As was widely expected by investors, Naspers/Prosus recently announced the next step in its plan to unlock value. The deal announced on 12 May, however, was probably not among the possibilities that investors had considered likely and, judging by the widening discount at which Naspers and Prosus have traded relative to their net asset values (NAVs) since this announcement, investors are distinctly underwhelmed by it. Considering the effort put into evaluating the various options available to unlock value by management, the fact that this was considered the best available option speaks volumes for the formidable tax and exchange control complications that confront the alternatives this Group has to unlock value. While this proposal does increase the NAV/share modestly (if it is accepted by shareholders), it comes at the expense of the creation of a large cross-holding structure, which adds complexity (investors hate complexity!), as well as removing the prospect for other corporate actions that would unlock value without significant tax consequences for the Group.

Furthermore, for private investors that hold Naspers shares in a tax-sensitive form, as was the case with the offer to take up Prosus shares when it listed, we think this latest proposal will create a difficult choice for them – accept the offer to exchange a portion of their Naspers shares for Prosus shares, thus securing a slightly enhanced uplift to the underlying NAV of their holding, but with the unwelcome consequence that it will trigger a deemed disposal of those Naspers shares and thus a tax event for those shareholders. What the correct choice is very much depends on each investor’s personal situation and what their subsequent intentions are for their investment in this Group.

The proposal in a nutshell

The main terms of the announcement are as follows:

- Prosus is making an offer to Naspers shareholders to exchange 45.4% of their Naspers shares for Prosus shares. The exchange ratio proposed is 2.27443 new Prosus shares for each Naspers share exchanged. The offer is voluntary, so Naspers investors are free to retain their shareholding in Naspers. It will take some time to get the necessary bureaucratic steps that precede this deal completed, so it is expected, at this stage, that the deal will only happen in 3Q21.

- A further US$5bn share buyback – the same size as the current share buyback programme, which is nearing completion.

- Naspers will agree to a 12-month lock-up, meaning that it will not sell Prosus shares it owns for a period of 12 months post the implementation of this transaction.

How does this deal change the Naspers/Prosus structure?

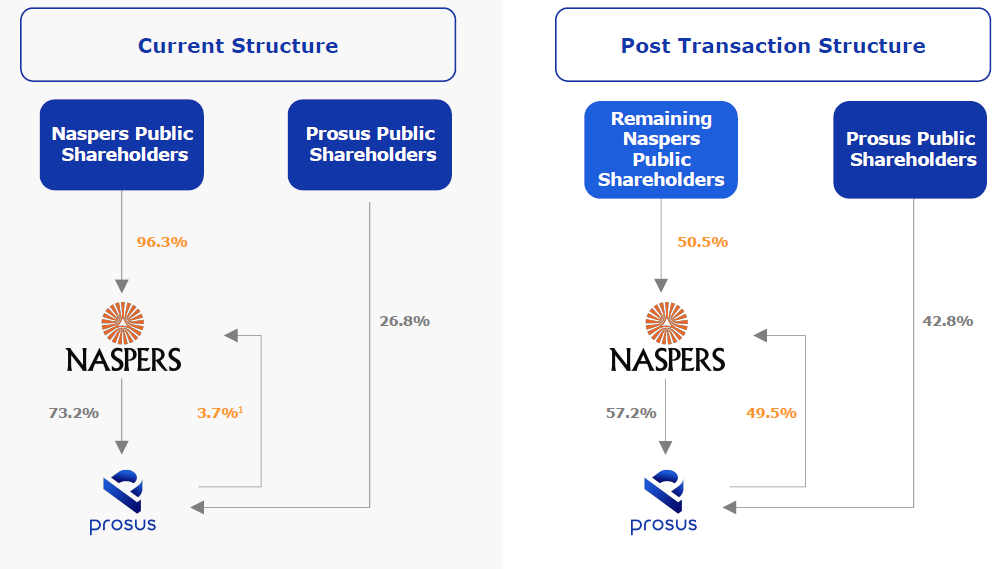

Should all shareholders accept the offer, the consequence would be that the ownership structure of the Naspers/Prosus Group will change as depicted in Figure 1 below. We note that, as a consequence of Prosus buying Naspers shares as part of the current share buyback programme underway, a cross-holding (a situation where both Naspers and Prosus have a shareholding in one another) has begun. A consequence of the proposed offer by Prosus to acquire a portion of Naspers shareholders’ holding in return for Prosus shares is that this cross-holding will become significantly more material.

Figure 1: The ownership structure of the Naspers/Prosus Group pre- and post-transaction

Source: Prosus Naspers presentation.

1. 3.7% estimated interest in Naspers held by Prosus once US$3.63bn buyback is completed.

Management’s rationale for the deal

In support of this deal, management highlighted the following benefits that it achieves:

- Both Prosus and Naspers shareholders will see an uplift to the NAV underpinning their shareholdings. This is likely to be where the rubber hits the road for investors evaluating this deal and we discuss it in further detail below.

- It does not change the tax position of the Group as it currently stands. As we understand the situation, conglomerate tax benefits, whereby investments can be moved around within the Group without being classified as a sale for tax purposes will be lost if Naspers’ stake in Prosus falls below 70%, while potentially a deemed sale for tax purposes of the underlying investments will take place if Naspers’ stake in Prosus falls below 50%. Presumably, an agreement has been reached with the South African Revenue Service (SARS) to allow this deal without any change to the Group’s conglomerate tax status. While this is a good outcome for Naspers/Prosus, it may not be the case for tax-sensitive investors in Naspers as we explain below.

- As Naspers’s stake in Prosus is diluted as a result of the new issue of Prosus shares to Naspers shareholders, its market capitalisation will fall and thus reduce its weighting in the various SA indices. This has long been provided as a contributory factor behind the widening discount at which Naspers trades to its underlying NAV – the fact that institutional investors are constrained by single stock exposure limits on what proportion of their portfolios can be held in a single stock. Management estimates that this transaction will lower the weighting of Naspers in the FTSE/JSE All Share Index from ~23% to ~15%. While this may be so, even at 15%, we think Naspers’s weighing is uncomfortably high and we do not see this change as having a material effect on institutional investors’ ability to add further to their Naspers holdings.

- By issuing further Prosus shares to Naspers shareholders, the Prosus free float in the market will increase and thus its weighting in various indices, in which it is a constituent, will also rise. Likely the most important one will be the Euro Stoxx 50, in which Prosus was included for the first time in September 2020. The argument here is that an increased weighting of Prosus in indices such as this, will attract new demand for its shares from passive funds that track these indices. While the logic behind this is simple enough to understand, judging from what happened when Prosus was included in the Euro Stoxx 50 for the first time, this source of demand may prove to be relatively temporary, as is its effect on driving a narrowing of the discount to NAV.

The impact of the deal for shareholders

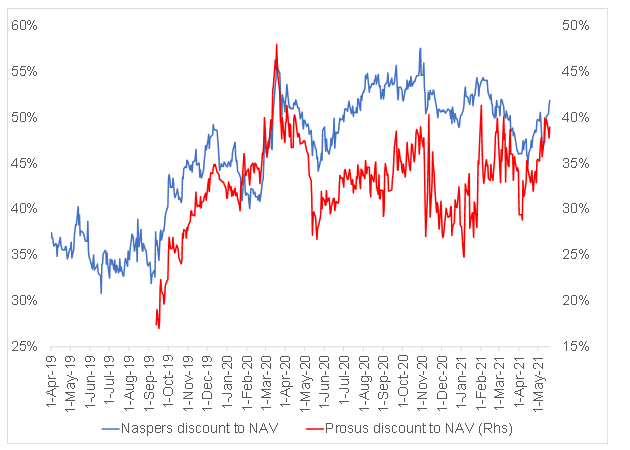

Although Naspers owns businesses such as Takealot and Media 24, these are completely immaterial in the context of the overall NAV of the Group. Thus, investors typically ignore them and focus on its investment in Prosus and the look-through discount at which it trades to the portfolio of investments that Prosus holds. At the time of writing, Prosus trades at a discount of c. 35.5% to its NAV, while Naspers trades at a c. 49% discount on a look-through basis to the same assets. Figure 2 below shows how these discounts compare to their respective histories.

Figure 2: Naspers and Prosus’ historic discounts to NAV

Source: Anchor, Bloomberg

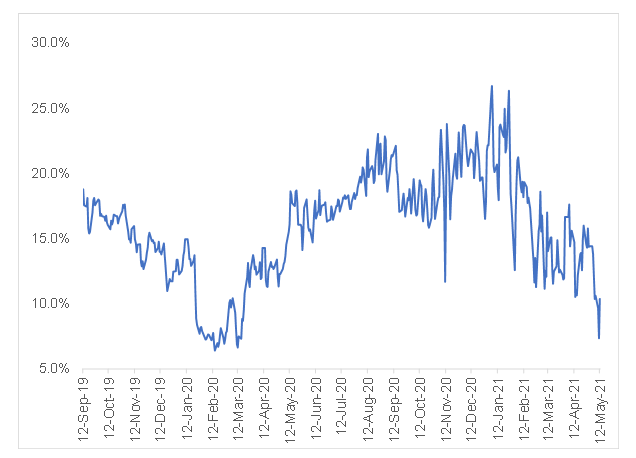

Another point to bear in mind is how the gap between the two discounts to NAVs have trended over time (see Figure 3 below). In recent months, the gap has been narrowing, implying that Naspers has been outperforming Prosus. This was possibly the result of investors positioning themselves in anticipation of a value unlock transaction in which Naspers shareholders stood to benefit more than Prosus shareholders.

Figure 3: Spread between Naspers’ discount to NAV and Prosus’ discount to NAV

Source: Anchor, Bloomberg

Although the gap between the two discounts has narrowed, the mechanics of this deal are still that, by using Prosus shares, which trade at a narrower discount to NAV, as the “currency” to buy the more deeply discounted Naspers shares, the result is that there is an uplift to the NAV underpinning the shareholdings of both Naspers and Prosus public shareholders. “Public shareholders” is a term which investors in this Group will have to get used to – it is the shares held by parties outside of the cross-holding that has been created. According to our calculations, assuming all shareholders accept the offer, the uplift to NAV will be as follows:

- For an existing Prosus shareholder, there is obviously no action to take. We calculate that they will see an increase in the NAV underpinning their holding of approximately 6%.

- For an existing Naspers shareholder that elects not to tender his/her shareholding in exchange for Prosus shares, we calculate that the uplift to NAV, underpinning the shareholding, will also be approximately 6%. The conflict with our assumption, that all shareholders accept the offer to deliver this 6% uplift, is acknowledged!

- For an existing Naspers shareholder that accepts the offer and tenders 45.4% of his/her Naspers shares in return for Prosus shares, we calculate that the uplift to NAV underpinning the shareholding will be approximately 9.5%. While mathematically this looks like the best option, for tax-sensitive investors, the dilemma these shareholders will face is whether it is advantageous enough to trigger a capital gain on which they will have to pay capital gains tax (CGT).

The market’s reaction and our thoughts on the deal

Although an announcement of the next step aimed at unlocking value was widely anticipated by investors, we think the current terms are quite different to the possibilities that were considered. Among these options was a further distribution of Prosus shares by Naspers, thereby reducing its shareholding in Prosus to 50.1%. The fact that, once investors had begun to understand the deal announced, the discount of both Naspers and Prosus widened, has sent a clear message that investors are disappointed that, after such extensive analysis of all the options available, this is the best that management could come up with. While there is an uplift to NAV for shareholders, and the points made by management are acknowledged, there are some drawbacks that have been glossed over. These include:

- Cross-holding structures are complicated and the market hates complexity. The complications introduced regarding how one unravels the true economics, will likely lead to some investors (particularly international investors that have a wide universe from which to select shares) simply deciding that the juice is not worth the squeeze and moving on. When it was initially announced that Naspers was planning to list Prosus, thus placing a new listed holding company between it and the underlying investments, we worried that it was creating the risk of a double layer of discounts. With reference to Figure 2 above, we see that, prior to the listing of Prosus, Naspers traded at a discount of 35%-40%. Presently, Prosus trades at a discount in this range, while Naspers’s discount since Prosus listed has often exceeded 50%. Conveniently for management, it is impossible to know what Naspers’ discount would have been, had it not decided to introduce Prosus. As we pointed out above, demand from passive investors in response to a change in Prosus’ index weighting, will likely prove temporary. How the market regards this additional level of complexity caused by the cross-holding will be revealed in where the discounts eventually settle – could management end up destroying more value than it creates?

- That this was judged to be the best option available to unlock value possibly speaks volumes about the tax, regulatory, and exchange control impediments that stand in the way of the alternatives. Unfortunately, further corporate action that management could take to unlock meaningful value, once this deal has been concluded, looks complicated and remote. It will be down to the hard yards proving to investors that the investments Prosus is making are creating a rump of technology investments that is growing faster than Tencent and are interesting enough in their own right to warrant embracing the complicated structure now created rather than just investing directly in Tencent. We think the optionality of corporate action to unlock value in the structure falls away from the investment thesis for the time being.

Concluding thoughts

We are underwhelmed by this deal and we are also concerned about how the complexity introduced by the cross-holding structure might impact the discount over the longer term. Nevertheless, we think the deal will likely be supported by a significant majority of shareholders for two reasons:

- the fact that it is the only option on the table (a bird in the hand … so to speak); and

- a very small proportion of Naspers shares are held directly by private investors who will face the difficult decision whether to trigger a capital gain in order to access the higher uplift to NAV (as explained above).

For those that do not trigger any tax consequences by doing so, mathematically it makes sense to take the Prosus offer and thus benefit from the greater uplift to NAV. For those that face the prospect of triggering CGT by taking the Prosus offer, the right choice will come down to personal circumstances. For long-term Naspers shareholders sitting on significant unrealised gains, it is very likely that the tax triggered will more than offset the additional NAV uplift available by accepting the Prosus offer. However, even for these shareholders, it may be worth considering whether it might be worth triggering the gain and at least benefitting from some additional NAV uplift to fund part of the CGT. If we are right that there is no obvious next step likely to unlock significant value that follows this deal, triggering the gain now would offer the opportunity to look at one’s exposure to Naspers/Prosus afresh.

As for our relative preference between Naspers and Prosus going forward, we have historically favoured Naspers on the basis that the larger discount and the potential to distribute further Prosus shares meant that the optionality for greater value unlock resided in Naspers. While Naspers’ outperformance over Prosus in recent months means that was the correct relative call, the deal announced achieves a much more balanced benefit to Naspers and Prosus shareholders than expected. With the gap between the two discounts relatively narrow vs history, prospects for further corporate action to unlock value are remote for the time being, for a fresh R100 invested today, we are now largely indifferent between the two companies.