MTN reported what we would sum up as a solid set of results for the six months to end June (1H20). However, before reviewing the result itself, we remind our readers what the thesis has been. We expect MTN to deliver low double-digit, currency-neutral service revenue growth over the next three years – margin expansion should mean that this translates into mid-teens EBITDA growth. By holding capex relatively flat, we expect MTN to deliver operating free cash flow growth of c. 20% p.a.While this improving profitability should obviously imply that return on invested capital is rising, the other leg to this potential turnaround story is the “self-help opportunities” available to MTN. It has committed to raising R25bn over the next 3 years, mainly through the sale of non-core assets, the proceeds of which will be used to cut debt. To put this in context, net debt currently stands at R71bn, so, should it achieve this goal, it will put a meaningful dent in the group’s gearing levels. Since many of these non-core assets are either not contributing to earnings (MTN’s 29% stake in IHS Group, for example, is classified as “available for sale”), or are making losses (investments in early stage technology ventures, for example), their disposal should not materially impact earnings, thus adding a further boost to the return on capital.

Finally, there is the potential for MTN to deliver on the opportunity to provide mobile financial and other digital services to its customers off what is currently a very low base – potential revenue streams that are not really available to developed market telcos. If one was to sum this up as the part of the investment thesis under management’s control, one has to balance this off against the largely unforecastable event risk coming from the high-risk portfolio of markets in which MTN operates.

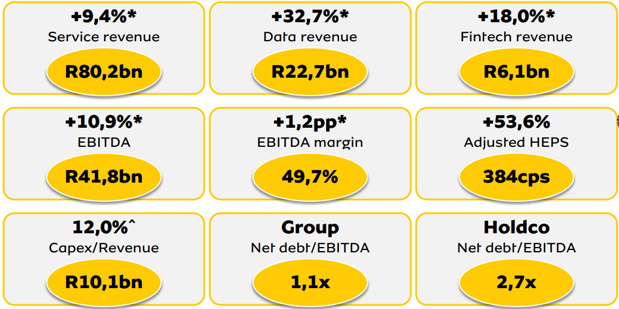

Regarding MTN’s currency-neutral operating 1H20 results (summarised in Figure 1 below), we highlight that, considering the disruptions from COVID-19-related lockdowns during the period, it was a solid outcome, with service revenue growth only slightly short of its medium-term guidance. MTN still managing to achieve margin expansion, drove 11% YoY EBITDA growth. Management pointed out that MTN saw its strongest commercial momentum for some time during this period, with gains in market share (as measured by its interconnect metrics) across every market except eSwatini. While cautions about how potential job losses and responses to a resurgence in infection rates may impact the rest of the year, comments about performance as lockdowns eased were reassuring, with data use holding up well and areas more negatively impacted initially exhibiting a V-shaped recovery. Despite the near-term uncertainties introduced by COVID, MTN has also stuck to its medium-term operational guidance.

Figure 1: MTN 1H20 operating results summarised

Source: MTN

MTN’s announcement in its pre-results trading update that it would not pay the interim dividend was a big disappointment. Upstreaming of cash to the holding company (holdco) has been a challenge and, most importantly, it has been unable to externalise the last two dividends out of Nigeria, owing to the lack of foreign exchange availability. This lack of upstreaming means that, while the group debt profile looks ok – group leverage improved from 1.3x EBITDA at December 2019 to 1.1x – the lack of upstreaming also meant that at the holdco level, gearing deteriorated to a slightly uncomfortable 2.7x EBITDA (MTN’s target is to bring this below 2x). As far as the final dividend is concerned, whether MTN pays it will depend on the “general macroeconomic environment, the status of cash upstreaming and outlook for holdco leverage” – it would not be wise to bank on it!

For us, the biggest news in the result is that MTN has decided to exit the Middle East, and thus become an exclusively pan-African operator. It says that this will be done in an orderly way over the medium term, which we assume to be the next 2-3 years. It is already in advanced discussions to sell its 75% stake in Syria, while the other opcos to be exited are Yemen and Afghanistan. Its associate in Iran is also likely to be exited, but management cautioned that this is likely to be a “phase 2” of this regional exit plan if it is to get a decent value for it. On an economic interest basis, these operations account for about 8% of the group, with Iran being by far the most material. Although the current state of geopolitics in these markets means that these operations probably will not fetch much, the current share price does not imply investors are ascribing any value to these operations.

Whatever MTN is able to realise should be a net positive. The removal of these particularly problematic markets from a risk perspective will also likely reduce the risk profile of the group (to some extent) going forward. As for progress on the R25bn asset realisation programme, COVID-19 has meant that this has not progressed much in the last few months. However, MTN’s 20% stake in Belgacom International Carrier Services (with a carrying value of R2.3bn) and its stake in Jumia (worth c. R4.5bn at the moment) appear close to exit. MTN’s exit from its 29% stake in IHS Group, which is currently valued by MTN at R30.7bn (R17/MTN share), likely remains the most significant from a potential catalyst point of view. However, this will likely require the on-again, off-again listing of IHS Group to be concluded.

Despite the disappointment associated with passing on the dividend payment and signs that problems upstreaming cash to the holdco may need to be considered, a permanent rather than temporary risk which will likely weigh on the share’s prospects of recovering fully from its dramatic fall earlier this year, we continue to see MTN as an attractive recovery play at current price levels. We are reassured by the respectable operating performance delivered under challenging market conditions, the sustainability of which should see the share continue to grind higher. Progress on the asset realisation side of the investment case in 2H20 could also be a source of more meaningful upside, as we do not believe the market is pricing in much prospect of MTN delivering on this plan at current levels.