Although Prosus’ offer to issue new shares in exchange for Naspers shares was met with widespread disappointment by shareholders of both companies, it has now received the requisite shareholder support. It will therefore go ahead, regardless of shareholders’ reservations and Naspers shareholders will shortly face the decision whether to tender their shares in exchange for Prosus shares. Since the share exchange will be treated as a disposal of Naspers shares by the South Africa Revenue Service (SARS), and thus a taxable event for tax-sensitive Naspers investors, this is likely to be a particularly tricky decision. For tax-sensitive investors, the correct decision is likely to come down to one’s own personal situation – this is not a case of “one-size-fits-all”. The purpose of this article is to share our thoughts on what investors should consider when making the decision on whether to tender their shares.

Salient terms of the offer

The key terms of the offer being made by Prosus are as follows:

- Prosus is inviting Naspers shareholders to tender up to 100% of their shares for which it is offering an exchange ratio of 2.27443 new Prosus share for each Naspers share tendered.

- We note that this is a voluntary offer and thus the default option for Naspers investors who do nothing is that they will not tender any of their Naspers shareholding and their shareholding in Naspers will be unchanged.

- Prosus will only take up a maximum of 45.33% of the total issued share capital of Naspers.

Key dates

The important dates that Naspers shareholders need to keep in mind are:

- Tuesday, 10 August: This is the last day on which investors can trade in Naspers shares to participate in the exchange offer.

- 12:00PM on Friday, 13 August: This is when the exchange offer closes and the point by which those wishing to tender their Naspers shares will need to have submitted that instruction in the correct form. Suffice to say that shareholders will need to notify their representatives in good time. Their representatives will submit the instruction of what their wishes are on their behalf to ensure this deadline is met.

- Monday, 16 August: The new Prosus shares will be listed on the relevant exchanges and the exchange offer becomes effective.

Impact of the exchange offer on shareholders

By using Prosus shares, which trade at a narrower discount to their underlying net asset value (NAV), as the “currency” to buy the more deeply discounted Naspers shares, there is an uplift to the NAV underpinning the shareholdings of both Naspers and Prosus’ public shareholders. “Public shareholders” are shareholders in each company other than the companies themselves. An agreement has been drawn up in terms of which the shares that Naspers and Prosus own in each other, after this exchange offer is concluded (a crossholding in other words), will be treated as if they do not exist when it comes to how the economics flow to shareholders.

We calculate that Prosus shareholders, who obviously have no action to take in this case, and Naspers shareholders, who opt not to tender their shares, will see an increase in the NAV underpinning their holding/s of approximately 6%. For Naspers shareholders who opt to tender their shares, we calculate a NAV uplift underpinning their shareholding of c. 9.5%. This means, absent any tax considerations, there is an additional incentive for Naspers shareholders to tender their shares.

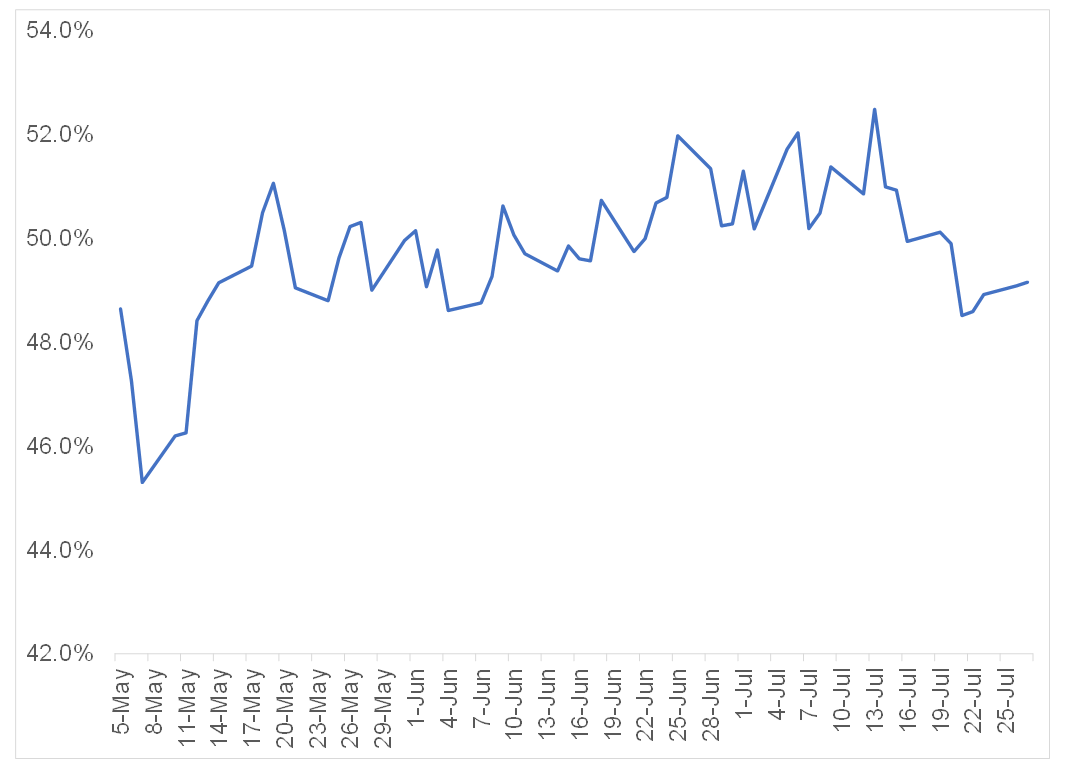

Typically, investment markets price in the impact of new information extremely quickly. With that in mind, one would have expected the Naspers discount to NAV to close as the market “prices in” the increased underpin to NAV that this transaction will produce. Interestingly, if we track how the discount has moved since the exchange offer was initially announced on 5 May, this has not happened – while the discount did narrow initially, it seems that, as investor opinion began to turn more negative (as the understanding of the offer became clearer), the discount actually widened.

Figure 1: Trend in Naspers discount to NAV since share exchange offer was announced

Source: Bloomberg, Anchor

The fact that the market does not seem to have priced in the NAV uplift, particularly now that the exchange offer has been approved by shareholders and is therefore guaranteed to go ahead, is tricky to interpret. The more negative interpretation at this point is that Mr. Market is likely to apply a 6%-10% wider discount to NAV on both Naspers and Prosus, after the exchange offer is concluded, than it did before. The justification for this wider discount might be the added complexity that is now introduced through the large crossholding structure, irrespective of management’s efforts to convince investors that the agreement overcomes complexity normally associated with crossholdings.

If the two shares simply end up trading at a wider discount than they did before, and thus saddle investors with juicy advisory and execution costs for no value unlock, it will certainly leave management with considerable egg on its face. This is particularly so given how vocal management has been about the time and effort invested in evaluating all the value unlock options. The reality is that the deal is going ahead, and the question is what Naspers investors should do?

Our thoughts on how Naspers investors should approach the offer

Non-tax sensitive investors

For those investors whom tendering their Naspers shares will not trigger a tax event (i.e., those holding Naspers shares inside a retirement product or living annuity, for example), we think the correct decision is to tender your Naspers shares. The main rationale for this is simply that, as we explained earlier, this option results in a larger uplift to the NAV underpin of your investment than doing nothing and thus keeping your investment in Naspers unchanged.

One possible area of doubt for investors may lie in the long-held belief that Naspers, trading at a c. 50% discount to virtually the same assets as Prosus, which trades at a c. 36% discount, naturally represents the greatest potential for value unlock. So, why would you exchange your Naspers shares for Prosus shares for a relatively small additional uplift? We think there are a couple of points to consider here:

- Management has gone to great lengths to ensure that this step does not in any way impair the tax status and flexibility of the Group, revealing how important this is to the Group. Unfortunately, beyond this share exchange transaction, it is far from obvious what material next step the Group could take corporate action-wise to unlock value without significant tax consequences for the Group. While, of course, we cannot be sure what management has up its sleeve, it certainly looks like further corporate action to unlock value in the near term is unlikely, at least for the time being.

- Allied to the point above, the absence of any obvious steps that management could take to unlock value for Naspers specifically is leading to a growing sense that Prosus may be the more interesting of the two for the next while. After the share exchange, it is likely to see its weighting in key European indices (the Eurostoxx 50, most importantly, perhaps) increase, which would attract further investment from passive trackers of these indices at the very least. There is also the US$5bn further share buyback that kicks off after the share exchange deal is concluded. There is not much that seems likely to drive the outperformance of Naspers vs Prosus over the next while.

- Having believed, prior to this share exchange deal being announced, that Naspers carried the best optionality for value unlock of the two, the deal management announced surprised us from the perspective of the lengths it went to in order to ensure the value uplift was fairly equitably shared between both Naspers and Prosus shareholders. Granted, there is an additional uplift to encourage Naspers shareholders to tender their shares, but it is not as material as we had hoped. This certainly sets a precedent that is worth keeping in mind for the future.

- Finally, remember it is always possible to sell the Prosus shares you receive and switch back to Naspers after the deal if you want to maintain exposure to the share at the greatest discount for the day that the great unlock of value eventually happens, whatever form that may take.

Tax-sensitive investors in Naspers

For tax-sensitive investors, Naspers shares that are exchanged for Prosus shares will be treated for tax purposes as if they have been sold. For those sitting on large unrealised gains on their Naspers holdings, does it make sense to tender one’s Naspers shares and thus trigger a capital gain? We think this is going to come down to investors’ personal circumstances. Some things to think about when deciding what to do are:

- For investors who are happy with the level of exposure to Naspers within their portfolios and who intend to be long-term shareholders, we think the golden rule with capital gains tax (CGT) should apply here – to delay triggering a CGT event for as long as possible and to allow the power of compound growth to work in their favour. The additional uplift in NAV for those that do exchange their Naspers shares for Prosus does not seem attractive enough to justify triggering the gain. This, of course, would apply in cases where there are not unrealised losses elsewhere in the portfolio, which could be used to offset the gain triggered by tendering Naspers shares in this deal.

- Alternatively, for those investors who have a high level of concentrated exposure to Naspers within their portfolios, it is worth considering whether the Prosus share exchange offer might provide a good opportunity to address this, even if it does trigger a capital gain. Despite the appeal of the long-term investment potential in a market of China’s size, the recent wide-ranging regulatory crackdown on Chinese technology companies, which has seen Tencent pull back by over 40% from its February high, continues to create considerable volatility and doubts for investors as to whether this potential will be realised. This is also proving to be a timely reminder of the risks associated with investing in markets where the priorities of regulators may not align with the interests of foreign investors. These risks are best managed by ensuring your portfolio is well diversified. The additional NAV uplift that those exchanging Naspers shares for Prosus shares will receive, should at least partially fund the CGT liability that arises. Thereafter, investors can re-evaluate the diversification of their portfolios, without this being clouded by tax consequences. With the rand having recovered most of the ground it lost last year amid the COVID-induced sell-off, making use of one’s foreign investment allowance to diversify investment exposure to the technology theme offshore is certainly worth exploring.

In summary, it is tax-sensitive investors with large unrealised capital gains on their Naspers holdings that likely face the most difficult decision on whether to tender their shares or not. It is very possible that the CGT arising from this will exceed the additional NAV uplift those tendering their shares are in line to receive. It is understandable that investors faced with this outcome would likely opt to avoid triggering the gain.

However, for SA investors who have a high Naspers concentration in their portfolios currently, exposing them to the unpredictability of Chinese regulation as aptly demonstrated by recent experience, the question needs to be asked whether this risk is justified by the avoidance of tax alone. With many more ways to gain investment exposure to the technology investment theme currently, this exchange offer may well provide an opportunity to reduce risk and take advantage of these.