Well, so much for the theory that as we turned the page on 2021 – an annus horribilis for Chinese shares caught up in the crosshairs of a domestic regulatory crackdown and Sino/US power politics, compounded by the very poorly received attempt to unlock value via a Prosus shares for Naspers shares exchange – 2022 was set to be a year of recovery. By the end of 1Q22, Naspers and Prosus had declined by 33% and 39%, respectively, while Tencent (which accounts for c. 75% of the Naspers/Prosus NAV) had lost 16%. Note too that until early February, Prosus was still busy with its US$5bn share buyback, which makes its performance in the quarter all the more surprising.

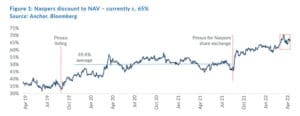

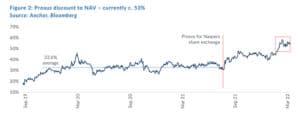

Part of the disparity in performance between Naspers/Prosus and Tencent is explained by the exchange rate (the rand appreciated by c. 10% against the US dollar over 1Q22), but there was also a notable widening of the discount to net asset value (NAV) to historic extremes.

Until shortly before the Russian invasion of Ukraine in late February, Tencent’s share price was in positive territory for the year. However, this tentative recovery was snuffed out as Chinese regulators pushed for further reductions in fees charged by food delivery platforms, leading to speculation that China’s regulatory crackdown on its technology giants has further twists in store. This sell-off gathered momentum as investors considered the broader implications following China’s close friend Russia’s invasion of Ukraine.

While reasons for the continued share price weakness in Naspers/Prosus’s key investment, Tencent, are clear, one may well ask what lay behind Naspers/Prosus’s significant investment underperformance against even this low bar. Although the extent of the underperformance suggests there may have been some non-fundamental factors in play (a large shareholder repositioning its portfolio perhaps?), focusing on the non-Tencent part of the portfolio (accounting for c. 25% of NAV), some possible explanations include:

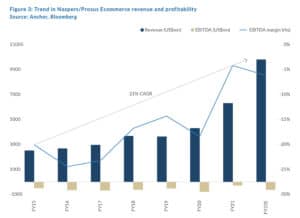

- Non-Tencent assets fall into the currently unloved “loss-making tech” category. Prosus has been increasingly active in building its technology portfolio outside of Tencent. Part of the funding of these investments in recent years has come from two placements of c. 2% each of its Tencent stake. The performance of this portfolio is collectively reported as its Ecommerce segment, with underlying investments in several chosen focus areas – Online Classifieds (the most mature), Food Delivery, Payments & Fintech, Etail, and, most recently, Edtech. While its strategy of investing in earlier stage technology opportunities and selling more mature holdings where it believes full value is being recognised in the market, means the track record of performance in Figure 3 below is not an apples-with-apples comparison of the same underlying investments, the point to note is that, while revenue growth has been healthy (and, in fact, accelerating more recently), collectively this portfolio has continued to generate losses. As bond yields began to rise and investors started to worry about the implications of this for valuations that could be justified for equities going forward, loss-making technology companies have been most severely punished over the last year. As inflation fears intensified over the past quarter and, with them, investors’ expectation of how high bond yields are likely to rise, it is probable that Prosus’ Ecommerce segment’s presence in this loss-making tech grouping will have caused any prospective new investors to conclude this share can be avoided until valuations on this currently unloved segment of the technology sector have sufficiently adjusted.

- Some exposure to Russia/Ukraine does not help the investment case. Although small in the context of Prosus’ total investment portfolio, it has exposure to Russia through Avito (online classifieds), a 27% stake in VK (previously called Mail.Ru), and a less than 2% revenue exposure for its PayU fintech operation. It also has a small online classifieds presence in Ukraine via OLX. In aggregate, these exposures equate to less than 3% of the market value of Prosus’s assets. However, Avito is a solidly profitable online classifieds platform in Russia, which had been responsible for delivering c. 20% of dividend income for the Group. Management has assured investors that funding was ample to cover Prosus’s investment plans over the next 3 years without Avito dividends, and the value impact is relatively immaterial, but this was likely a further reason to avoid Naspers/Prosus shares.

While the above provides context behind the very poor investment performance of Naspers/Prosus in recent times, the critical question is what investors, many of whom had used these shares as a reliable central pillar around which they had built their local equity portfolios, should do now? In periods of strong investment returns from Naspers/Prosus, it is easy to imagine adding further to the position should a significant pullback occur, the problem is that the risks responsible for such a pullback loom large. Market commentators, reflecting the sentiment of the day, stress further downside risks, which means emotionally the easiest course of action at this point is not to add further but rather to cut the risk of further losses (capitulate?) and switch into other investments that are in favour. Political developments in China and signs that the authorities there are beginning to interfere more in the commercial decisions of its private sector cement even more strongly in our minds the view that the high individual company weighting that many SA investors were comfortable holding in Naspers/Prosus needs to be re-evaluated for the future, but this is not the time. Right now, as long-term investors, we believe it calls for us to show the strong temperament to do what makes us feel uncomfortable – that is hold the line with this investment and be patient.

Yes of course there is the possibility that those looming risks that lie behind the sell-off to date intensify further, leading to additional downside for the shares. China using the current global focus on the Russia/Ukraine conflict as an opportunity to annex Taiwan, for example, would be an event, if it was to occur, that would undoubtedly lead to a further exodus from Chinese equities by international investors. However, there are some encouraging signs that the investment tide in China may be turning more positive too. These include:

- A shift towards a decidedly more market-friendly policy backdrop in China. There were times in the last year when the steady stream of negative regulatory news out of China led one to suspect the authorities there were deliberately trying to render the market “uninvertible” for foreign investors, and indeed, some now seem to see it in that light. However, we may well look back on several recent developments as being important signals of a decisive shift towards a more investor-friendly stance. In late March, Chinese authorities finally stepped in to restore market stability, committing, among other things, to complete their regulatory reset as soon as possible and in a more coordinated and transparent manner. Subsequently, apparent efforts by China to comply with US demands to provide access to sensitive audit information on US-listed Chinese companies and thus avert a threatened de-listing of these shares in the US, represents a significant shift towards resolution and de-escalation of tensions. Finally, there has been the introduction of a range of domestic economic policy stimulus measures, in contrast to its restrictive stance last year and policy tightening currently underway across most western DMs.

- A healthier and more sustainable technology sector in China? Tencent’s 4Q21 results announced in late March set a very different tone about the outlook for Tencent and the broader technology industry in China. Characterising the past environment as one of aggressive zero-sum competition and focusing on short-term profitless revenue growth, Tencent envisages a shift to a new paradigm of enhanced focus on cost efficiency, innovation, and long-term sustainability. For Tencent’s part, it stresses that this year will be about controlling costs and rationalising its non-core businesses. Coming on top of a set of results that fell short of already heavily reduced market expectations, we were concerned about how investors would interpret Tencent’s repositioning of its outlook to one of “sustainable growth”. The steady recovery in Tencent’s share price since the results were released suggests investors may be warming to it.

- A lot of bad news is already reflected in the price. It is probably fair to expect that experience over the last year or so will mean that the risk premium attached to investing in China will remain considerably higher for the foreseeable future. This means it is unlikely we will see Tencent return to the sort of valuation it attained in the past any time soon. That said, with reference to Figure 4 below, the current 12-month forward P/E of 21x is in line with historic low points of investor sentiment. Something to keep in mind, too, is that since around 2015, Tencent began deploying its considerable organic cash generated into building its own portfolio of technology investments. These currently contribute a small loss to operating earnings and thus actually detract slightly from the “E” used to calculate the P/E multiple in the chart. If one rather excludes the market value of these investments from Tencent’s market value, it implies the forward P/E multiple is closer to 13.5x.

- The growing influence of Prosus’s Ecommerce segment over time. In recent results, Prosus management has repeated its target of growing the NAV of the Ecommerce segment to US$100bn by FY25, which would imply it would need to roughly double in value over the next 3 years. To give some sense of materiality, this would equate to c. 43% of Tencent’s value as it stands today. We have highlighted the growing investor fatigue related to the perpetual losses reported by this segment historically, but with reference to the chart showing the segment’s profitability, it is on a steadily improving trend. It will be interesting to see if the loss of investment appetite for loss-making tech is reflected in a greater urgency to deliver the long-anticipated “J”-curve in Ecommerce segment earnings. Although there is no guarantee that the FY25 target will be achieved, it creates the possibility that the investment case of Naspers/Prosus has the potential to begin decoupling to some extent from that of Tencent.

- Options to unlock value back on the table for Naspers and Prosus? The widening of the Naspers and Prosus discounts to NAV over the past quarter likely implies investors attribute a very low probability of any material corporate action occurring. Based on how things stood after the Prosus shares for Naspers shares exchange last August, we acknowledge this is probably a reasonable assumption. However, considering how much prices have fallen subsequently, it may be dangerous to assume the status quo remains for corporate action. If paying capital gains tax (CGT) eventually is an unavoidable step in eliminating the discount and positioning this group correctly for the future, then the current set-up may be presenting an ideal opportunity to address this once and for all.

To conclude, in better times, if one was to sum up what an ideal situation would be in which to build exposure to Naspers and Prosus shares it would likely be a combination of (1) a relatively strong rand exchange rate; (2) Tencent’s valuation being attractive; and (3) the Naspers and Prosus discount to NAV being at an attractive level. The problem is, in these happier times, one seldom considers whether you will have the emotional fortitude to stare down the risks that have pushed the shares into what we might call “golden tri-factor” territory, when all three factors align at the same time, and invest. There remain issues that still hang over the investment case for Tencent and, by association, Naspers and Prosus. China’s stubborn pursuit of a zero-COVID policy and its continued refusal to resume new online game approvals to name a few. Sadly, it is the nature of markets that you are unlikely ever to get the comfort of both certainty on risks and the golden tri-factor of value factors you wish for. We see some encouraging signs that the tide may finally be turning and, judging by the sizeable share buybacks being made by Tencent since the release of its latest results, maybe its management does too. For many SA investors, holdings in Naspers and Prosus are already sizeable exposures in their local portfolios and our advice is to hold fast. For the rest, the golden tri-factor being in place is a rare occurrence indeed and presents a great opportunity for long-term investors to be accumulating exposure.