According to behavioural economics research conducted into the psychology of investors, we feel the pain of a loss twice as much as the joy of an equivalent gain – ‘loss aversion’ is the name given to this phenomenon, where we tend to hate losing money far more than we enjoy earning money. No doubt, these emotions contribute greatly to investment mistakes that are often made during large market falls, such as the one we have been experiencing over the last few months. One potential investment mistake at times like these is to become obsessed with trying to predict the short-term direction of the equity market, or, more specifically, how close to the bottom are we? We think this is a misallocation of time for two reasons: (1) predicting short-term market movements is often a mug’s game, so the effort may not produce the right answer anyway; and (2) it causes one to miss individual share opportunities that arise during these periods.

Indeed, it is typical during sharp market falls that some investors become “forced sellers”. Perhaps this happens because they borrowed money to buy the shares in the first place and now that the debt is being called in, or because they find that they do not have the emotional strength to cope with paper losses to the extent that they thought they did, thus turning these declines into real losses! For patient investors, this is a great time to be looking for investment opportunities in equity markets. Indeed, for long-term investment success, it is less important what you owned going into a market correction than what you own coming out the other side!

The recent sell-off in quality/growth shares (such as the tech counters) has given rise to an incredible investment opportunity for our offshore model portfolio. In this article, we explore the current turbulent market environment and how our favourite quality growth shares have been impacted.

The US S&P 500 Index has fallen almost 20% from its all-time highs, while the Nasdaq, which is more biased towards technology and other growth shares, has sold off by almost 30%. However, if you drill down further and look at how sectors within the index have performed, the results are surprisingly divergent. Some sectors have absolutely collapsed whilst other sectors have thrived.

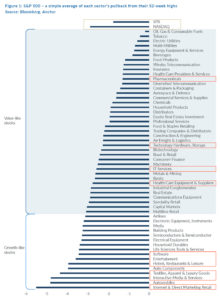

The chart in Figure 1 below, shows how much each of the sectors within the S&P 500 have fallen from their 52-week highs. The oil and gas sector, towards the left-hand side, has had a stellar few months, with the oil price where it is (at multi-year highs), and thus this sector continues to reach new highs. On the opposite side of the spectrum, Amazon, eBay, and Etsy (part of the Internet & Direct Marketing sector) have had a torrid time, falling by an average of 50% from their 52-week highs.

Most of the shares that have held up well during the current sell-off could be categorised as value or defensive style companies, whereas those companies that have been extremely out of favour in the current rising interest rate environment could be considered as growth style companies in nature.

The orange circled sectors in Figure 1 are typically the pools where Anchor seeks to find high-quality growth compounders. They have clearly been under severe pressure over the last few months relative to the value style shares. However, over a five-year period, many of these sectors have far outperformed the index and we believe that quality growth should still outperform over the long term. For example, the US tobacco sector has been trading at 52-week highs of late and has risen by 10% over the past year compared with the S&P 500 falling by 5% over the same timeframe. If an investor had held this sector over 5 years that investor would have had a negative return compared to the S&P 500 Index’s 65% increase. This is also the case for oil and energy investing. Therefore, in many ways, the index is currently being held up by poorer-performing sectors that are now having their time in the sun but have proven to be disappointing long-term investments and thus do not have a place in a long-term, quality growth portfolio.

What is quality growth?

At Anchor, we seek to invest in companies with superior growth characteristics vs the market, whilst also exhibiting superior quality characteristics.

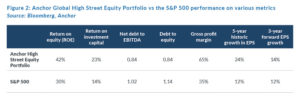

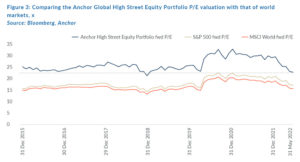

The Anchor Global High Street Equity Portfolio is expected to grow earnings per share (EPS) by an average of 14% p.a. for the next three years, which is greater than the S&P 500’s 12% growth over the same time. In addition to acquiring companies with above-average growth characteristics, Anchor also prefers businesses that have a competitive advantage over their peers, which often translates into an ability to generate a superior return on the capital they invest (the power of compound growth). We also wish to own companies with robust balance sheets (not too much debt in other words) that can weather economic downturns. It is entirely logical that companies that have these quality growth characteristics would attract a higher valuation from investors in the same way that one would expect to pay more for a BMW motor car than for a VW Polo. In Figure 3 below, we show that the valuation of the quality growth shares in our model portfolio has consistently been higher than the market over time (i.e., traded at a premium valuation). A critical point though is that the recent sell off has reduced this premium dramatically, meaning that investors are having to pay a lot less to own these quality shares than they have in the past.

The blue line in Figure 3 above is the weighted average price-earnings (P/E) ratio of the current portfolio of shares that are generating positive earnings. The valuation of the portfolio has always traded above the S&P 500 (black) and the MSCI World (grey) valuations over time. This is to be expected as quality characteristics, superior to the index, deserve to trade at a premium, otherwise the market would be extremely mispriced.

If we analyse how this premium has changed over time by graphing the difference between the valuation of the portfolio and the market, we can determine whether our portfolio of high-quality shares is relatively cheap or relatively expensive compared to world markets vs their history (see Figure 4).

By graphing the portfolio’s premium over the past 7 years, we can conclude that it has traded, on average, about 10 P/E points above the MSCI World Index P/E. When this gap narrowed to less than 9 points, we could infer that our portfolio was relatively cheap vs the market and when it trades above 11 points, we could say that it is relatively expensive vs the market. With the benefit of hindsight, we can clearly see that the Anchor portfolio was relatively cheap before COVID-19 and then became relatively expensive during the COVID-19 pandemic. What has happened since then is the indiscriminate selling of quality growth stocks which has caused this strategy to return to the cheapest levels in many years relative to the market. We see this as an opportunity not to be missed – long-term outperformance from these levels is statistically in our favour.

If we assess some of the businesses within the portfolio we can come to the same conclusion

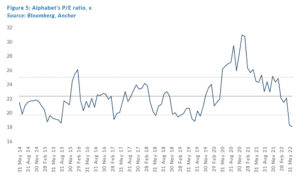

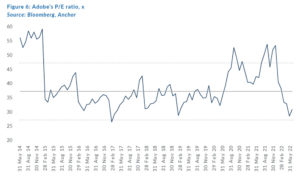

Alphabet, Google’s parent company, is currently trading at its cheapest valuation in 8 years. Adobe, the software giant, is also trading at the bottom of its valuation range. Both these businesses’ balance sheets are in a net cash position, their earnings are growing at a rate far greater than inflation and they are thus presenting excellent long-term investment opportunities.

We aim to increase the diversification across the portfolio via a larger number of shares as well as by including more sectors. The portfolio is also tilted towards growth shares as they are displaying the best valuation entry points at this time. Portfolio construction is always fluid and evolving and we will continue to assess the current environment and what changes need to be made in the portfolio. Although market corrections are an extremely stressful experience, on the positive side they allow for an incredible long-term investment opportunity as we are able to make opportunistic changes and add new companies that were previously too expensive. We have several exciting ideas for our offshore client portfolios that we aim to include in the coming weeks and for long-term investors, this should be a breath of fresh air.