It has been over 50 years since the first moon landing and most would likely recall the famous quote by Astronaut Neil Armstrong “That’s one small step for man, one giant leap for mankind”. What you are probably not aware of is that there has been a total of six successful moon landings. In addition, there has also been over 100 planned missions to the moon, with a large number of these ending in failure, but there are still more planned for the future. Items left on the moon range from six planted flags, a disc of goodwill messages, a gold-plated olive branch, two golf balls, and five vehicles.

Now imagine being one of those astronauts, setting foot on the moon and glancing up at our beautiful blue planet. As big as the full moon is when viewed from earth, from there the earth is thirteen times greater in size. So too it becomes clear to us in SA, how large the global investment world is. SA only accounts for a tiny part of the global economy (less than 1%), so having all your investment “eggs” in one basket is certainly not ideal. In this regard, diversifying your portfolio offshore presents investors with a multitude of investment opportunities. However, this vast opportunity set does come with its own issues and, in this article, we have tried to highlight some of the key points investors need to consider before investing offshore.

DIVERSIFICATION AND ASSET ALLOCATION

Diversification and asset allocation is a risk management strategy that mixes a wide variety of investments within a portfolio. A diversified portfolio contains a mix of distinct asset types and investment vehicles in an attempt at limiting an investor’s exposure to any single asset or risk. The rationale behind this investment technique is that a portfolio constructed of a variety of assets will, on average, deliver a more predictable long-term outcome with lower risk than any individual holding or security. It aims to balance risk and reward by apportioning a portfolio’s assets according to an individual’s goals, risk tolerance, and investment horizon.

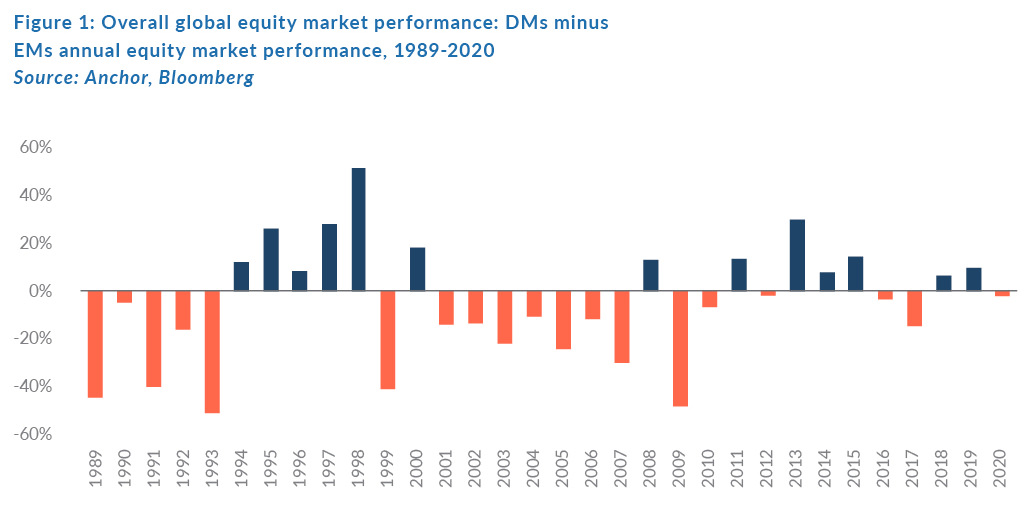

The main asset classes are equities, fixed income, property, and cash. Each of these assets have varying levels of risk and return, so each will behave differently over time. For example, some investors are very comfortable with 100% equity exposure in their investment portfolio, while others prefer a mixed portfolio. If your portfolio has a higher equity exposure, it typically comes with the risk that you can experience substantial, albeit usually temporary, capital losses. Selecting a blend of assets will give an investor a very different range of returns. An individual will need to select what is most appropriate to their specific investment strategy. Historically, EMs have outperformed DMs but most recently (over the past 10 years), DMs have handsomely outperformed EMs by an average of c. 6% on an annualised basis.

TIME

Before you invest, be acutely aware of the time frame you can work with. To create a portfolio based on time, you must realise that volatility is a bigger risk in the short term, than over the long term. If you have 30 years to reach an investment goal, such as retirement, a market move that causes the value of your investments to temporarily decline is not as big a danger to your financial wellbeing, given that you still have decades to recover. However, experiencing the same volatility a year before you retire can seriously impact your retirement plans. Investors often choose aggressive asset allocation and then maintain it indefinitely, without adjusting their portfolios to changing circumstances or their specific stage of life, which can end in disaster.

SHORT-TERM INVESTING:

As a general rule, short-term goals are those less than three years hence. With a short-term time horizon, if markets drop, the date on which the money is needed will be too close for your investment to have enough time to recover from a market decline. To reduce the risk of loss, keeping your investments in cash or cash-like investments is likely the most appropriate strategy here. Money market funds and fixed-deposit accounts are common conservative investment options.

MEDIUM-TERM INVESTING:

Investment goals of three to seven years in the future, can be classified as a medium-term investment. Over this time, some exposure to equities and bonds will introduce capital growth to the portfolio. Having the additional time allows investors to recover from temporary market corrections. Balanced funds, which include a mix of equities, bonds, and cash should be held for these type of intermediate investment terms.

LONG-TERM INVESTING:

Investment horizons of more than seven years will allow investors to aim for significant capital growth and therefore having maximum equity exposure offers the greatest returns. While these assets also entail greater risk, there is time available to recover from a significant loss. A unit trust that is 100% invested in equities would be an ideal investment in this instance.

CURRENCY MOVEMENTS

Currency fluctuations are a natural outcome of floating exchange rates, which is the norm for most major economies. Numerous factors influence exchange rates, including a country’s economic performance, the outlook for inflation, interest rate differentials, capital flows, and so on. A currency’s exchange rate is typically determined by the strength, or weakness, of the underlying economy. Predicting currency movements is fraught with risk. An economic data release surprising on the downside or an unpredictable political event can cause a currency to slip or jump in the short term.

However, in the medium or long term, the main drivers of currency are the differentials in interest rates and investors’ perspectives of the trajectory of those interest rate differentials. Inflation, along with the sustainability of debt, is a key driver of interest rates. Stable economies, which have predictable demand growth and sufficient productivity to meet growing demand, tend to have lower inflation.

INFLATION, TAX, AND REAL RETURNS

Inflation reduces the purchasing power of each unit of currency, which leads to increases in the prices of goods and services over time. In practical terms that means you have to spend more every year to fill up your car, buy bread and milk, or even go for a haircut – it basically increases your cost of living. DMs have predominantly lower inflation rates than EMs such as SA. In addition, to factoring in inflation’s impact on your investments, you should also consider the impact of other factors such as taxes and investment fees to calculate real, net returns on your investment. Bear in mind that different investments will provide disparate returns, so when you are searching for a real return in excess of inflation this will depend a lot on your overall asset allocation.

BENCHMARK YOUR INVESTMENT

A benchmark is a standard or a measure that can be used to analyse the allocation, risk, and return of a given portfolio. A variety of benchmarks can be used to understand how a portfolio is performing against various market segments. The MSCI World Index, for example, is often used as a benchmark for equities around the world. You need to select an appropriate benchmark that mirrors your offshore investment allocation since you want to be able to gauge whether your investment has done better or worse than the benchmark and take the appropriate actions if need be.

Ultimately, the most important benchmark you should have is to see if you are on track to reach your investment goals. This is the greatest of all benchmarking, and it is one that should be checked and reviewed at least once a year, ideally as part of an investor’s annual portfolio review with their investment advisor.