The adage “sell in May and go away”, based on the theory that the period from November to end April has significantly more robust stock market growth, on average, did not seem to hold sway last month as US equity markets ended the month with healthy gains. This was despite continued concerns around the impact of the COVID-19 pandemic and a possible second wave of infections and as renewed tensions between the US and China, first over COVID-19 and then, last week, over Beijing’s fresh crackdown in Hong Kong, came to the fore. US markets seemed to be betting that the global economy will reopen successfully following the worldwide COVID-19 induced shutdowns. Reports in mid-May that Moderna’s early stage coronavirus vaccine trials had yielded positive results, and that Novavax is starting Phase 1 clinical trials for its coronavirus vaccine seemed to add to positive sentiment. Over 6mn COVID-19 cases have now been confirmed globally, with Johns Hopkins University calculating that there are 1.7mn cases in the US alone, with more than 100,000 deaths due to the pandemic.

Looking at the major US indices, the Dow Jones closed May 4.3% higher MoM (-11.1% YTD), while the S&P 500 gained 4.5% (-5.8% YTD), and the tech-heavy Nasdaq jumped by 6.8% MoM (+5.8% YTD). On the economic front, US government data released on Friday (29 May) showed that consumer spending had plummeted c. 13% in April. Meanwhile, Refinitiv consensus economist forecasts expect that the US economy shed c. 8.3mn jobs in May on top of the 20.5mn jobs lost in April – pushing the US unemployment rate up to 19.7% – the highest since 1935, during the Great Depression. However, the encouraging sign that continuing unemployment claims have fallen, suggests that labour market conditions are starting to improve again as workers are recalled to their jobs.

In the UK, the FTSE 100 rebounded by 3.0% last month (-19.4% YTD) but UK purchasing managers indices (PMI) indicated a slow recovery from the pandemic. May PMI came in at 28.9, higher than April’s 13.8 print but still showing contraction (a reading above 50 signals expansion, and below 50 implies stagnation). Meanwhile, UK 1Q20 GDP declined 1.6% YoY as the impact of COVID-19 and the UK government’s slow response to the pandemic started to filter through. In Europe, major indices enjoyed solid gains for May – Germany’s Dax jumped 6.7% MoM (-12.5% YTD), while France’s CAC rose by 2.7% MoM (-21.5% YTD). Eurozone GDP recorded a 3.8% QoQ plunge in 1Q20, according to a flash estimate from the EU’s statistics agency, while Germany’s GDP shrank by 2.2% QoQ in 1Q20 – the sharpest quarterly decline for Europe’s largest economy since the global financial crisis. Earlier in the month IHS Markit’s eurozone composite PMI posted a bleak April reading of 13.6 – down significantly from March’s 29.7 print.

In Asia, Japan’s Nikkei soared 8.3% MoM (-7.5% YTD), but Chinese markets were under pressure with the Shanghai Composite Index ending 0.3% lower MoM (-6.5% YTD), while Hong Kong’s Hang Seng fell 6.8% MoM (-18.5% YTD). China’s April industrial output grew by a better-than-expected 3.9% – quite a turnaround from the collapse of 13.5% in the first two months of this year when massive lockdowns were imposed. The country’s factory and services sector activities also expanded in May with manufacturing and non-manufacturing sector PMI both above 50. Manufacturing PMI eased to 50.6 from 50.8 in April, while PMI for China’s non-manufacturing sector came in at 53.6 in May, up from 53.2 in April. China drew the ire of several Western nations last month after it passed legislation that could see Hong Kong’s democratic freedoms being curtailed. The law has led the US to say that it will no longer treat Hong Kong, already shaken by anti-government protests and the pandemic, as autonomous from Beijing.

On the commodity front, iron ore prices rallied c. 20.0% MoM, while the price of the platinum group metals (PGM) basket recorded a double-digit jump. The price of crude oil surged c. 40% as it reached $35/bbl by month-end. Despite this massive move in May, YTD crude oil is still down 46.5%. The gold price was again a good performer (up 2.6% MoM) in May as the yellow metal benefits from uncertainties clouding the global economy that COVID-19 has brought about and the move by central banks to expand balance sheets to support economies, companies, and individuals.

In SA, the JSE ended the month mixed, with PGMs and diversified miners doing most of the heavy lifting. The FTSE JSE All Share Index recorded a slight 0.3% MoM gain (-11.6% YTD), pushed into the green by robust share price gains from various diversified mining counters (the Resi-10 rose 5.6% MoM), including Kumba Iron Ore (+34.5%), Anglo American Platinum (Amplats; +13.7%), Anglo American (+11.1%), BHP Group (+10.8%), and Impala Platinum (Implats; +3.4%). While Prosus rose by 3.4% MoM, several other large-cap counters such as Glencore, Naspers, British American Tobacco, Richemont and Anheuser Busch InBev weighed on the JSE with MoM declines of 4.2%, 3.8%, 2.1%, 2.0% and 0.7%, respectively. The Indi-25 closed May 1.6% down (+0.6% YTD), while banking and financial counters were amongst the biggest losers as the Fini-15 ended May 4.7% lower (-37.9% YTD). The rand strengthened 5.6% in May to close at R17.55/$1 and YTD, the local currency is down 25.3% vs the greenback.

In local economic data, Stats SA postponed releasing the latest consumer price inflation (CPI) data in May (it will now be released at the end of June) due to COVID-19 lockdown restrictions. April’s trade balance showed a deficit of R35.02bn, from March’s revised surplus of R23.94bn. Exports fell 55.1% MoM to R53.02bn, while imports declined 6.5% YoY to R88.03bn. The SA Reserve Bank’s (SARB) Monetary Policy Committee delivered a further 50-bpt interest rate cut in May, bringing SA’s repo rate to a record low of 3.75%.

May saw government allowing the re-opening of some sectors of the economy under Level 4 lockdown restrictions and an announcement from President Cyril Ramaphosa that 1 June would see the country move to Level-3 lockdown, allowing the economy to open up further as more people return to work. Up to 31 May, Minister of Health, Dr Zweli Mkhize said that SA had a total number of 32,683 confirmed COVID-19 cases, with total deaths rising to 683. According to Bloomberg, the ruling ANC has started looking at ways to spur local economic growth with a draft document leaked to the media showing that these plans range from encouraging the use of pension funds and the central bank to finance infrastructure spending, to the creation of a state bank and even a pharmaceutical company. Many have criticised the suggestions as pushing “prescribed assets”, the controversial move of forcing pension funds to invest money into state projects, but the ANC says the change would merely mean changing regulations so that pension funds can opt to invest in development finance institutions if they so desire.

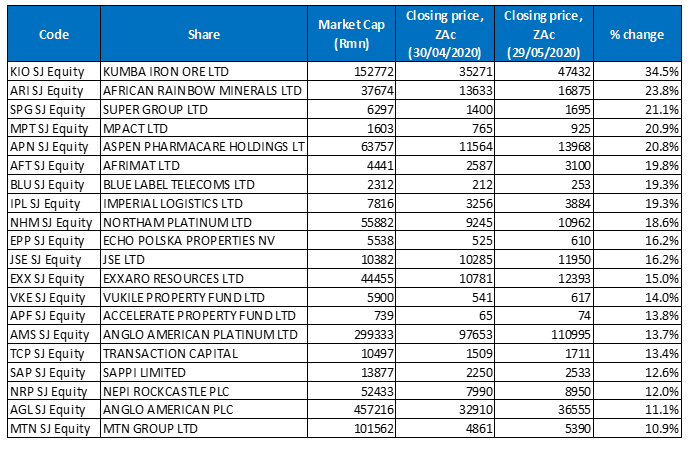

Figure 1: The 20 best-performing shares in May 2020, MoM

Source: Anchor, Bloomberg.

Kumba Iron Ore’s share price rallied 34.5% MoM in May, making it last month’s best-performing share. Stronger demand from China, which seems to be recovering faster than expected from the COVID-19 induced lockdowns, and lower iron ore exports from Brazil, which has been hard hit by the pandemic and is now the country with the second-highest rate of infections after the US, has seen the price of iron ore surge over the past few weeks. Kumba was followed by African Rainbow Minerals (ARM; +23.8% MoM) in second spot, with Super Group (+21.1% MoM) in third position. ARM, which has platinum, copper, iron ore, and nickel interests has seen recent gains in the copper, iron ore and platinum prices buoying its share price.

Mpact Ltd and Aspen Pharmacare recorded MoM share price gains of 20.9% and 20.8%, respectively. Covid-19 seems to be a blessing in disguise for Aspen – the company said in May that it is dealing with unusually high demand for its drugs. In a May trading update (for the 10 months ended 30 April), Aspen highlighted that it is also experiencing an elevated demand for certain of its sterile brands in Europe. The company highlighted that these products are of critical importance in the clinical management of patients infected with COVID-19. Nevertheless, Aspen has maintained its FY20 profit forecast, stating that the uncertainty surrounding the severity, impact and duration of COVID-19 prevents it from reliably assessing and quantifying the future impact of the virus on its business.

Industrial and construction open pit mining group Afrimat (+19.8% MoM) reported impressive FY20 results in May that showed its revenue advancing by 11.4% YoY to R3.30bn, while headline EPS jumped 48.5% YoY from ZAc234.1 to ZAc347.7. The stellar results were due largely to an improvement across all three of its business segments, especially in bulk commodities. CEO Andries van Heerden said that Afrimat was “well-positioned to grow” its business in the current environment, adding that it is “… well hedged against the uncertainty of the future”.

Blue Label Telecoms and Imperial Logistics both recorded a 19.3% gain in May, while Northam Platinum rose 18.6% MoM. Last month, Imperial Logistics announced that it had agreed to sell its non-core European shipping business to Germany’s Häfen und Güterverkehr Köln for EUR176.1mn (c. R3.64bn), as it continues to focus more on Africa. The firm also said that its South American shipping business would continue on a stand-alone basis but will remain available for sale. A rally in the platinum price helped Northam end the month higher. Last week, Mining Weekly reported that Northam had strengthened its liquidity position in response to COVID-19 by attracting R411mn in additional new long-term funding during the lockdown period as part of the completion of a R2.65bn restructuring of its domestic medium-term note programme.

Rounding out the top-10 performers, Polish property investor, EPP (previously Echo Polska Properties) jumped 16.2% in May. EPP announced that Poland would reopen all its larger shopping centres from 4 May after restricting trading in March due to COVID-19. The reopening was sooner than expected in Poland as containment measures in that country also seem to have been quite effective. The closure did not extend to grocery stores, pharmacies, and cosmetic stores which account for c. 21% of EPP’s portfolio. EPP’s office portfolio was also not affected.

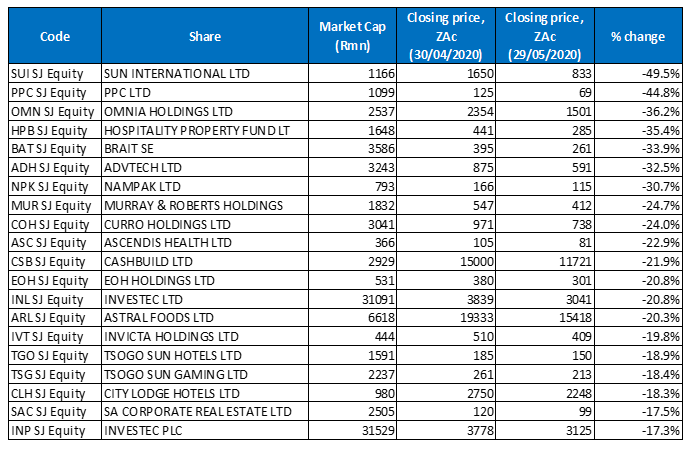

Figure 2: The 20 worst-performing shares in May 2020, MoM

Source: Anchor, Bloomberg.

Hospitality and gaming Group, Sun International (-49.5% MoM) was May’s worst-performing share as the government-ordered COVID-19 lockdown continued to weigh on the business. As of 1 June, there is no clear indication as to when businesses in the tourism sector such as hotels, conference centres, gambling venues, lodges and other accommodation facilities will be allowed to operate again. The move to level 3 on 1 June still excludes these sectors of the economy.

In second spot, cement manufacturer PPC saw its share price fall by 44.8% in May. It was followed by Omnia, which was down 36.2% MoM. Last month, PPC said that its businesses have generally been operationally constrained in their respective markets during April. In SA, only PPC Lime sold small quantities to customers deemed by government as essential providers. Overall, PPC’s SA sales volumes in April are expected to be c. 95.0% lower YoY, due to the stringent government lockdown measures.

Hospitality Property Fund (Hospitality) and Brait recorded MoM losses of 35.4% and 33.9%, respectively, for May. Hospitality, which owns 54 SA hotel and resort properties, announced late last month that its board had decided not to declare a FY20 dividend. In December 2019 (1H20), shareholders received an interim dividend of ZAc35.4/share. In a trading statement, Hospitality said that due to the impact of the pandemic on the economy, all capital expenditure had been placed on hold, except for essential maintenance. In May, the board of investment company Brait, said it would be cutting its salary by a quarter for the three months to end-June, as COVID-19 batters some of its investments, especially the Virgin Active gym chain. In a trading update, Brait said that gyms have been closed across the territories in which Virgin Active operates, and that shareholders recently approved a GBP20mn loan to the gym group to help it through the pandemic – Brait’s share is GBP16mn (c. R362mn). Virgin Active is also in discussions with lenders about waiving debt covenants and increasing the size of its debt facilities. Moving to Premier Foods, Brait said that business continues to trade well and is benefiting from strong customer demand, while Iceland Foods (based in the UK) is also enjoying strong sales, particularly in its frozen-food categories.

Private education Group, AdvTech (-32.5% MoM) said in May that it was feeling the effects of the fallout from the COVID-19 induced lockdowns, with the Group stating that it was c. 20% behind YoY in terms of school-fee collections for April. CEO Roy Douglas said that AdvTech was “well aware” of the crippling effects of the economic disruption and that it has “undertaken to engage with individuals to understand the extent of the problems and the consequences”.

Packaging group, Nampak (-30.7% MoM) said last month that it expects a fall in its half-year to end March earnings due, in part, to the weak economy. In a trading statement, Nampak said it expected headline EPS for continuing and discontinued operations to fall to ZAc1 during the period vs ZAc115 previously. It also expects a loss per share of between ZAc334 and ZAc339.5 vs earnings of ZAc107.8 in the comparable period of 2019.

Last week, Murray & Roberts (-24.7% MoM) released a trading update which showed that its order book remains healthy despite projects having been delayed. The engineering and construction firm said that headline EPS for FY20 (the year to end-June) were expected to fall by more than one-fifth, but that its order book at the end of March stood at R51.5bn, vs R50.8bn at the end of December. The Group had more than R1.7bn in cash available at the end of March, and R1.1bn in unutilised credit facilities.

Rounding out May’s 10 worst-performing shares were Curro Holdings (-24.0% MoM) and Ascendis Health which, following a strong run in April when the share price gained 81%, fell back to record a 22.9% MoM decline.

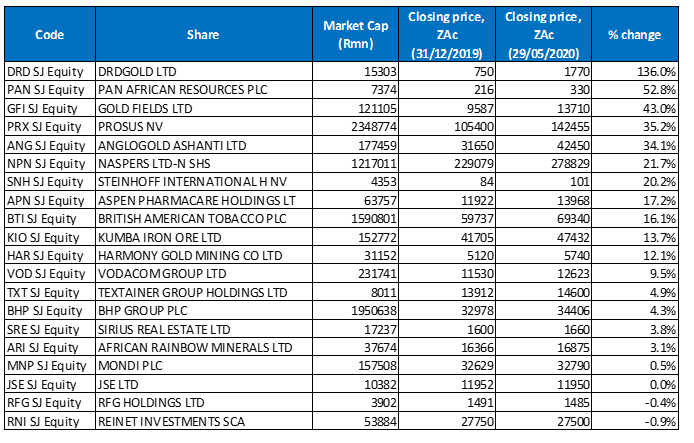

Figure 3: Top-20 YTD performers (to end May2020)

Source: Anchor, Bloomberg

Eighteen of April’s YTD best-performing shares remained among the 20 best performers for the year to end May. Aspen Pharmacare, Kumba Iron Ore, BHP Group, ARM and JSE Ltd were May’s new entrants in the top-20, bumping Assore, Sibanye Stillwater, Peregrine, Oceana, and Quilter from the list.

For the third month running, DRD Gold was the YTD best-performing share with a share price gain to end May of 136.0% (DRD Gold was up 2.2% MoM in May). It was followed by Pan African Resources (+52.8% YTD), which bumped Gold Fields (+43.0% YTD) into third place, as a strong gold price and the counter’s impressive performance in May (it rose 4.1% MoM) saw it inch higher in the rankings. Gold has experienced a big rally this year (+14.0% YTD), and last week the yellow metal was trading close to its best levels in 8 years before retreating. Local gold miners are also benefiting from a weaker rand as they earn their income in US dollar, while paying expenses in rand.

Following Prosus (+35.2% YTD) in fourth position, AngloGold Ashanti (+34.1% YTD) took fifth spot. It was followed by Naspers (+21.7% YTD), Steinhoff (+20.2% YTD), Aspen (+17.2% YTD), British American Tobacco (+16.1% YTD) and Kumba (+13.7% YTD). Shares in Prosus closed at a record high of R1,647.03 on 13 May, buoyed by growth in online gaming during the various lockdown periods (Chinese tech giant Tencent, in which Prosus owns a one-third stake, is one of the world’s biggest players in online gaming).

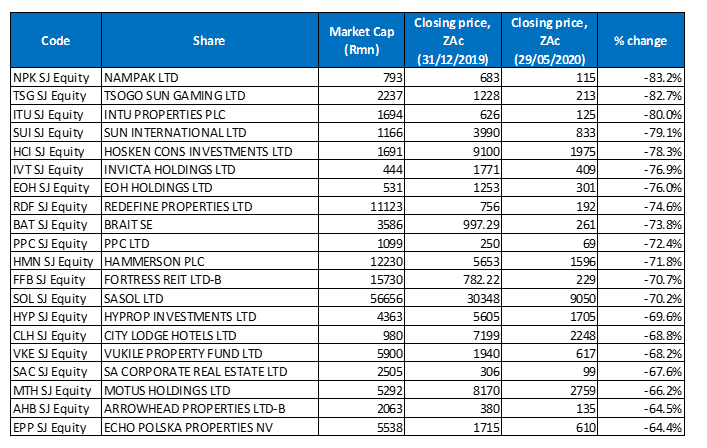

Figure 4: Bottom-20 YTD performers (to end May 2020)

Source: Anchor, Bloomberg

Looking at the year to end-May’s worst performing shares, apart from Sun International (-79.1%) and PPC (-72.4%), which replaced Accelerate Property Fund and Zeder, the remainder were unchanged from the year to end-April rankings. Following its poor showing in May, Nampak (-83.2% YTD) moved up from third worst-performing share to the worst performer YTD. It was followed by Tsogo Sun Gaming (-82.7% YTD) in second spot and Intu Properties (-80.0% YTD) in third position.

On Friday (29 May), Tsogo Sun Hotels reported a R1.2bn FY20 loss, which CEO Marcel von Aulock largely attributed to the “obliteration” of demand in March, due to the impact of the lockdowns on business, and R1.2bn in write-downs related to its majority stake in Hospitality Property Fund. Rooms revenue increased to R2.79bn, vs R2.73bn posted in the previous year, while its diluted loss per share stood at ZAc84.50 vs a loss of ZAc450.4 in the prior year. Von Aulock said that it will take two to three years for occupancy rates to recover and some of its hotels may not open for another year due to the pandemic.

Sun International, in fourth place, was followed by Hosken Consolidated Investments (HCI), Invicta and EOH Holdings with YTD declines of 78.3%, 76.9% and 76.0%. HCI’s primary investee companies are in manufacturing, hotels and casinos (HCI has a stake in Tsogo Sun), which for the most part have completely closed due to the lockdown. HCI’s CEO has said that because its investee companies are in those sectors they will probably have to operate under this cloud for most of 2020, with the exception of manufacturing. Fin24 writes that, to make matters worse, as an investment holding company that spends money to acquire new ventures, HCI’s balance sheet is highly leveraged.

Rounding out the ten worst-performing shares YTD, were Redefine Properties (-74.6%), Brait (-73.8%) and PPC (-72.4%).