower (from 50 to 45.1). Above 50 signals expansion and below 50 contraction.

In Asia, Japan’s Nikkei closed November 15% higher MoM and the index is now up 11.7% YTD. Japan’s 3Q20 GDP data showed that the country has exited from a recession, growing by a better-than-expected 5% (and an annualised 21.4%) on the back of a rise in domestic demand and exports. According to Nikkei Asia, this rebound marks the fastest pace of growth since 4Q68. China’s Shanghai Composite Index rose 5.2% MoM (up 11.2% YTD) and Hong Kong’s Hang Seng soared 9.3% MoM (-6.6% YTD). China’s economic recovery continued in November, with the National Bureau of Statistics saying that the country’s official manufacturing PMI exceeded expectations, rising to 52.1 vs October’ 51.4. This was the ninth straight month of expansion as China continues to see a strong bounce back from the pandemic.

On the commodities front, iron ore prices were higher (+3.8% MoM) on rising steel production in China driven by the country’s infrastructure and manufacturing sectors. YTD, the steel-making ingredient is up c. 36%. The platinum price jumped 14.2% MoM and is up 0.4% YTD, while the gold price fell (-5.3% MoM) for a fourth consecutive month. Oil prices (+27.0% MoM) reached eight-month highs during November, benefitting from the prospect of higher demand if successful vaccines result in a resumption of global travel next year and the unexpected decline in US crude supplies, which fell by 754,000 barrels last week. In addition, Bloomberg reports that Chinese and Indian oil refiners have issued tenders seeking crude oil for loading in January 2020, highlighting “robust demand coming from parts of Asia.” Renewed geopolitical tensions, including an attack on a fuel depot in Jeddah, Saudi Arabia, and an oil tanker in the Red Sea. Also supported the oil price.

In South Africa (SA), November was a spectacular month for local equities with the FTSE JSE All Share Index rising by an impressive 10.5% MoM – its first monthly increase since July and its best MoM performance since April (+13.1% MoM). YTD, the index is basically unchanged (+0.01%). Among the large-cap constituents, Glencore rocketed 37.0% MoM, while Richemont, Anglo American Plc, Annheuser Busch InBev, and BHP Group jumped 28.2%, 23.6%, 22.4%, and 13.7% MoM, respectively. Prosus, the biggest share by market cap was up 3.8% MoM. The Fini-15 rose 18.0% MoM (-28.8% YTD), while the Resi-10 erased October’s losses, jumping 11.4% MoM (+7.0% YTD). The Indi-25 gained 7.5% MoM (+13.9% YTD). The rand had a strong November, up c. 5% MoM vs the greenback, although YTD the local unit is still down c. 10%.

On the economic data front, October annual consumer price inflation (CPI) hit a seven-month high of 3.3% YoY (vs September’s 3.0% YoY rise), driven by the cost of food and non-alcoholic beverages (+5.4% YoY) and offsetting the effects of lower oil prices. MoM, inflation rose 0.3%. September retail sales data showed a continued recovery, rising 1.1% MoM albeit down 2.7% YoY, but still an improvement from August’s 4.1% YoY decline. SA’s trade surplus continued to show resilience and the latest SA Revenue Service (SARS) data showed an October trade surplus of R36.13bn ($2.36bn) from a revised R33.36bn in September. Exports rose 10.0% MoM to R149.16bn, while imports were up 10.5% MoM to R113.03bn. Since the opening of the economy following level-1 lockdown, SA has achieved record-breaking monthly trade surpluses which were initially mostly due to lack of imports as the local economy shut down and some mining operations could continue exporting goods. It was expected the surplus would quickly reverse as the economy emerged from the lockdowns but, surprisingly, exports kept pace and even exceeded the recovery of the imports. This was because SA was fortunate in that most key imports (mainly crude oil) remained suppressed, while export commodities (such as precious metal prices and iron ore) remained elevated.

In late-November, Moody’s downgraded SA to Ba2 (with a negative outlook), while Fitch downgraded the country to a BB- (also with a negative outlook). Standard & Poor’s was the only rating agency not to downgrade SA, retaining its BB- rating for foreign currency debt (with a stable outlook). Meanwhile, at its final meeting of the year last month, the Monetary Policy Committee (MPC) of the (SARB) left interest rates unchanged at a record low of 3.5%.

On 30 November, the Health Department said the total number of confirmed SA COVID-19 cases to date, stood at 790,004. The country seems to be experiencing flare ups or a second wave in the Eastern Cape and the Western Cape, while the recovery rate has declined to 92.6%. The US is still the country with the highest COVID-19 infection rates at 13.9mn, followed by India (9.5mn), Brazil (6.3mn), the Russian Federation (2.3mn) and France (2.2mn). SA is in sixteenth position globally in terms of total COVID-19 cases.

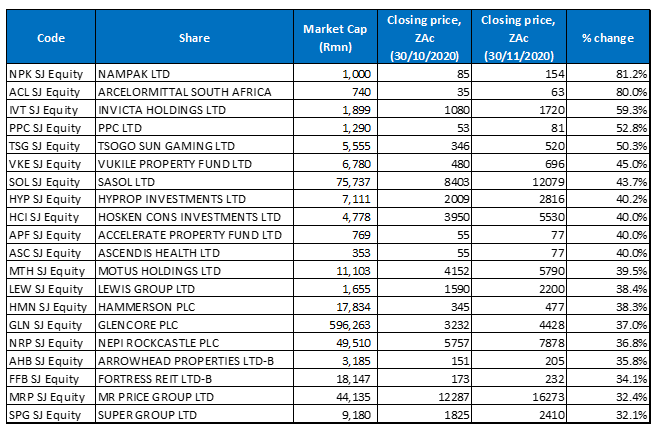

Figure 1: The 20 best-performing shares in November 2020, MoM

Source: Anchor, Bloomberg

November was a bumper month for the local equity market as the positive announcements around vaccines lifted hopes that the world will be returning to relative economic normality next year. This resulted in past underperforming and oversold shares, as well as some of the more domestically focussed and even cyclical counters, rallying the most in November. Packaging Group, Nampak emerged as last month’s best-performing share, albeit from a very low base, with a MoM share price gain of 81.2%. Last week, the company said that it expects it full-year losses to widen due to the impact of COVID-19 on its operations, large impairments, currency devaluation and restructuring costs. Nampak is also writing-off c. R4bn in value from its Angolan and Nigerian operations.

Another oversold counter this year, ArcelorMittal SA, saw some turnaround in its fortunes in November as the share price rallied 80.0% MoM. Last month, ArcelorMittal said that it is implementing a variety of measures to address the critical shortage of steel products locally, which Moneyweb writes has severely and negatively impacted the building, construction and manufacturing sectors in SA. According to ArcelorMittal, its second blast furnace in Vanderbijlpark will restart in December, with all three its furnaces fully operational by January 2021, allowing it “ … to meet more than the steel requirements in South Africa and neighbouring countries”.

November’s third best-performing share was investment firm, Invicta Holdings (+59.3% YoY), which in its 1H20 results, reported a revenue decline of 18.0% YoY to R3.57bn, while diluted EPS stood at ZAc108 vs ZAc109 recorded in 1H19. CEO Steven Joffe, speaking to Engineering News, said the company is starting to see its strategy, which focuses on lowering debt, optimising return on equity, simplifying structures, and focusing on key operational areas, pay off.

Invicta was followed by another perennial underperformer, cement producer PPC (+52.8% MoM). PPC has been struggling financially but received good news in November when it was granted immunity from prosecution in a long-standing competition case involving price fixing and market sharing between local cement producers. In an operational update, PPC also reported strong cement sales, noting that from July to September 2020, cement sales volumes increased by 20.0% to 25.0% YoY, and adding that this trend has continued in October 2020, with strong cement sales volumes experienced for the month. According to PPC, it is continuing to make positive progress on restructuring, with the finalisation of revised facilities documentation with its SA lenders expected soon and restructuring negotiations also progressing constructively with its DRC lenders.

In November, Tsogo Sun Gaming (+50.3% MoM), posted a half-year headline loss of R543mn vs headline earnings of R708mn in the same period of 2019, as traffic at its casinos plummeted due to government-imposed lockdown restrictions. However, the company did indicate that, in October, its businesses delivered a “solid” performance and further improvements due to a relaxation of the government-imposed curfews.

Real estate investment trust (REIT), Vukile Property Fund, Sasol, and Hyprop recorded MoM gains of 45.0%, 43.7%, and 40.2%, respectively. Local property counters have been battered this year and both Vukile and Hyprop were significantly oversold at the onset of the hard lockdown in April. However, these retail-focused funds retraced some of these losses in November on the back of the positive vaccine announcements (which will ultimately be positive for retail-exposed funds) and improved sentiment around the retail property sector as a whole. Meanwhile, Sasol, which has been under immense pressure this year due to mounting debt worries and the crash in the oil price, also recorded a turnaround in November. This, on the back of the oil price rally which seems to have boosted sentiment towards the stock, while Sasol also announced last week that it has agreed to sell its 50% stake in US-based polyethylene business, Gemini, for R6.20bn.

Rounding out November’s ten best-performing shares were investment company, Hosken Consolidated Investments and Accelerate Property Fund, with both advancing by 40.0% MoM. Last week, Hosken released 1H20 results, which showed that its revenue had decreased to R3.85bn, compared with the R7.23bn posted in 1H19, while it also reported a diluted loss per share of ZAc319.63, vs diluted EPS of ZAc378.16 in the same period of the prior year.

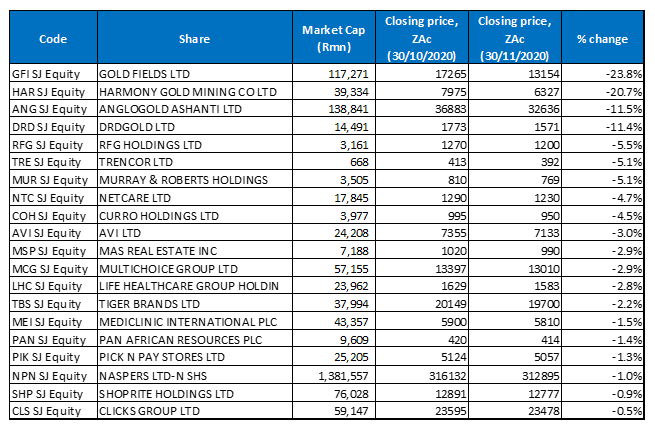

Figure 2: The 20 worst-performing shares in November 2020, MoM

Source: Anchor, Bloomberg

As several successful COVID-19 vaccines near fruition and the dust settles on what has been a very hotly contested US Presidential Election, gold’s safe-haven appeal took a knock in November with the price of the yellow metal falling 5.4% MoM. This in turn weighed on local gold mining counters, which have recorded impressive gains this year, resulting in Gold Fields (-23.8% MoM), Harmony Gold (-20.7% MoM), AngloGold Ashanti (-11.5% MoM) and DRDGold (-11.4% MoM) tracking the lower gold price and accounting for November’s four worst-performing shares. Added to the plight of these companies was the fact that a softer dollar (and a firmer rand), would weigh on their gold exports.

The four gold companies were followed by RFG Holdings (formerly Rhodes Food Group; -5.5% MoM), which said in November that it is cutting costs by combining its operations in KwaZulu-Natal and Gauteng as economic pressure mounts on SA consumers. According to Business Day, RFG CEO Bruce Henderson said that this move is at odds with RFG’s nature, but COVID-19 had laid bare inefficiencies at the Group. While the pandemic has had a mixed impact on RFG this year, with lockdown-related sales restrictions and reduced store traffic hitting its hot pie sales while boosting demand for ready-meals and most of its longer-life products, Henderson expects local economic conditions to continue to deteriorate as SA unemployment rises, while RFG is still incurring coronavirus-related health and safety costs.

Meanwhile, Trencor, Murray & Roberts, and Netcare recorded MoM declines of 5.1%, 5.1%, and 4.7%, respectively. The pandemic dealt Netcare quite a blow and the company reported an FY20 revenue decrease of 12.7% YoY to R18.84bn, while its adjusted headline EPS fell 72.2% YoY to ZAc47.6. Netcare estimated a R3.7bn loss in revenue and an EBITDA loss of R2.3bn due to COVID-19. Its FY20 occupancy levels stood at 52.5% vs 66% in 2019. Nevertheless, Netcare said it is “continuing to see a steady improvement in average acute occupancy levels”.

Curro (-4.5% MoM) and AVI Ltd. (-3.0% MoM) rounded out November’s ten worst-performing shares.

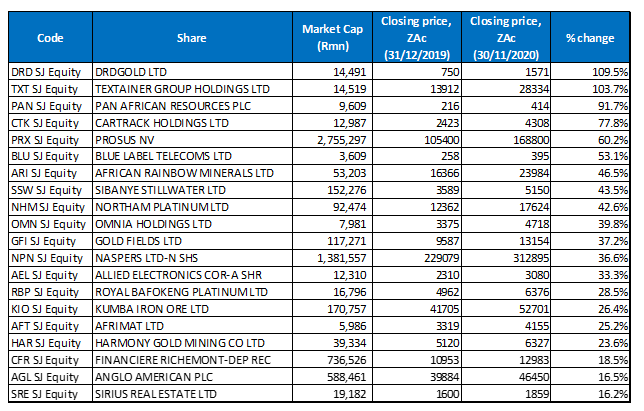

Figure 3: Top-20 YTD performers (to end November 2020)

Source: Anchor, Bloomberg

Most of the YTD (to end November) best-performing shares were unchanged from those of October, with AngloGold Ashanti, Multichoice, and Afrox exiting the list and making space for November’s new entrants Richemont, Anglo American, and Sirius Real Estate. Although the gold price was down for a third straight month in November, dragging gold counters lower, the price of the yellow metal is still up 17.1% YTD, and with this year’s rally the gold price has supported gold counters such as DRD Gold (+109.5% YTD), which was once again the best-performing share YTD. DRDGold increased its gold production by 9% YoY (to 30 June 2020), despite the COVID-19 induced lockdown, while its operating profit rocketed 320% YoY thanks to the increase in gold produced and a c. 33% rise in the average rand gold price received.

DRD Gold was followed by shipping container company, Textainer (-103.7% YTD), which is listed both on the JSE and in New York, in second spot and another gold miner, Pan African Resources (+91.7% YTD) in third place. Last month, Pan African Resources entered into a conditional agreement to buy two tailings retreatment projects from Mintails. The company said it will pay R50mn for Mogale Gold and Mintails SA Sowetos Cluster (MSC) if the due diligence results are positive. The tailings are expected to yield an estimated gold content of 2.36mn ounces.

Cartrack, the local telematics car and fleet tracking company, retained its fourth spot with a 77.8% YTD gain. In October, the Group more than quadrupled its interim dividend after reporting that the COVID-19 pandemic had failed to dull interest in its software. It opted for an interim dividend of ZAc87/share for the six months to end-August – up c. 30% YoY, while revenue grew by 16% YoY to R1.08bn. Cartrack also said that it had added 13% more subscribers despite the pandemic, bringing the total number of subscribers to 1.17mn.

Last week, Prosus (+60.2% YTD), Naspers’ consumer internet arm, launched the biggest share buyback in JSE history (at c. R80bn), whereby it will buy back shares as it looks to help close the gap between the value of its underlying assets and its shares. Prosus also reported increased revenues for the six-month period to end September.

Prosus was followed by Blue Label Telecoms (+53.1% YTD), African Rainbow Minerals (+46.5% YTD), Sibanye Stillwater (+43.5% YTD), Northam Platinum (+42.6% YTD), and Omnia Holdings (+39.8% YTD).

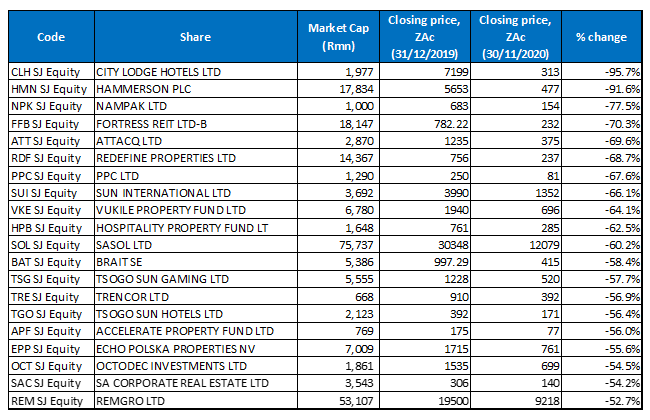

Figure 4: Bottom-20 YTD performers (to end November 2020)

Source: Anchor, Bloomberg

Ten of the 20 worst-performing shares YTD were once again from the JSE-listed property sector, which was already under pressure before the pandemic hit, due to weak fundamentals and the SA economy being in a technical recession. However, subsequent COVID-19-related lockdowns imposed by various governments around the world and locally, have resulted in listed property companies facing their most challenging year yet. This as lockdown-related rental relief and weak demand for retail, office, and industrial space severely impacted company earnings, while the pandemic also accelerated the digitisation of businesses and commerce. In addition, some of these property companies have exposure to European markets that are now experiencing a second wave of the pandemic and further movement restrictions.

Most the YTD worst-performing shares were unchanged from those in the year to end October, with only Trencor, SA Corporate Real Estate, and Remgro entering the ring, while ArcelorMittal, Hyprop (both discussed earlier) and Ascendis Health exited.

City Lodge (-95.7% YTD), which has seen limited trading in its shares over the past eight months, was the worst-performer YTD for the fourth month in a row, as the COVID-19 induced lockdowns and a difficult local economic environment continued to weigh on the company’s fortunes. In July, City Lodge was compelled to raise R1.2bn through a rights issue to pay down debt and prop up its balance sheet. This after asking its bankers in June for an additional R200mn, which pushed the company over agreed lending limits.

For the second month running City Lodge was followed by UK and European shopping centre owner, Hammerson plc (-91.6% YTD) and Nampak (-77.5% YTD, discussed earlier) once again in second and third position. Last month, Hammerson, which owns shopping centres in the UK and Europe, said it had completed the sale of its 50% interest in VIA Outlets for EUR307mn.

Nampak was followed by Fortress REIT -B- (-70.3% YTD), Attacq (-69.6%), Redefine (-68.7% YTD), and PPC (-67.6% YTD), with Sun International (-66.1% YTD), Vukile Property Fund (-64.1% YTD), and Hospitality Property Fund (-62.5% YTD), rounding out November’s ten worst-performing shares YTD.