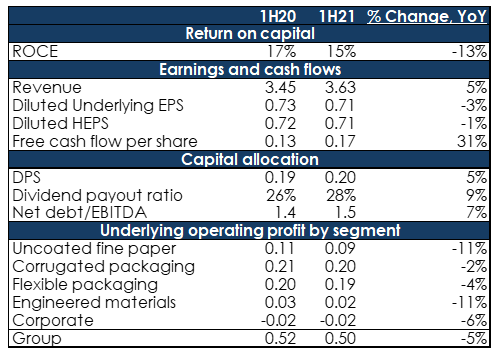

Global packaging and paper Group, Mondi reported 1H21 results (for the six months ended 30 June 2021) on 5 August. Underlying earnings before interest, taxes, depreciation, and amortisation (EBITDA), fell 4% YoY to EUR709mnin 1H21, negatively impacted by currency fluctuations. Group revenue rose 5% YoY to EUR3.6bn, on the back of higher sales volumes and pricing. Net debt increased from EUR1.79bn as at 31 December 2020 to EUR2.04bn. This was due to investments in the business, including the acquisition of Olmuksan International Paper. The Group’s uncoated fine paper business performed better vs 2H20 but the performance was still lower YoY and below pre-COVID-19 levels. This improvement complemented its packaging segment which, according to Mondi, is the growth engine of the business because of the explosion in ecommerce. The company declared a dividend of EUR0.20/share, up from EUR0.19/share in 1H20.

Figure 1: Mondi Plc 1H21 results overview, in EURbn except per share

Source: Anchor, Bloomberg

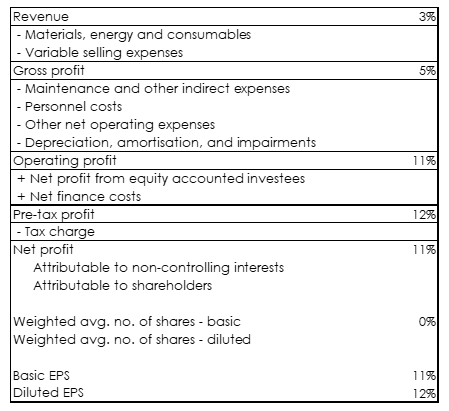

Despite packaging being a low volume growth industry, Mondi has historically been able to grow earnings at an attractive rate. To illustrate, Figure 2 below shows the company’s compound annual growth rate (CAGR) over the 2014 to 2019 period for its income statement. Despite revenue only growing by 3% p.a. over that period, Mondi has been able to grow its operating profit and earnings at c. 11%-12% p.a. A combination of a low-cost asset base, scale, and bolt-on acquisitions helped the company do so.

Figure 2: Mondi Plc CAGR 2014-2019, EURbn except per share

Source: Anchor, Bloomberg

We believe that, over time, Mondi can continue to grow earnings at an attractive rate. However, in the short term, the company is facing input cost inflation (for recycling, resins, energy, and transport) that is weighing on margins and earnings. It can be seen in diluted underlying EPS, which was down 3% YoY despite revenue being up 5% for the period under review.

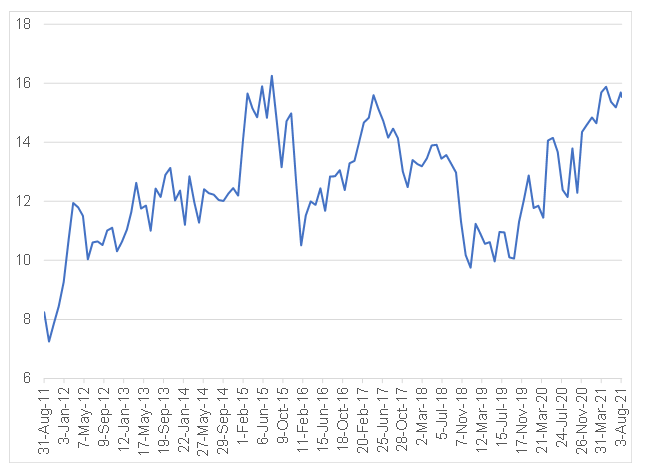

Figure 3: 12-month forward P/E

Source: Anchor, Bloomberg

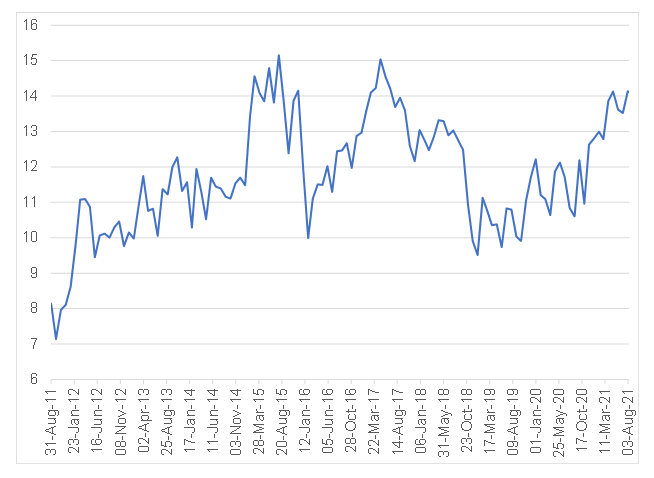

Figure 4: 24-month forward P/E

Source: Anchor, Bloomberg

We like Mondi’s low-cost asset base, its management team, its history of a good return on capital employed (ROCE), and the company’s decent earnings growth. However, we would not currently be buyers of the share as it is quite fully valued vs its own history. The share is currently expensive, trading at a c.16x multiple on a 12-month forward consensus estimate and we would not accumulate at these levels since that is about as high as it has been over the past decade (see Figure 3). Similarly, when looking at its 24-month forward consensus earnings estimates (Figure 4), the share is trading at a c.14.5x multiple, which is close to its high over the past decade. Still, we believe that Mondi is one of the better businesses available to buy in the resources space, but we would recommend investors wait for a better entry point.