Microsoft released 4Q19 results on 18 July, reporting revenue of $33.7bn and net income of $13.2bn – up 12% and % YoY, respectively. Revenue was above the Refinitiv consensus analyst estimate of $32.77bn. Earnings came in at $1.37/ share (up % YoY), also above the Refinitiv estimate of $1.21/share.

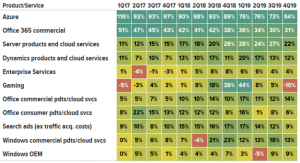

Once again it was cloud services that was the star performer with its Intelligent Cloud business segment, including its Azure public cloud, Windows Server, SQL Server, Visual Studio, GitHub and consulting services, recording revenue of $11.39bn in the quarter. Azure maintained its impressive performance, growing 64% YoY (see Figure 1) or 68% in constant currency terms. Microsoft doesn’t disclose exact revenue for Azure.

Figure 1: Microsoft products and services YoY growth by quarter:

Source: Company data, CNBC

The More Personal Computing segment, comprising of Windows, Surface, Xbox and Search (Bing), ended the quarter with revenue of $11.28bn, while the Productivity and Businesses segment (containing Office, Dynamics and LinkedIn), came in at $11.05bn in quarterly revenue. There are 34.8mn people subscribed to Microsoft’s Office 365 service for consumers. Microsoft said it recorded $11bn in Commercial Cloud revenue, up 39% YoY (this includes Azure, Office 365 business subscriptions, Dynamics 365 enterprise software and commercial LinkedIn products).

However, the company’s gaming business stalled, with revenue down 10% YoY, alongside an Xbox software and services revenue decline of 3% YoY. Xbox Live active users, nevertheless, grew to 65mn in the quarter, thanks to the wide range of users across Xbox One consoles, Windows 10 PCs, and mobile devices (iOS and Android). Microsoft will publicly preview its xCloud game streaming service in October.

Capital expenditure came in at $5.3bn in the quarter under review as it acquired Express Logic, revealed the new Xbox console with no disc drive and updated Azure.

In terms of FY19, Microsoft’s revenue grew 14% YoY to $125.8bn, while net income soared 137% YoY on a non-adjusted basis to $39.8bn. Diluted earnings of $5.06/share rocketed 138% YoY.

Looking ahead to the current quarter (1Q20), CFO, Amy Hood, said on the conference call that the firm expects to achieve between $31.7bn and $32.4bn in revenue across its three business segments. She noted that the company’s cost of goods for 1Q20 would be between $10.55bn and $10.75bn.

Microsoft is now a $1trn market-cap company, first passing this milestone in the quarter under review (on 25 April) on the back of continued growth in its cloud and diverse businesses.